Oil Trading Alert originally sent to subscribers on August 3, 2015, 9:20 AM.

Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective.

On Friday, crude oil declined sharply after news that production among OPEC members in July pushed supply at the oil cartel to its highest level in seven years. In this environment, light crude lost 3.45% and re-tested the Jul low. Where will oil bears take the commodity in the coming days?

On Friday, news that OPEC supply increased to 32.01 million barrels per day (from an upwardly revised total of 31.87 million bpd in June) in combination with bearish Baker Hughes report (which showed that U.S. oil rigs increased to its highest level since May) weighed on investors’ sentiment and pushed the commodity sharply lower. As a result, light crude erased all last week’s gains and dropped to the Jul 28 low. Where will the commodity head next? (charts courtesy of http://stockcharts.com).

In our Oil Trading Alert posted on Tuesday, we wrote the following:

(…) If the commodity extends declines (…), we’ll see (at least) a test of the 78.6% Fibonacci retracement levels (around $46.72).

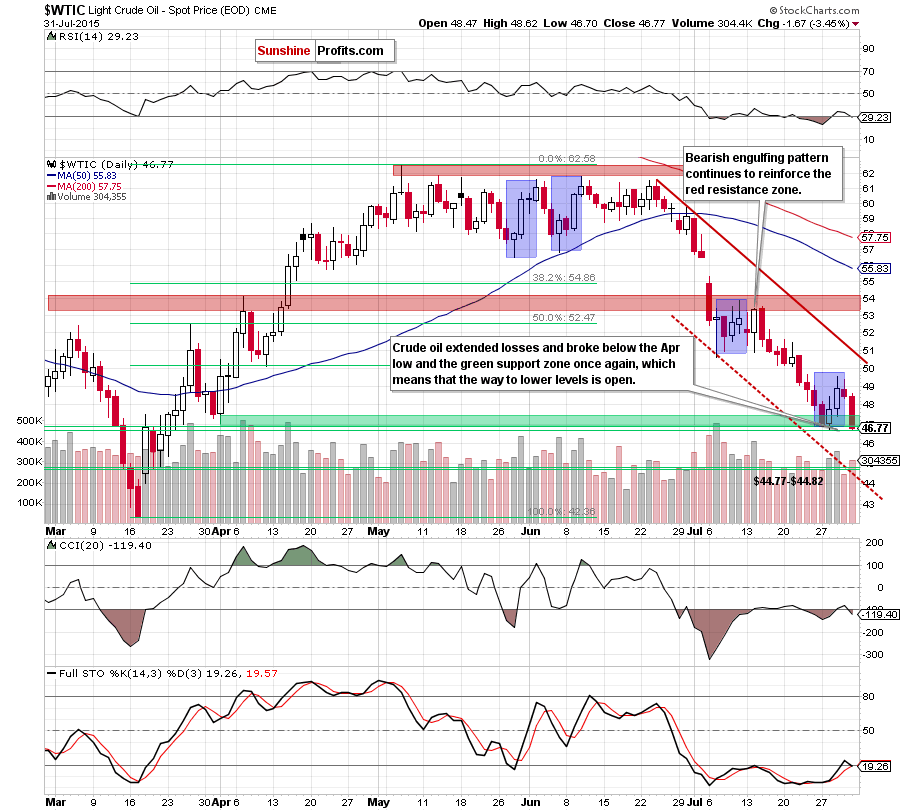

Looking at the daily chart we see that although crude oil moved higher in the previous week, the commodity reversed and declined sharply on Friday, reaching our initial downside target. What’s next? When we take a closer look at the daily chart, we clearly see that the last week’s upward move didn’t change anything in the short-term picture because it was similar to the previous one and much smaller than upward moves in May and June (all marked with blue on the above chart). This means that the downtrend remains in place and lower prices of light crude are just around the corner.

At this point, it is worth noting that Friday’s downswing materialized on sizable volume and took crude oil below the Apr low and the green support zone (it was also the lowest daily close since Mar 20), which suggests that our next downside target from our Tuesday’s alert will be in play in the coming days:

(…) What could happen if this support is broken? In our opinion, the next target for oil bears would be the lower border of the declining trend channel (…) or even the green support zone created by the Mar 19 and Mar 20 lows ($44.77-$44.82).

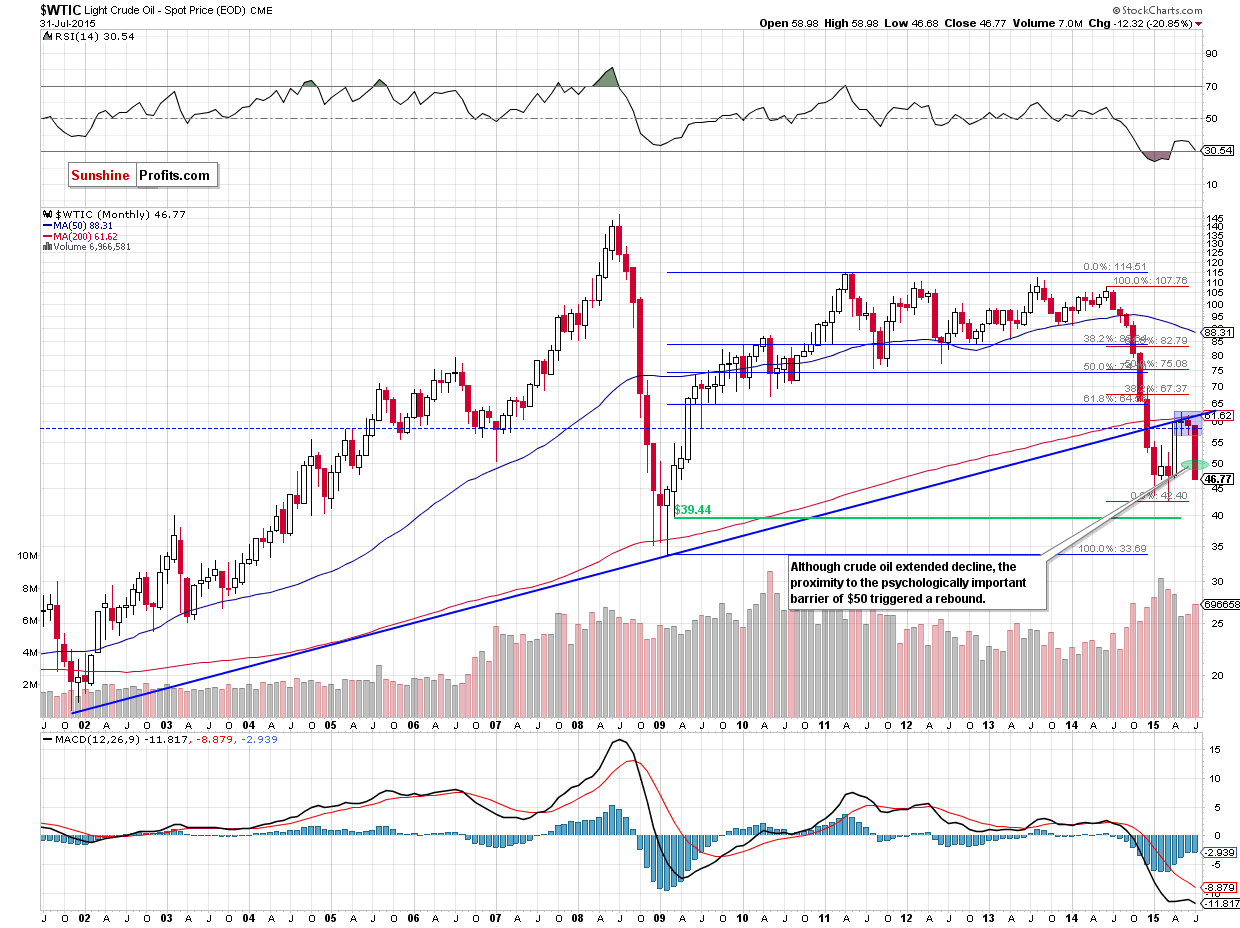

Summing up, July was the worst month for the commodity since the beginning of the year. In this period of time, crude oil lost 20.85% (we entered the short position on May 8 when crude oil was trading at about $59) and broke below the Apr low, closing Friday’s session at its lowest level since Mar 20. This confirms that the downtrend remains in place and suggests that lower values of the commodity are ahead us.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts