The Fed finally ended the zero interest rate policy (ZIRP) this December. Fundamentally, the Fed’s hike is a step in the right direction (but only a small one, since the U.S. interest rates will remain deeply below their normal levels), because interest rates have been clearly held too low for too long. The ZIRP impaired the recovery (by increasing uncertainty and subsidizing a distorted structure of production and mal-investments) and created new economic bubbles at the same time (ZIRP induced searching for yield and excessive risk-taking, and the lack of investment prospects – due to impaired recovery – prompted companies to buy back their own shares).

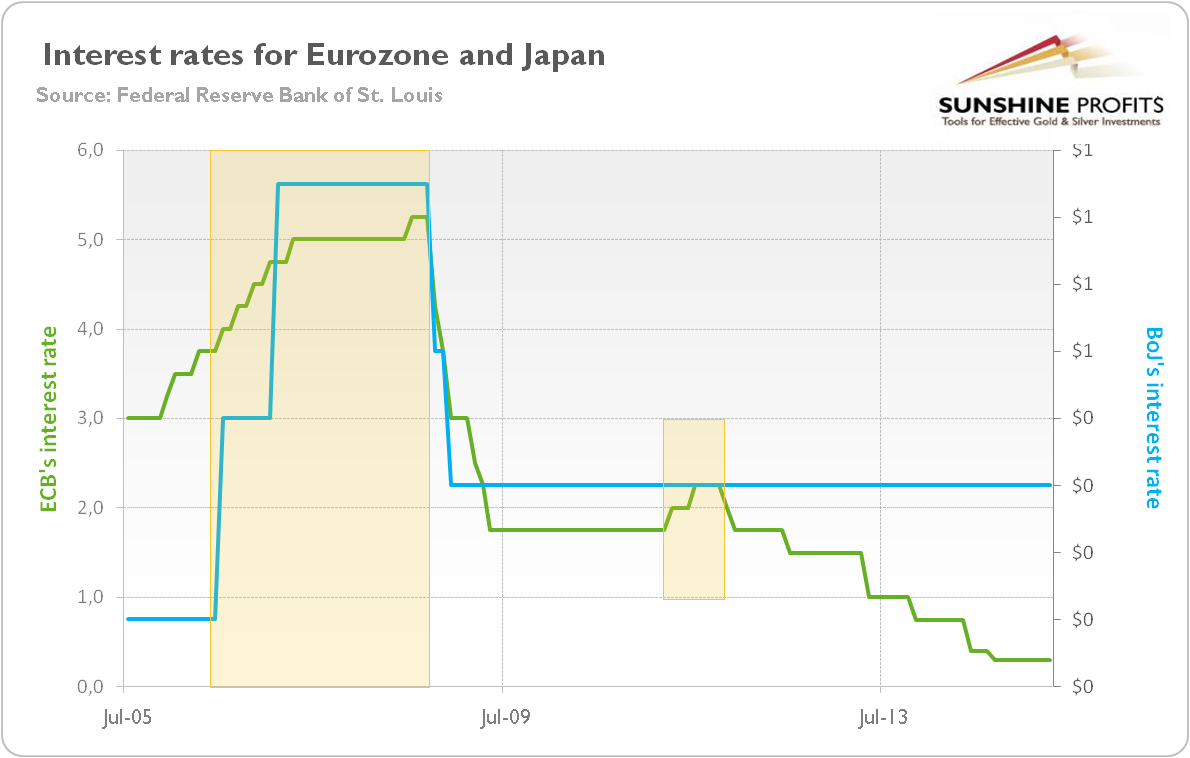

As we all know, the Fed is terribly delayed with its action. The recession officially ended in June 2009 according to the NBER's Business Cycle Dating Committee. If the U.S. central bank had used the Taylor rule, it would have started tightening in2011. Therefore it may be forced to loosen its monetary policy sooner than expected. We agree with Yellen who said during her December press conference that expansions do not die of old age. However, it is also true that recessions usually start after the central bank tightens its monetary stance (since companies that sprang up on the back of the previous loose monetary policy suddenly lack support from the money supply or ultra-low interest rates and get into trouble). So far, no central bank has successfully escaped from zero. The Bank of Japan vainly tried in 2006-2007, and the ECB in 2011 (see the chart below).

Chart 1: The ECB’s interest rate (green line, left scale, in %) and the BoJ’s interest rate (blue line, right scale, in %) from 2005 to 2015.

What does the Fed hike mean for the U.S. economy? On the one hand, a quarter-point increase seems to be too small to affect the asset market or raise the risk of recession. Investors should remember that the FOMC’s decision has been communicated for a few years. The real tightening started in 2013, when the Fed began to slow its $85 billion of bond purchases each month.

On the other hand, the Fed hike means higher refinancing costs for all those junk bonds and oil and gas related stocks, which would spur even more defaults in those markets. Usually, the U.S. central bank starts the tightening cycle to prevent the economy from overheating and excessive inflation. But this time is really different. We are experiencing commodity price deflation, not inflation, while the economy is far from overheating. Actually, the latest data look worrisome. The high-yield spreads are rising, while corporate earnings and manufacturing look recessionary. Indeed, on the very same day that Yellen raised rates, the Fed said that industrial production decreased by 0.6 percent monthly and by 1.2 percent on an annual basis in November, while the November ISM gauge of manufacturing was below the boom-bust line of 50.

We do not claim that the Fed’s hike mechanically implies recession in 2016 (investors should remember that monetary policy affects the real economy with certain levels of lag). Our point is that the chances of recession are already higher than many people believe. Therefore, when it comes, it will surprise markets and give the price of gold a boost.

Disregarding the possible recession, what does the Fed’s hike imply for the gold market? Well, the gold trade is no longer about when the U.S. central bank raises interest rates for the first time. Now, the shiny metal’s behavior will be dependent on when the Fed delivers the next hikes. Therefore, the price of gold will still fluctuate on the Fed’s actions and expectations for the whole path of future rate hikes.

The December hike was to a large extent factored into the price of gold, so it should not affect the bullion market, at least when analyzed separately. However, the increase was associated with the FOMC statement and Yellen’s press conference. Although the Fed officials assured the markets that the tightening cycle will be gradual, the lack of dissent and any significant downward revisions of dot plots were interpreted by many investors as hawkish.

We are a bit skeptical about the official Fed projections, since historically the U.S. central bankers failed at predicting what they would do. For example, in September 2014, not so long ago, the majority of FOMC members projected that the federal funds rate would end up at 1 percent or even higher by the end of 2015. Pretty funny, is it not? Therefore, investors should not be guided by dot plots when trading gold.

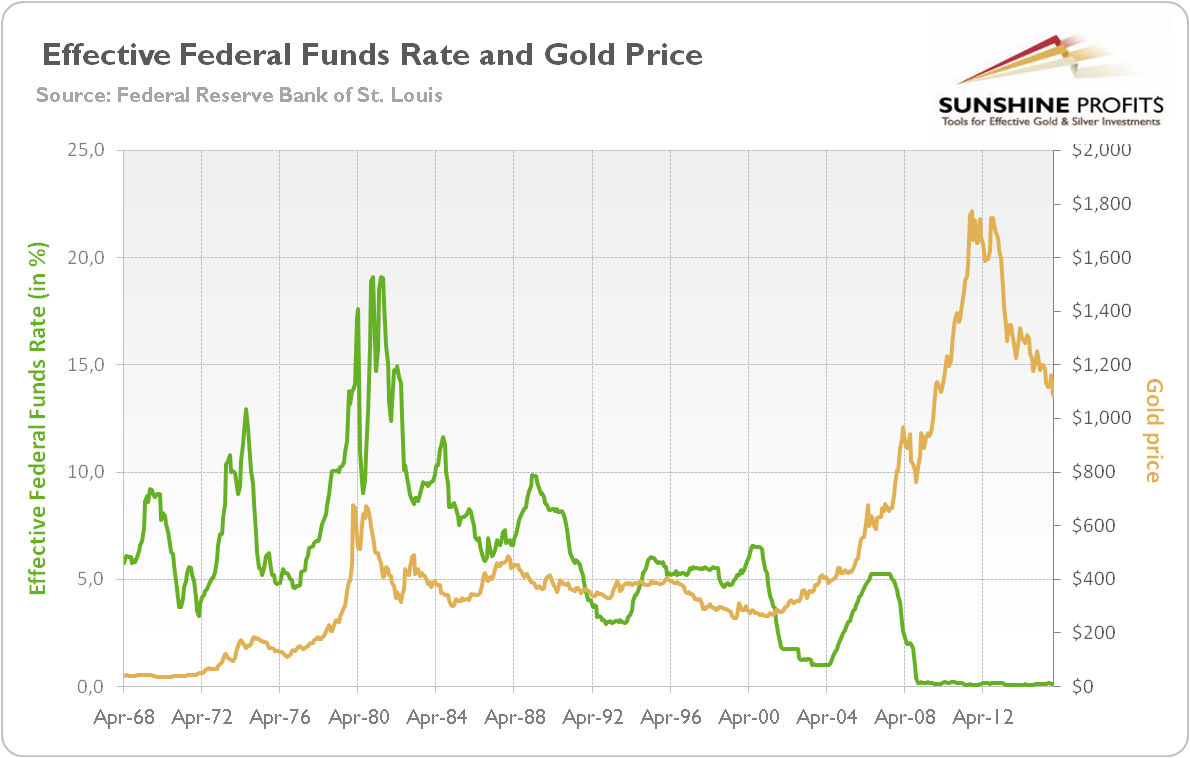

But let us assume that the ultra-dovish U.S. central bankers have changed in the new year and promised themselves to be like Paul Volcker. How would the tightening cycle affect the gold market? It is widely assumed that the gold price must decline when the Fed hikes interest rates. However, this assumption is not supported by empirical evidence. As one can see in the chart below, there is no strict correlation between the federal funds rate and the price of gold, and there were many cases (as in the 70s or during the 2004-2006 cycle) when the tightening cycle was accompanied by upwards moves in the price of gold. As we explained in the October edition of the Market Overview, the real interest rates are much more important for the price of gold than the federal funds rate.

Chart 2: The effective federal funds rate (green line, left scale in %) and the price of gold (yellow line, right scale, London P.M. fixing) from 1968 to 2015.

The key takeaway is that the Fed has finally hiked interest rates. Some analysts say that the price of gold must drop now. We do not preclude further declines, even below $1000, due to the divergence in global monetary policies and expectations for the next hikes. However, the price of gold is more correlated with real interest rates than with the federal funds rate. We also see upside potential for the shiny metal, since the FOMC’s projections of the fed funds rates are completely unreliable, while in the U.S. economic recent data is worrisome, and may have prompted the Fed into a more gradual tightening cycle than expected. The above has implications for many months, not necessarily for the short- and medium term though.

If you enjoyed the above analysis and would you like to know more about the most important factors influencing the price of gold, we invite you to read the January Market Overview report. If you’re interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts. If you’re not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview