The Consumer Price Index increased 0.3 percent last month. What does it imply for the gold market?

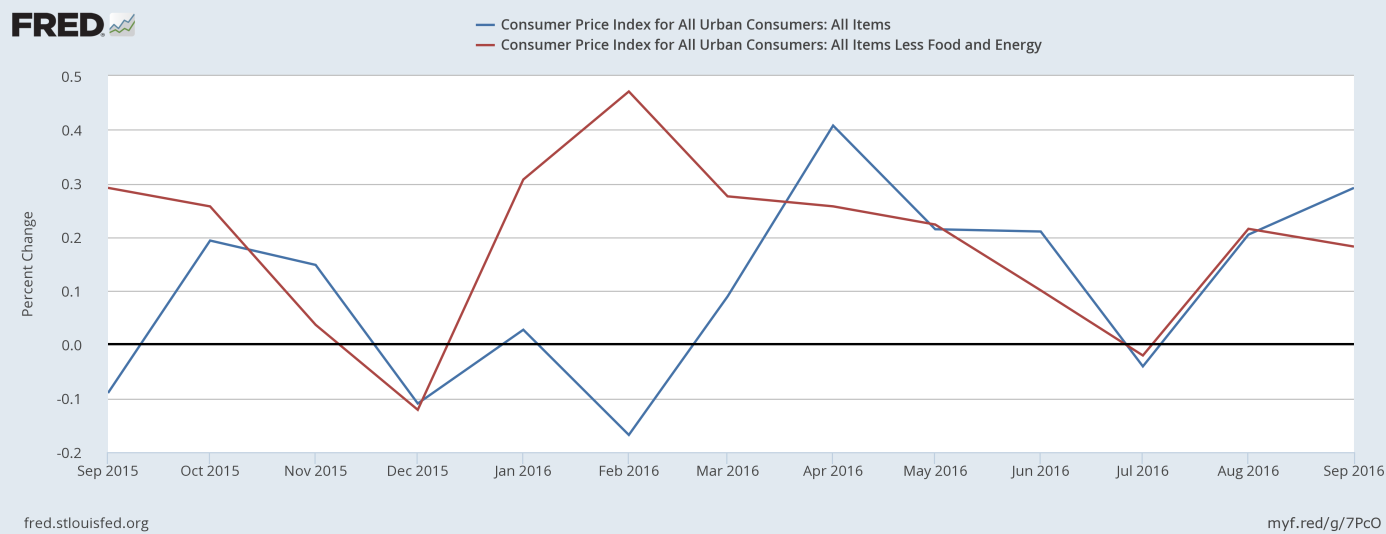

U.S. consumer prices climbed 0.3 percent in September. It was the largest rise since April, as one can see in the chart below. The core CPI Index, which excludes food and energy, rose 0.1 percent.

Chart 1: CPI (blue line) and core CPI (red line) on a monthly basis from September 2015 to September 2016.

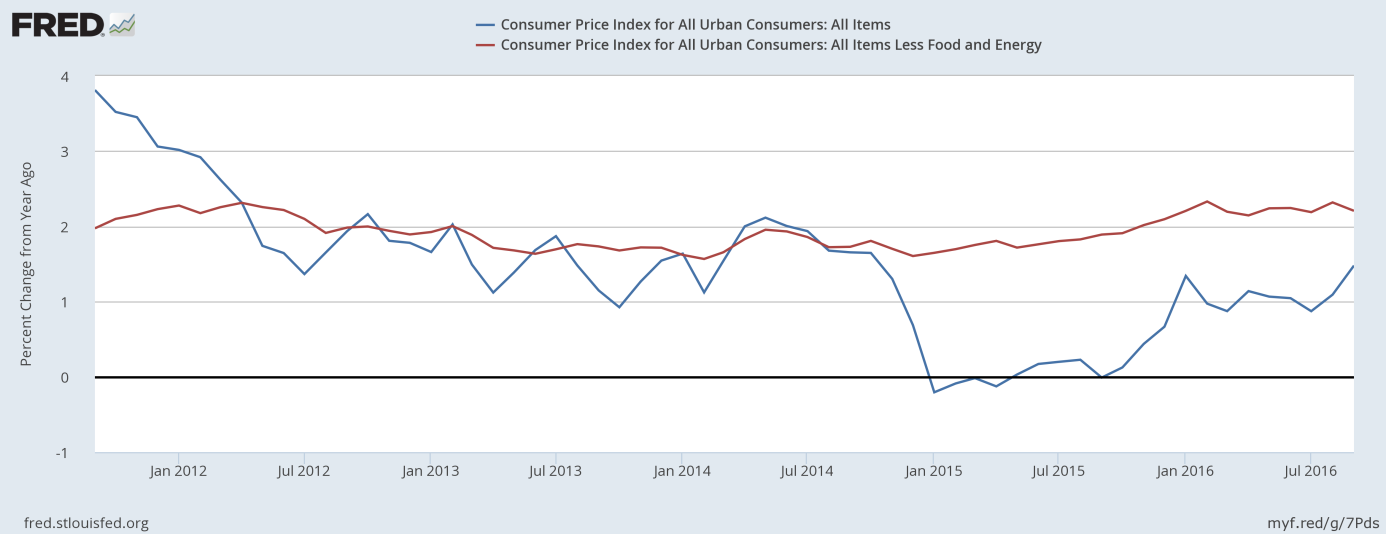

On an annual basis, the core CPI jumped 2.2 percent, while the all-items index of consumer prices increased 1.5 percent, the largest increase since October 2014. The chart below shows that although the core CPI has been generally flat for a while, the overall index has accelerated recently . This is because gasoline prices rose 5.8 percent in September, accounting for more than half of the increase in the CPI.

Chart 2: CPI (blue line) and core CPI (red line) year-over-year from September 2011 to September 2016.

It does not need to be terrible news for the gold market in the long-term, since higher inflation implies lower real interest rates, but in the short run the rise in CPI should spur the Fed to hike interest rates sooner rather than later.

Summing up, U.S. consumer prices rose 0.3 percent in September. Although the core index increased less than it had a month earlier (and also less than expected), the report should slightly strengthen the hawkish camp within the Fed. Or at least is should not prevent it from going through with the likely hike in December. The market odds of raise in interest rates in the last month of this year remains at about 70 percent. And the latest Fed’s Beige Book said that the U.S. economy in most of the country grew at a modest to moderate rate. All this is not good news for the gold market in the near future; however, there still is plenty of data to come.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview