The narration of reflation and ‘Great Fiscal Rotation’ imply that the Fed will hike interest rates in a more aggressive way in a response to accelerated growth and higher inflation. We have already covered the Fed’s likely policy in 2017 in the previous edition of the Market Overview, but let’s discuss the impact of higher interest rates for the U.S. dollar and gold once again. It is widely believed that higher interest rates are bullish for greenback and bearish for the yellow metal. Is that really so? Some analysts do not agree with that opinion, pointing out that the U.S. dollar did not rally during Fed tightening cycles. Therefore, the hawkish Fed may be actually good for gold, they argue.

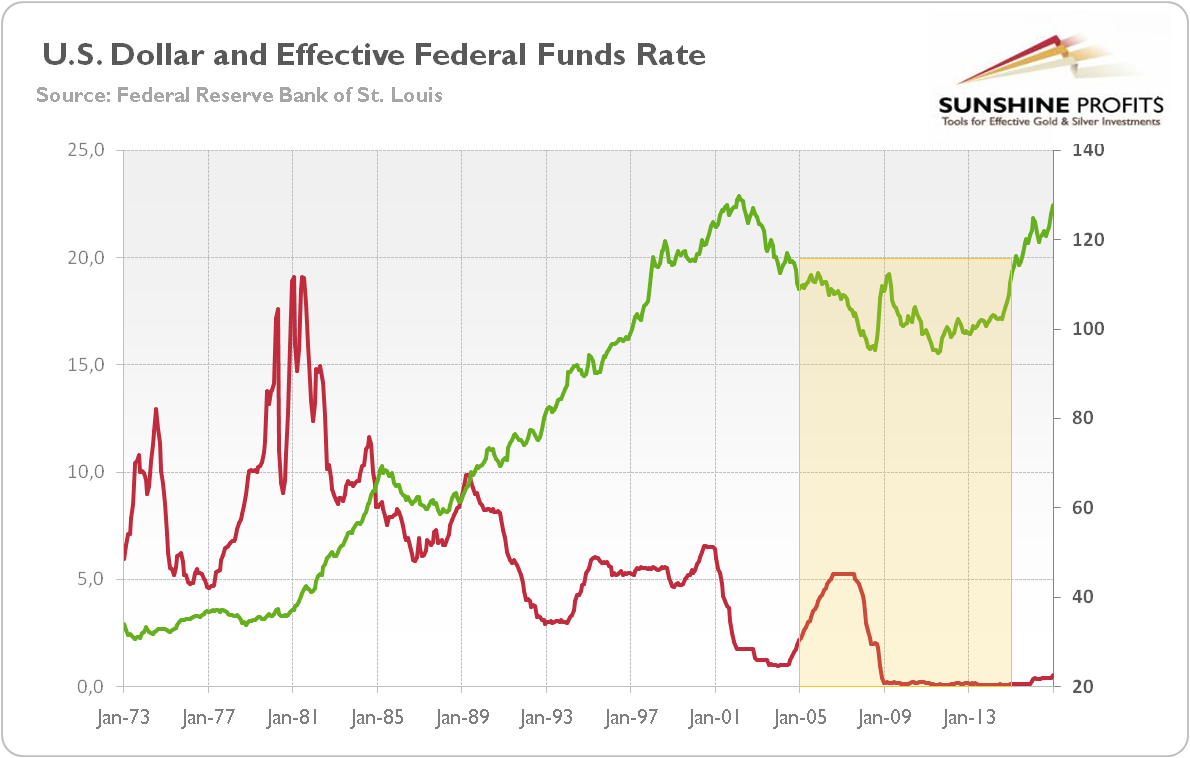

They are right, in some senses. Just look at the chart below: the tightening cycle which took place in 2004-2006 was actually bearish for the greenback and bullish for gold, while the U.S. dollar was essentially traded sideways during ZIRP.

Chart 1: The broad trade weighted U.S. dollar index (green line, right axis) and the effective federal funds rate (red line, left axis, in %) from 1973 to 2016.

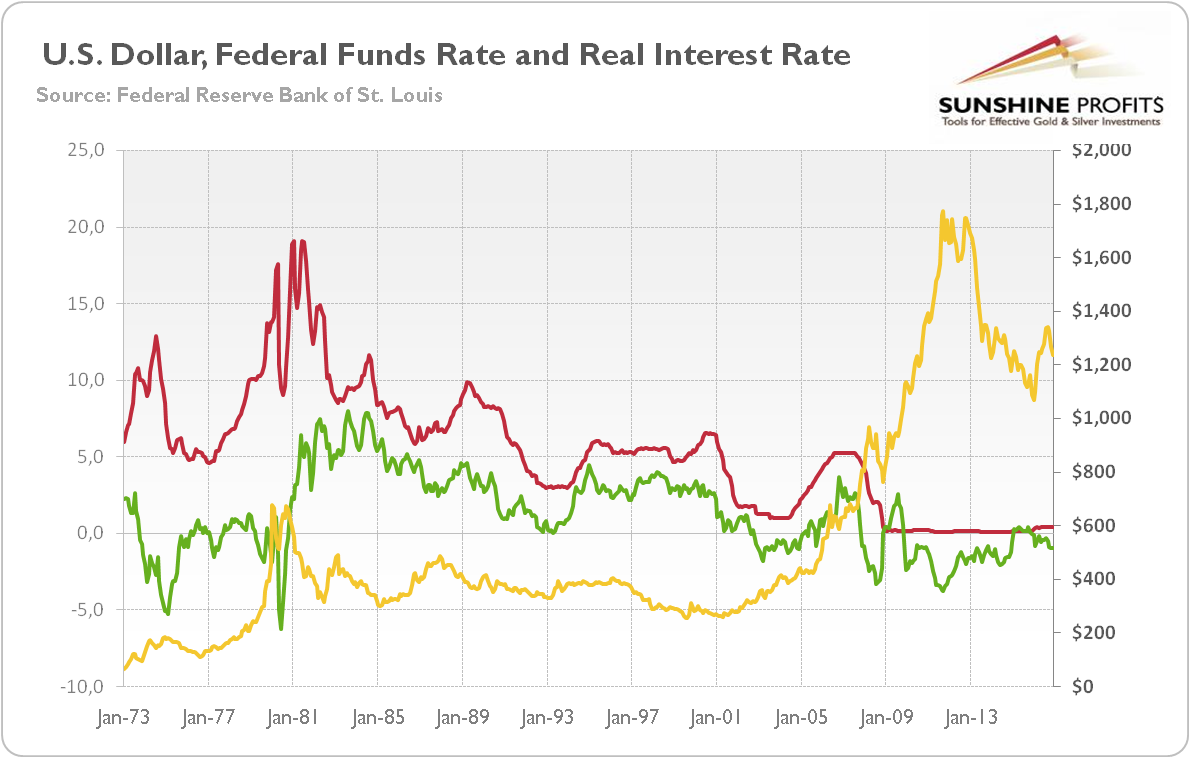

However, the three previous tightening cycles corresponded with the bullish dollar. Actually, the federal funds rate does not matter. As we have emphasized many times, what really counts for gold prices are the real interest rates, not the federal funds rate. The chart below illustrates that truth (we use the 1-year treasury yield adjusted for the CPI, since the yields at 10-year inflation-protected treasuries are available only since 2003).

Chart 2: The price of gold (right axis, yellow line, London P.M. Fix), the federal funds rate (red line, left axis, in %) and the real interest rates (green line, left axis, as 1-year treasury yield less CPI year-over-year, in %) from 1953 to 2016.

It shows that there are many others important drivers of the greenback and gold than the federal funds rate. A lot depends on the broader macroeconomic situation in which the Fed acts. For example, the previous tightening cycle coincided with the bear market in the U.S. dollar, because the fiscal position of the country deteriorated. Moreover, in the past, the Fed actively determined the market conditions. Now, the U.S. central bank is data-dependent, so it is more passive or retroactive. Why does it matter? Well, the Fed hiked its interest rate in December 2016 after real interest rates actually surged. If the Fed is behind the curve and just follows the data, why should we look at the federal funds rate instead of the market interest rates? Investors look ahead and adjust to their expectations of the future developments, including the Fed’s moves.

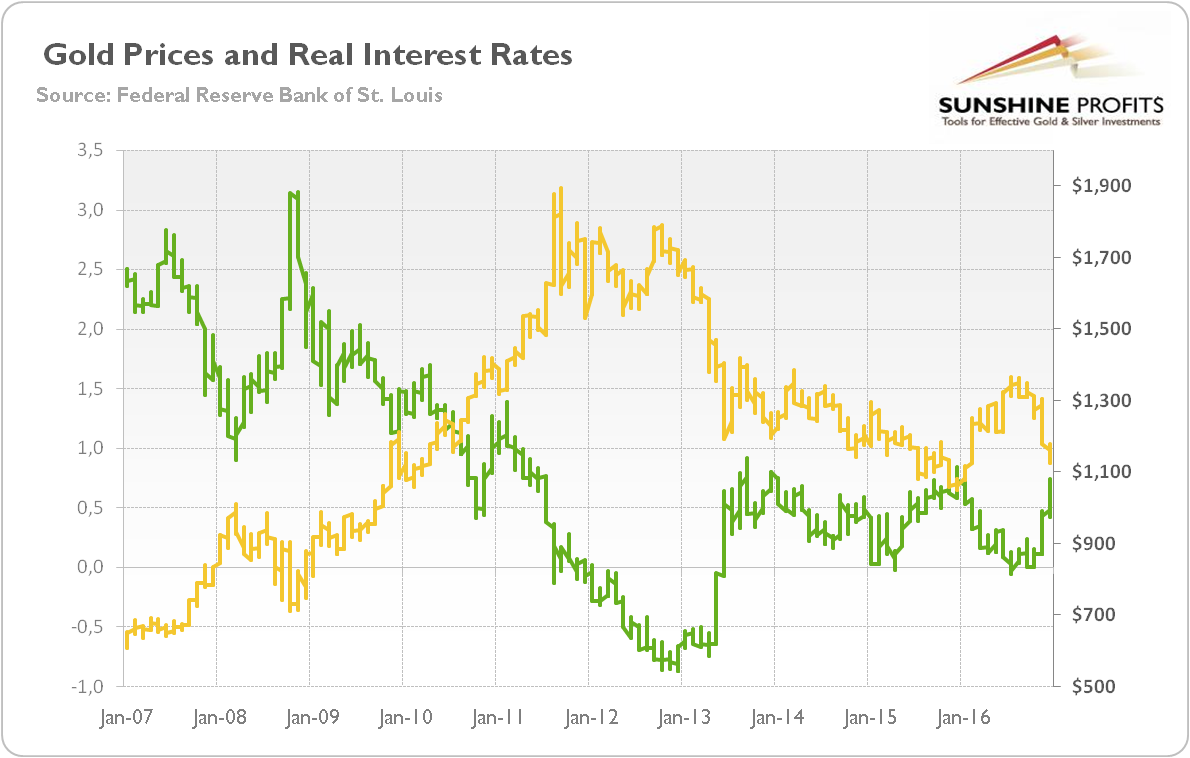

So, let’s focus on the real interest rates. For the last 10 years, there was a really strong negative correlation between them and the price of gold, as the chart below shows.

Chart 3: The price of gold (right axis, yellow line, London P.M. Fix) and the real interest rates (green line, left axis, as yield at 10-year inflation-indexed Treasury, in %) from 2007 to 2017.

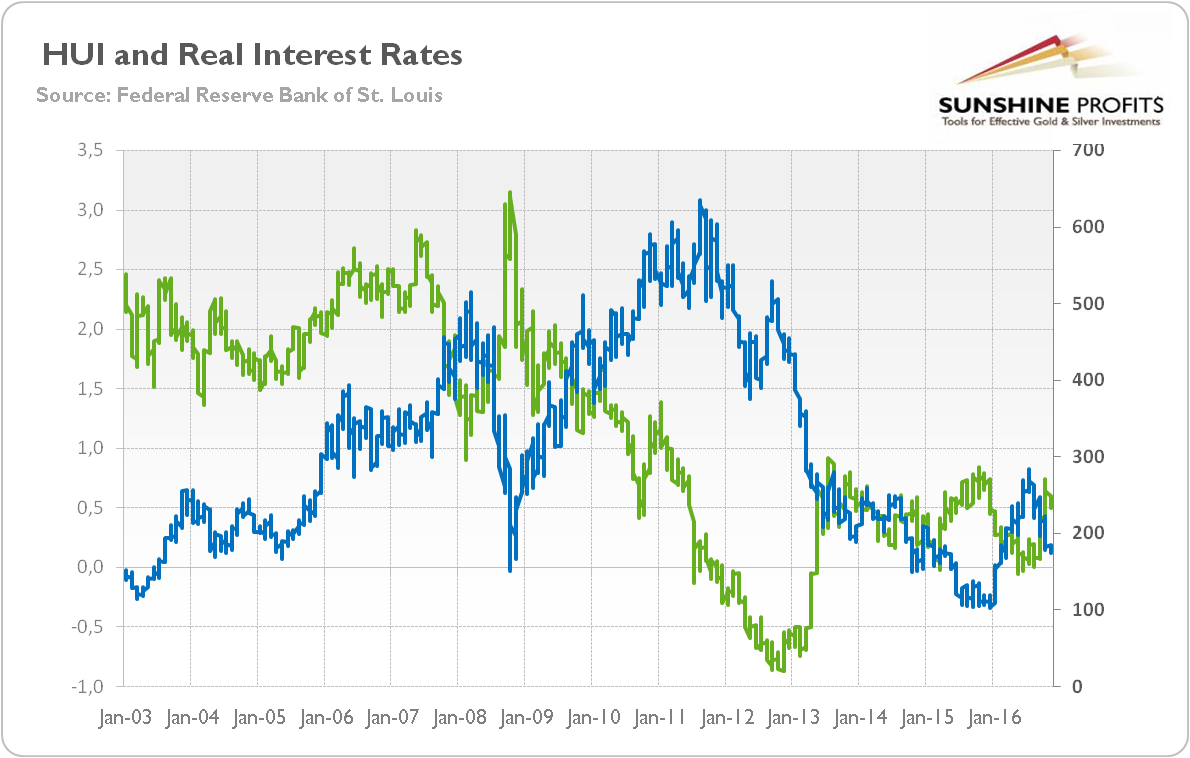

The correlation between real interest rates and silver or mining stocks is weaker, but still significant as one can see in the two charts below.

Chart 4: The price of silver (right axis, blue line, London Fix), and the real interest rates (green line, left axis, as yield at 10-year inflation-indexed Treasury, in %) from 2003 to 2016.

Chart 5: The HUI (right axis, blue line), and the real interest rates (green line, left axis, as yield at 10-year inflation-indexed Treasury, in %) from 2003 to 2016.

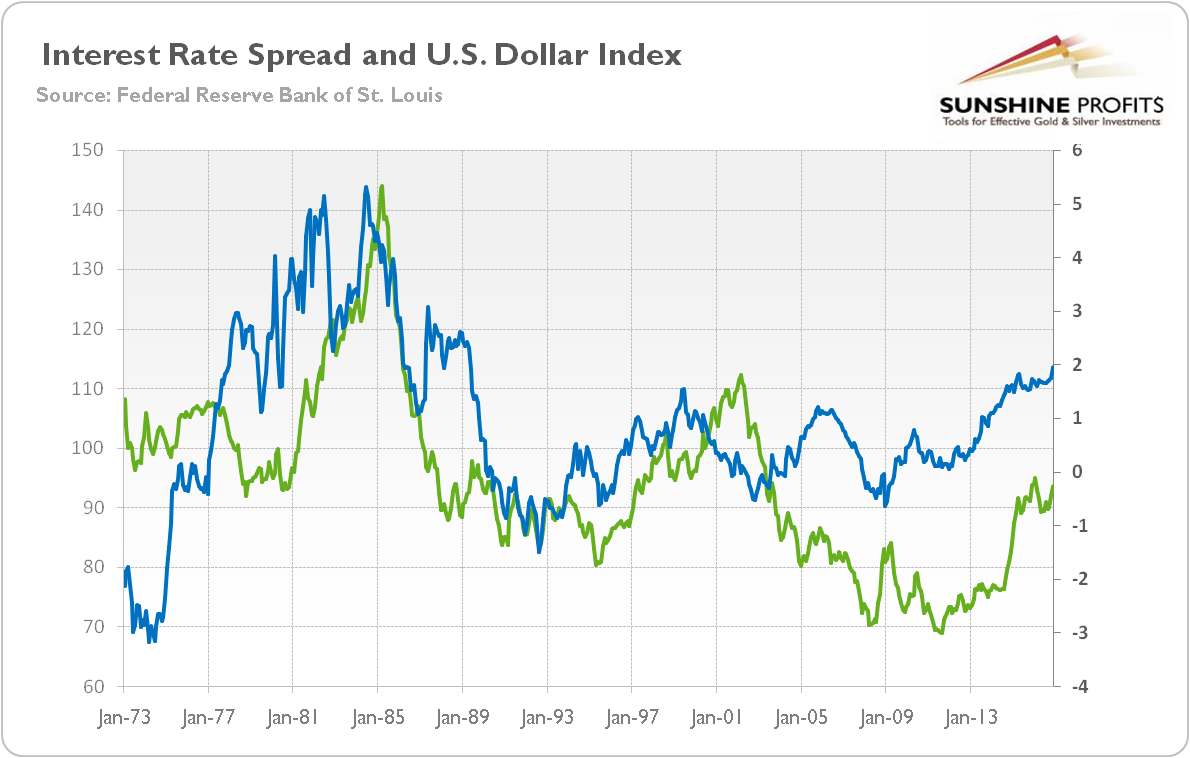

And what about the link between interest rates and the U.S. exchange rate? According to the economic theory, the rise in interest rates leads to inflow of capital, which strengthens the currency. Let’s check it. Since the euro accounts for majority of the U.S. index, we will analyze the correlation between the U.S. dollar index and the difference between the U.S. and German interest rates. The chart below shows important positive correlation between these two variables (perhaps, the relationship would be even stronger, if we use interest rates for the whole euro area and the EUR/USD exchange rate).

Chart 6: The U.S. Dollar Index (green line, left axis) and the difference between long-term U.S. and German interest rates (blue line, right axis) from 1973 to 2016.

The bottom line is that market interest rates are an important driver of U.S. dollar’s strength and, thus, gold. The Fed’s monetary policy is extremely important, as we constantly emphasize, but it affects the real economy through the market interest rates, as well as other channels (exchange rate, asset prices and so on). Therefore, gold investors should not examine only the federal funds rate, but always look at the broader macroeconomic picture.

And what does it all mean for the U.S. dollar and the gold market? Well, there is no rule how the greenback behaves during a Fed tightening cycle. However, if the U.S. economic growth accelerates compared to the euro area (and Japan), while the divergence in monetary policies conducted by the Fed and other major central banks continues (as a reminder, the Fed is likely to make a hike a few times this year, while the ECB and the BoJ will probably not move their interest rates upward, at least not in a similarly aggressive way), the U.S. dollar should strengthen further. As such, it will be a major fundamental headwind for the price of gold.

If you enjoyed the above analysis and would you like to know more about the impact of the current macroeconomic trends on the gold market, we invite you to read the February Market Overview report. If you’re interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts. If you’re not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview