Last week, the Federal Reserve Bank of New York released the May edition of U.S. Economy in a Snapshot. Does the state of the U.S. economy warrant a Fed hike?

The recent FOMC minutes showed that June is a live meeting. The Fed suggested that it may hike interest rates next month if data justifies such a move. In consequence, gold dropped to a seven-week low, driven by the Fed interest rate hike prospects. If so, let’s check what the data really says.

- Real GDP growth was weak in the first quarter of 2016.

- There was a slowdown in labor market improvement in April. The unemployment rate was unchanged, while both the labor force participation ratio and the employment population ratio fell in April. Moreover, payroll growth slowed.

- Inflation softened in March, but the CPI jumped in April on a monthly basis.

- According to the New York Fed, April industrial production data suggests that manufacturing activity may be stabilizing. Yesterday, we showed that regional manufacturing indexes and the Markit Flash PMI for May deny such hopes.

- Consumer spending was flat in March, but retail sales jumped in April.

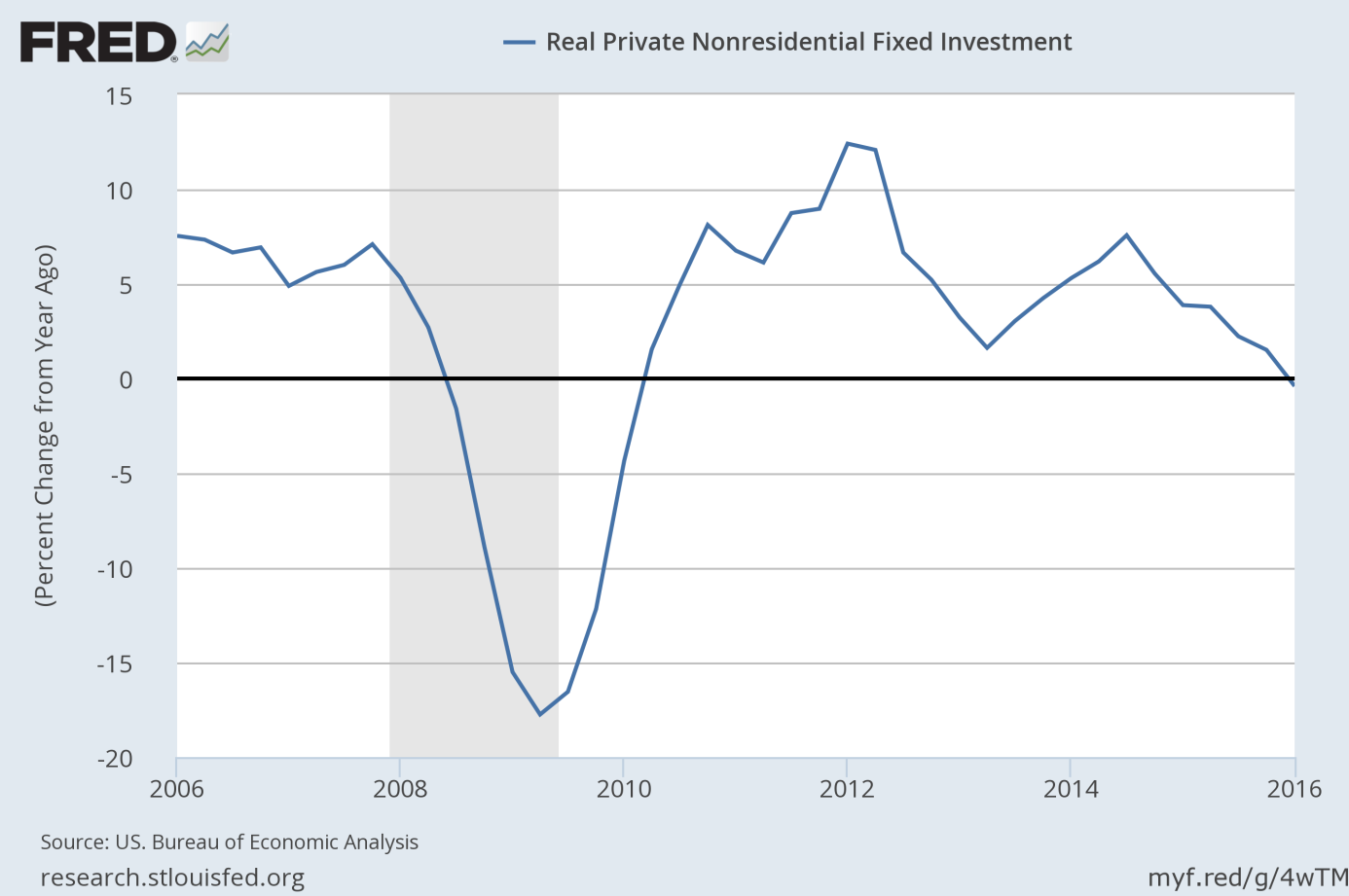

- Business fixed investments were soft in the first quarter of 2016. It indicates that companies are not investing in plant and machinery, as they are not very confident about the prospects of economic growth and worry about their profitability. Actually, the dynamics of real private non-residential fixed investments fell to a recessionary level, as the chart below shows.

Chart 1: Real private non-residential fixed investments (as percent change from year ago) from 2006 to 2016.

- Housing starts increased 6.6 percent in April, but building permits slowed down. And existing-home sales rose 1.7 percent in April, while the home builder sentiment was unchanged in May. Generally speaking, the housing sector remains in a very gradual uptrend (however, sales of new homes surged in April).

As one can see, very few of the pieces of data suggest an interest rate hike in June. This should be good news for the gold bulls. However, there are significant doubts whether the Fed is really data dependent – as a reminder, in the end of 2012, the Fed provided a 6.5-percent unemployment target with respect to allowing interest rates to remain near zero. The unemployment rate fell below this target at the beginning of 2014. In April 2014, the Fed removed its target, clearly showing that it was not data dependent. The U.S. central bank can also arbitrarily choose data to follow and decide how to interpret incoming economic news. Moreover, some analysts point out that the Fed cannot be fully dependent on domestic data, since it also cares about foreign developments. Others claim convincingly that the Fed is not dependent on the broad spectrum of domestic data, but focuses on the U.S. equity markets. As they have continued to stabilize in the recent months, the Fed may be more eager to hike interest rates in June.

Summing up, the recent economic data does not suggest an interest rate hike in June. Foreign risks (like the Brexit) also do not encourage such a move. However, the Fed may still raise interest rates, especially if the U.S. equity markets continue to stabilize. The change in rate hike expectations has recently sent gold prices south. It seems that we witness a replay of the end of 2015. The yellow metal will be under pressure until the hike or until some dovish signals from the Fed. After the hike or after the Fed’s failure to deliver a hike, the positive sentiment in the gold market should be back.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview