Oil Trading Alert originally sent to subscribers on March 16, 2016, 8:57 AM.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Tuesday, crude oil lost 1.74% ahead of American Petroleum Institute supply report. In this way, light crude reached the first support area and rebounded slightly. Will we see further improvement and a re-test of recent highs?

Yesterday, the commodity slipped to an intraday low of $35.96 as the combination of the uncertainty surrounding the participation of Iran in the freezing deal and fears that the API report will show another increase in crude oil inventories weighed on investors’ sentiment. Thanks to these circumstances, light crude reached the first support area and rebounded slightly. Will we see a further improvement and a re-test of recent highs? Let’s examine charts and find out (charts courtesy of http://stockcharts.com).

Yesterday, we wrote the following:

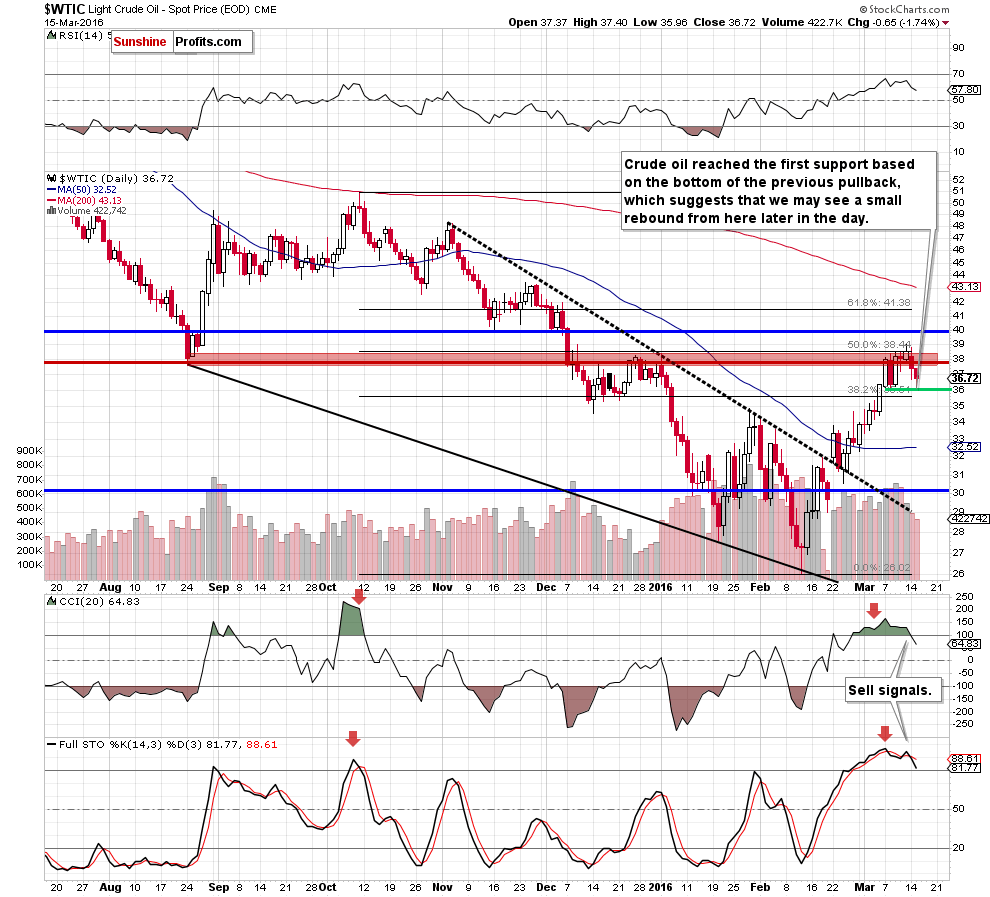

(…) light crude invalidated earlier breakout above the red resistance zone, which in combination with the medium-term picture and sell signals generated by the CCI and Stochastic Oscillator suggests further deterioration. How low could the commodity go in the coming days? In our opinion, the initial downside target would be around $35.96, where the 23.6% Fibonacci retracement (based on the entire recent upward move) is.

Looking at the daily chart, we see that the situation developed in line with the above scenario and crude oil moved lower to our first downside target. As you see, in this area is also the bottom of the previous pullback (hit on Mar 8), which in combination with the 23.6% Fibonacci retracement could encourage oil bulls to act. If this is the case, light crude will likely rebound from here and re-test the strength of the red resistance zone once again (we may see an upswing even to around $38.30-$38.36).

Nevertheless, even if we see such price action, in our opinion, the above-mentioned key resistance zone will be strong enough to stop further rally. Therefore, what we wrote yesterday remains up-to-date:

(…) We expect a high volatility in the crude oil market tomorrow due to futures contracts expiration and we might be able to open short positions at more favorable prices because of that. Consequently, we are not opening such positions just yet (…)

Finishing today’s Oil Trading Alert, we would like to draw your attention to one of the most important factors, which usually affects the price of crude oil and other commodities.

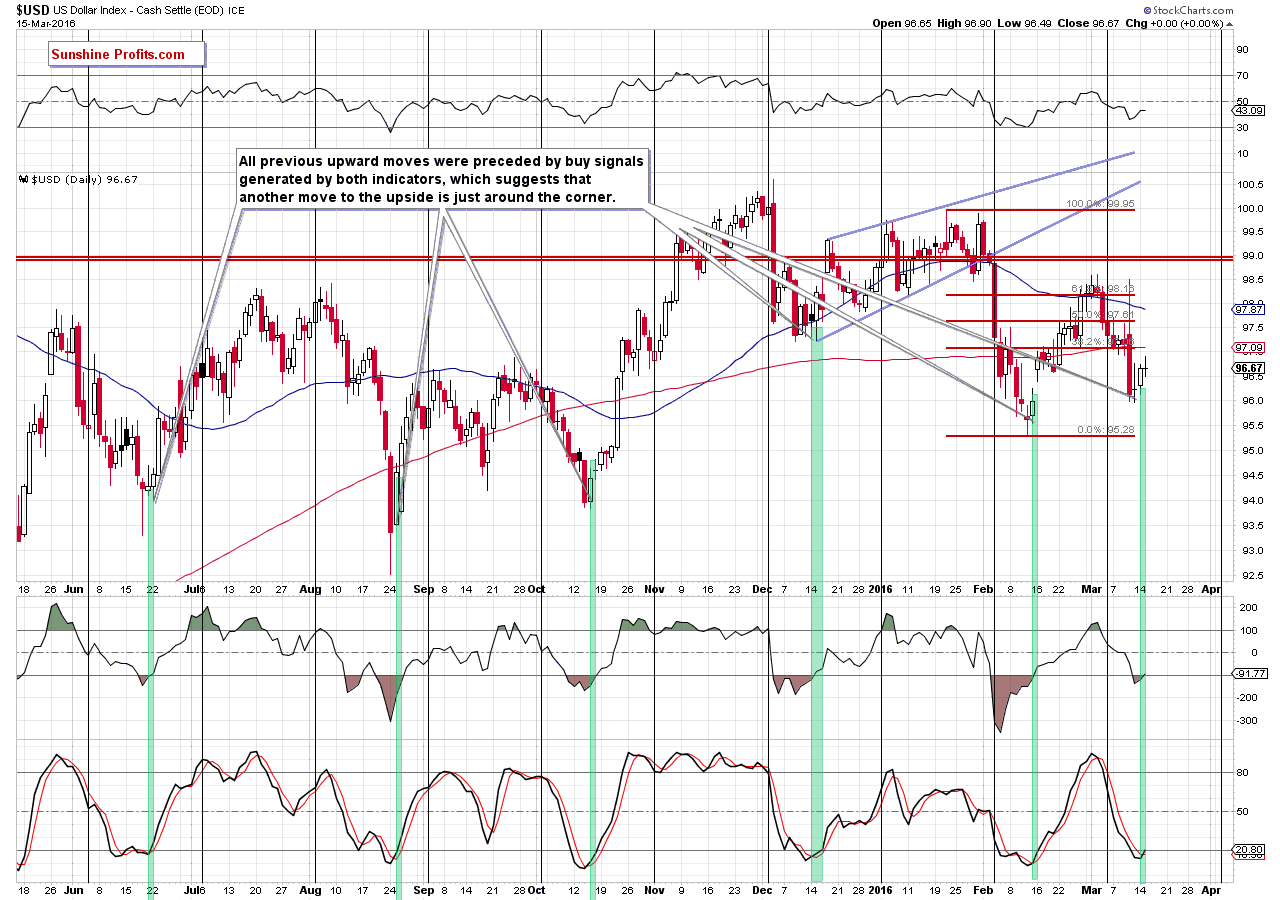

As you see on the daily chart, a negative correlation between light crude and the USD Index came back at the beginning of March. Since then, lower values of the index corresponded to higher values of crude oil. Additionally, recent greenback’s rebound coincides with the pullback in the commodity. Taking this relationship into account it seems that today’s Fed interest rates decision may also have an impact on the price of crude oil. Although most market participants expecting no change in monetary policy, we should keep an eye on the U.S. currency, because the CCI and Stochastic Oscillator generated buy signals, suggesting higher values of the greenback in the coming days. On the above chart, we see that all previous bigger upward moves were preceded by buy signals generated by both indicators. Therefore, in our opinion, the history will repeat itself once again and we’ll see the USD Index above 98 in the coming days.

Summing up, crude oil extended losses and dropped to the first support area created by the Fibonacci retracement and the bottom of the previous pullback. Taking this fact into account, we may see a rebound from here later in the day. Nevertheless, we believe that even if we see such price action the key resistance zone will be strong enough to stop oil bulls. Therefore, in our opinion, lower values of the commodity are more likely than not.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed with bearish bias

MT outlook: mixed with bearish bias

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts