Oil Trading Alert originally sent to subscribers on January 5, 2015, 10:04 AM.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Friday, crude oil lost 1.68% as the combination of weak Chinese economic data, a stronger greenback and news of increased production in some regions weighed on the price. As a result, light crude extended losses and hit a fresh multi-year low. Will we see new lows in the coming days?

The National Bureau of Statistics showed that China's official manufacturing Purchasing Managers Index (a gauge of conditions in the industry) dropped to 50.1 in December from 50.3 in the previous month. It was the lowest reading in a year and a half, which affected negatively the price of the commodity, fuelling worries over oil demand in the world's second largest oil consumer. Additionally, the USD Index, which tracks the greenback's value against a basket of other currencies, climbed to its highest level since Dec 2005 on expectations that the Federal Reserve will raise interest rates this year. This upward move also weakened investors’ sentiment, making crude oil less attractive on dollar-denominated exchanges. On top of that, reports that Russian and Iraqi oil production rose in December also weighed on the price. In this environment, light crude slipped to an intraday low of $52.03. Will we see lower values of the commodity? (charts courtesy of http://stockcharts.com).

Quoting our previous Oil Trading Alert:

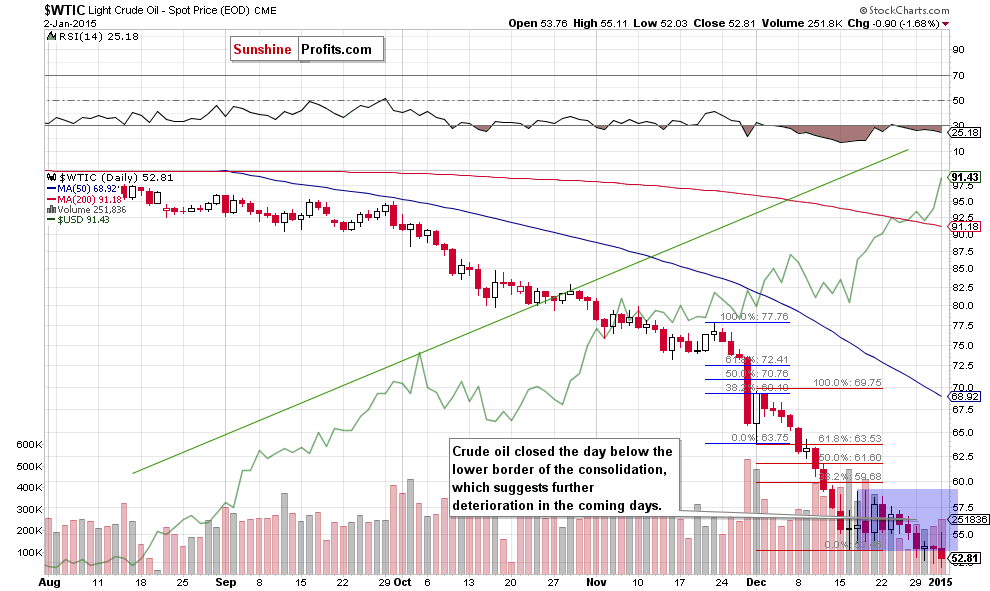

(...) In our opinion, the situation will improve, if we see an increase above the upper line of the consolidation and a confirmed breakout above the 38.2% Fibonacci retracement (…). Until this time, another downswing and test of the above-mentioned support zone is more likely than not.

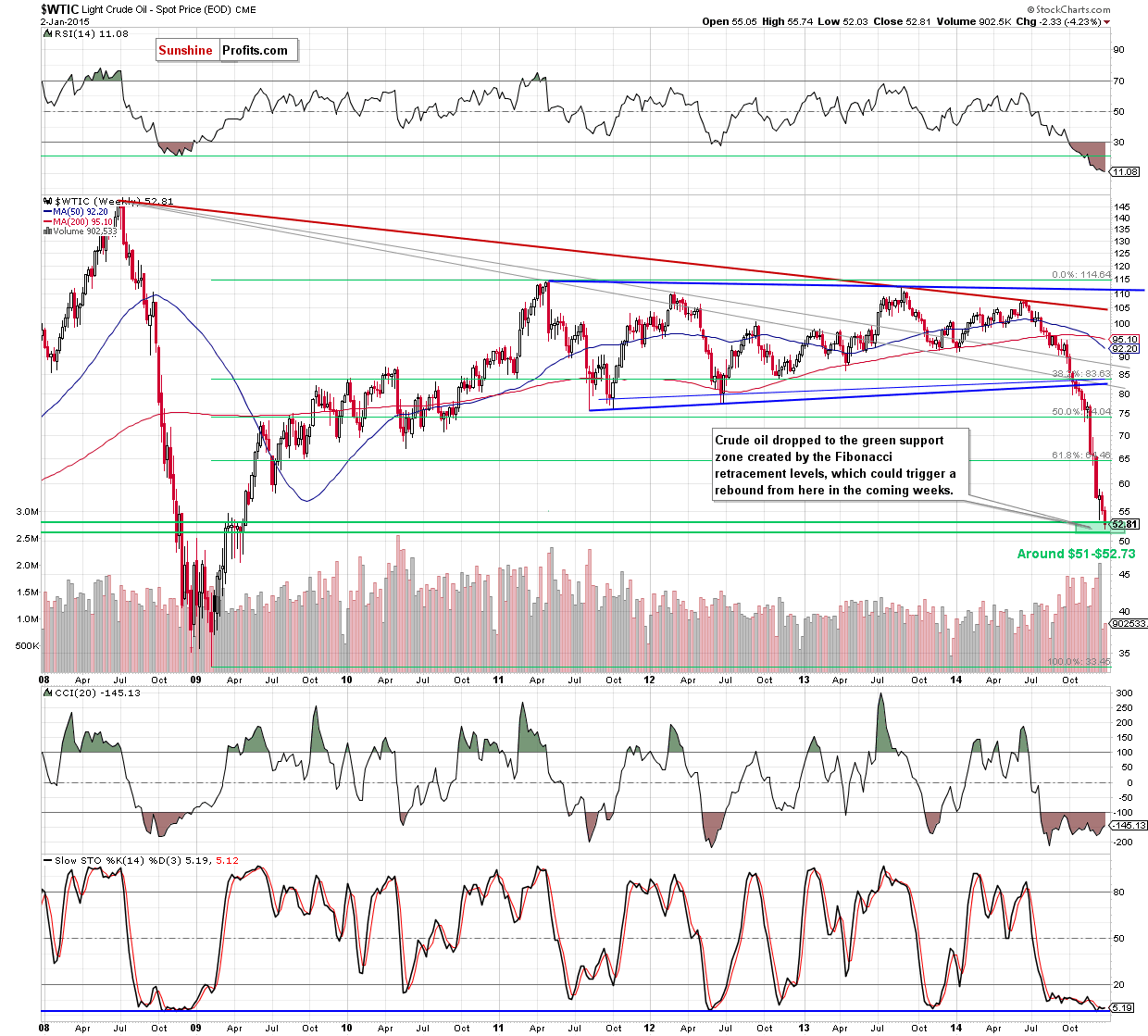

Looking at the daily chart, we see that although crude oil moved higher after the market’s open, hitting an intraday high of $55.11, this improvement was only temporary and the commodity reversed. With a downward move, light crude dropped not only to a fresh multi-year low of $52.03, but also closed the day under the lower border of the consolidation. This is a bearish signal that suggests further deterioration in the coming day(s). If this is the case, the initial downside target for oil bears will be the lower border of the support zone marked on the weekly chart (the 78.6% Fibonacci retracement at $51). However, taking into account the above, it seems that light crude could go even lower and test the next psychological barrier of $50 per barrel in the coming week.

Summing up, crude oil closed the day under the lower border of the consolidation and the previous lows, which suggests further deterioration to $51 or even a test of the psychological barrier of $50 in the coming week. Nevertheless, as long as there is no breakdown below the green support zone marked on the weekly chart, opening short positions is not justified from the risk/reward perspective as the space for declines seems limited.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

On an administrative note, there will be no regular Oil Trading Alert tomorrow - we will post the next one on Wednesday. Thank you for understanding.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts