Forex Trading Alert originally sent to subscribers on May 24, 2016, 9:18 AM.

Earlier today, the German ZEW showed that its economic sentiment index declined sharply to 6.4 in May, missing expectations for an increase to 12. Thanks to these disappointing reading, the euro moved lower against the greenback and approached the next support zone. Will it stop further declines in the coming days.

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: short (stop-loss order at 1.4785; initial downside target at 1.4220)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

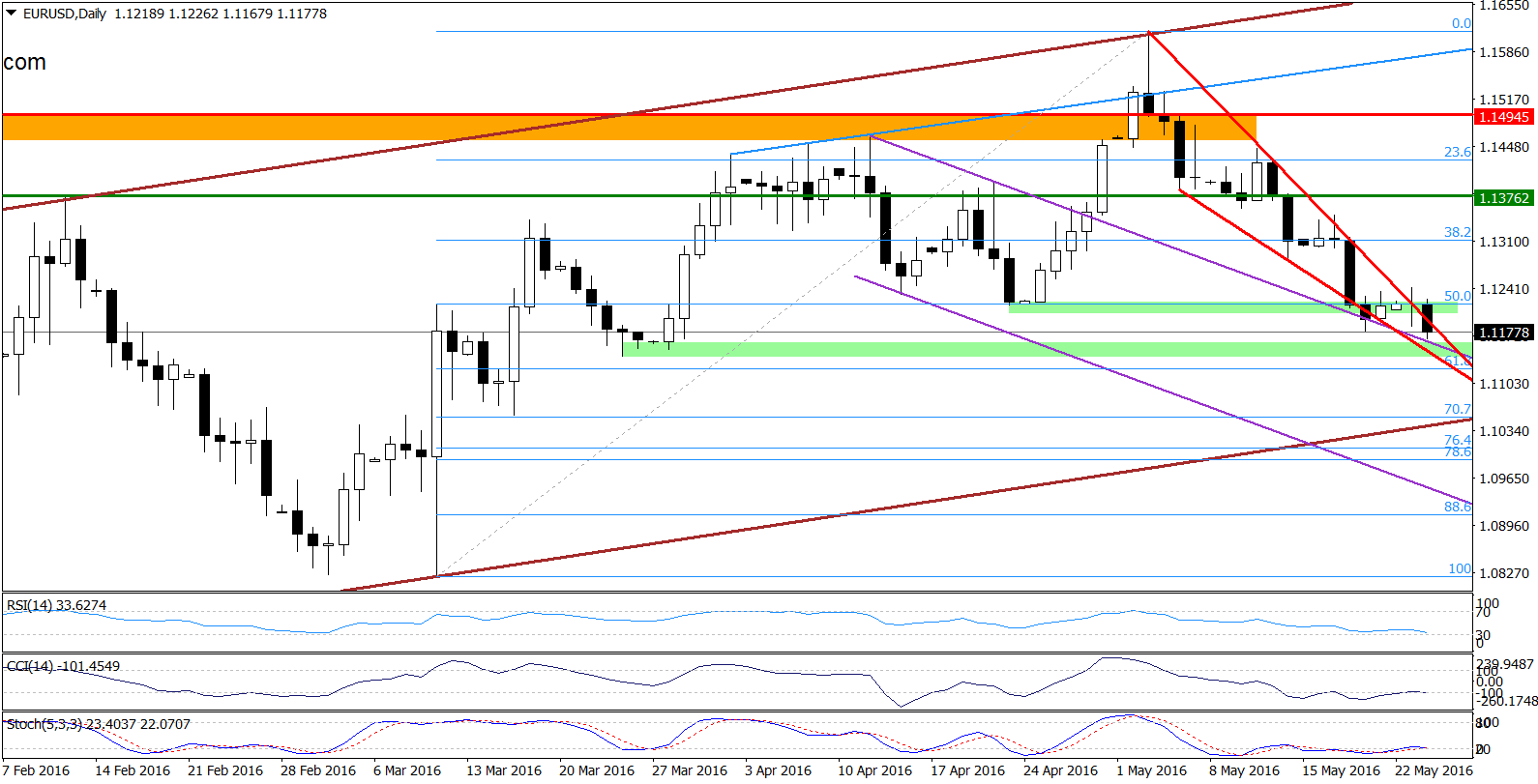

EUR/USD

The situation in the medium-term hasn’t changed much as EUR/USD is still trading under the previously-broken support/resistance line based on the March and Apr 2015 lows. Today, we’ll focus on the very short-term changes.

On the daily chart, we see that yesterday’s invalidation of small breakout above the upper border of the red declining wedge encouraged currency bears to act. As a result, the exchange rate moved lower earlier today, but the purple declining support line based on the Apr highs continues to keep declines in check. At this point it is also worth noting that slightly below it is also green zone created by the late Mar lows and the lower border of the red wedge, which serve as an additional support. On top of that, the current position of the CCI and Stochastic Oscillator suggests that the space for declines may be limited and reversal is just around the corner.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

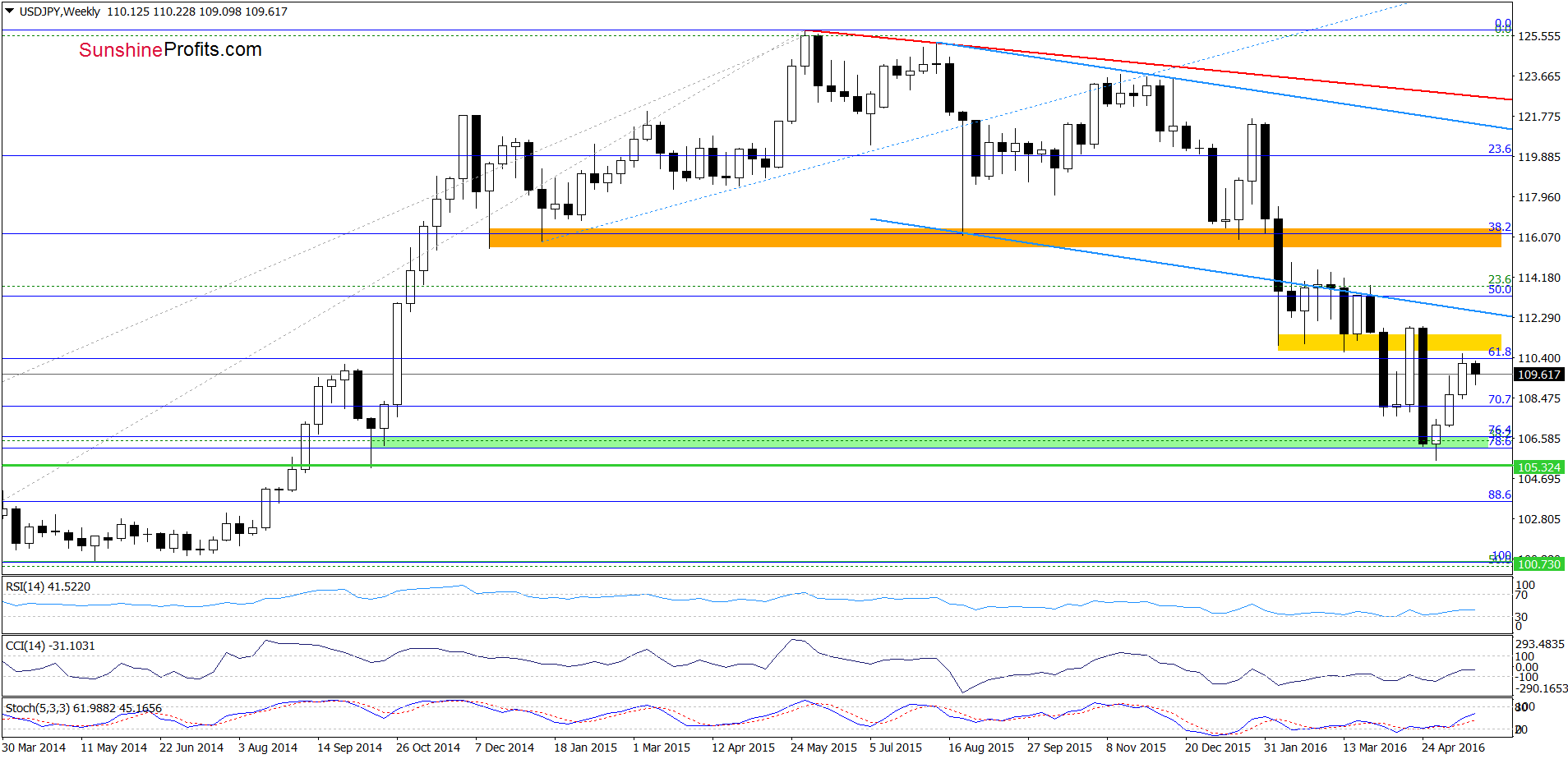

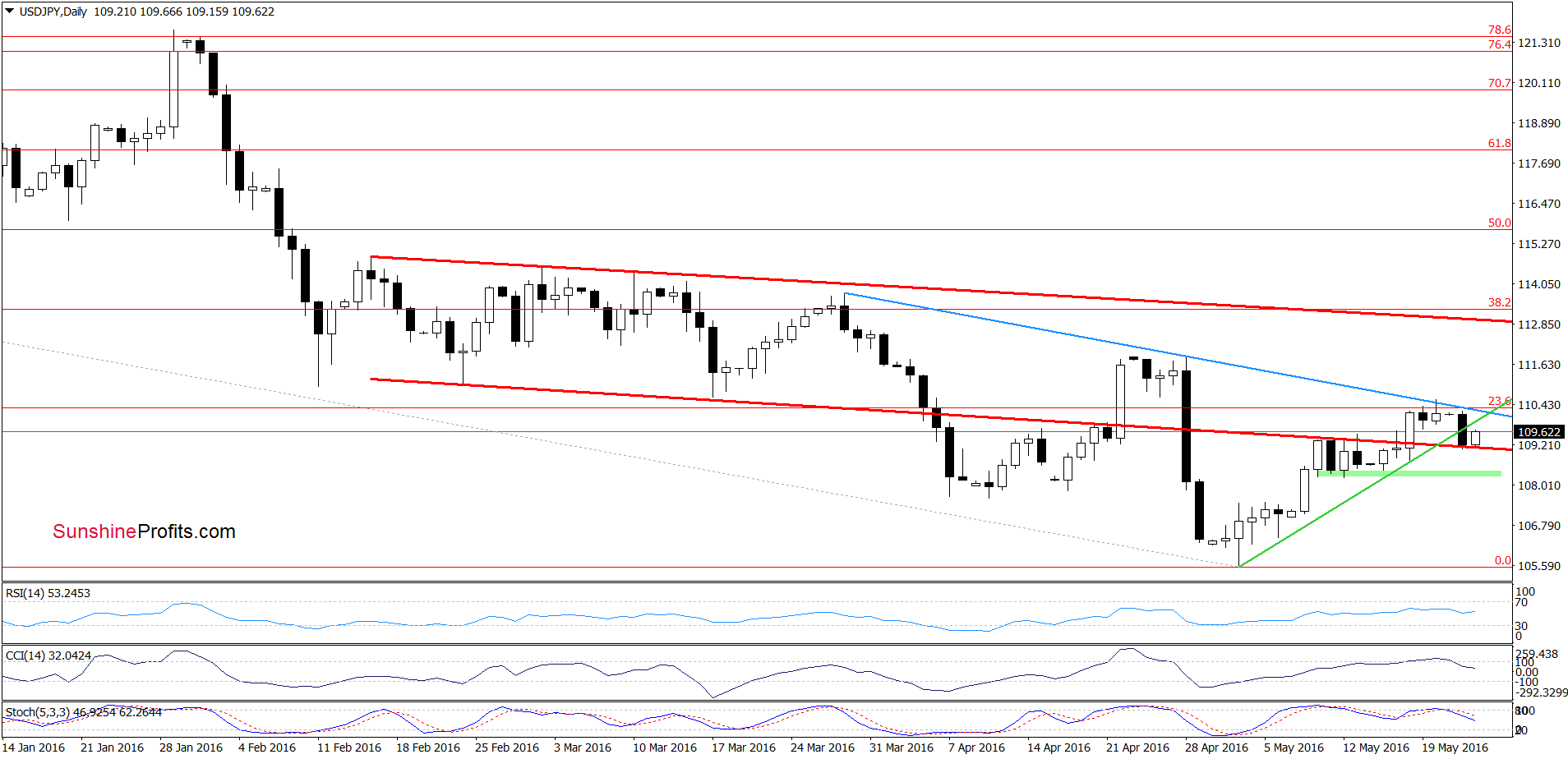

USD/JPY

Yesterday, USD/JPY declined to the red support line (parallel to the upper red line based on the Feb and Mar highs), which triggered a rebound earlier today. Despite today’s increase, the pair remains under the blue resistance line based on the previous highs and green support/resistance line based on the recent lows, which in combination with sell signals generated by the indicators suggests that what we wrote yesterday, is up-to-date:

(…), if the pair drops under the previously-broken red line, we’ll likely see (at least) a test of the green support zone created by the mid-May lows (around 108.21-108.47)

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

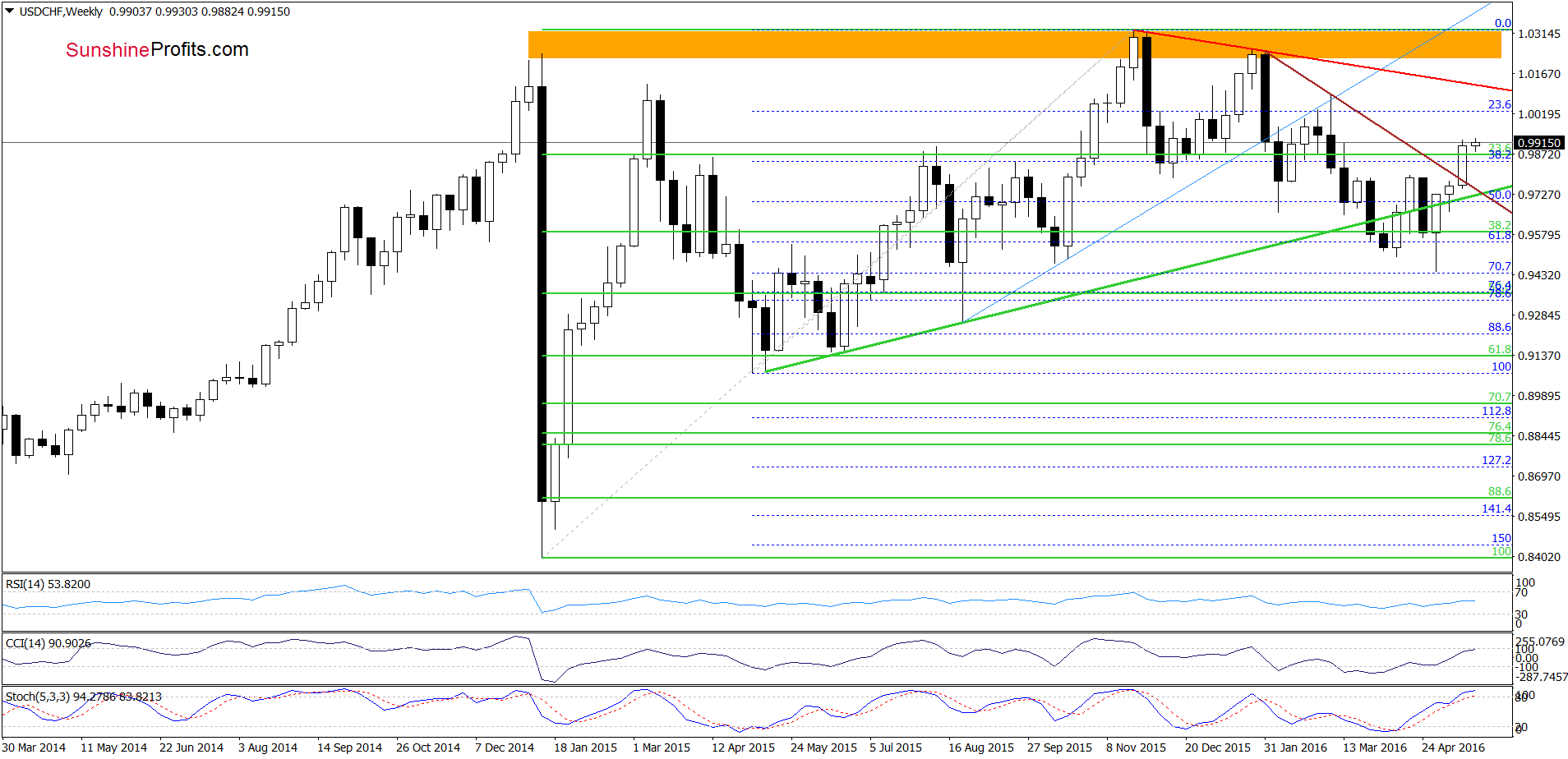

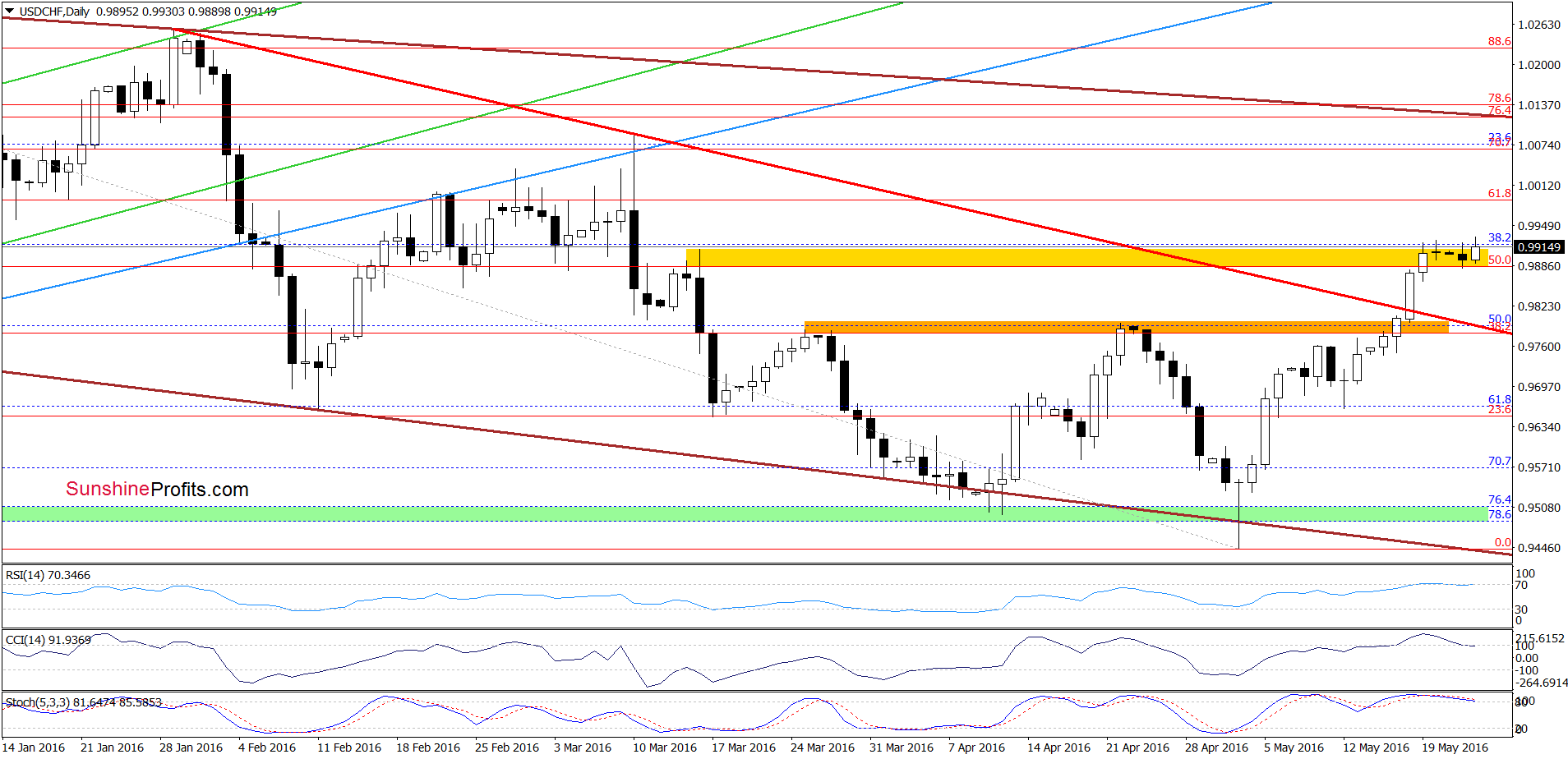

USD/CHF

From today’s point of view, we see that although USD/CHF moved little higher earlier today, the yellow resistance zone is still in play (there was no daily closure above it). Additionally, the current position of all indicators suggests that reversal and lower values of the exchange rate in the coming week are very likely. Therefore, if we see such price action and USD/CHF declines from this area, the initial downside target would be around 0.9793, where the previously-broken red declining line (based on the Jan and Mar highs) and the orange zone are.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts