Oil Trading Alert originally sent to subscribers on June 3, 2015, 6:46 AM.

Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective.

On Tuesday, crude oil gained 1.33% as the combination of a weaker greenback and speculations that OPEC will maintain production at its current level on Friday's meeting in Vienna supported the price. Thanks to these circumstances, light crude broke above one of the resistance lines, but is this as positive event as it seems at the first sight?

Yesterday, the Commerce Department showed that factory orders declined by 0.4% in April, missing expectations for a 0.2% increase. Additionally, on a year-over-year basis, factory orders fell by 6.4%, which fueled worries over the outlook for second quarter growth and pushed the USD Index below 96. A weaker greenback made crude oil more attractive for buyers holding other currencies, which translated to an increase to an intraday high of $61.58. Is yesterday’s increase as positive event as it seems at the first sight? (charts courtesy of http://stockcharts.com).

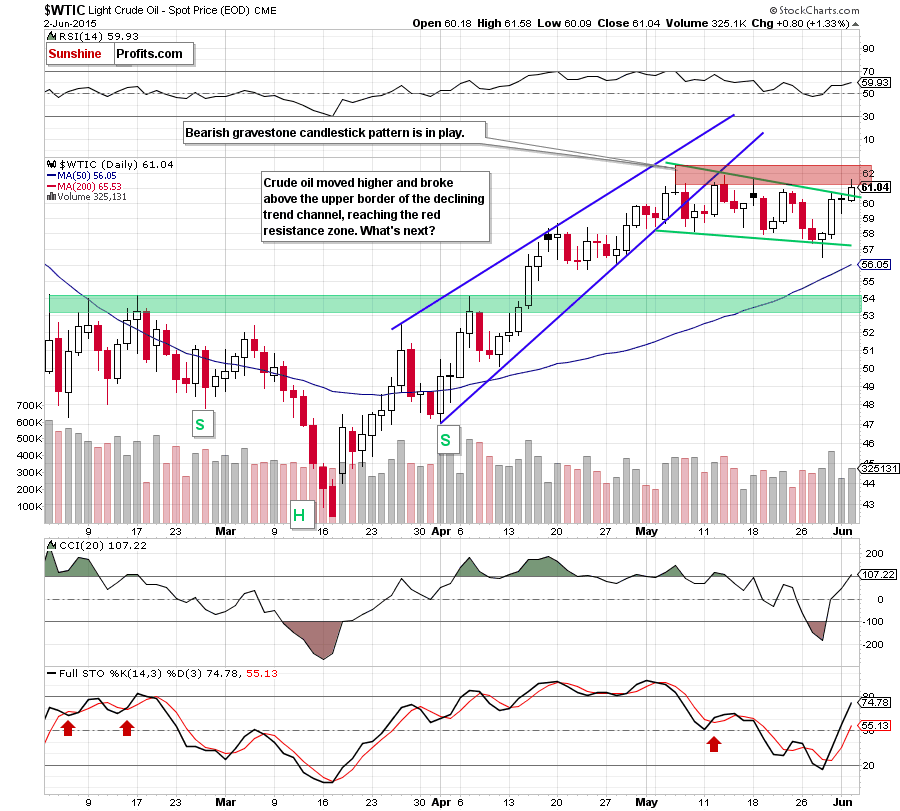

On the daily chart, we see that crude oil extended gains and broke above the upper border of the green declining trend channel. Alhough this is a positive signal, which suggests a test of the 2015 high, the size of volume that accompanied yesterday’s increase wasn’t huge, which means that oil bulls might not be as strong as it seems at the first sight. Additionally, the commodity reached the red resistance zone created by the May highs (and reinforced by a bearish gravestone candlestic pattern), which could stop further improvement – especially when we factor in the long-term picture.

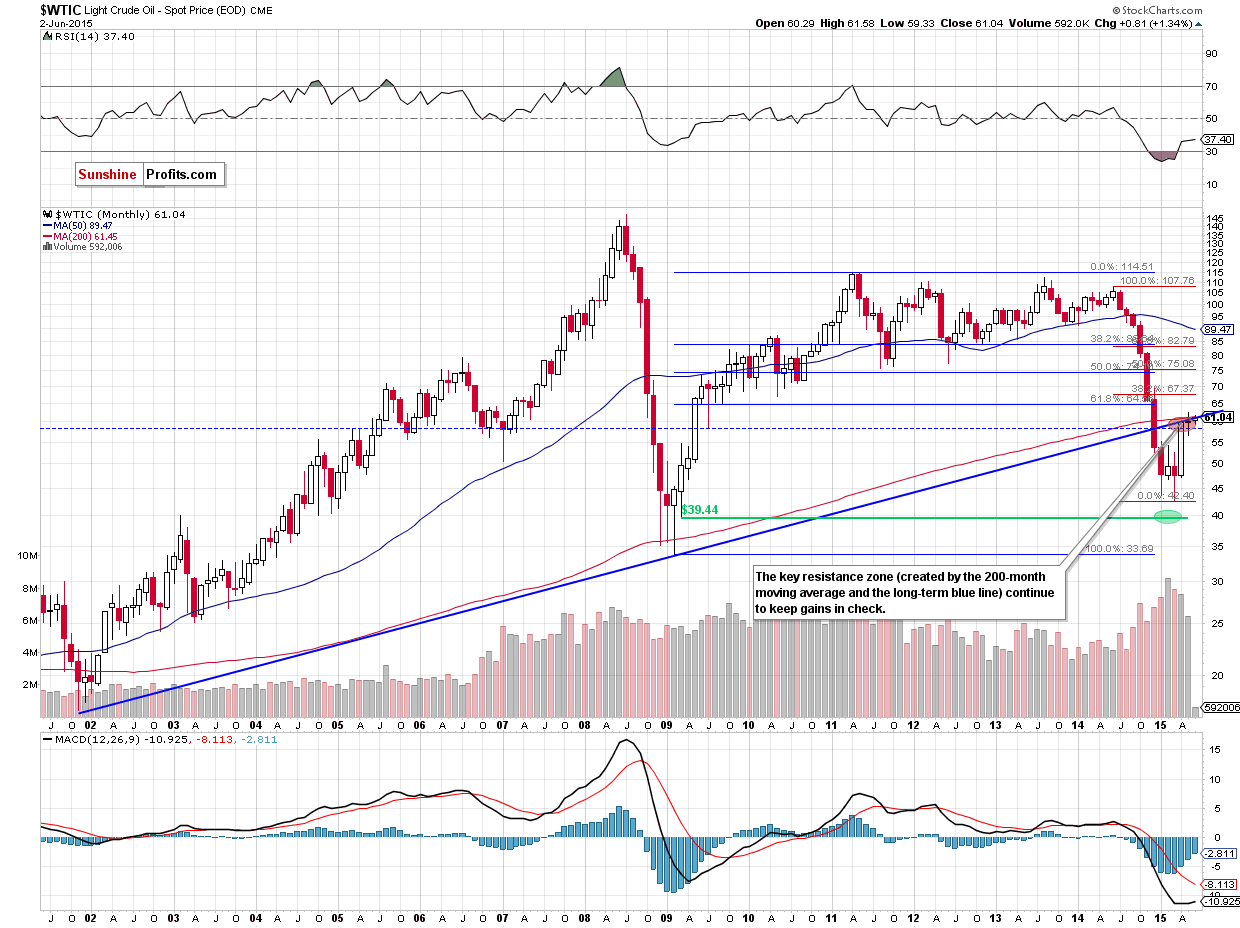

From this perspective, we see that although crude oil moved higher in the recent days, the key resistance zone (created by the long-term blue resistance line and the 200-month moving average) continues to keep gains in check. In our opinion, this means that as long as there is no successful breakout above this area further rally is not likely to be seen and further deterioration is more likely than not.

Summing up, although crude oil broke above the upper border of the declining trend channel, the key resistance zone (marked on the monthly chart) remains unbroken, which suggests that a pullback from here in the coming day(s) is more likely than not.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts