Oil Trading Alert originally sent to subscribers on December 15, 2014, 10:21 AM.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Friday, crude oil lost 2.81% as the International Energy Agency cut its outlook for demand growth in 2015. In this environment, the commodity hit a fresh multi-year low of $57.34 and reached its key support line. Will we see a rebound from here?

Although U.S. oil services firm Baker Hughes’ data showed that the number of rigs drilling for oil in the United States were down by 29 this week (the biggest weekly drop in two years), the IEA’s outlook for demand growth in 2015 watered down the price of the commodity. On Friday, the IEA cut its outlook for global oil demand growth in 2015 by 230,000 barrels per day to 900,000 bpd on expectations of lower fuel consumption in Russia and other oil-exporting countries. Additionally, the IEA predicted that global oil inventories would build by close to 300 million barrels in the first half of 2015 in the absence of disruptions or cut in OPEC production, which pushed light crude o its lowest level since May 2009. What’s next for the commodity? (charts courtesy of http://stockcharts.com).

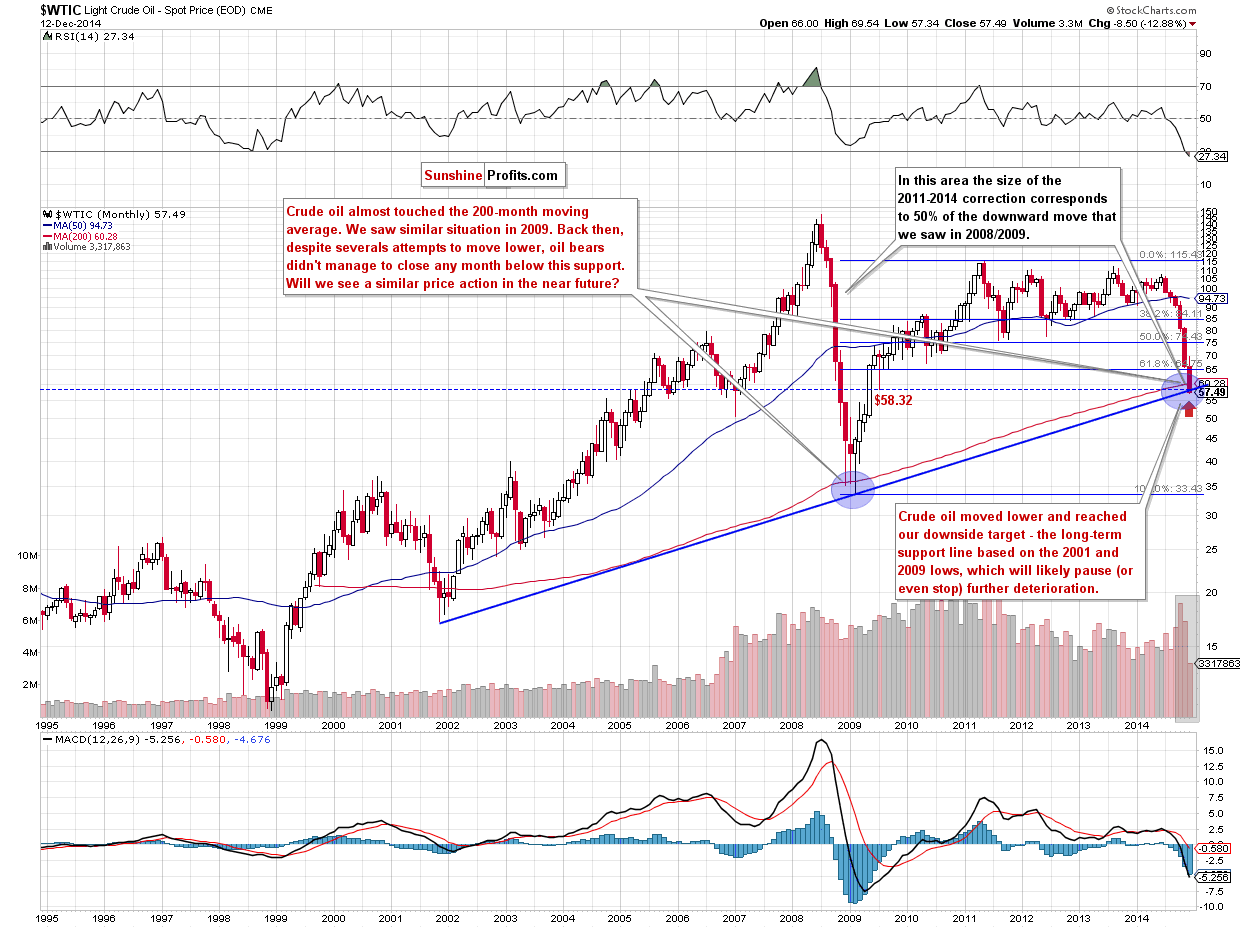

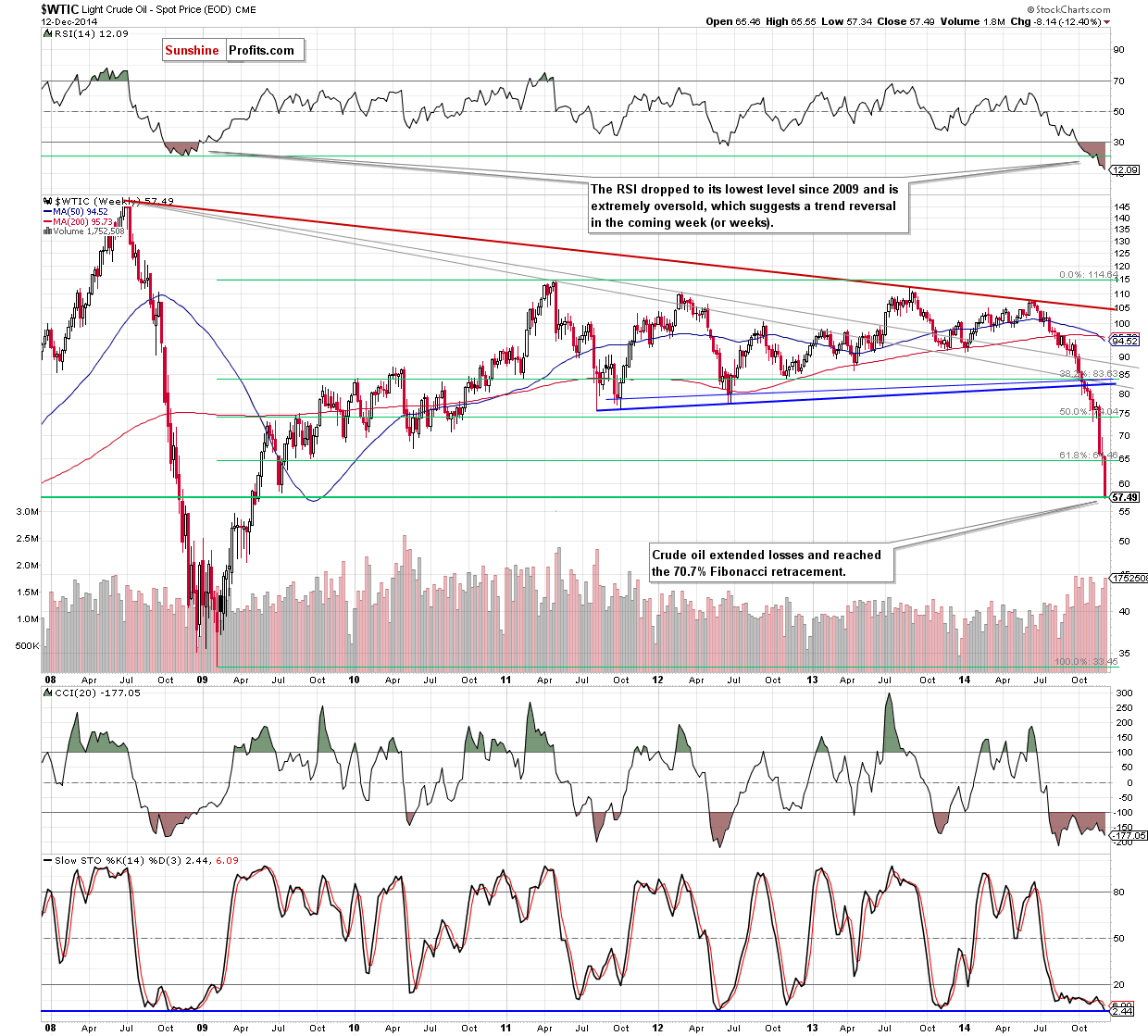

From today’s point of view, we see that crude oil moved lower once again and broke below the Jul 2009 lows in terms of intraday and weekly closing prices. This strong bearish signal triggered further declines, which took the commodity to the long-term blue support line (based on the 2002 and 2009 lows and marked on the monthly chart) and the 70.7% Fibonacci retracement based on the entire 2009-2014 rally (marked with green on the weekly chart), which could pause further deterioration in the coming days. If this is the case, light crude will rebound from here and increase to (at least) the previously-broken 200-month moving average (currently at $60.28). At this point, it’s worth noting a quote from our previous Oil Trading Alert:

(…) although we saw several attempts to close the month below the 200-month moving average in 2009, oil bears failed, which resulted in a significant rebound in the following months. Taking this fact into account and combining it with the above-mentioned support zone and decreasing volume (at least in the previous months), we think that (…) a trend reversal is just around the corner.

Nevertheless, taking into account the fact that crude oil reached its key long-term support, we should also consider a bearish scenario (although we think that this is a less likely scenario to play, it cannot be ruled out as an option). In this case, if the commodity extends losses in the coming days, the next downside target would be around $51-$52.73, where the 76.4% and 78.6% Fibonacci retracement levels are.

Summing up, crude oil extended losses once again and reached its key long-term support line, which is currently reinforced by the 70.7% Fibonacci retracement. Although light crude go both north or south from this point, we think that the combination of the above-mentioned lines will be strong enough to at least pause further deterioration. Therefore, if this area withstands the selling pressure in the coming days and we see any strength in the market, we’ll consider opening long position.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts