Forex Trading Alert originally sent to subscribers on April 20, 2016, 5:23 AM.

Although official data showed that Japanese imports declined by 14.9% (which was a 15th straight drop) and exports fell by 6.8%, the U.S. dollar moved lower against the yen once again. What’s next for USD/JPY?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (stop-loss order at 1.1512; initial downside target at 1.0572)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

EUR/USD

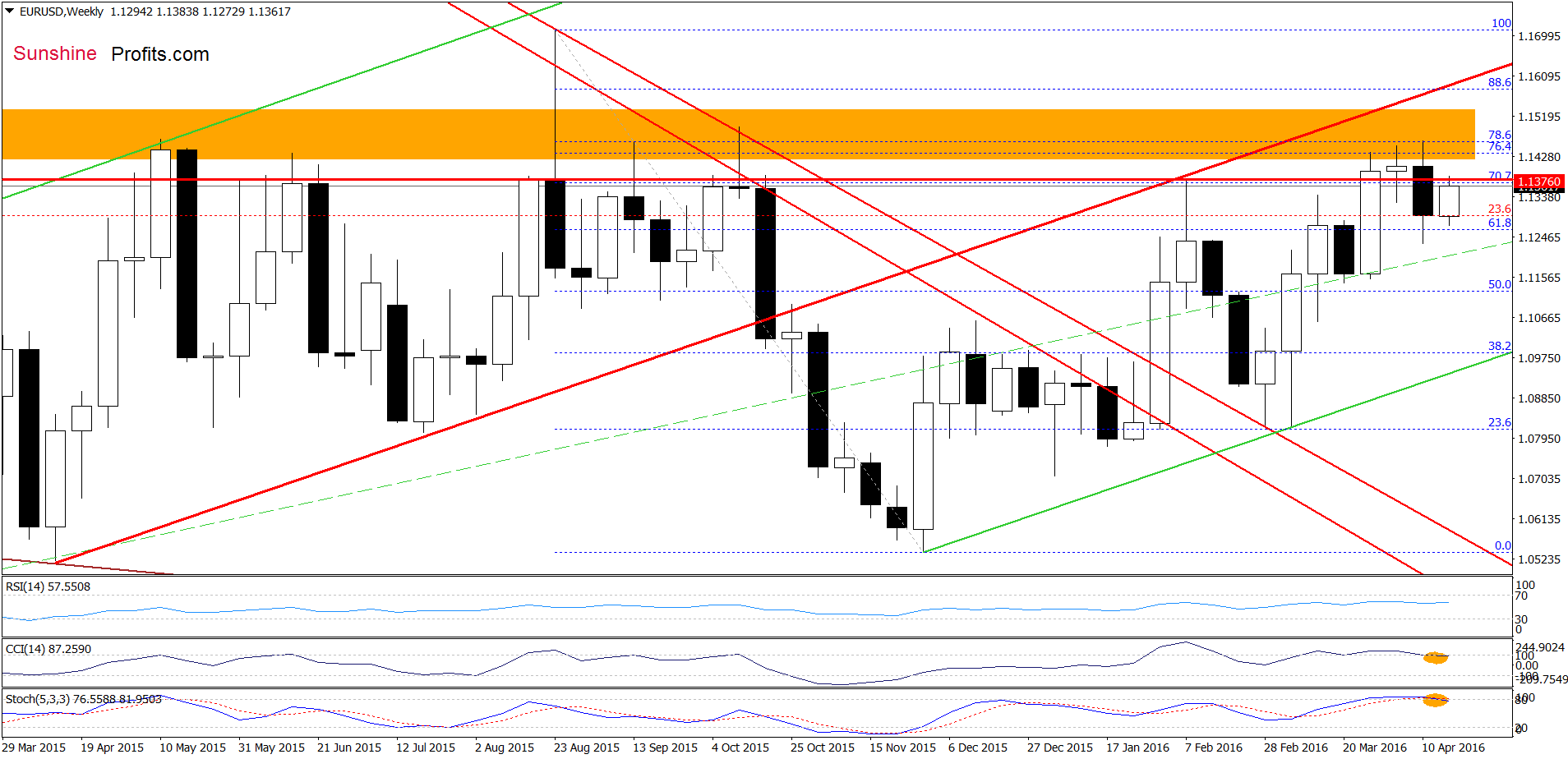

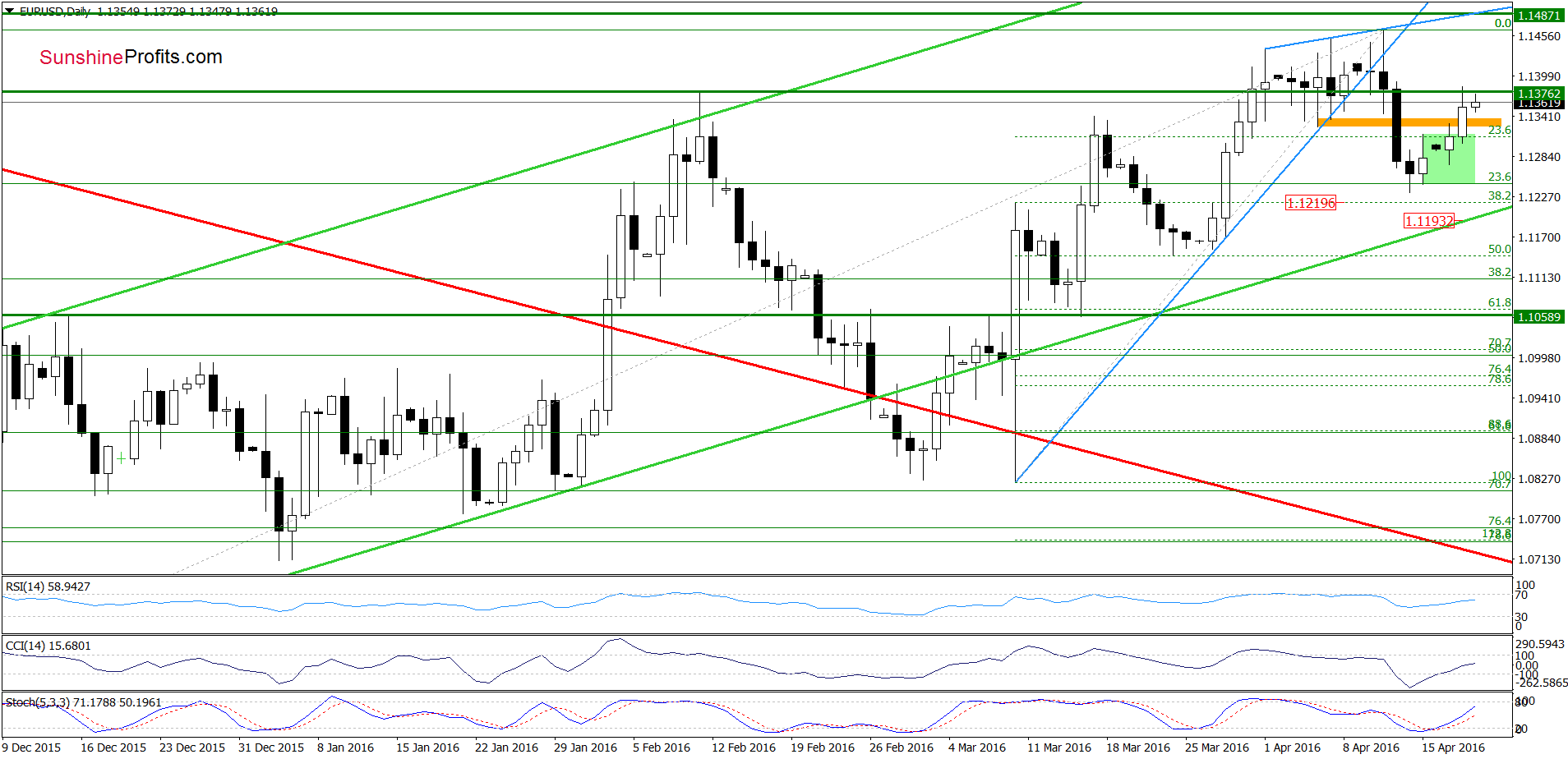

Looking at the above charts, we see that although EUR/USD increased above the Feb high yesterday, currency bulls didn’t manage to push the pair higher, which resulted in a pullback after our alert was posted. In this way, the exchange rate invalidated earlier small climb, which pushed the pair lower earlier today. Despite this move buy signals generated by the daily indicators remain in place, suggesting another attempt to move higher and even a test of recent highs (especially if the pair closes the day above the Feb high). Nevertheless, as long as EUR/USD remains under the orange zone marked on the weekly chart, further declines are just a matter of time – especially when we factor in sell signals generated by the weekly indicators.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.1512 and the initial downside target at 1.0572) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/JPY

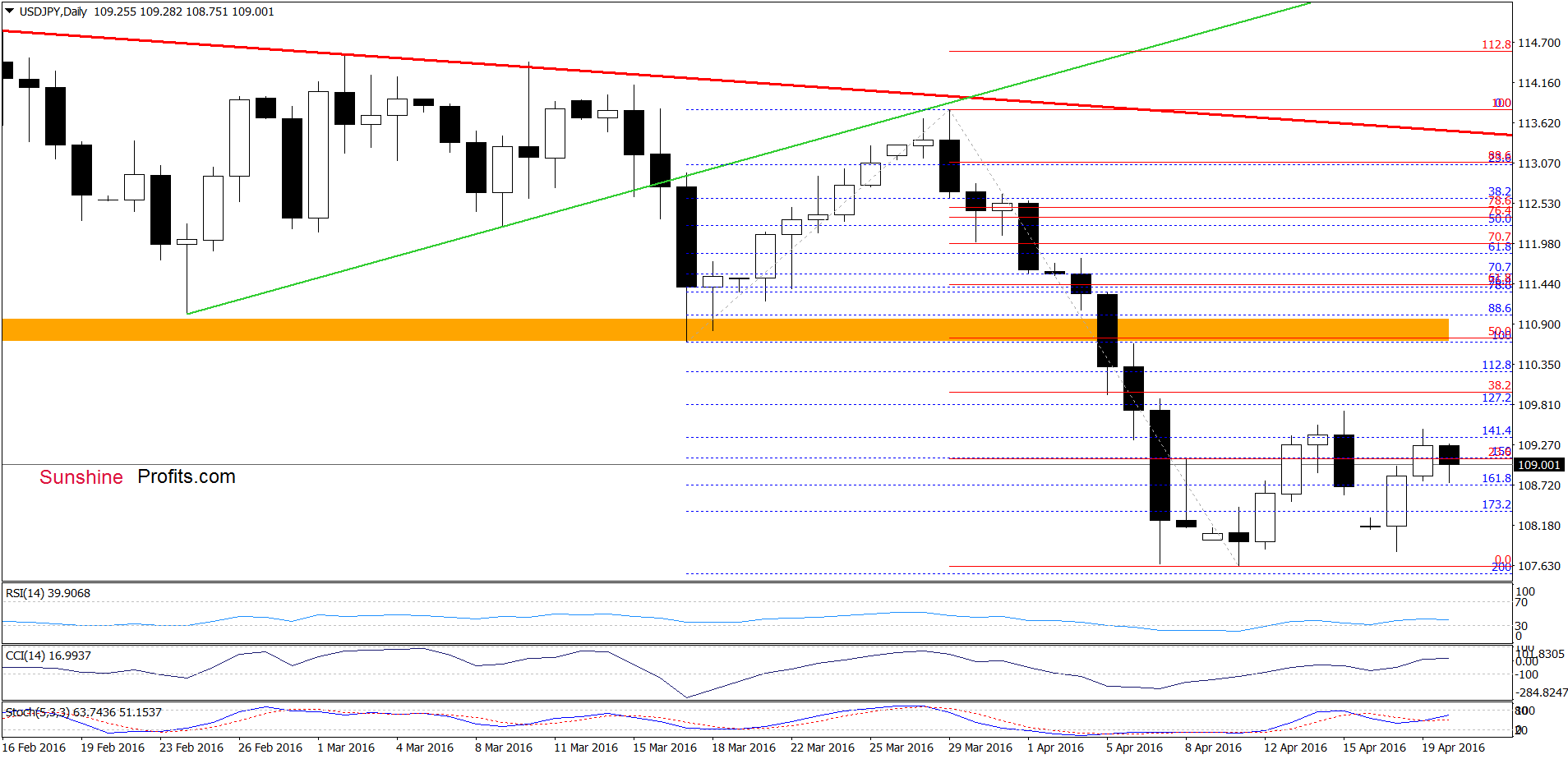

The situation in the medium term hasn’t changed much as USD/JPY is trading between last week’s high and the 70.7% Fibonacci retracement. Will the daily chart give us more clues about future moves? Let’s check.

From this perspective, we see that the proximity to the 200% Fibonacci extension encouraged currency bulls to act once again. As a result, USD/JPY rebounded in recent days, however, despite this move, the pair remains not only under the Friday’s high but also well below the 38.2% Fibonacci retracement (based on the late-March-Apr decline), which means that the size of an upward move is still too small (compared to the preceding decrease) to ay with conviction that the worst is already behind currency bulls. Therefore, in our opinion, another downswing and a re-test of the 200% Fibonacci extension is still likely.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

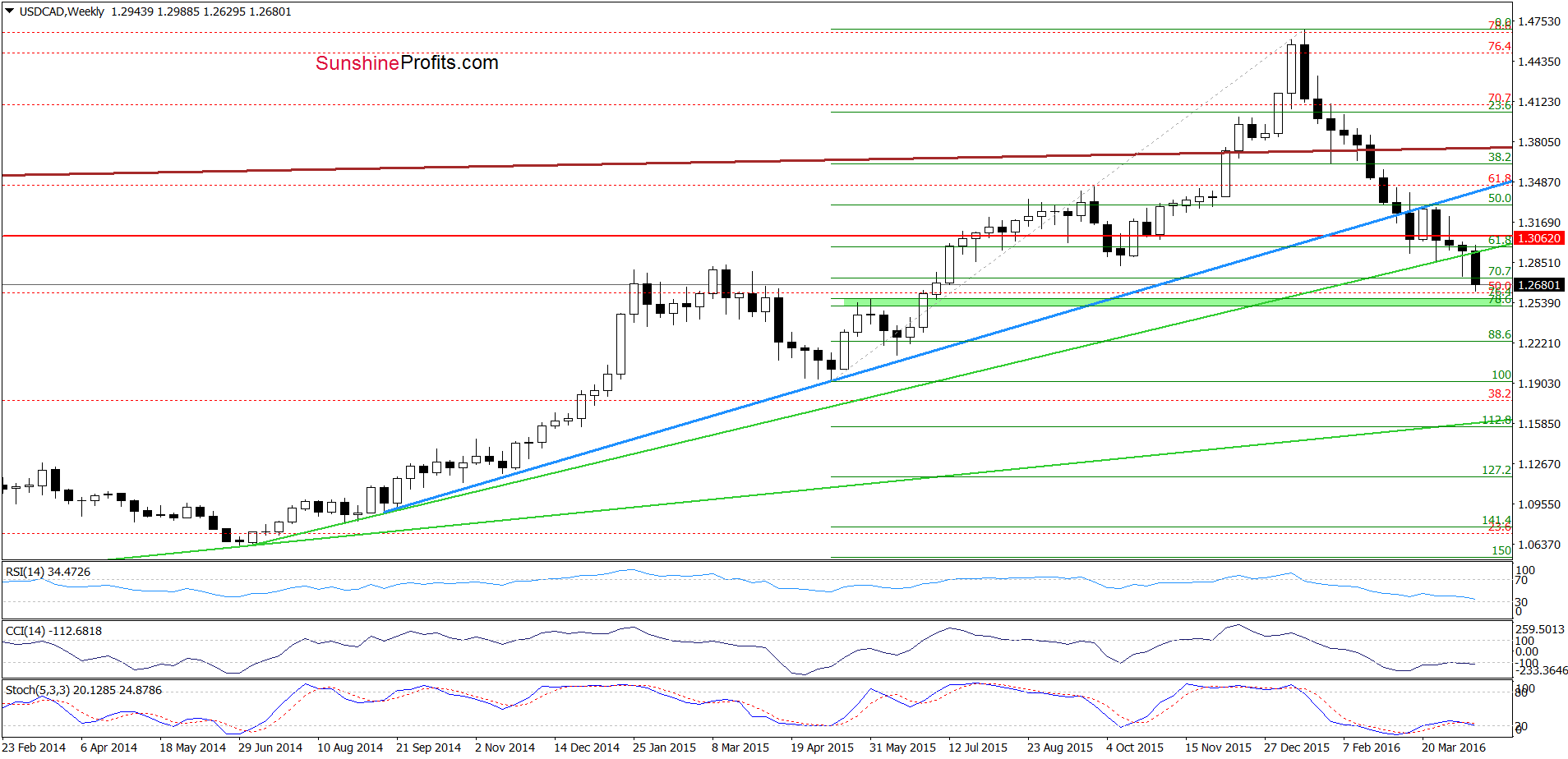

USD/CAD

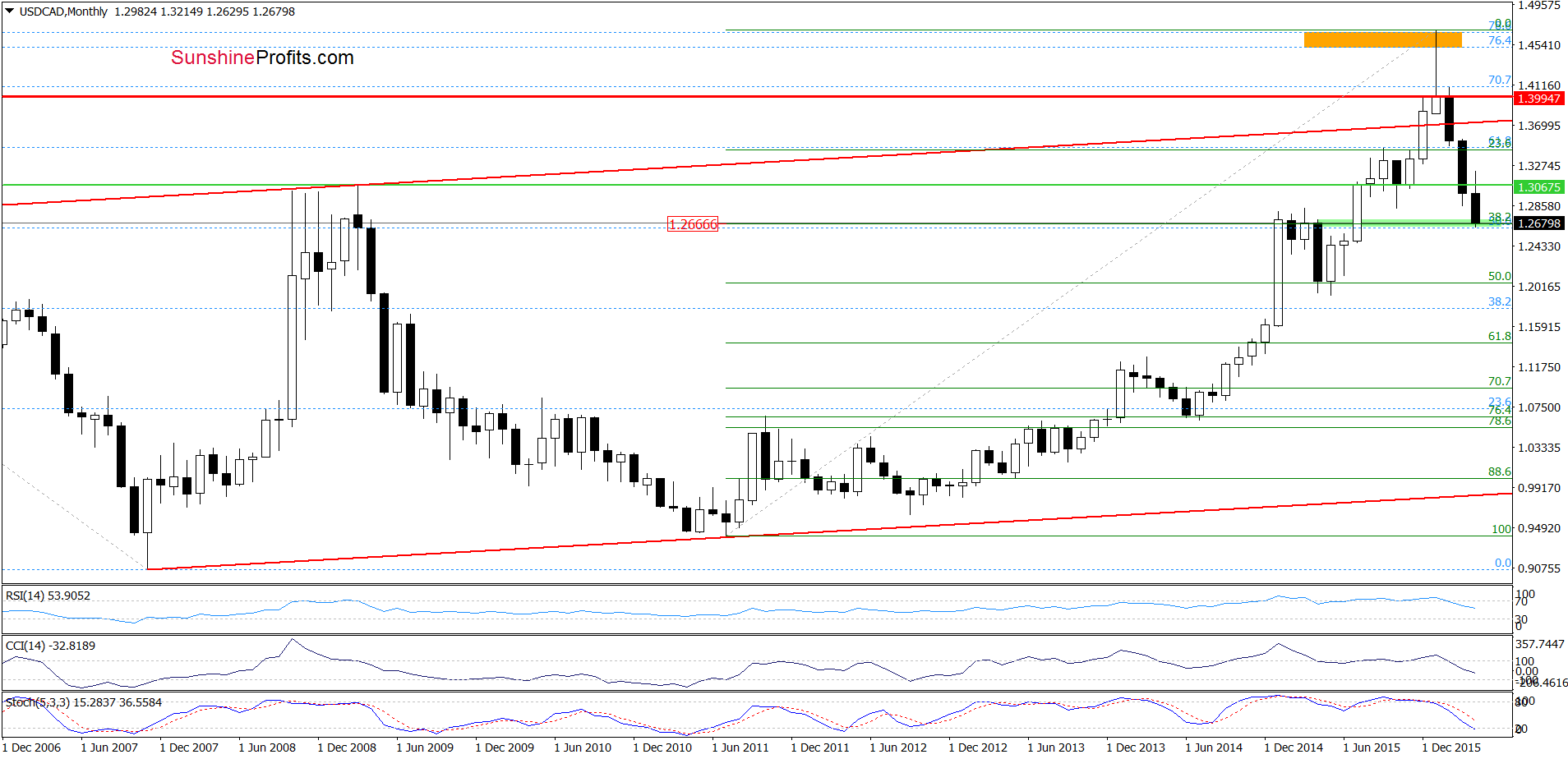

A week ago, we wrote the following:

(…) USD/CAD (…) declined under the long-term green support line, which resulted in a drop to the green support zone created by the Jan and March 2015 highs and reinforced by the 70.7% Fibonacci retracement (based on May-Jan rally). Taking this fact into account, we think that reversal is just around the corner – even if the exchange rate moves lower once again and test the strength of the 38.2% Fibonacci retracement based on the entire Jul 2011-Jan 2016 upward move (around 1.2666) in the coming week.

From today’s point of view, we see that the situation developed in line with the above scenario and USD/CAD extended losses, slipping to our downside target - the 38.2% Fibonacci retracement. Taking this fact into account and the current picture of crude oil (we encourage you to read our oil essay posted on Monday), we still believe that reversal and higher values of the exchange rate are just around the corner.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts