Based on the October 18th, 2013 Premium Update. Visit our archives for more gold articles.

On Thursday, the S&P 500 closed at a new high and its intraday record of 1733.45 broke the all-time high set Sept. 19. Over 80 percent of stocks traded on the New York Stock Exchange rose. According to FactSet, companies in the S&P 500 index are on track for third-quarter earnings growth of 1.1% from last year. Excluding J.P. Morgan Chase's loss, they would be on pace for 3.6% growth. Please note that at the beginning of earnings season, analysts expected earnings growth of 3%.

Taking into account the fact that there are no technical resistance levels at the moment, it seems that stocks could continue their rally in the coming weeks or even months. Additionally, with Janet Yellen scheduled to take over as chief of the Fed, the stock market should increase as long as inflation remains low and unemployment remains elevated.

And speaking of the Fed… According to Reuters, many investors think that damage done to the U.S. economy by the 16-day government shutdown and uncertainty over the next round of budget and debt negotiations may keep the Fed from withdrawing monetary stimulus until at least a few months into next year.

The Fed's taper decision will ultimately be tied to the economic data. In the coming week all eyes will be on the crucial nonfarm payrolls report. The report was originally scheduled for release on Oct. 4, but because of the government shutdown, it will be released next Tuesday.

It seems that the U.S. debt deal and a rather unlikely reduction of Fed asset purchases are positive for both gold and the general stock market. However, let’s not forget that these two markets used to move in the opposite directions in the past few weeks. The question becomes - how will the current situation in the general stock market impact the gold market? Before we try to answer these questions, let's take a closer look at the charts to find out what the current situation in the general stock market is (charts courtesy of http://stockcharts.com).

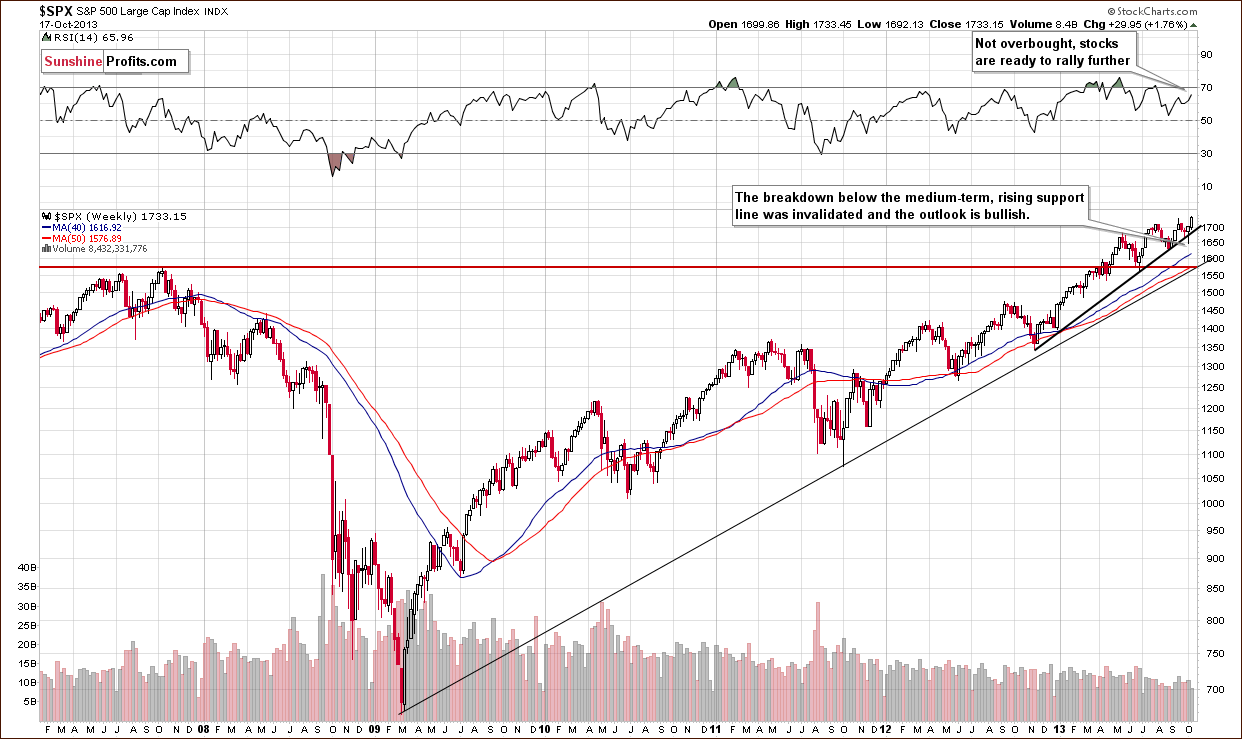

Looking at the above chart, we see that the invalidation of the breakdown below the rising medium-term support line has indeed triggered the expected rally in the past few days. The S&P 500 rose and actually moved above its September 18 top. There was no analogous breakout in case of the Dow Jones Industrial Average, though.

The outlook is bullish and – as you will see in the section about gold & silver correlations - the implications for gold are bearish.

Let’s turn now to the financial sector, which in the past used to lead the rest of the general stock market.

As we wrote in previous essay on the general stock market on October 15:

(…) since the support created by the 2011 high is relatively close, we will likely not see another major decline.

On the above chart, we clearly see that, in spite of the last week’s downward move, the financial stocks didn’t invalidate the breakout above the level of 130. These positive circumstances triggered an upward move this week, which took the financials to slightly below the September high.

Consequently, the medium-term outlook remains bullish. Please note that the financial stocks proved once again to be a reliable indicator in estimating whether the trend is about to change or not.

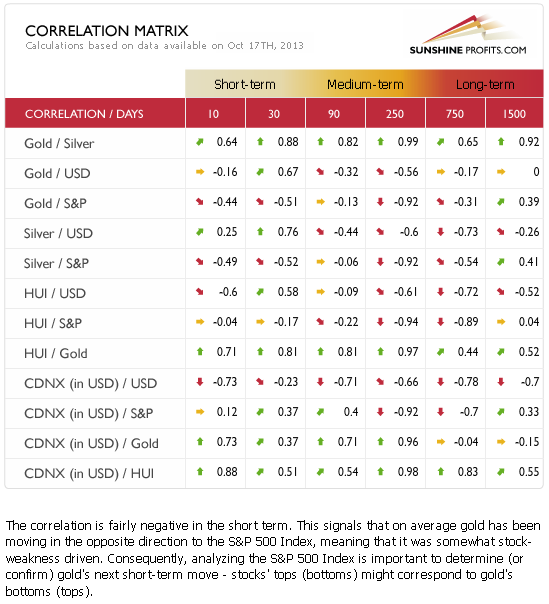

Once we know the current situation in the general stock market, let’s see how it may translate into the precious metals market. Let’s take a look at our Correlation Matrix – a tool designed to measure, present and provide interpretations of correlations between various parts of the precious metals sector and key markets that impact it – specifically, at the USD Index and the general stock market.

In the previous week, the correlations have turned upside down in the short-term (30-days) column. The most interesting thing about these coefficients is what actually caused them to reverse. In the case of the USD Index – it was the fact that metals managed to decline even when the dollar declined (bearish implications). In the case of the general stock market, it was the fact that metals managed to decline along with a decline in stocks.

The bullish invalidation of the breakdown in stocks and this week’s breakout are so important because of the significant and negative correlation with gold and silver. Naturally, the bullish action in the stock market is bearish for the precious metals sector.

Recently (mainly on Thursday), we have seen some strength in precious metals and mining stocks, but this was not enough to change the most important correlations. In the case of gold, silver and the general stock market, the correlations remain strongly negative. Although the correlation between miners and the S&P500 is weaker, mining stocks are not likely to move anywhere without metals moving in the same direction, so the negative impact of the stock market’s rally should also be seen in case of mining stocks – if not directly, then most likely indirectly, and if not immediately, then eventually. On a side note, correlation does not imply causation by itself, we estimate the direction of the relationship (for instance that the general stock market impacts mining stocks, not the other way around) based on fundamental information and our experience.

Summing up, the long-term, medium-term and short-term outlook for the stock market remains bullish which is a bearish factor for the precious metals market.

Meanwhile, on a short-term note, yesterday's almost $40 rally in gold invalidated a few important resistance levels, not only on the gold market, but also in case of silver. Will this breakout make gold rally despite stocks' negative impact? You'll find detailed analysis along with our preferred way of taking advantage of the situation in today's Premium Update. Sign up today.

Thank you.

Przemyslaw Radomski, CFA

Back