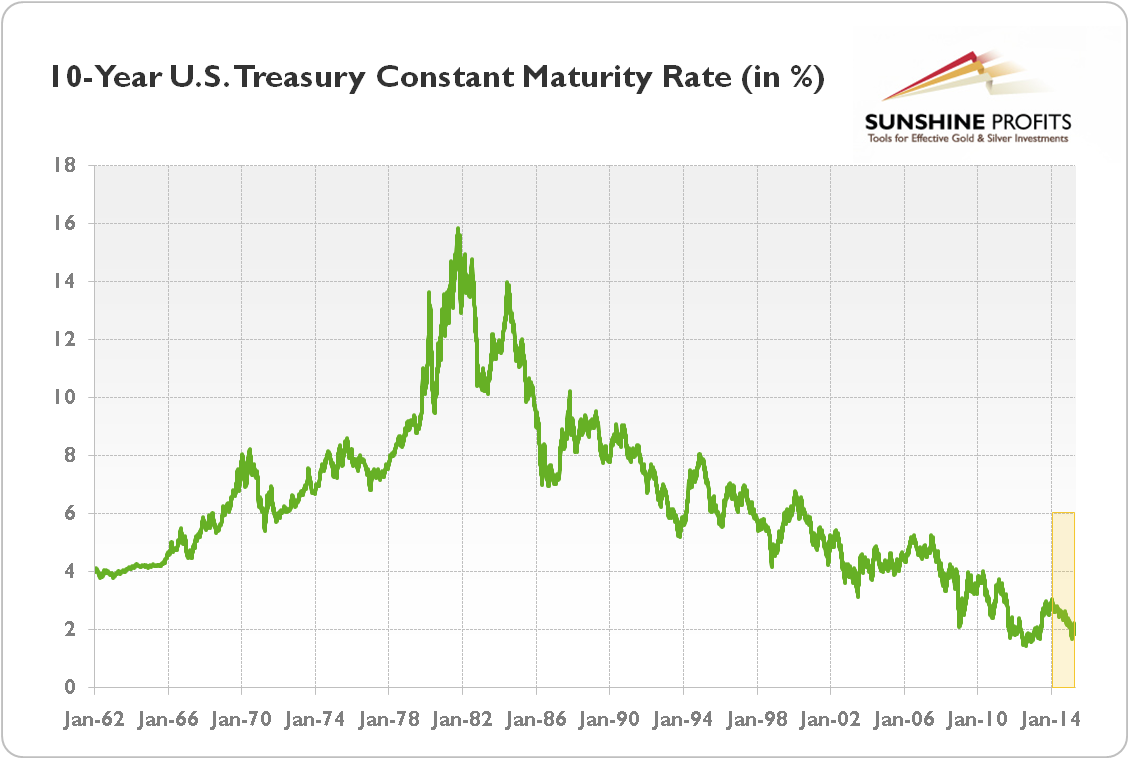

The drop in international liquidity is a very important (but often overlooked) issue, since it explains the fall of the U.S. depositary institutions lending and the deterioration of U.S. credit conditions. In March, the amount of extended credit dropped to recessionary levels because the rejections of credit applications rose. Banks are not eager to grant new loans, and this may reflect limited global liquidity. The surging U.S. dollar and declining 10-year Treasury yield (it has declined more than 30 basis points within the last two months, as can be seen in Figure 1) are symptoms of contracting global liquidity. Investors shift capital from risky assets into U.S. Treasuries, while central banks stop printing money to buy the U.S. dollar (which became too expensive). This is why the strong greenback is pressuring cash reserves all over the world.

Figure 1: 10-Year U.S. Treasury Constant Maturity Rate from January 1962 to April 21, 2015 (in %)

In December 2014, the Bank for International Settlements said that “market liquidity is structurally lower now than it was in the past” and warned that “there are a number of investors buying assets on the presumption of a level of liquidity which is not there”. The Bank of England and the IMF in its April issue of Global Financial Stability Report, also warned against global liquidity shock, which could cause violent repercussions if funding costs are no longer close to zero. If the pace and scale of its tightening are not correctly anticipated by the investors, the possible Fed’s hike could trigger a sell-off in the bond markets similar to the U.S. bond crash in 1994.

Investors should remember that it was a liquidity shock within the shadow banking system, which caused the last economic crisis, and that some parts of the world economy can be even more vulnerable to a financial shock than it was in 2007-2008. The total amount of global debt has risen by $35 trillion since the last crisis, debt ratios to GDP in the developed economies have risen by 20 percent, and margin debt as a percentage of market capitalization is higher than it was during the late 1990s stock market bubble.

It seems that there are three main risk factors, which could significantly affect the international financial markets and, thus, gold prices. First, as we have already pointed out, further appreciation of the U.S. dollar and decline in commodity prices put more pressure on the companies from emerging markets, which were borrowing heavily in greenbacks. Indeed, according to BIS’ working paper, “since the global financial crisis, outstanding dollar credit to non-bank borrowers outside the US has risen by half, from USD 6 trillion to USD 9 trillion”, while energy and commodity firms account for more than a third of nonfinancial corporate bonds issued in emerging markets in hard currency since 2007.

Second, a fall in oil prices could further undermine credit quality in a worldwide high-yield debt market. According to the BIS “the debt borne by the oil and gas sector has increased two and a half times over, from roughly $1 trillion in 2006 to around $2.5 trillion in 2014”, and the price of oil is a proxy for the value of the underlying assets that underpin that debt. Its recent decline may have caused significant financial perturbations. Indeed, since June 2014, when oil prices started falling, the total returns on energy-related bonds in the Barclays High-Yield Index fell by 13 percent (in January 2015). Meanwhile, according to the IMF, energy-related bonds (both high-grade and high-yield) account for 56 percent of the bonds trading at distressed levels. Investors should be aware that bankruptcies in the energy sector usually lag oil price crashes by about a year since mining companies generally hedge their output on the futures markets for such horizons.

Third, a decline in the oil prices could lower investable oil reserves. In 2014, oil-exporter reserves contracted $88 billion. The so-called petrodollars have been an important source of global liquidity: soil-exporting countries have doubled their banking deposits in BIS reporting banks since 2014 and now hold more than $2 trillion in U.S. assets. For the first time in twenty years, OPEC countries will be withdrawing liquidity from the market. It is estimated that oil-rich countries will sell more than $200 billion of assets this year and more than $800 billion over the next three. The precise impact of drying up petrodollars is not certain; however it would diminish support for U.S. (and European) asset prices. It is true that the losses of oil exporters should to some extent be counterbalanced by gains of oil importers; however there may be some market repercussions due to portfolio rebalances.

The impact of tightening of global liquidity on gold prices is also mixed. On the one hand, squeezed global liquidity is bad for asset prices, but good for the U.S. dollar (remember the 2008?), which should exert some downward pressure on the yellow metal’s prices. Moreover, some investors may initially sell their gold to raise needed liquidity. On the other hand, the increase of the safe-haven demand for gold and the likely easing of Fed’s monetary stance in the case of global low liquidity shock would be positive for gold prices.

Stay updated on the latest global developments by joining our free gold newsletter. We analyzed the possible consequences of the eventual Fed’s interest rate hike in our April Market Overview report and we examine how the global developments can affect the gold market in the last issue. We provide also Gold & Silver Trading Alerts for traders interested more in the short-term analysis.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview