The latest Commitment of Traders report shows that speculative positions decreased. What does it mean for the gold market?

In the April edition of the Market Overview, we wrote that the Commitments of Traders Report is one of the most important publications on the gold market, as it breaks down the open interest number into categories of traders, showing the trade positions of market participant groups in the gold market. Let’s analyze the recent changes in traders’ positions.

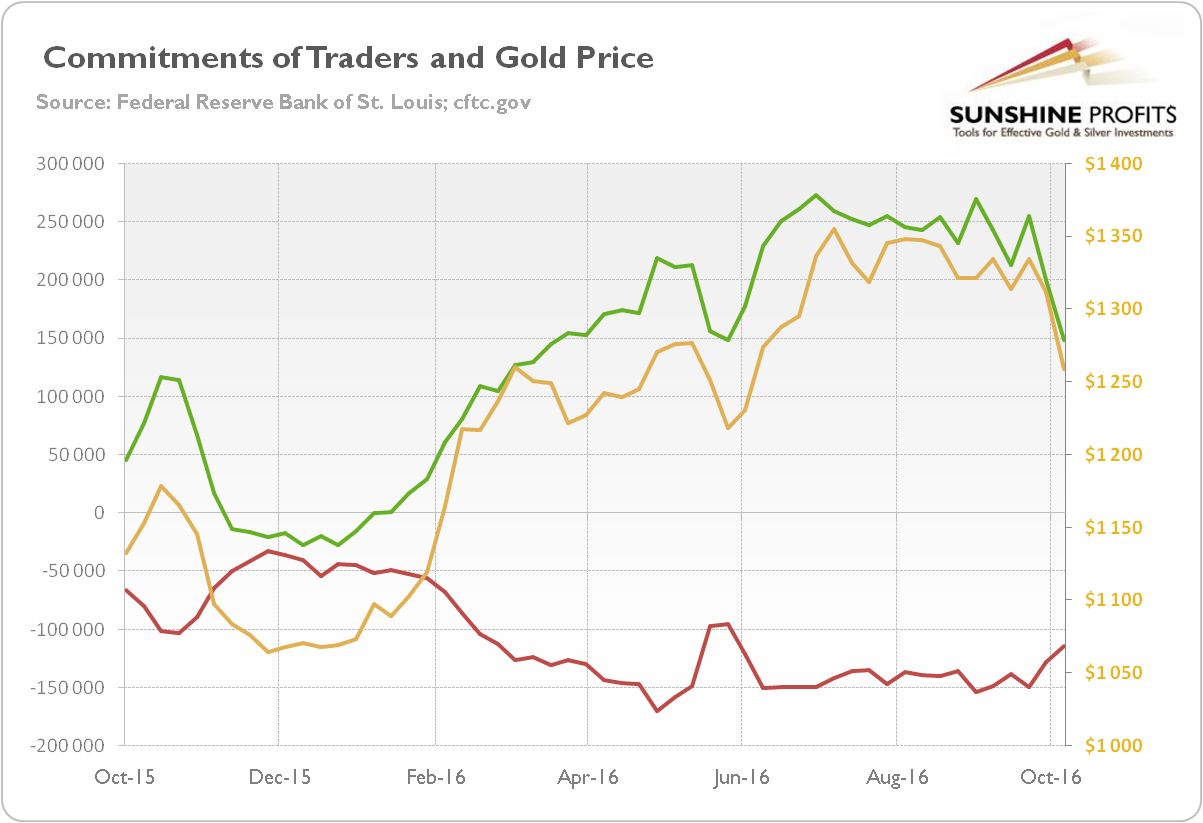

Chart 1: The price of gold (yellow line, right axis, London P.M. fixing), the net position of money managers (green line, left axis) and the net position of producers (red line, left axis) over the last 12 months.

As one can see in the chart above, money managers (green line) tended to follow gold prices, while producers (red line) moved in the opposite direction to gold prices. The 2016 rally in gold was partially caused by the fast rise in net long positions of speculative traders. The chart also shows that these investors really tend to be most bullish just prior to significant price tops (and most bearish before the significant price bottoms).

What is crucial here is that money managers decreased their position from over 255,000 to about 149,000 net long contracts over the last two weeks. Although further declines are clearly possible, speculative positions are now at much more healthier levels.

The take-home message is that speculative traders (money managers) significantly reduced their net long position. The end of speculative fever may be good news for the gold market in the long-term. However, it is rather too early to call the bottom, as we should see some stabilization in net long positions first. We have to wait for Friday’s release of the Commitment of Traders report – but investors should always remember that there is a three day lag between the report and the actual positioning of traders (the report is issued on Friday, but contains Tuesday’s data).

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview