The price of the yellow metal backed below $1,200. What does it mean for the gold market?

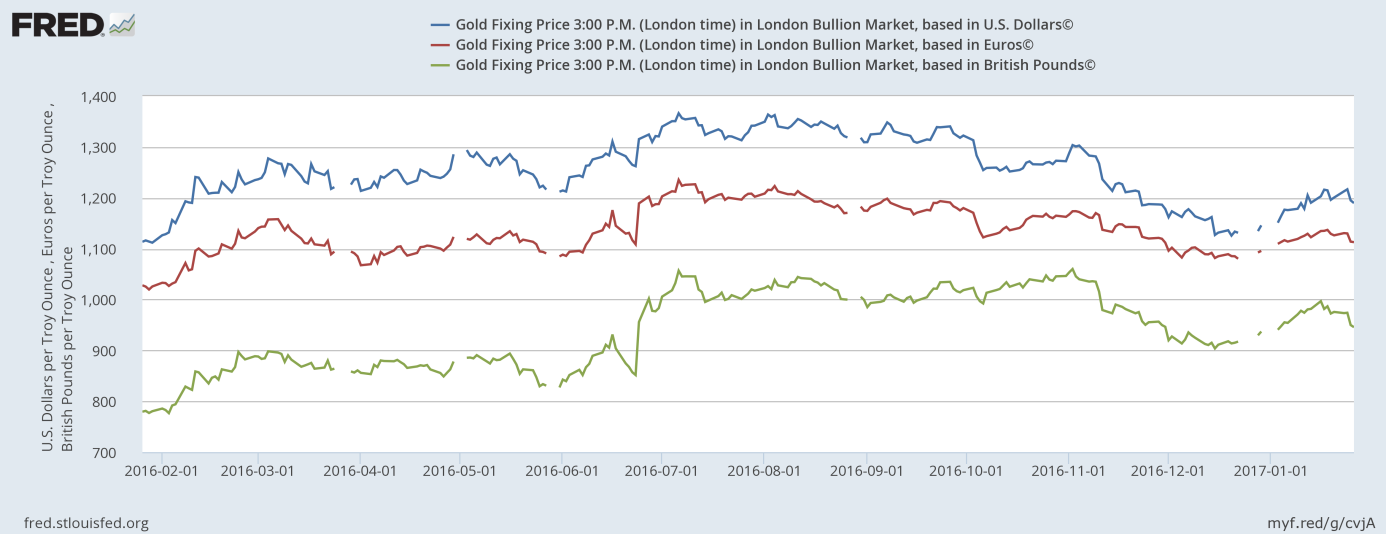

Well, gold’s trip above $1,200 did not last too long. Gold prices exceeded this level on January 12, after the Trump’s press conference. Two weeks later the yellow metal retreated, as one can see in the chart below. We are hardly surprised, as we were always a bit skeptical about the fundamental foundations of the current rally. As the chart shows, gold prices expressed in other major currencies do not paint too optimistic a picture, which indicates the inherent weakness in the gold market, at least for a while.

Chart 1: The price of gold in the U.S. dollar (blue line), the euro (red line) and the British pound (green line) over the last year.

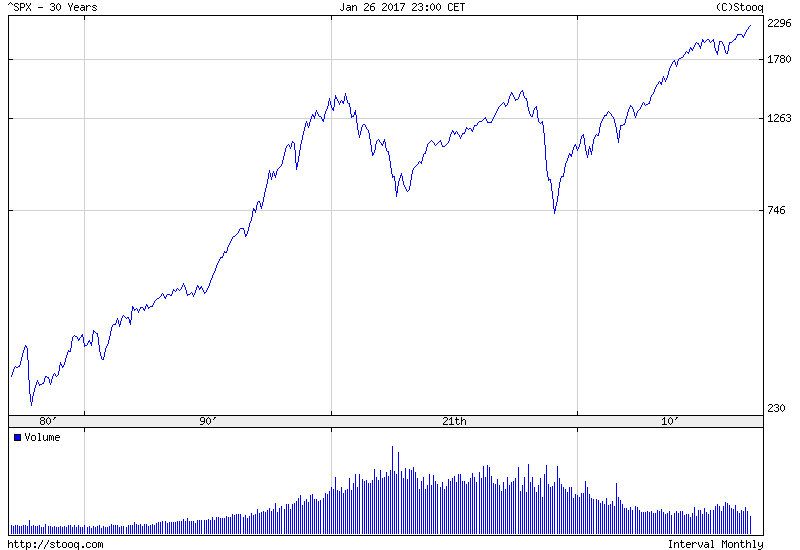

Will the price of gold decline further? Well, a lot seems to depend right now on the performance of the equity market. Many analysts point out that the U.S. stock market is clearly overbought, so the current rally may only be temporary. It is true that equities are trading at historic valuations, but the economy seems to be in relatively good condition. And the current bull market hardly paints a picture of euphoric market participants typical for bubbles. Just look at the chart below. There was a clear secular bull market in the 1990s, but in the 21th century the U.S. stock market just seemed to consolidate for most of the time until recently. We will probably investigate the current bull market in equities in the near future in more detail.

Chart 2: The S&P 500 Index since the 1980s.

We are not saying that there will be no correction – markets simply correct from time to time and it’s perfectly normal. What we are arguing is that the mere fact of another all-time high does not automatically trigger a market crash. Therefore, there is still room for further declines in gold prices. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview