The million-dollar question is: what will the price of gold be in the next year? We do not know the exact numbers and we do not pretend that we know the future as other analysts often do (usually the same people, who deny making wrong forecasts). We can say that the precious metals market is quite likely to form its final bottom sometime this year and the exact trading details are and will be covered in our Gold & Silver Trading Alerts. Within the scope of the fundamental analysis, we can offer some qualitative predictions for the gold market in 2016. What will affect the price of gold in the next year?

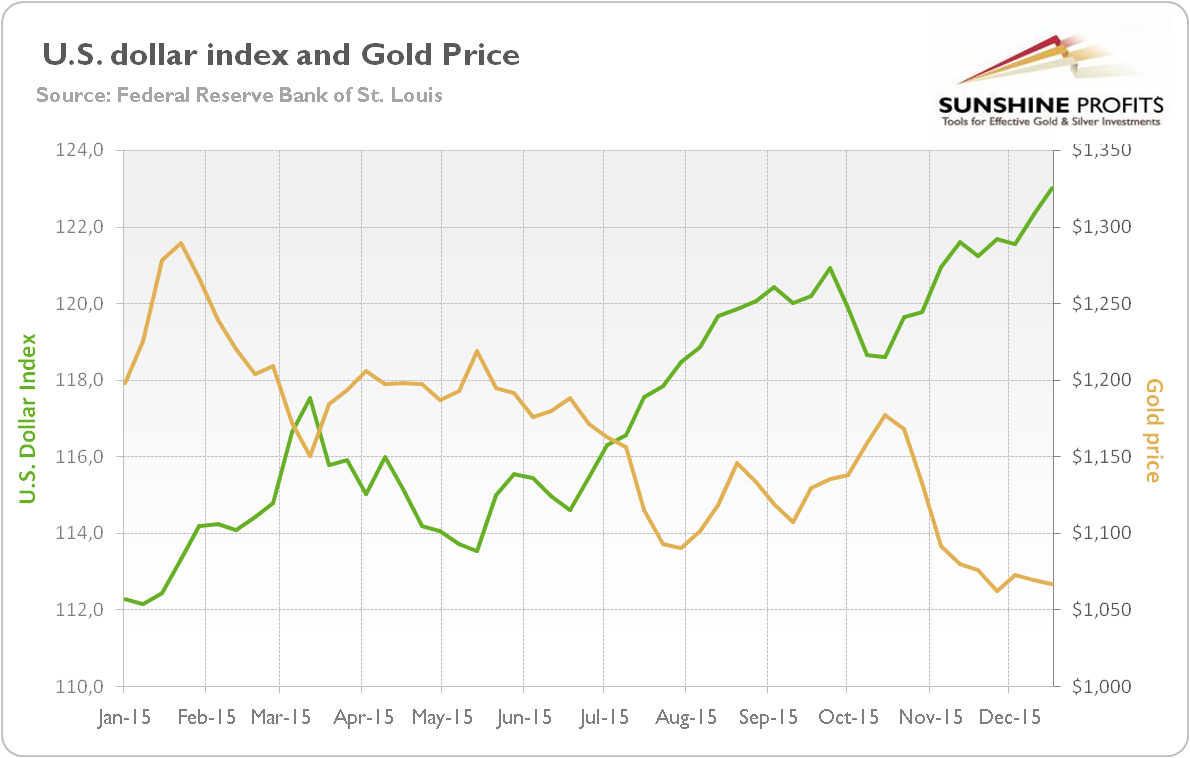

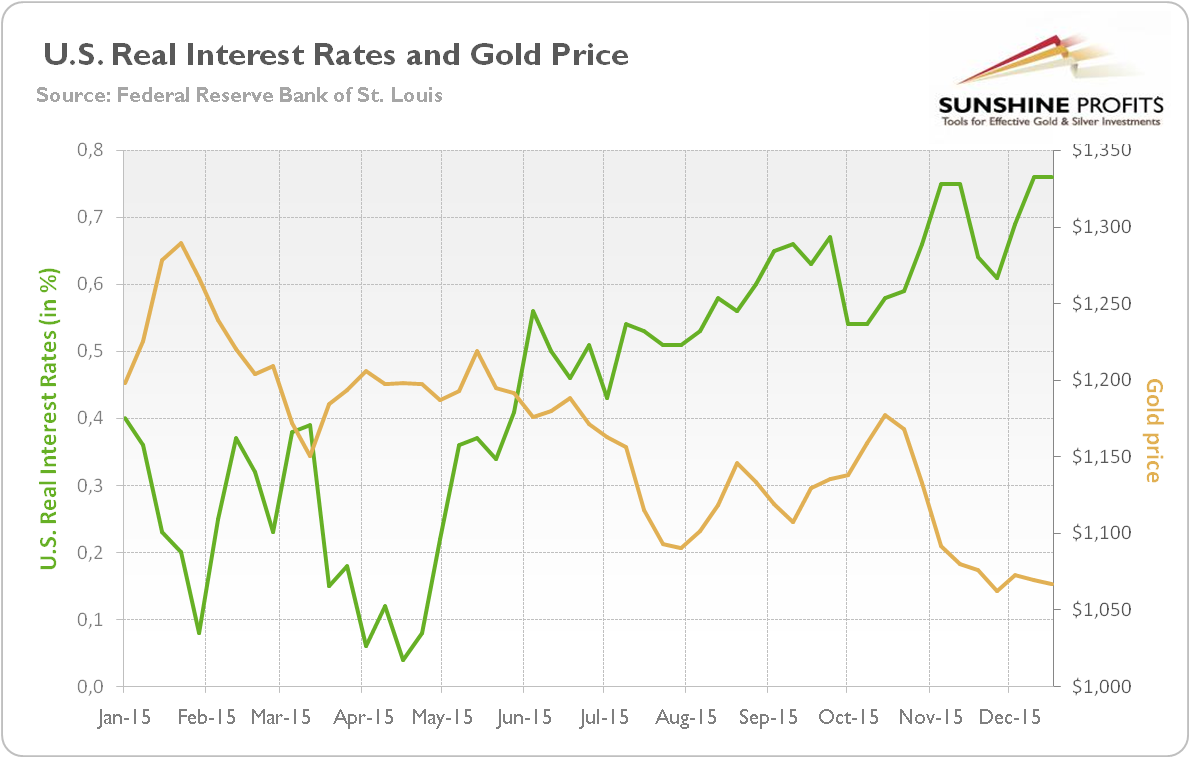

The major force influencing the gold market will be, as in 2015, the changes in divergence in the monetary policies among major central banks in the world. Investors witnessed the starkest contrast between them in December, when the European Central Bank eased its monetary policy, while the Fed raised its interest rates. Last year, the gold price fell on the expectations of the Fed’s hike and the resulting appreciation of the U.S. dollar against major currencies, and on the rise in the U.S. real interest rates (see the charts below).

Chart 1: The price of gold (yellow line, right scale, London PM Fix) and the U.S. dollar index (green line, left scale, Trade Weighted Broad U.S. Dollar Index) in 2015

Chart 2: The price of gold (yellow line, right scale, London PM Fix) and the U.S. real interest rates (green line, left scale, yields on 10-year Treasury Inflation-Indexed Security)

That divergence is likely to remain in 2016, as the U.S. economy grows faster than other developed economies. However, there are strong reasons to believe that the level of divergence in the Fed’s stance compared to the rest of world would diminish or at least stabilize, which would ease the downward pressure on the price of gold.

Why? First, the ECB disappointed markets by extending, but not expanding its quantitative easing program, as it implicitly promised. It probably means that Draghi could not convince other voting members of the Governing Council (the Eurozone’ counterpart of the FOMC) to increase the level of quantitative easing as he had signaled to the markets. As the economic activity in the Eurozone has picked up recently, there is less need for further monetary easing.

Second, the U.S. central bank’s tightening cycle will be less aggressive than expected. Fed’s officials ensure that the future path of rate hikes will be slow and gradual (the December FOMC minutes confirm that view). Instead of a meaningful tightening cycle that would restore positive real rates, the Fed is likely to deliver only a symbolic 25 basis point hike. In other words, there may be a “one-and-done” scenario, since the Fed delayed its hike for a few years (if the Fed had really been confident about the U.S. economy’s strength to the extent that would justify a whole series of hikes, it would have raised the interest rate a long time ago). The recession officially ended in June 2009. Thus, in the next 6 months, we would be in the seventh year of the current expansion, while the average expansion since 1945 lasted less than five years. Investors should remember that 2016 is an election year, so the Fed may be reluctant to hike aggressively and risk recession, especially with the stubbornly low inflation.

Since the yellow metal serves as a safe-haven, the unexpected tail risks may affect its price this year. The black swans that could change sentiment toward the yellow metal and spur safe-haven demand for gold in 2016 are: China’s hard landing, Britain’s exit from the European Union, another edition of the Eurozone crisis and a new global or U.S. recession. Given the fact that gold is mainly traded as a bet against the American economy, the U.S. recession could be the most important one.

According to JP Morgan, there is 23 percent likelihood that U.S. economy will enter recession in 2016 (and a 76 percent that it enters recession in the next three years), while the Citigroup gives it 65 percent chance. Indeed, data do not look encouraging: the global economy has already entered a dollar recession (global GDP measured in the greenback has fallen), the energy sector is already in a bust, the manufacturing and corporate profits are in a recession, and the junk bond markets are crashing, which often signals stock market turmoil. Needless to say, the U.S. recession would be ultimately positive for the gold market (although initially the greenback could be the king).

Actually, we are already observing positive changes in the attitudes in the marketplace that could support the price of gold. Investors, unsure about the Fed’s normalization process, deteriorated liquidity in the global markets, the dubious prospects of the U.S. economy and elevated equity prices are resulting in a more conservative stance. The turbulence in the junk bond market clearly indicates that investors have become more risk-averse. The increased fear in the market may change the sentiment towards gold.

Summing up, the major forces affecting the gold market in 2016 will be the divergence in the monetary policies among major central banks in the world and the level of fear in the markets. The U.S. economy should grow faster than other developed economies, while the Fed is likely to remain less dovish than other central banks. Thus, the U.S. dollar is likely to further appreciate, which would be negative for the price of gold. However, the divergence in the anticipated paths of the Fed and the ECB interest rates should stabilize or narrow, as the U.S. central bank could be less restrictive than expected. Therefore, 2016 should be a better year for gold than 2015, especially since bad news (like the future rate hikes) have probably already been priced into the yellow metal. The possible recession in the U.S. would strengthen the shiny metal, while the black swan landing in Europe would boost the greenback and drag gold down.

If you enjoyed the above analysis and would you like to know more about the most important factors influencing the price of gold, we invite you to read the January Market Overview report. If you’re interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts. If you’re not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview