Reflation is a fact, at least for a while. And it is not limited to the U.S., as it is a truly global phenomenon – since 2016, the rebound in economic activity has been seen both in the advanced and emerging markets (this is partially due to the flattening in deep recessions in Russia and Brazil). The broad-based improvement is bad for the yellow metal, as it signals a more lasting revival. Additionally, although the recent rebound has mainly been triggered by the huge fiscal stimulus in China, the advanced economies have also improved significantly, in particular the U.S. It means negative news for gold, which is more sensitive to developments in America.

Going back to China, the country announced an infrastructure spending program worth half a trillion dollars. The program should not be underestimated, given the fact that China contributes about half of all global growth. Moreover, the UK also declared the biggest government investment program in over a decade, worth about £23 billion. Even the fiscal policy in the euro area has turned modestly expansionary. All these actions, as well as Trump’s fiscal plan, signal an important shift in global policy towards a more active role of fiscal policy, which may be called ‘The Great Fiscal Rotation’.

The new global regime – which only gradually materializes and results from the slow recovery, weak productivity and the widely perceived need for infrastructure investments – is negative for the gold market. We are not great fans of government spending, but fiscal policy can indeed stimulate the GDP in the short-term. The acceleration in the economic activity should support risky assets and put gold into limbo.

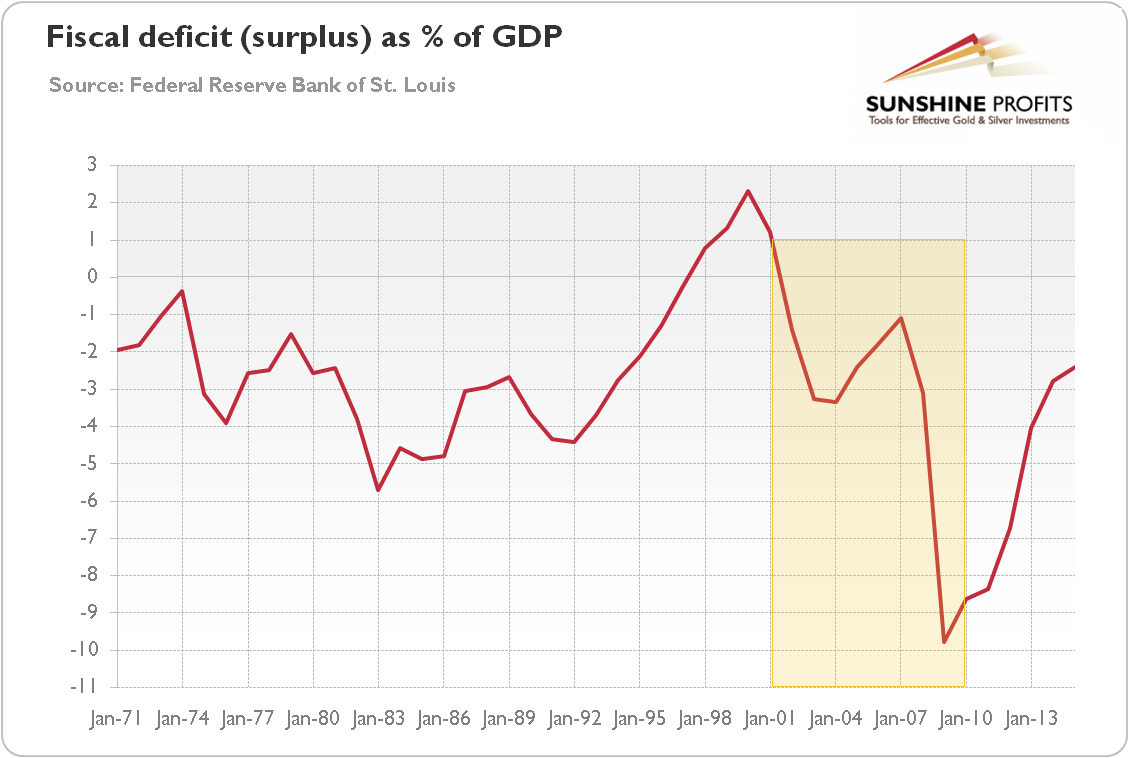

To be clear, we do not mean that the global economy entered the land of milk and honey and all risks vanished. Not at all. Significant threats may stem from the China’s economy, the wave of populism and protectionism, or European banking sector. Nor should we forget about the global indebtedness, high fiscal deficits, and the bitter truth that there is not much room for fiscal stimulus. In good times we should not borrow to accelerate growth, but we should actually save for bad times – otherwise we risk being less prepared for the next crisis when it comes. In particular, Trump’s tax cuts may not drive growth and only make budget deficits surge. Although many analysts make parallels between Trump and Reagan, the comparison with George W. Bush may be more appropriate. Bush’s fiscal policy did not work and had no effect on jobs or investments. Instead, it just planted the seeds of the great recession and blew out the deficit, hurting economic growth and undermining fiscal position, as one can see in the chart below.

Chart 1: Federal surplus or deficit as a percentage of GDP from 1971 to 2015.

We simply point out that the macroeconomic situation turned out to be less favorable for gold. First, economic growth is accelerating globally, but the U.S. leads the race with Europe or Japan. This development should support risky assets and the greenback, which are negatively correlated with gold. In particular, the manufacturing sector and corporate investment seem to be rebounding as the energy shock dissipates. Secondly, monetary policy ceased to be the only game in town. With fiscal policy more active, monetary policy becomes less accommodative. As a reminder, gold gained in 2016 to a large extent due to fears that monetary policy was ineffective. Even if these worries are warranted, as we argued in the October edition of the Market Overview, the effectiveness of monetary policy is less important when the fiscal policy is also strongly in play. And again, the Fed is the leader of the monetary tightening, which should strengthen the U.S. dollar and weaken the yellow metal.

Summing up, policymakers have called for a more expansionary fiscal policy for years. Now, it seems that the consensus has shifted in favor of fiscal stimulus. Actually, some governments have already eased their fiscal policies, and others are going to do that soon. The shift in the global macroeconomic regime is negative for the yellow metal, as it makes risky assets more attractive. Surely, the fiscal policies effects seem to be exaggerated – neither Bush’s nor Obama’s Keynesian stimuli boosted economic growth – but gold investors should remember that reflation trade is rooted in something more than just Great Fiscal Rotation. The regime shift simply coincided with the spontaneous, cyclical acceleration in the global economic growth.

If you enjoyed the above analysis and would you like to know more about the impact of the current macroeconomic trends on the gold market, we invite you to read the February Market Overview report. If you’re interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts. If you’re not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview