Based on the July 31st, 2013 Premium Update.

When we take into account last week’s events, it seems that the yellow metal is more sensitive to signs of tapering than any other asset. According to Reuters, gold slipped to a two-week low on Friday after falling through a key technical level near $1,300 as strong U.S. economic data raised fears that the Federal Reserve may start to taper its commodities-supportive stimulus measures. Losses pushed gold towards its worst weekly performance in a month. However, the shiny metal rebounded sharply from a low at $1,285 to $1,317 after weaker than expected US non-farm payrolls.

Does it mean that the Federal Reserve may have to push back plans to taper the current round of quantitative easing? A push-back of the plans is believed to be bearish for the US dollar and bullish for gold. Will we see a bullish scenario in the precious metals market? Or maybe recent gains are just a result of speculation and gold’s position will deteriorate?

In our previous essay we wrote that if you want to be an effective and profitable investor, you should look at the situation from different perspectives and make sure that the actions that you are about to take are really justified. That’s why in today’s essay we examine the gold chart from the European perspective and we check how gold stocks move relative to gold. Do they provide us with interesting clues as to the next possible moves in the entire sector? Let’s take a closer look at the charts below and find out for ourselves (charts courtesy by http://stockcharts.com).

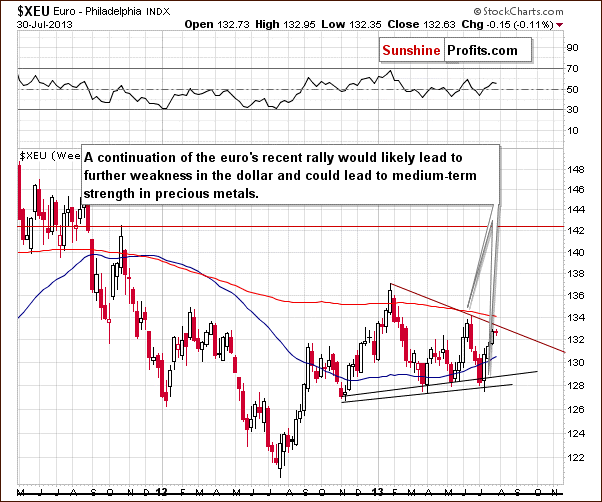

We hit off with a short recap of what’s been going on with the Euro Index recently. After an invalidation of the bearish head-and-shoulders pattern on July 10, the European currency continued its rally throughout the next two weeks. Although the euro climbed up and improved its position, the buyers didn’t manage to push it above the 133 level on July 25. This psychological resistance level slowed the rally and triggered a consolidation.

At this point, it’s worth mentioning that this price action in the euro led to further weakness in the dollar. Although these changes should have had bullish implications for gold, the yellow metal didn’t move sharply above the highs it had established on July 23 and July 24. In the following days, metals declined even though the dollar moved lower which is a strong bearish sign.

Another bearish factor on the above chart is the declining resistance line based on the January top and the June peak. We saw its impact on the euro last Wednesday. The European currency touched this declining resistance line without breaking it. From this perspective, it seems that the top may very well be in, which is a bearish factor for the precious metals sector.

In the recent days, the Euro Index declined below the 132 level and is still trading below the previously mentioned 133 level. If the euro declines further, we might see another head-and-shoulders pattern on a smaller scale.

The combination of the psychological resistance level and the above-mentioned declining resistance line may have encouraged sellers to go short and thus trigger a correction. In this case, the Euro Index will likely bounce off the psychological resistance level at 133 once again. If we see such a bearish scenario, it would likely lead to a strengthening in the dollar which could then lead to medium-term weakness in precious metals.

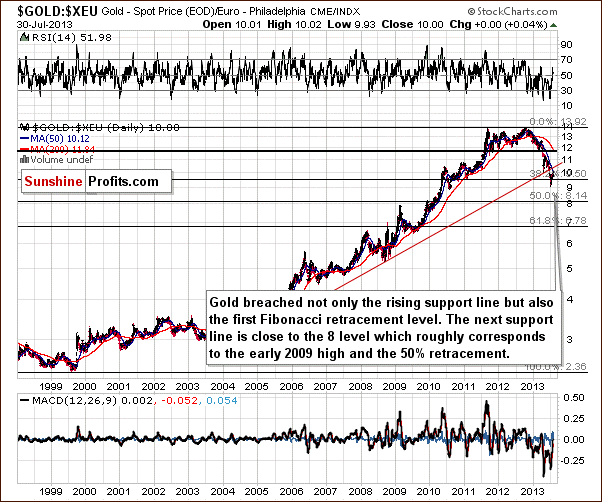

Once we know the current situation in the European currency, let’s take a closer look at gold priced in the euro.

On the above chart, we see that the situation hasn’t changed much from what we saw in the previous weeks. Gold priced in euro remains below the 50-day moving average, which still serves as resistance. Moreover, the yellow metal didn’t break out above the previously broken, important long-term support line which turned into resistance.

Therefore, from the European perspective, the situation looks quite bearish for the short term and it doesn’t look too optimistic. However, if we want to have a more complete picture of the situation, we should examine another factor which is used to provide important signals for the precious metals market - the way gold stocks move relative to gold.

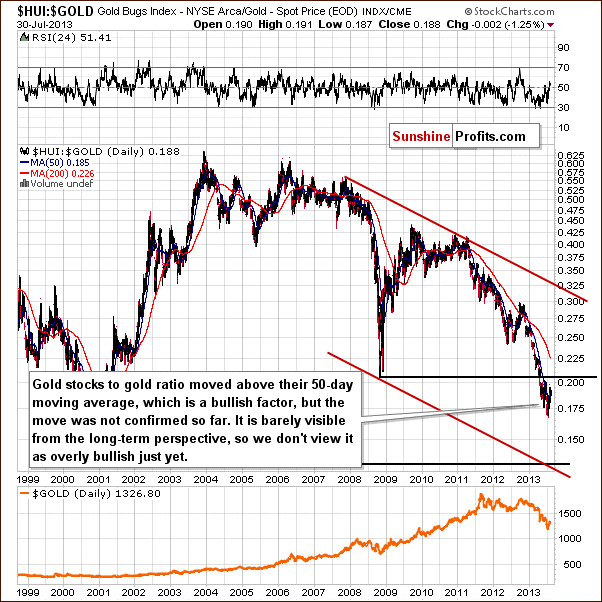

Let’s start with the HUI-to-gold ratio, which is one of the more interesting ratios there are on the precious metals market. After all, gold stocks used to lead gold both higher and lower for years (which wasn’t the case on a very short-term basis in the past few months).

On the above chart we see that the ratio moved above the 50-day moving average in the middle of the June. However, the breakout didn’t change the outlook. The gold-stocks-to-gold ratio still remains below the 2008 bottom. Despite the moves up we saw in July, the breakdown has not been invalidated and the downtrend still appears to be in play here. A downtrend in this ratio indicates that the gold stocks are underperforming gold, not outperforming it.

At this point, it’s worth mentioning that in the gold-stocks-to-gold ratio chart, we didn’t see a continuation of strength last week. Instead of further increases, we saw declines which resulted in a big drop in the HUI:gold ratio on Friday. In this way, the ratio moved below the 50-day moving average which now serves as resistance.

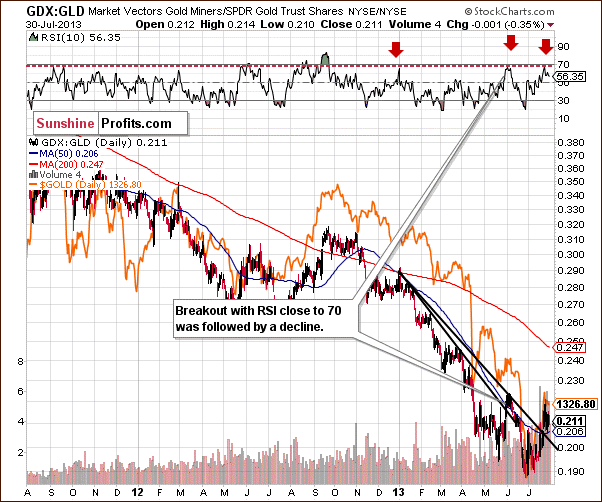

Before we summarize, let’s take a look at the GDX-to-GLD ratio chart.

In the medium-term miners-to-gold ratio chart, we initially saw a breakout above the declining resistance line. However, the RSI level was close to 70. When you take a closer look at the top of the chart, you will see that this level coincided with local peaks in the ratio this year, and the same was seen throughout the precious metals sector.

The following decline (we see it clearly on the above chart) is consistent with our previous observations. The fact that we did not see a huge drop in the recent days doesn’t mean that we won't see one in the near future. We saw similar price action at the beginning of the June. After a slight decline, there was a major one.

In other words, the previous breakout (in June) was followed by a decline, so the current one is not as bullish as it might seem at first sight.

Summing up, the situation is quite bearish for the short term from the European perspective, and it doesn’t look too optimistic - especially when we take into account the combination of the psychological resistance level at 133 and the strong declining resistance line. The outlook for the mining stocks is also bearish and the trend is still down. The long-term breakdowns have not been invalidated and it seems that lower prices for the whole precious metals sector could follow soon.

Last week was very rich in clues as to what is likely to happen with gold, silver and mining stocks. When is the decline likely to accelerate? Some similarities with the past allow us to discuss this matter in today's Market Alert. If you'd like to read it and receive follow-ups - please sign up.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA