Gold & Silver Trading Alert originally sent to subscribers on August 20, 2015, 9:28 AM

Briefly: In our opinion, long (half) speculative positions in gold, silver and mining stocks are justified from the risk/reward point of view. In other words, we are taking profits off the table for half of the current long position.

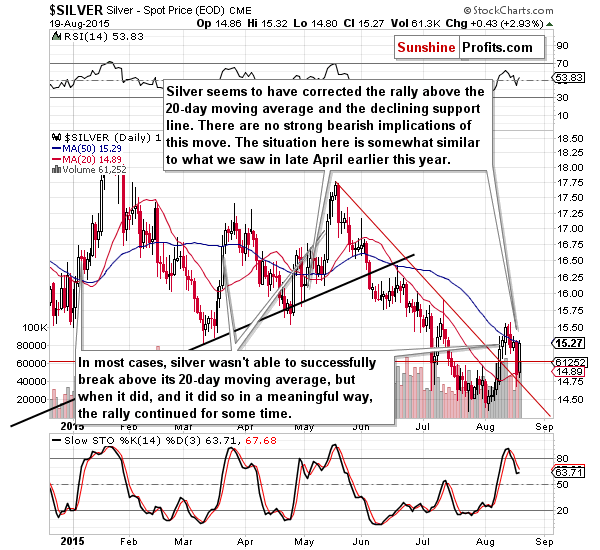

Gold, silver and mining stocks moved once again higher yesterday and silver practically erased the previous day’s decline. Once again – as we had expected - the same thing happened – silver’s signals were not confirmed by other parts of the precious metals market, and it was silver that had to “catch up” with the real action. However, gold is now once again at the 2014 low, which was a very important support and now its serves as major resistance – will metals and miners manage to break higher despite it?

In the ideal world all trading situations would be clear, but unfortunately this is not the case at this time. To make a long story short, the short-term trend remains up as we haven’t seen clear sell signals, but since gold and the RSI based on it moved to our target levels and miners are relatively close to their target, it seems to be justified from the risk/reward perspective to only have half of the position opened at this time.

Let’s take a closer look why we think the above is the case (charts courtesy of http://stockcharts.com).

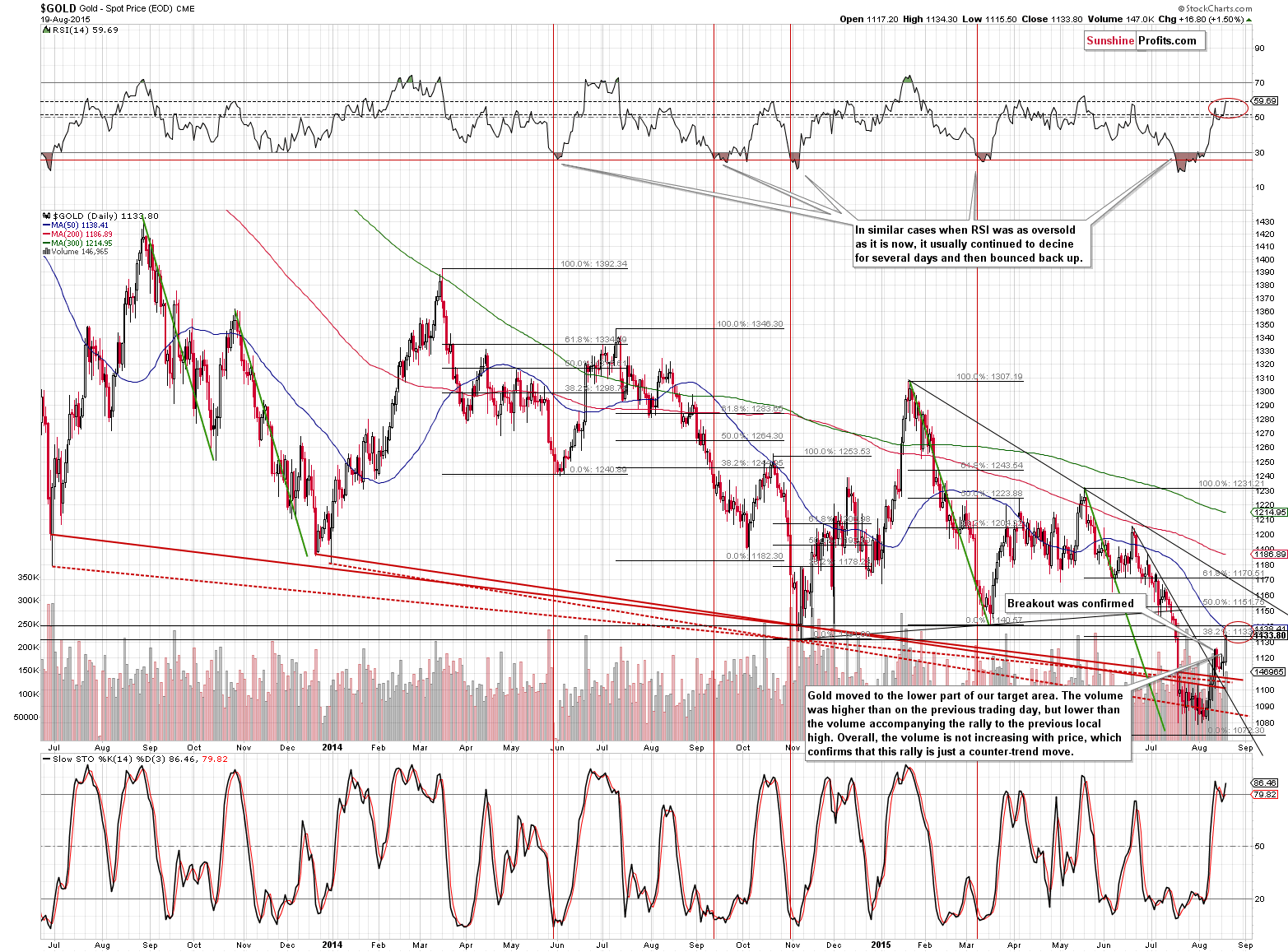

Gold moved to the lower part of our target area yesterday and moved to its upper part in today’s pre-market trading. The 50-day moving average was hit (and insignificantly broken) and in quite a few cases in the past (Oct. 2013, Apr. 2014, Oct. 2014, Mar. and Apr. 2015) this meant that the rally was close to being over.

There were some times that gold rallied visibly above the 50-day moving average like in early 2014 or early 2015, so the implications are not extremely bearish.

Previous declines were usually corrected by 38.2% - 61.8% and we are already above the lower of this range.

The RSI indicator is close to 60, which is where it was at many previous local tops.

The volume that accompanied yesterday’s rally was significant, but not as significant as the one accompanying the previous rally, so overall we can’t say that gold is rallying on increasing volume.

All in all, it seems that at least the easy-to-trade part of the rally is behind us. Will gold rally even higher? It could be the case – after all, gold moved higher on volume that was not low and it moved above the 50-day moving average. More importantly, we haven’t seen many sell signals so far other than the above.

Speaking of sell signals, we would like to see sharp outperformance of silver as a confirmation of the top – just like we’ve seen it so many times before. If it does materialize, the odds are that silver will rally visibly higher than it is today (to $16 or so) and that’s one of the reasons to keep part of the long position opened.

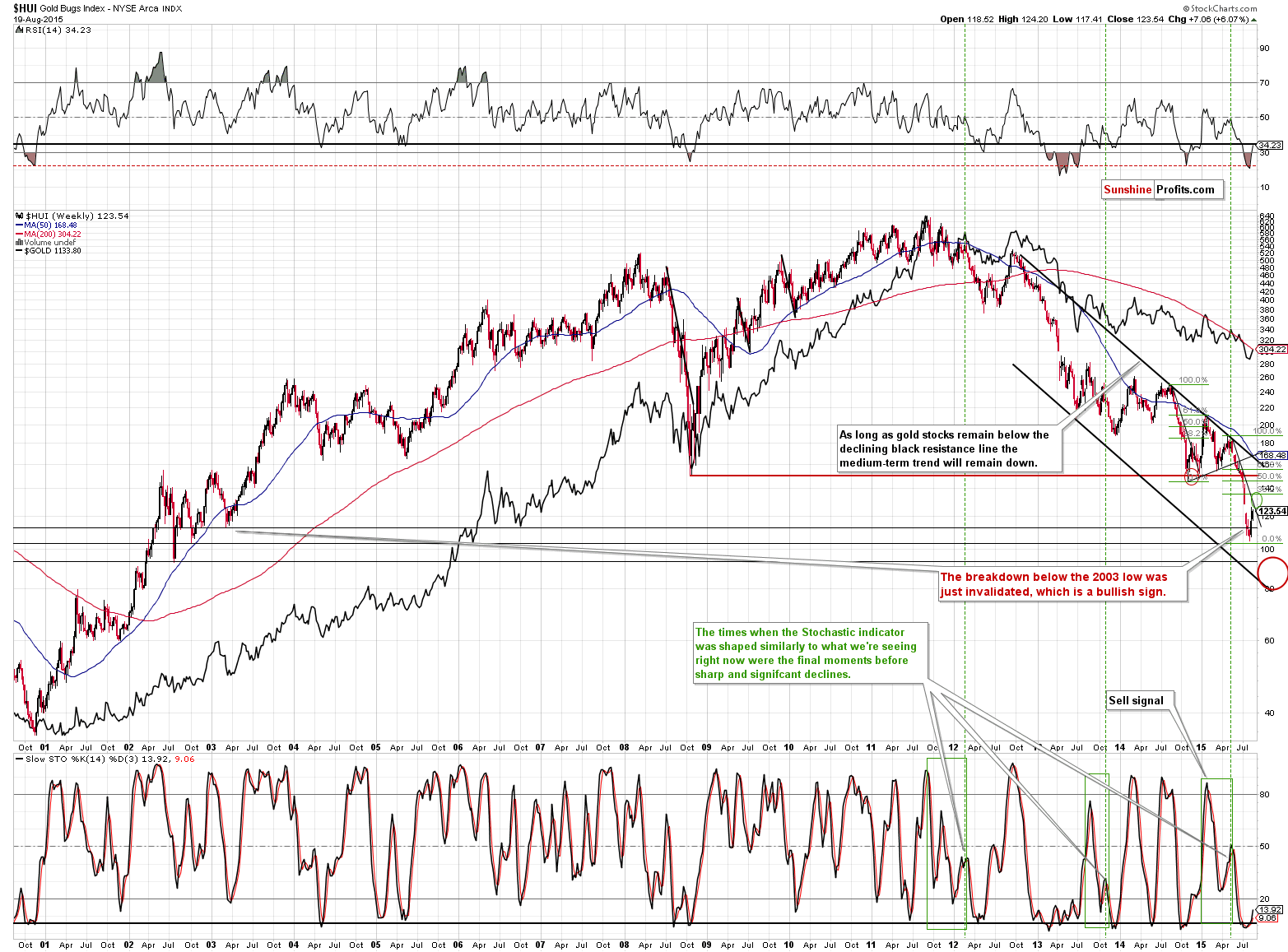

The HUI Index is very close to our target area, but not yet at it, so there is still some room to rally.

In the July 27 alert (when we opened the long positions) we wrote the following:

Gold stocks invalidated the breakdown below the 2003 low, which is a very bullish sign for the short term. It doesn’t seem that they are done declining, though – from the medium-term perspective that is. As far as short term is concerned, it seems that a corrective rally will be seen. We have been expecting one based on the size of the decline and the sudden increase in the negativity in the mass media. Friday’s reversal on strong volume (which you can see on the GDX chart below) serves as a confirmation that “it’s time”.

How high will miners rally? Since the recent decline is similar to the previous one in terms of size and sharpness, we might expect the post-decline corrections to be similar as well. In the final part of 2014, gold stocks corrected almost to the 38.2% Fibonacci retracement and moved slightly above the declining short-term resistance line. If we see similar performance also this time, we might expect gold stocks to correct to the target area that we marked green on the above chart.

The HUI is very close to the mentioned declining resistance line although it hasn’t reached the 38.2% Fibonacci retracement, so – like it is the case with gold – it seems that the easy-to-trade part of the rally is over and limiting the size of the long positions is justified from the risk to reward perspective.

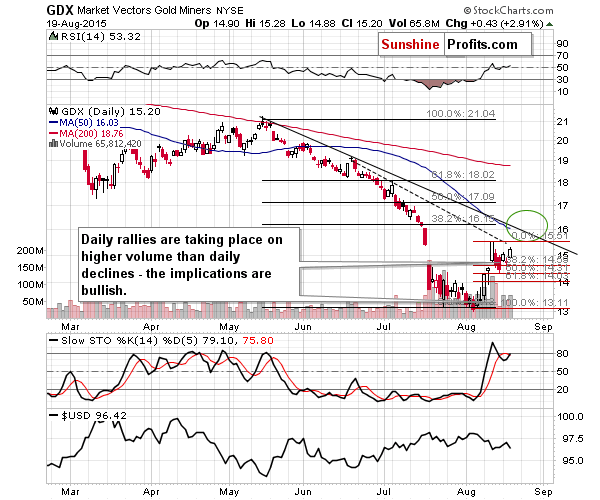

From the short-term point of view, it seems that the rally is close to being over, but not over yet. On a very short-term basis, we have bullish implications form the price-volume link. The volume is higher during the daily upswings than during the daily downswings, so the immediate-term implications are bullish.

However, please note that gold just made a new high and miners didn’t, which is a bearish sign. Plus, the volume on which miners moved higher – while being higher than yesterday’s volume – is visibly lower than the volume on which miners rallied earlier this month.

Again, it seems that the easy part of the rally is over and while there is still some upside potential left, it does no longer seem that a full long position is justified from the risk to reward point of view.

Summing up, while it doesn’t seem that the medium-term decline is over yet, it also doesn’t seem likely that the counter-trend short-term rally is over. However, there are less factors pointing to higher prices than it was the case yesterday and there are more pointing to lower prices. Consequently, we are taking profits off the table for half of the current long position and leaving the other half intact. We opened this position on July 27 (the alert was posted before the markets opened) and since that time gold has moved higher by (taking the current prices into account - gold is at $1,146 at the moment of writing these words) more than $45, silver by about 90 cents and the GDX ETF rallied by about 13%. However, if you recall, we described what 4 individual stocks our Golden StockPicker and Silver StockPicker had chosen for this trade (GOLD, IAG, SLW and AG) and a trade consisting out of these 4 with equal weights would have gained about 20% since that time.

Depending on how the situation evolves, we will adjust the current trading position accordingly. The most likely outcome in our view is that metals and miners will move a bit higher (which is when we aim to close the remaining half of the current long position) and then continue their decline. How high will gold, silver and miners likely go? The target is unclear in the case of gold (but most likely $1,160 or so), about $16 in the case of silver and about $16 - $16.50 in the case of GDX. It will most likely be bearish confirmations that will make us close the position, not specific price levels being reached, so we are not providing “exit order” levels at this time.

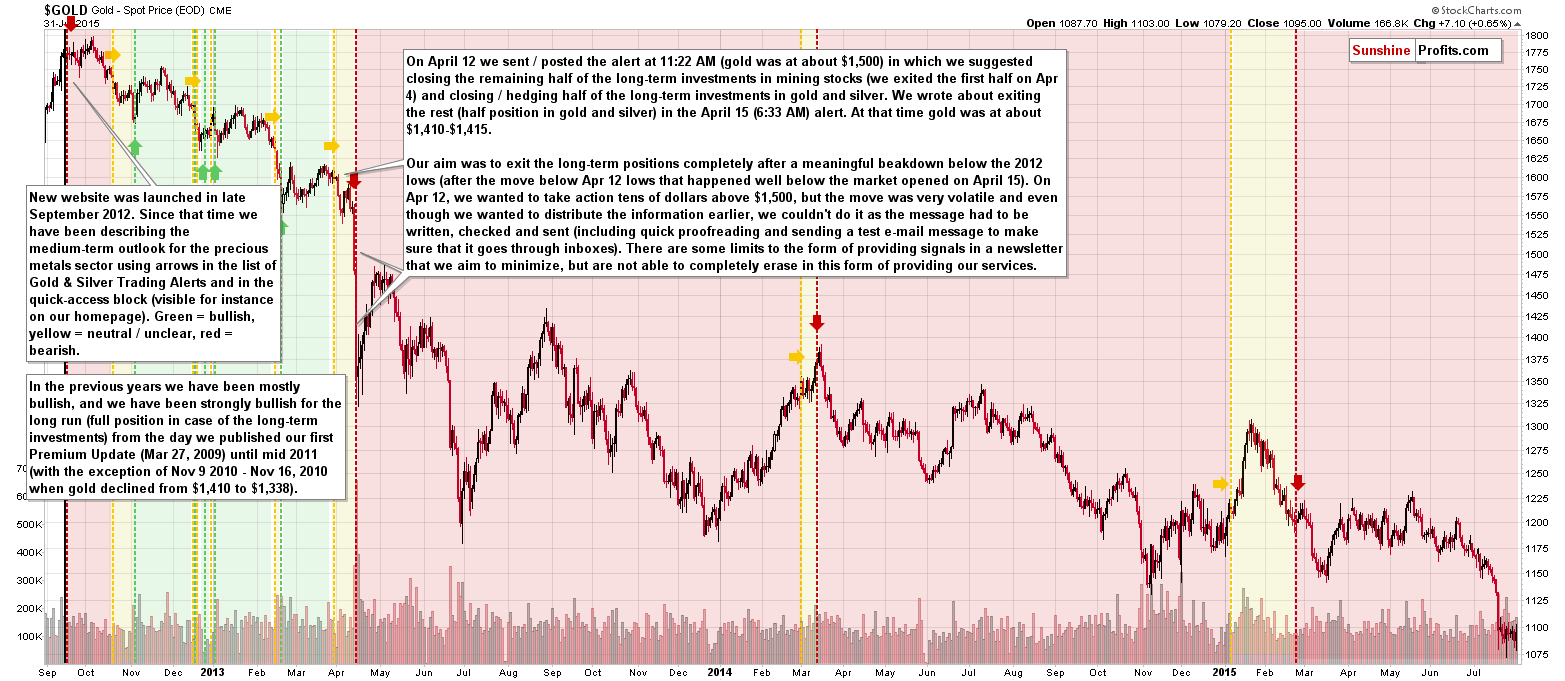

Before finishing today’s alert we would like to draw your attention to the big picture once again. Namely, we would like to discuss our long-term performance. We did this several weeks ago, but since we have a lot of new subscribers, we believe a reminder would be useful.

Below you’ll find the clearest proxy for the performance of our long-term precious metals signals from our alerts. Of course, this does not guarantee analogous performance in the future, but still, it does tell you that our good calls this year might have not been accidental.

The chart below starts at September 2012 as that’s when our current website was released (its current form) and from this day we started describing our medium-term outlook using arrows next to links in each alert on the website (also visible in blocks with quick-access links, for instance on the homepage; you have to be logged-in to see the arrows; otherwise you’ll see padlocks). The chart below is colored in tune with the color that the arrow next to the alert’s title. (Note: in case of other alerts these arrows describe the current trading position).

In short, we’ve been mostly bearish since 2013 and the chart includes a description of this situation. Before Sep 2012 I was bullish at almost all times (you’ll find details on the chart).

Our long-term investment capital calls outperformed gold (descriptions of suggested action for gold vs. a buy-and-hold strategy; taking the Mar. 27, 2009 – Jul. 31, 2015 period into account as Mar. 27, 2009 is the date when the first premium gold alert was posted) by 18%.

Our long-term investment capital calls outperformed silver by 57%.

Our long-term investment capital calls outperformed mining stocks (not counting individual stock selection and taking the HUI Index as a proxy for the entire sector) by 42%.

Comparing a portfolio of 1/3, 1/3, 1/3 weights in gold, silver and the HUI that would follow our long-term calls and the buy-and-hold strategy for the same portfolio, the former would have outperformed the latter by 39%.

At the same time the variability of the portfolio (often referred to as the portfolio’s risk) would have been lower. The Sharpe ratio for the former portfolio would have been about 0.0225 and the same ratio for the buy-and-hold portfolio would have been 0.0021, which means that it would have been more than 10x higher. In other words, one would have received more than 10x as much return per unit of risk.

This performance does not include the short-term speculative trades and doesn’t include additional profits that would have likely been made (thanks to rebalancing) if the Golden StockPicker and Silver StockPicker were used and the above does not take into account any leverage.

We will keep you – our subscribers – updated.

To summarize:

Trading capital (our opinion): Long position (half) position in gold, silver and mining stocks is justified from the risk/reward perspective with the following stop-loss orders and initial (! – this means that reaching them doesn’t automatically close the position) target prices:

- Gold: initial target price: $1,160; stop-loss: $1,063, initial target price for the UGLD ETN: $10.37; stop loss for the UGLD ETN $7.69

- Silver: initial target price: $16.00; stop-loss: $14.12, initial target price for the USLV ETN: $16.94; stop loss for USLV ETN $11.51

- Mining stocks (price levels for the GDX ETN): initial target price: $16.25; stop-loss: $12.37, initial target price for the NUGT ETN: $5.57; stop loss for the NUGT ETN $2.46

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ: initial target price: $24.28; stop-loss: $17.67

- JNUG: initial target price: $15.28; stop-loss: $6.39

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts