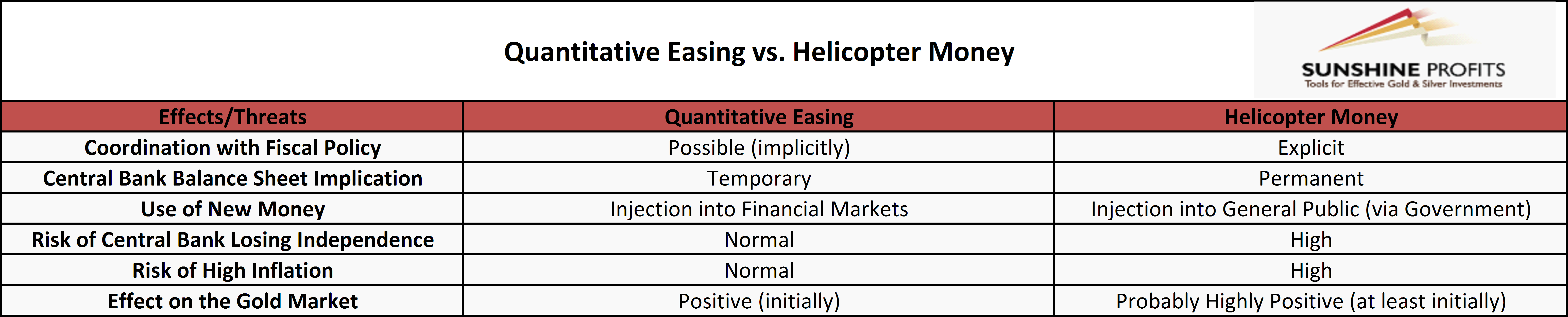

To properly understand helicopter money and its potential effects for the gold market, it is necessary to analyze differences between it and quantitative easing. In some senses, both tools are similar as they support the government budget. Some analysts even call quantitative easing in ‘helicopter money in disguise’. However, there are a few important differences between these two monetary policies, as one can see in the table below.

Table 1: Comparison of quantitative easing and helicopter money.

First, financing of fiscal deficits was not the explicit aim of quantitative easing which was generally conducted independently from the fiscal policy. The purpose of quantitative easing was to purchase financial assets and to stimulate the economy by wealth effects (due to higher asset prices), as well as a portfolio rebalancing effect and inflation expectations – the lower borrowing costs for the government were only a by-product (well, at least officially). On the other hand, helicopter drops are overt money finance and their very aim is the direct funding of government spending or tax cuts. Therefore, helicopter money may be regarded as a quasi-fiscal policy, in fact. Here lies one of the biggest risks connected with the helicopter money. You see, helicopter drops require a stronger cooperation between the central bank and the Treasury. Call us skeptics, but it is not difficult to see that ‘cooperation’ could lead to the loss of independence of central banks. Remember the ‘collaboration’ between the Fed and the U.S. Treasury during the World War II? The central bank committed to keep the Treasury rates low to provide the government with cheap debt financing of the war effort. Surely, the WWII was an unusual time that required unconventional moves and perhaps justified such a pledge. However, the Fed did not restore independence until 1951. Last time we checked, the war ended in 1945, six years earlier. It goes without saying that the reduction in the central banks’ independence would support the gold market. It would wipe out any credibility in central banks’ inflation targeting. The inflation expectations could become unanchored at some point, spurring the safe-haven demand for gold.

Second, in theory, quantitative easing is temporary, since central banks are supposed to resell assets they previously purchased. We would not bet money that the Fed’s balance sheet will shrink significantly someday, but such a commitment could affect market expectations and thus aggregate demand. On the other hand, helicopter drops are practically irreversible by assumption, because central banks do not purchase assets, but merely transfer money for nothing in exchange. Therefore, reversing this policy would require the destruction of banknotes or proclaiming them invalid. This is why some analysts see helicopter money as a permanent and irreversible quantitative easing.

This explanation sheds some light on the implications for the gold market. As everyone remembers, quantitative easing was initially positive for the price of gold. However, fears associated with the asset purchase programs diminished over time and their impact on the gold market turned out to be negative. One of the reasons why worries vanished was that investors believed that the increase in the money supply was only temporary. Thus, permanent quantitative easing could bring more uncertainty, which should be welcomed by the gold bulls. Moreover, it would be coordinated with (if not subordinated by) the expansionary fiscal policy, which should only add to the uncertainty about the U.S. dollar’s strength, supporting the price of gold. Contrarily, the U.S. quantitative easing programs were partially accompanying by reductions in government spending.

Third, and perhaps most importantly, helicopters would drop money through other channels of monetary policy transmission. As you probably well know, traditional monetary policy operates via interest rates. In normal times, central banks used open market operations to affect the price of bank reserves and, consequently, the lending activity of commercial banks. The Great Recession forced a change of approach. Since interest rates had approached zero, central banks started quantitative easing programs. Their aim was to increase the broad money supply through a direct increase in the monetary base, rather than through affecting the price of bank reserves. In other words, central banks began to introduce new money into the economy via the asset market, bypassing the impaired bank lending channel. Quantitative easing might help a bit, but the pace of credit growth and broad money supply growth still depends on the banks and borrowers’ decision to increase leverage. Helicopter money would revolutionize the transmission mechanism of monetary policy, since it would bypass the financial sector by introducing new money directly into the ‘real economy’ (by transferring funds to citizens or government). In other words, helicopter drops would directly affect the aggregate demand, not indirectly through the response of the private sector (like expansion of credit) to the central banks’ actions.

You may think that it sounds good. But there is a catch: inflation. Yes, we know that the boosting inflation is the very aim of the whole idea of helicopter drops. However, there is a risk that it would get out of control. Surely, smart rules would keep inflation in check. However, the problem is that once the monetary Rubicon is crossed, it opens the way to gradually loosening the constraints. You see, when a government gets a new policy tool, it tends to use it until it blows something up. To be clear, we do not argue that once helicopters take off, hyperinflation immediately emerges. We just say that giving a box of whiskey to the alcoholic would not be the smartest thing in the world. It’s simply better not to take the risk. Investors are of course aware of this truth, so they would probably get insured against the worst inflationary scenario by buying gold, at least until they see that their worries were unjustified. The introduction of quantitative easing was initially positive for the shiny metal. Since helicopter money would be a permanent quantitative easing coordinated with an expansionary fiscal policy and associated with more widespread inflation (because new money would be placed by the government into the accounts of the general public, not of securities dealers like in case of QE), it is not rocket science to see why the implementation of helicopter drops would support the price of gold.

If you enjoyed the above analysis and would you like to know more about the consequences of the unconventional monetary policy for the gold market, we invite you to read the October Market Overview report. If you’re interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts. If you’re not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview