Based on the November 22nd, 2013 Premium Update.

In our previous essay on silver, we examined long- and short-term charts of silver to find out what the outlook for the white metal was. Back then, we wrote the following:

(…) an initial downside target – something that silver is likely to reach (and pause / bounce) before moving to our final target (…) At this time, this (..) is very close to $19.50.

Since that essay was published, the white metal has moved lower and earlier this week it almost reached the downside target. Taking this fact into account, you are probably wondering what comes next. Therefore, we‘ve decided to examine long- and short-term charts of silver once again to check what has changed recently and what impact could it have on future silver’s price movements.

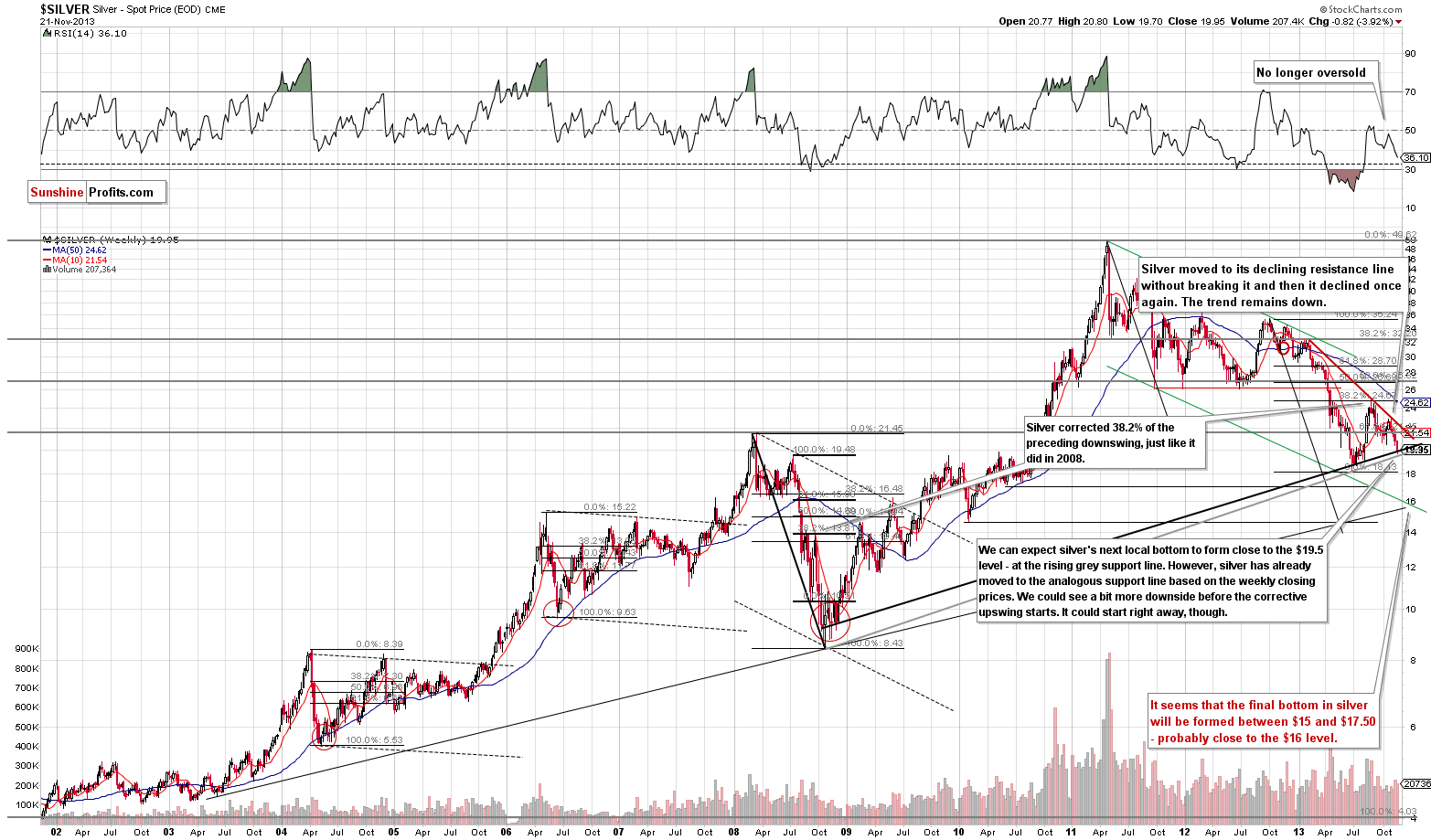

Let‘s begin with the long-term chart (charts courtesy by http://stockcharts.com).

As you can see on the above chart, after the confirmation of the breakdown below the 61.8% Fibonacci retracement level, the situation became more bearish and a heavy decline followed. This downswing pushed the price of silver below the previous week’s low and resulted in a new monthly low. With this decline, the white metal reached the support line based on the 2008 and 2013 lows in terms of weekly closing prices (marked with the black bold line). Earlier this week, it moved to the lower of the support lines (marked with grey) without breaking it.

Taking this fact into account, in last week’s Premium Update we mentioned that the corrective upward move could start right away or we could see a bit more downside before the corrective upward move started.

Quoting our essay on silver from Nov. 20:

(…) the support line based on the 2008 and 2013 lows creates an initial downside target – something that silver is likely to reach (and pause / bounce) before moving to our final target level around the $16 level. At this time, this initial target is very close to $19.50.

On Monday, the intra-day move lower took the white metal to the rising long-term support line (marked with the grey bold line). What’s important, there was no breakdown and the support held, which is a bullish signal for the short term.

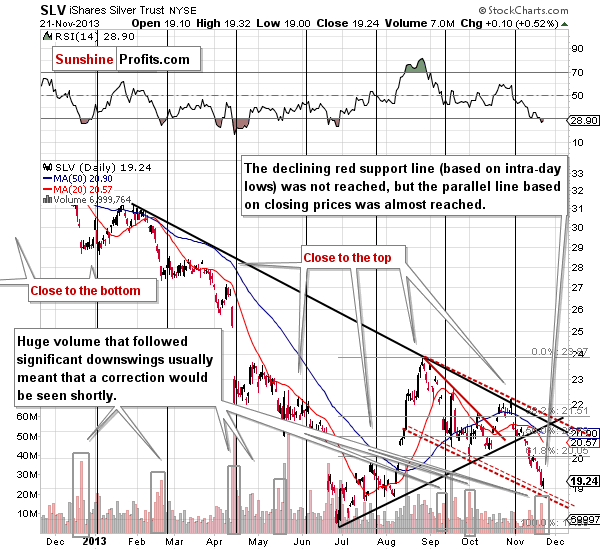

Let’s move to the daily chart to see the very recent price moves more clearly.

Quoting our previous essay on silver from Nov. 20:

(…) the recent decline in SLV materialized on significant volume, which suggests that it was no accident. Interestingly, we saw something similar (a visible but not huge plunge) in early June, which preceded the real downswing and investors had several days to prepare. (…) the downside target for the SLV ETF very close to the $19 level. The target is created by the red dashed line, which is a parallel line to the declining resistance line based on the most recent local tops.

Looking at the above chart, you can see that after the breakdown below the 61.8% retracement, the SLV ETF accelerated declines and reached the downside target level.

At this point, it’s worth noting that a huge volume that followed significant downswings in the SLV ETF usually meant that a correction would be seen shortly. Combining these two facts, we can conclude that an upswing in the coming days should not surprise us.

Summing up, the outlook for silver remains bearish. However, taking into account the facts that spot silver reached the support line based on the 2008 and 2013 lows and the SLV ETF just declined on significant volume, we might see a corrective move up in the short term. Additionally, Monday’s reversal makes the upward correction even more likely to be seen in the coming days.

In order to stay updated on a continuous basis (via Premium Updates and Market Alerts + intra-day alerts whenever necessary), please subscribe to our Premium Service.

Thank you for reading. Have a great weekend and profitable week!

Przemyslaw Radomski, CFA

Back