Gold News Monitor originally sent to subscribers on June 16, 2015, 9:38 AM.

The U.S. factory sector declined 0.2 percent in May, falling into a technical recession. What does it mean for the U.S. economy and the gold market?

According to the new Federal Reserve data, industrial production decreased 0.2 percent in May, after falling 0.5 percent in April. That was a weaker reading than the most pessimistic estimate (on average, economists expected a 0.2 percent increase month-over-month).

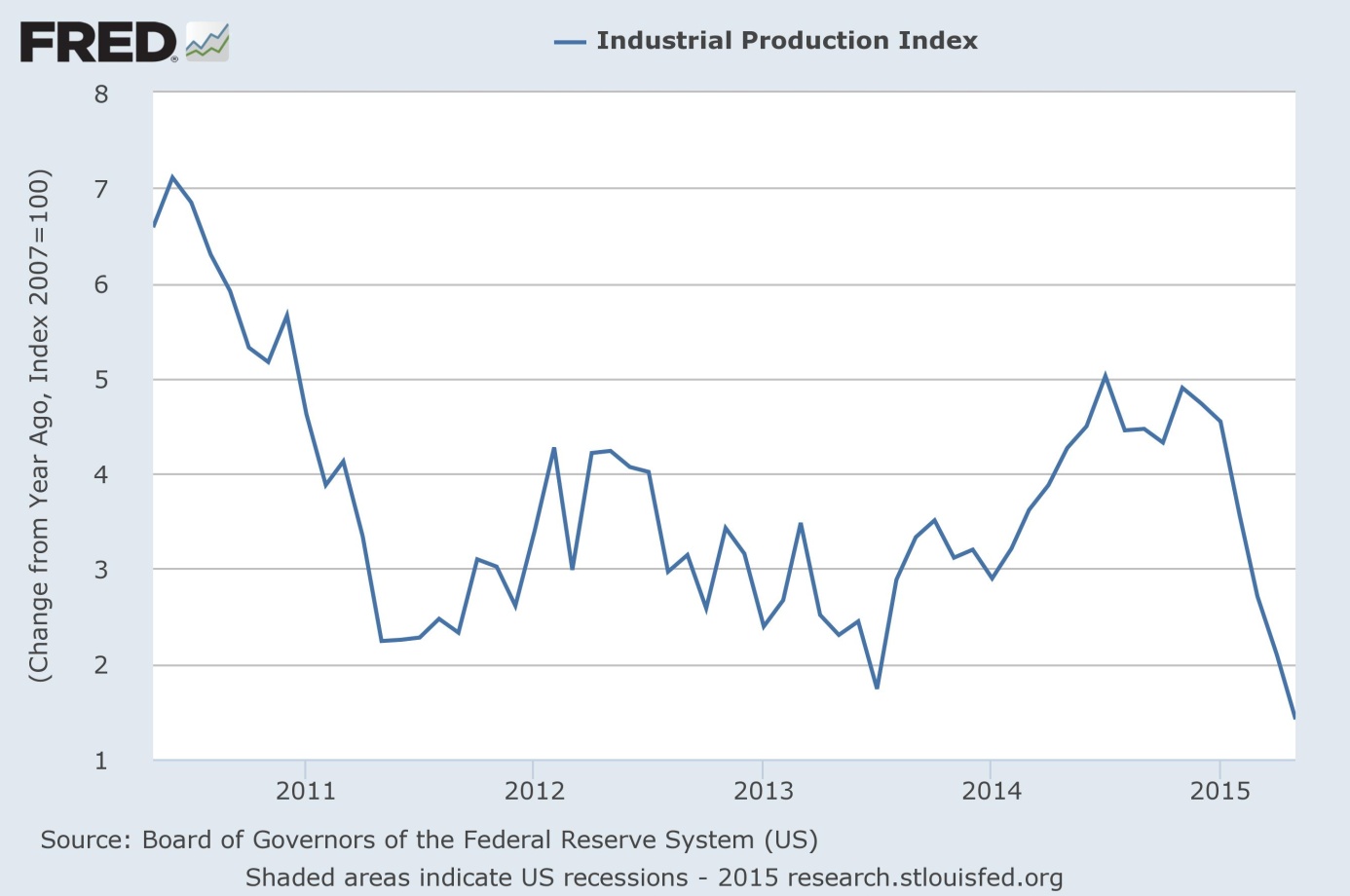

The number has been week since November. The sector’s real output has dropped 0.64 percent since then. The six-month decline in output, adjusted for inflation, technically qualifies as a recession. See the chart below, this is how the decline looks like.

Chart 1: Industrial Production Index (Change from Year Ago) from May, 2010 to May, 2015

Moreover, capacity utilization for the industrial sector declined 0.2 percentage points in May to 78.1 percent, a rate that is 2.0 percentage points below its forty-year average.

The industrial production number consists of three components — manufacturing, mining and utilities. In May, only utilities were in positive territory, while within the manufacturing component, auto production was the only bright spot, rising 1.7 percent. Autos were also a leading component in May retail sales. Motor vehicle sales jumped 2.0 percent, driving up retail sales 1.2 percent.

Unfortunately, there is one problem with the automotive industry. Auto sales are fueled by subprime auto loans. Therefore, we believe that auto sales are not in a stable trend and are going to collapse at some point.

To make matters worse, the first read on manufacturing in June is no better. The Fed’s Empire State Manufacturing Index declined from 3.1 in April to -2 in May, its second negative reading in the past three months.

The key takeaway is that U.S. industrial production fell into a technical recession, the first time since the Great Recession. Such weak data should get the attention of Fed officials at their policy meeting tomorrow and Wednesday and induce them to hike interest rates later and in a more gradual way. Thus, weak industrial production seems to be good news for the gold market. And uncertainty over the U.S. economic conditions should increase some safe-haven demand.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview