Oil Trading Alert originally sent to subscribers on June 8, 2015, 9:18 AM.

Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective.

Although crude oil moved lower after the market’s open, the commodity reversed and rebounded, invalidating earlier breakdown. Will we see further improvement?

On Friday, OPEC kept production levels unchanged from their current level at approximately 30 million barrels per day in line with expectations. On top of that, the Baker Hughes reported that the number of oil rigs declined by four to 642 in the previous week to the lowest level since Aug 2010. In these circumstances, light crude invalidated earlier breakdown and closed the day above $58. Will we see further improvement? (charts courtesy of http://stockcharts.com).

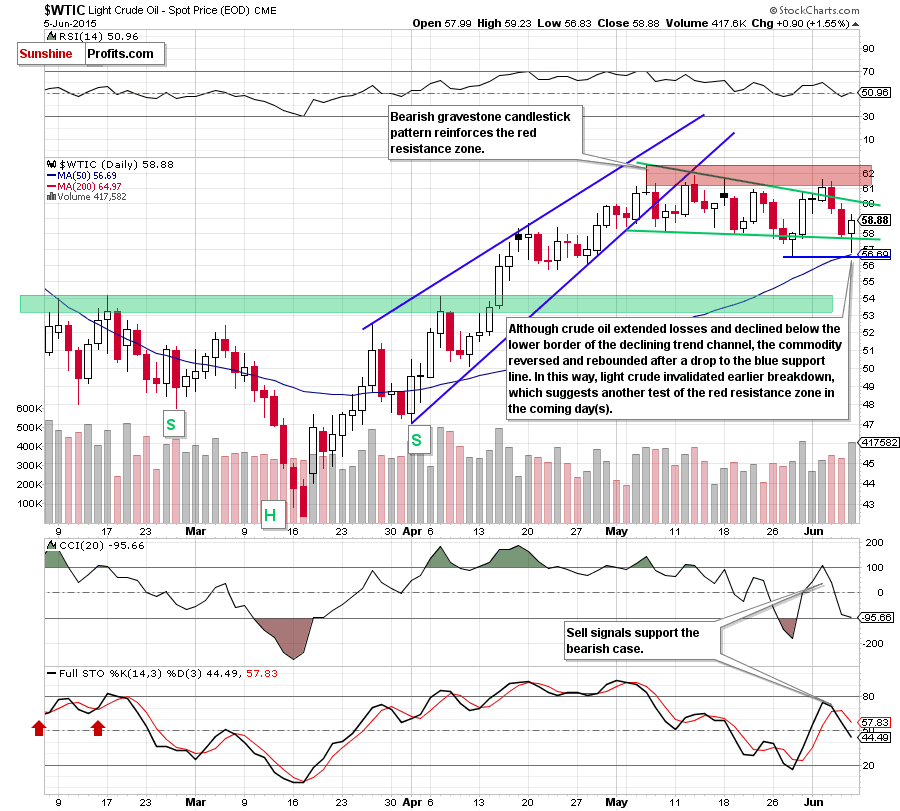

Looking at the daily chart we see that crude oil moved sharply lower after the market’s open and slipped below the green support line, which triggered a test of the recent low and the 50-day moving average. As you see on the above chart, the combination of these two supports encouraged oil bulls to act and resulted in a sharp rebound. In this way, light crude invalidated earlier breakdown, which is a positive signal that suggests further improvement and a test of the red resistance zone in the coming day(s).

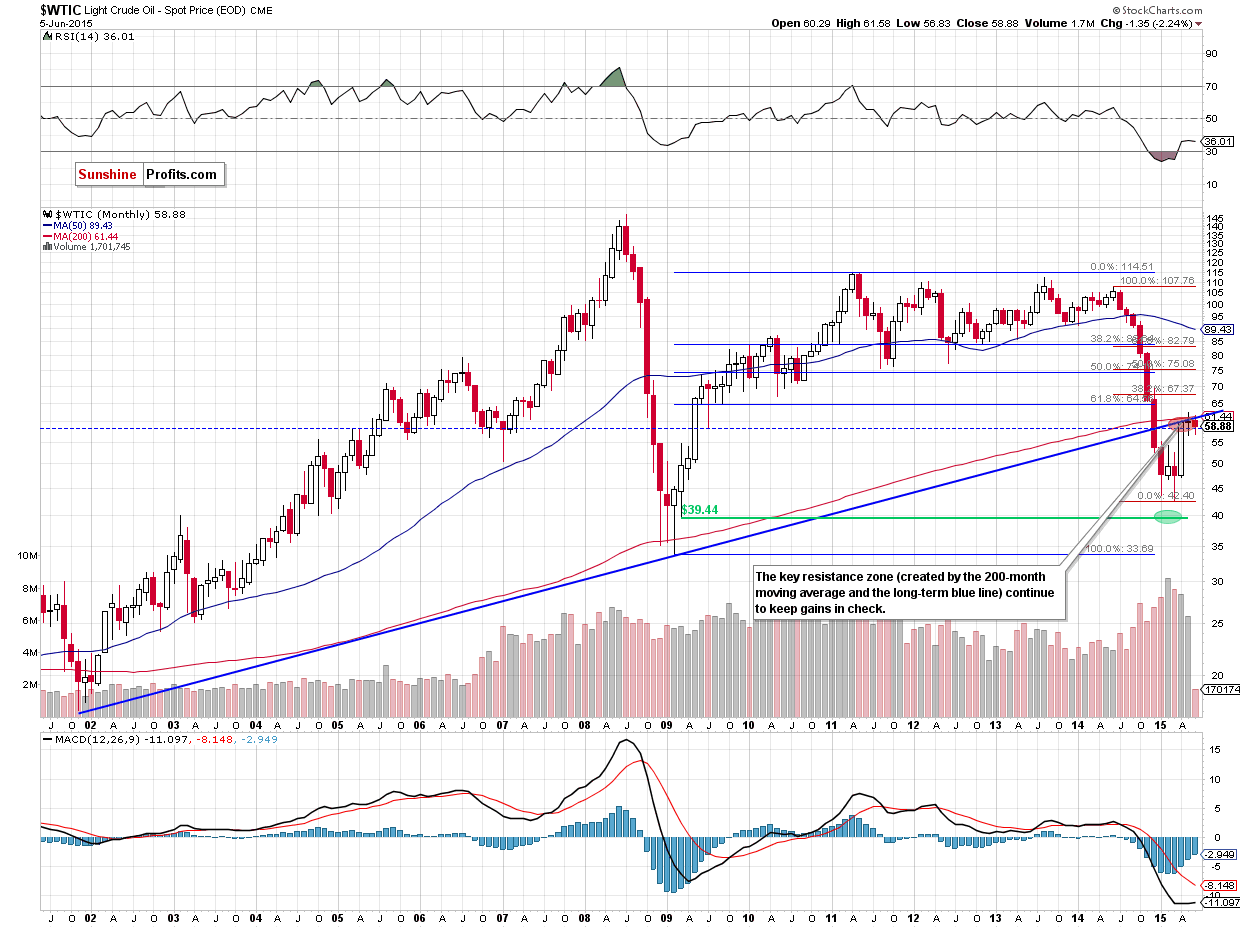

Nevertheless, we should keep in mind that sell signals generated by the indicators remain in place, supporting further declines. Therefore, we believe that even if we see such price action and crude oil moves higher from here, the red resistance area in combination with the key resistance zone (created by the 300-month moving average and the long-term blue resistance line) marked on the monthly chart will be strong enough to stop further improvement – similarly to what we saw in the previous weeks.

Summing up, crude oil invalidated earlier breakdown under the lower border of the declining trend channel, which suggests further improvement and a test of the red resistance area in the coming days. Nevertheless, sell signals generated by the indicators and the key resistance zone support oil bears.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts