Oil Trading Alert originally sent to subscribers on February 16, 2015, 7:16 AM.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

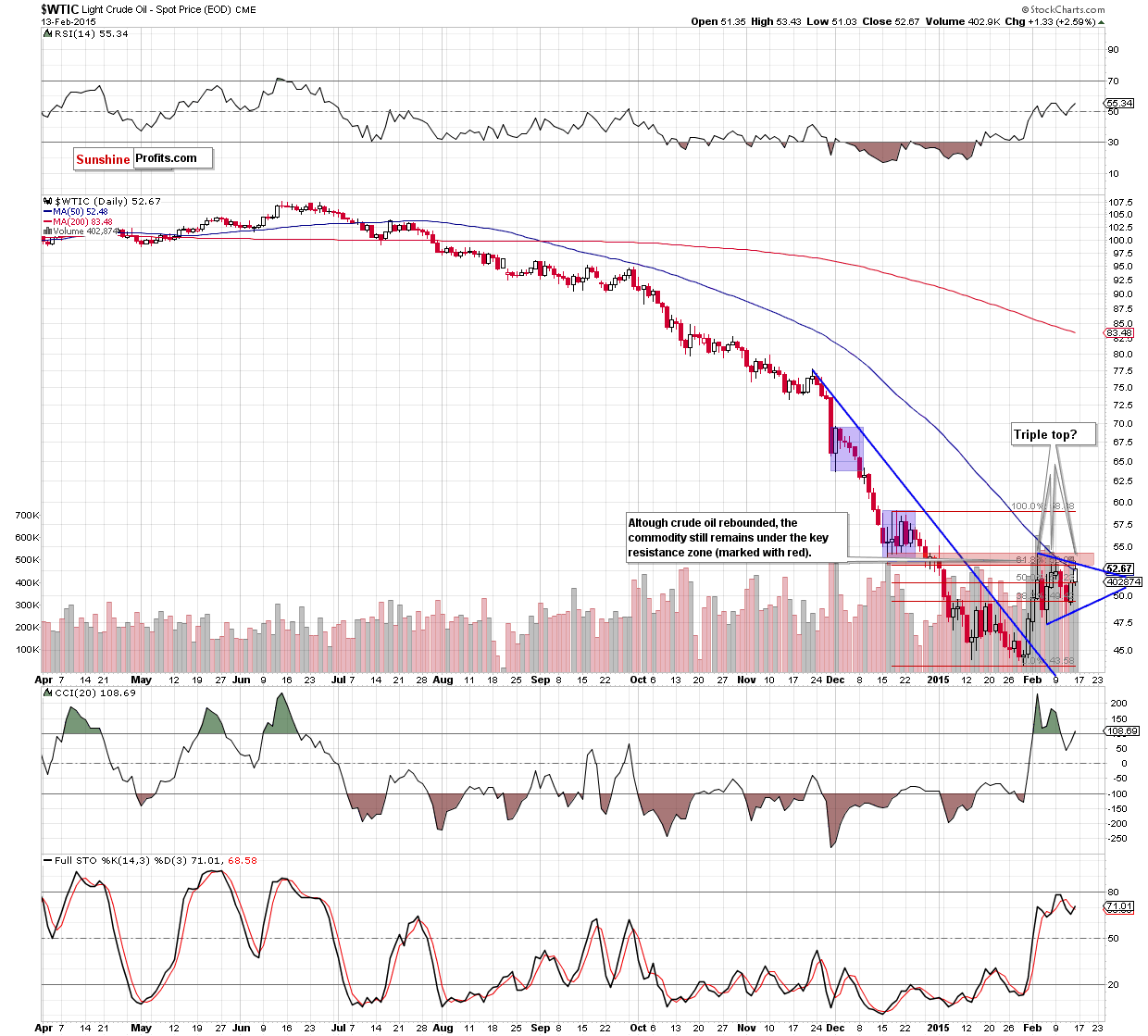

On Friday, crude oil gained 2.59% as weaker greenback and Baker Hughes’ report supported the price. As a result, light crude closed the week above $50 once again, but the commodity still remains under the key resistance zone. Will we finally see a breakout in the coming week?

On Friday, the price of crude oil moved higher as demand for the dollar remained weaker after Thursday's disappointing U.S. retail sales and jobless claims data. Additionally, industry research group Baker Hughes reported that the number of rigs drilling for oil in the U.S. fell by another 84 in the past week to 1,056, which is the lowest since August 2011. At this point, it’s worth noting that the number of oil rigs has declined in 15 of the last 18 weeks, boosting hopes over alleviate a glut in domestic supplies faster than thought. In his environment, light crude extended rally and climbed to an intraday high of $53.43. Will the commodity increase to $60 in the coming weeks? (charts courtesy of http://stockcharts.com).

Quoting our previous Oil Trading Alert:

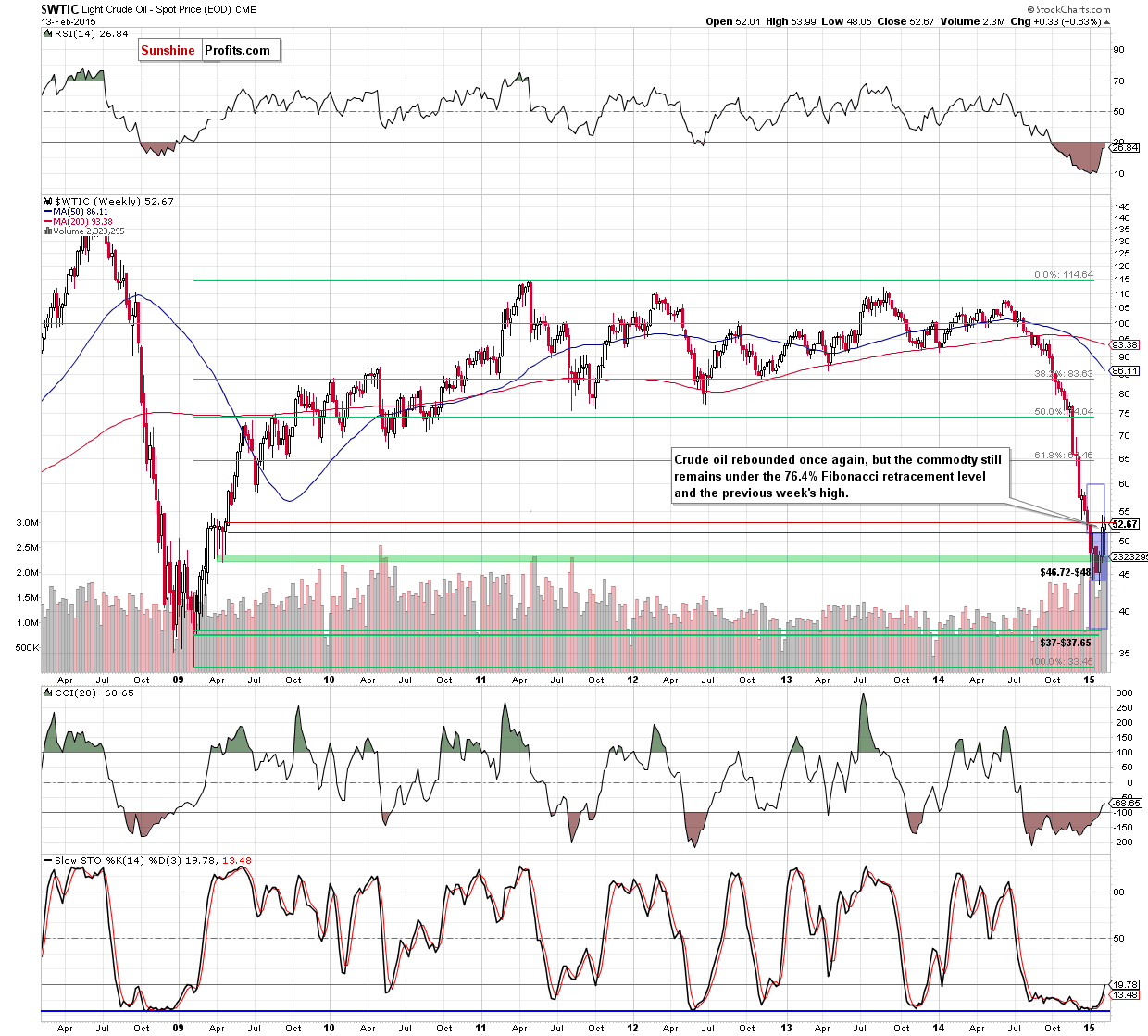

(…) yesterday’s move materialized on sizable volume, which is a positive signal that suggests further improvement and another test of the key resistance red zone around $53.13-$54.24 created by the previously-broken 76.4% and 78.6% Fibonacci retracement levels (marked on the weekly chart), the 61.8% retracement (based on the Dec-Jan decline and seen on the daily chart), the 50-day moving average and the recent highs.

From this perspectie, we see that oil bulls pushed the commodity higher as we expected. Despite this improvement, light crude still remains under the above-mentioned key resistance zone, which means that the overall situation in the very short term hasn’t changed and remains mixed. Nevertheess, we should keep in mind that volume that accompanied Friday’s move was smaller than the day before, which suggests that oil bulls might getting weaker. If this is the case, we’ll likely see another pullback from here and a test of the lower border of the triangle (currently around $48.64) in the coming days.

Before we summarize today’s alert let’s check whether Friday’s increase changed the medium-term picture or not.

Looking at the weekly chart, we see that Friday’s upswing resulted in an invalidation of the breakdown under the 78.6% Fibonacci retracement. Nevertheless, we saw similar price action in the previous week. Back then, despite this positive signal, oil bulls didn’t manage to push the commodity higher, which resulted in a pullback to the support zone based on Apr 2009 lows. Taking this fact into account, and combining it with the very short-term picture, we still believe that as long as the commodity is trading below $53.13-$54.24 further improvement is questionable and another pullback (in the coming days) is likely.

Summing up, crude oil increased once again, but the size of the volume was smaller than the day before, which suggests that oil bulls might getting weaker. Taking this fact into account, and combining it with the proximity to the key resistance red zone (around $53.13-$54.24), it seems to us that another pullback from here and a test of the lower border of the triangle (currently around $48.64) in the coming days is likely.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. Nevertheless, if we see a daily close above the 61.8% Fibonacci retracement based on the Dec-Jan decline, we’ll consider opening long positions. We will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts