Gold & Silver Trading Alert originally sent to subscribers on April 11, 2014, 7:57 AM.

Briefly: In our opinion the speculative short positions (full) in gold, silver, and mining stocks are justified from the risk/reward perspective.

We sent out 2 Gold & Silver Trading Alerts yesterday and the situation at this time remains just as we described it in the second of them. Consequently, we will mostly quote it, illustrate the phenomena mentioned, and add more comments when necessary. Let’s start with gold (charts courtesy of http://stockcharts.com.)

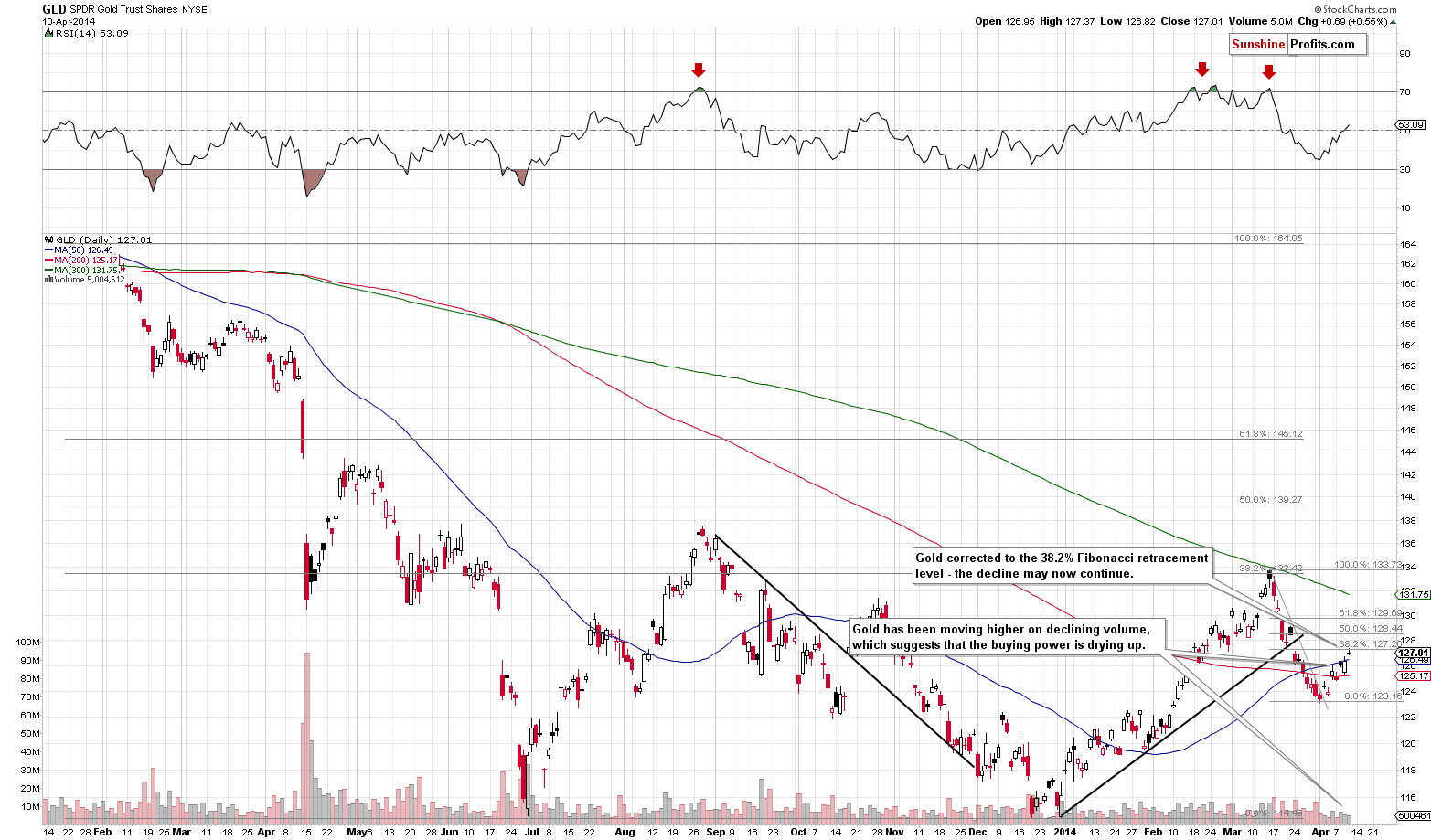

- About gold: "Please note that this upward correction is relatively small – it hasn’t even wiped out 38.2% of the March decline. Perhaps this is the level that will be reached before the next local top is in – we will watch out for signals confirming this theory."

This level was reached today.

Today, we can add that the GLD’s rally was accompanied by volume that was slightly lower than on the previous day, when the rally was much smaller. The above is another bearish sign.

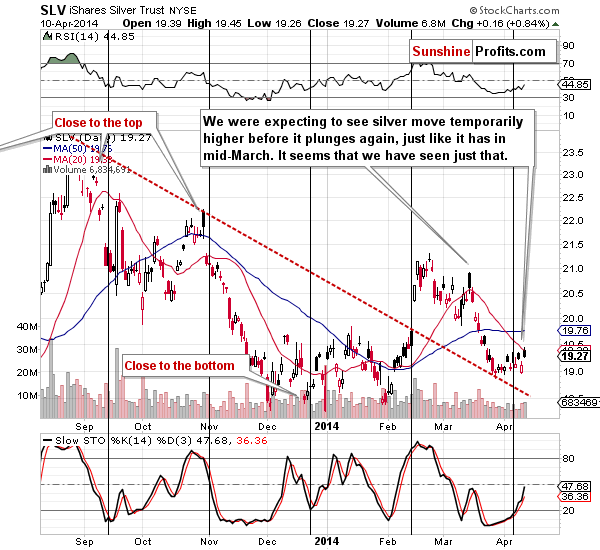

- About silver: "Silver continues to underperform and miners are indeed moving higher, but they are doing so on rather low volume. It does seem that the current upswing is a corrective move, not a true rally. If silver finally rallies strongly relative to the rest of the precious metals sector it will quite likely not be a bullish sign, but a day when the entire sector tops (or very close to it). That’s not a clear prediction, just an early heads-up – we don’t think that jumping on the silver bandwagon as soon as it seems to be gaining speed is a good idea at this market juncture. There will be a time when silver rallies strongly and the rally will be sustainable, but it doesn’t seem we are at this point just yet."

Silver rallied by more than 1.5%, while gold moved higher by less than 1% and miners didn't rally. Silver moved above the previous April highs - we are seeing the very short-term outperformance.

Silver finally ended the session lower than it had been when we sent out yesterday’s alert, but still, it moved higher (percentagewise) than gold and mining stocks, so the implications remained in place.

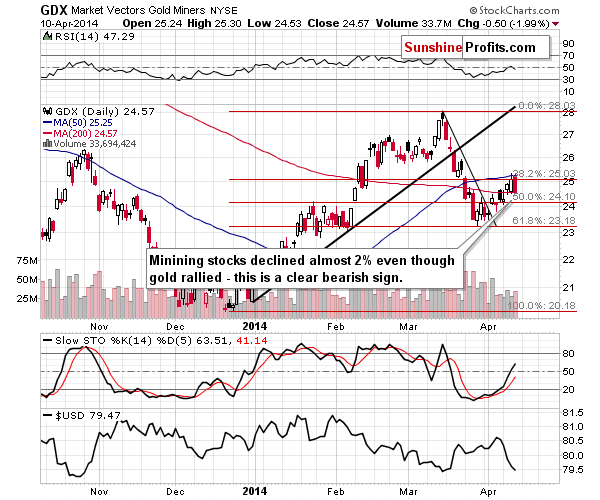

- About mining stocks: "The mining stocks are still moving higher and are still doing so on low volume. Miners are moving up more visibly than gold does, which is a slight indication that the move higher is not over yet, but at the same time the low volume suggests that the rally will not take place for much longer."

Today, miners are underperforming in a very visible way. They might catch up later today, but for now, we get a clear bearish indication for the short term.

Miners didn’t catch up – they declined even more, almost 2%. The volume that accompanied the decline was not huge, but was not very low either. The fact that miners have declined almost 2% while gold moved higher is much more important in our view.

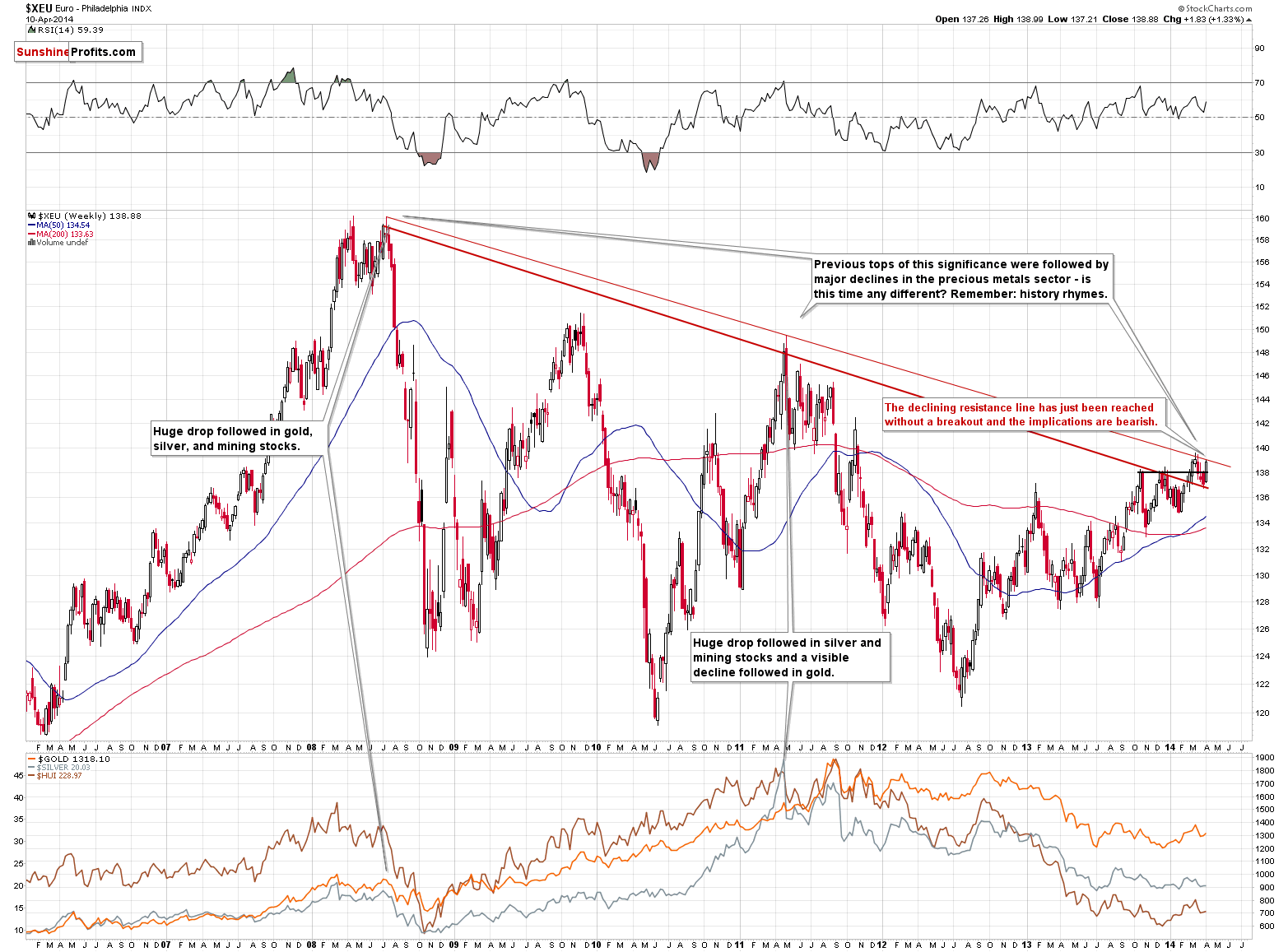

- About the Euro Index: "We will be looking for confirmations along the way, but at this time our best guess is that the Euro Index will rally to the 139 level or close to it (a move to the March high is not out of the question) and make gold move to one of the Fibonacci retracement levels – probably the first one, which is just about $10 higher than where gold closed on Wednesday."

The Euro Index moved to 138.99 today - practically reaching the above-mentioned 139 level.

The 138.99 level was not breached yesterday, and we saw only a small move above it in today’s pre-market trading (to 1.3906 in the EUR/USD exchange rate, after which we saw another slide back below 1.39). Consequently, the above-mentioned implications remain in place.

On a side note, I (PR) am now co-authoring i.a. Forex Trading Alerts and in yesterday’s alert we wrote about the situation being too unclear to open any positions in the EUR/USD pair because of a specific divergence (we did open a position in a different currency pair, though), but the situation is bearish enough to have implications for the precious metals market. In case of the latter, the EUR/USD outlook simply strengthens the signals coming from gold, silver and mining stocks, which are bearish on their own anyway.

The way we summarized yesterday’s second alert also applies today:

All in all, the puzzles seem to be in place and the next downswing in the precious metals sector seems to be just around the corner. As always, it's not possible to tell if this is really the top or if we are going to see another (probably small if any at all) move higher before the decline materializes, but it seems that combining the odds with the possible sizes of price swings strongly favor opening short positions at this time. Please note that even if we see slightly higher precious metals prices it will not immediately invalidate the bearish outlook - unless the stop-loss levels are broken, the outlook will remain unchanged.

To summarize:

Trading capital (our opinion): Speculative short positions (full) in gold, silver, and mining stocks. You will find our take on many trading vehicles in our Precious Metals ETF Ranking.

Stop-loss details:

- Gold: $1,353

- Silver: $20.86

- GDX ETF: $26.2

Long-term capital: No positions.

Insurance capital: Full position.

Please note that a full speculative position doesn’t mean using all of the speculative capital for this trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts