Last week, important reports on industrial production were released. What do they mean for the gold market?

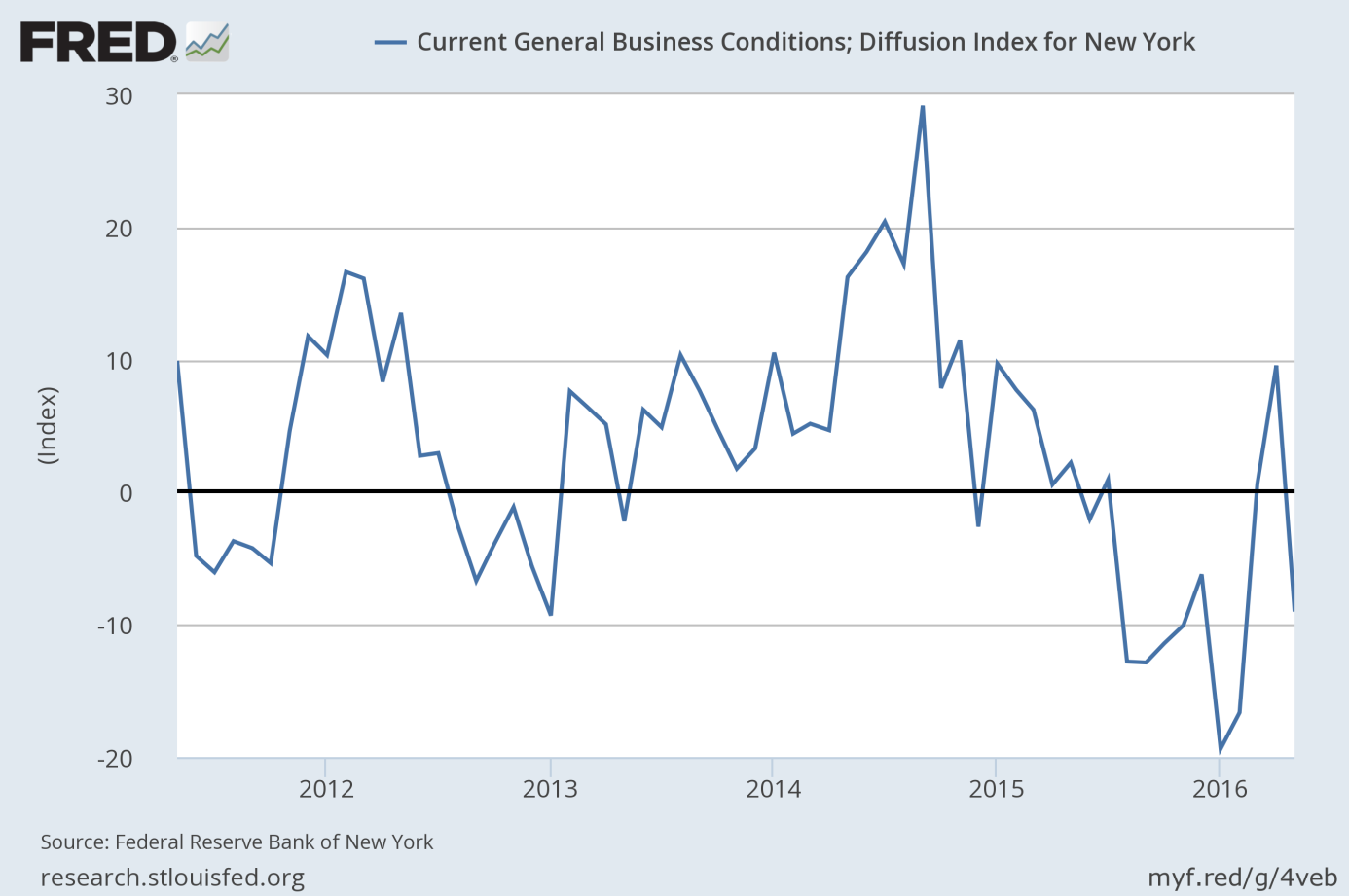

Let’s begin with the Empire State Index, which turned negative in May. Manufacturing conditions in the state of New York deteriorated sharply, as the index plunged from 9.6 to minus 9. Additionally, the new orders and shipments indexes also fell below zero. As the chart below clearly shows, the trend in manufacturing in New York remains negative. It does not support an interest rate hike in June, which is positive news for the gold market. However, manufacturing conditions have been worsening since September 2014, but the Fed did raise the interest rates in December 2015.

Chart 1: The General Business Conditions Index in the New York area from 2011 to 2016.

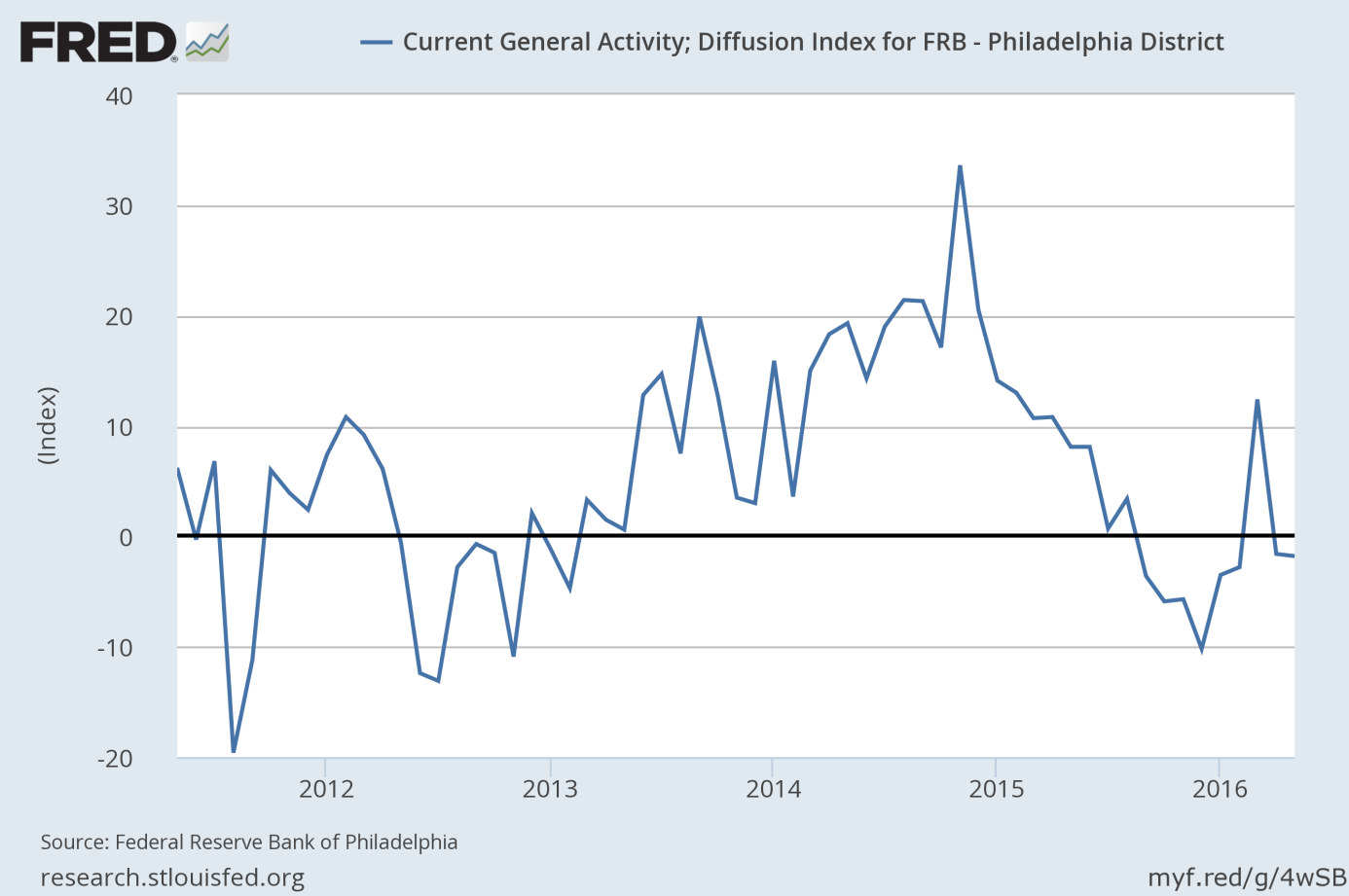

The Empire State report was followed by the Manufacturing Business Outlook Survey, which presents a barometer of manufacturing in the Philadelphia Fed region. The Philly Fed Index declined from negative 1.6 to negative 1.8 in May. The reading disappointed economists who had expected a positive 3. It was the eighth negative reading in the past nine months. Moreover, the new orders index and employment were in contraction in May. As one can see in the chart below, there is a disappointing trend consistent with manufacturing conditions in the New York. Thus, the negative signal from the industry is strengthened, which should be positive for the gold market. However, the Fed may believe that the manufacturing sector is likely to stabilize in the medium-term.

Chart 2: The Current General Activity Index in the Philadelphia Fed region from 2011 to 2016.

To sum up, manufacturing remains in recession. Industrial production jumped in April, however, the move was driven mainly by the rebound in utilities. And the most recent regional manufacturing indices fell again in May, which suggests that April gains may be only temporary. Indeed, the Markit Flash PMI decreased from 50.8 to 50.5 in May, with production declining for the first time since September 2009. Therefore, manufacturing does not support an interest rate hike in June, which is good news for the gold market. However, it is not clear if the Fed is really data dependent and if it pays enough attention to the industrial production to postpone the hike again.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview