One week passed since Brexit vote and now we can better assess the impact of British decision to leave the EU on the gold market.

As we have already reported, there was a knee-jerk reaction in markets, which pushed the British pound and risky assets down and boosted gold. However, the panic did not last long. Since Monday, we observe a rise in risk appetite, as investors have been realizing that Brexit vote did not trigger the end of the world. Actually, some stock indices (like British FTSE 100) have already pared losses from last Friday. The upside price action in most world stock markets from this week suggests that markets over-reacted initially to the “Leave” vote).

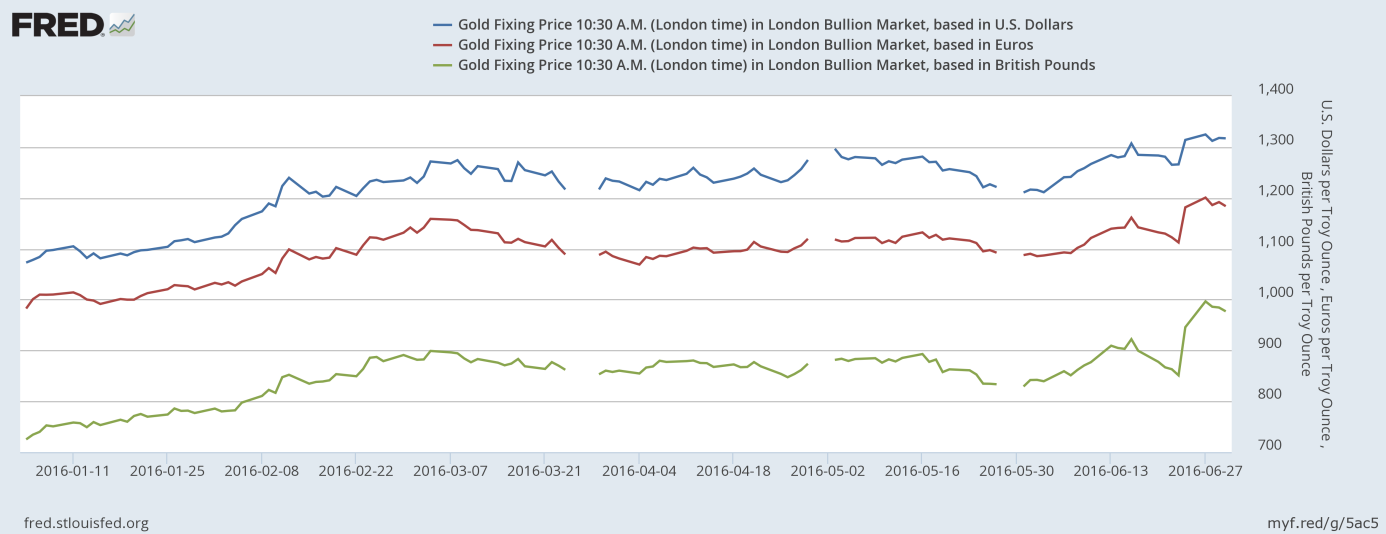

Gold also pared down some of its earlier gains, however it managed to remain above $1,300, as one can see in the chart below.

Chart 1: The price of gold (London A.M. Fix) in the U.S. dollars (blue line), Euros (red line) and British pounds (green line)

It’s an important achievement for the shiny metal, especially in the face of strengthening of the U.S. dollar. Usually, the greenback and gold move in opposite directions, but not that time. It should not be surprising for our readers, as we have already explained in the Market Overview that the yellow metal and the U.S. dollar do not always move inversely, because both of them are considered as the world’s safe haven currencies. Therefore, although gold is usually considered as a bet against the U.S. economy, it is also an insurance policy against global financial crashes, as well as the greenback, which is still the main reserve currency. Thus, European crises may support both the U.S. dollar and gold.

There are two reasons why gold did not correct more. First, although the Brexit vote does not automatically imply a withdrawal from the EU, it increased uncertainty and created some demand for safe haven assets, like gold. That uncertainty was strengthened by some European politicians’ comments urging Britain to quick invocation of Article 50 of the Lisbon treaty, and concerns about the Scottish independence referendum. Second, the market odds of the Fed’s interest rate raises this year collapsed. Indeed, a rising dollar combined with increasing global economic fears make them look very unlikely. However, investors should watch these chances closely, as if the Fed starts to think seriously about raising interest rates, it may send gold down.

The key takeaway is that one week after the Brexit vote the world still exists. The financial apocalypse did not happen. There was a huge panic on Friday, but since Monday there was a gradual comeback of risk appetite – some stock market indices even managed to completely pared losses. The “risk on” mode should be negative for the yellow metal, but gold remained above $1,300 due to increased political uncertainty and lower odds of the Fed’s hike this year. However, investors have to be extremely cautious now, as the net speculative gold positions are extremely high.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview