Forex Trading Alert originally sent to subscribers on December 29, 2015, 8:20 AM.

Although trading volumes remain thin after Christmas and ahead of the New Year, GBP/USD broke below very important support line. What does it mean for the exchange rate?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (stop-loss order at 1.1363; initial downside target at 1.0462)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

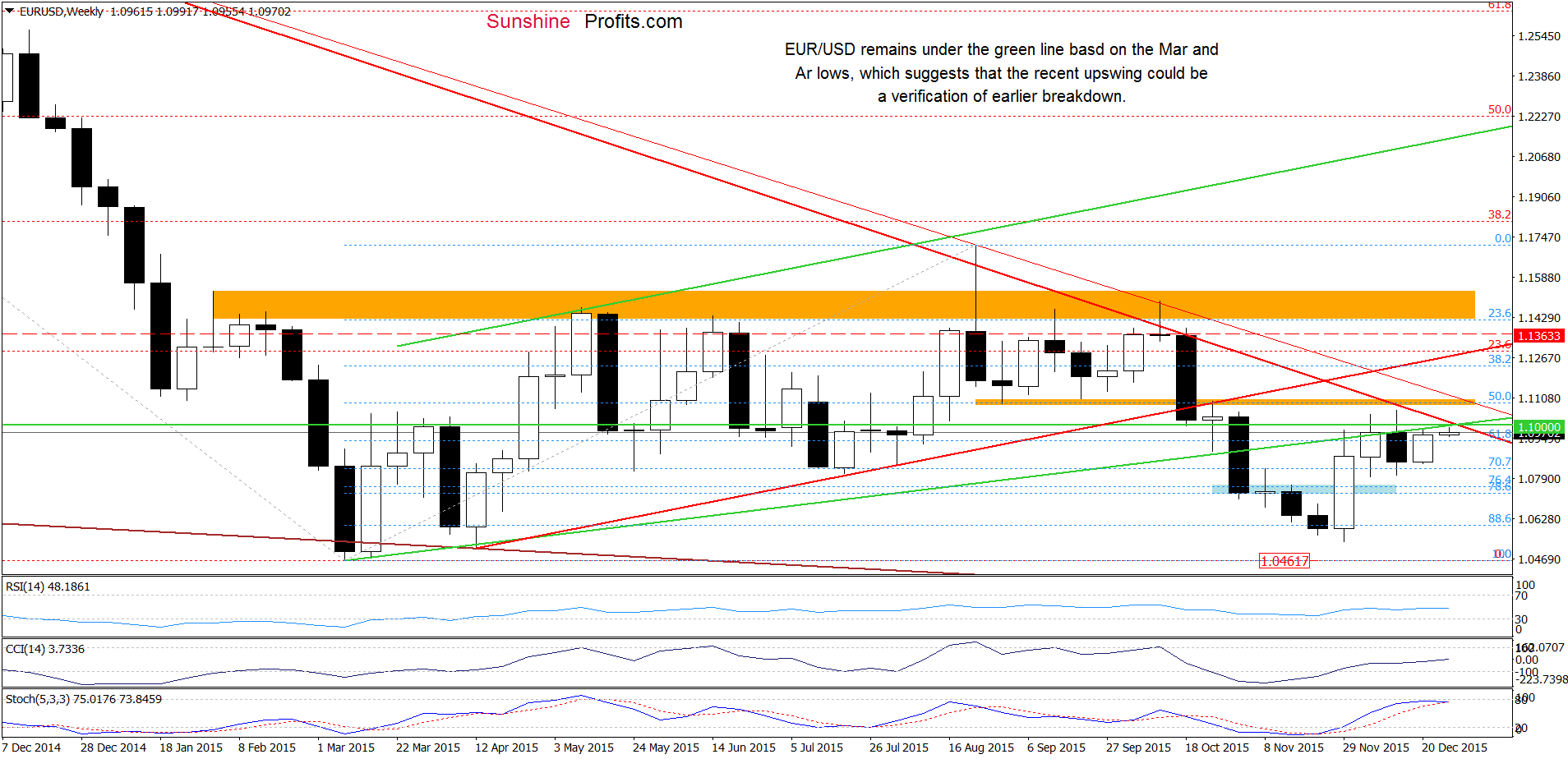

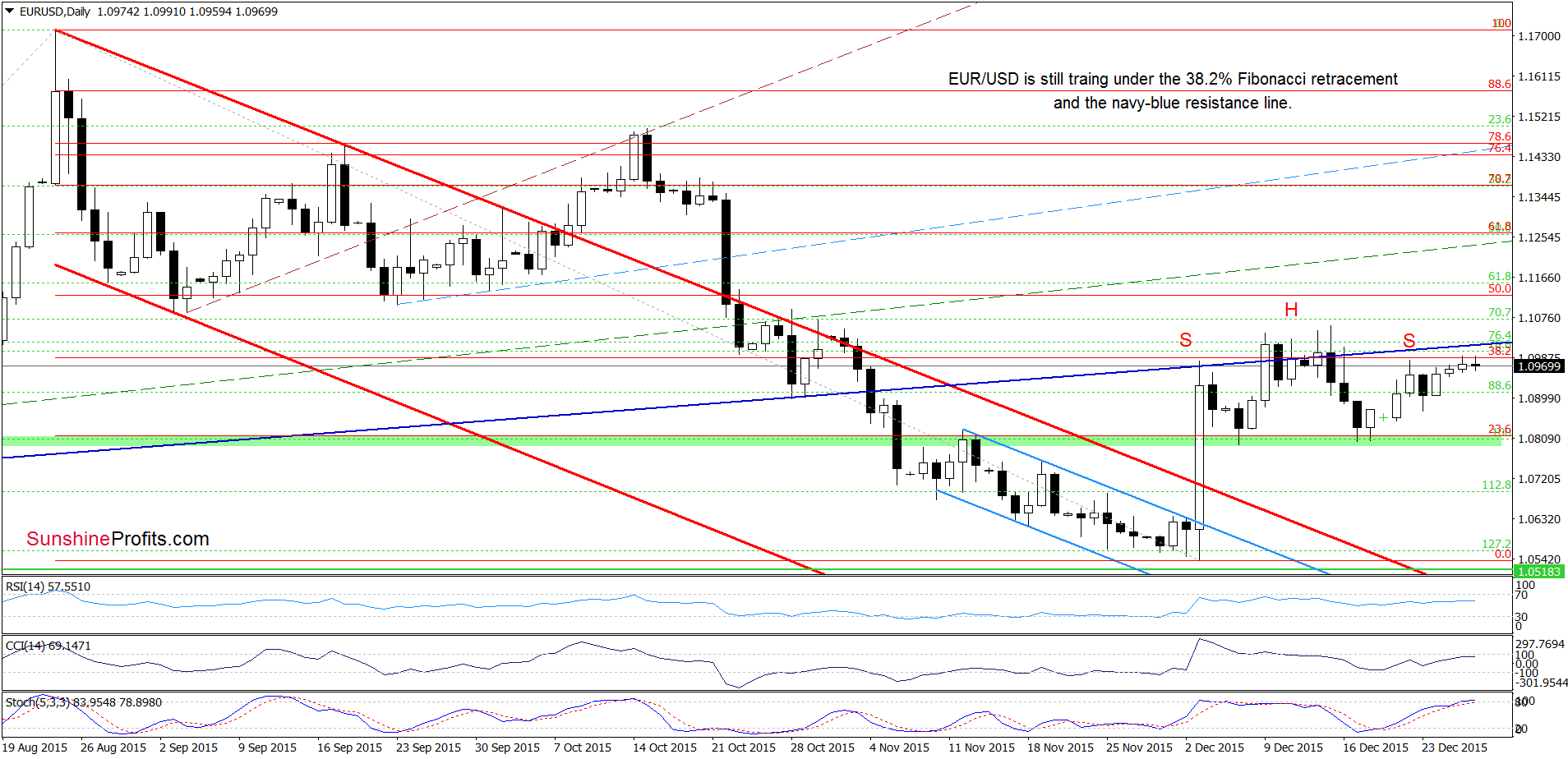

EUR/USD

Looking at the charts, we see that EUR/USD is still trading under the key short-term resistance area created by the combination of the 38.2% Fibonacci retracement and the navy blue resistance line, which means that hat we wrote yesterday is up-to-date:

(…) In previous weeks, it was strong enough to stop further rally, which suggests that we may see a similar price action in near future. Therefore, in our opinion, as long as there is no breakout above this zone, further increases are doubtful. At this point, it is also worth noting that the current position of daily indicators suggests a reversal and lower values of the exchange rate in the coming days.

(…) the combination of the previously-broken green resistance line, the barrier of 1.1000 and the orange resistance zone continues to keep gains in check. Additionally, the pair reached long-term red declining resistance line, which has successfully stopped currency bulls several times in the past. Taking all the above into account, and the position of the weekly Stochastic Oscillator (it is very close to generating a sell signal), we believe that reversal and declines from here are just around the corner.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.1363 and the initial downside target at 1.0462) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

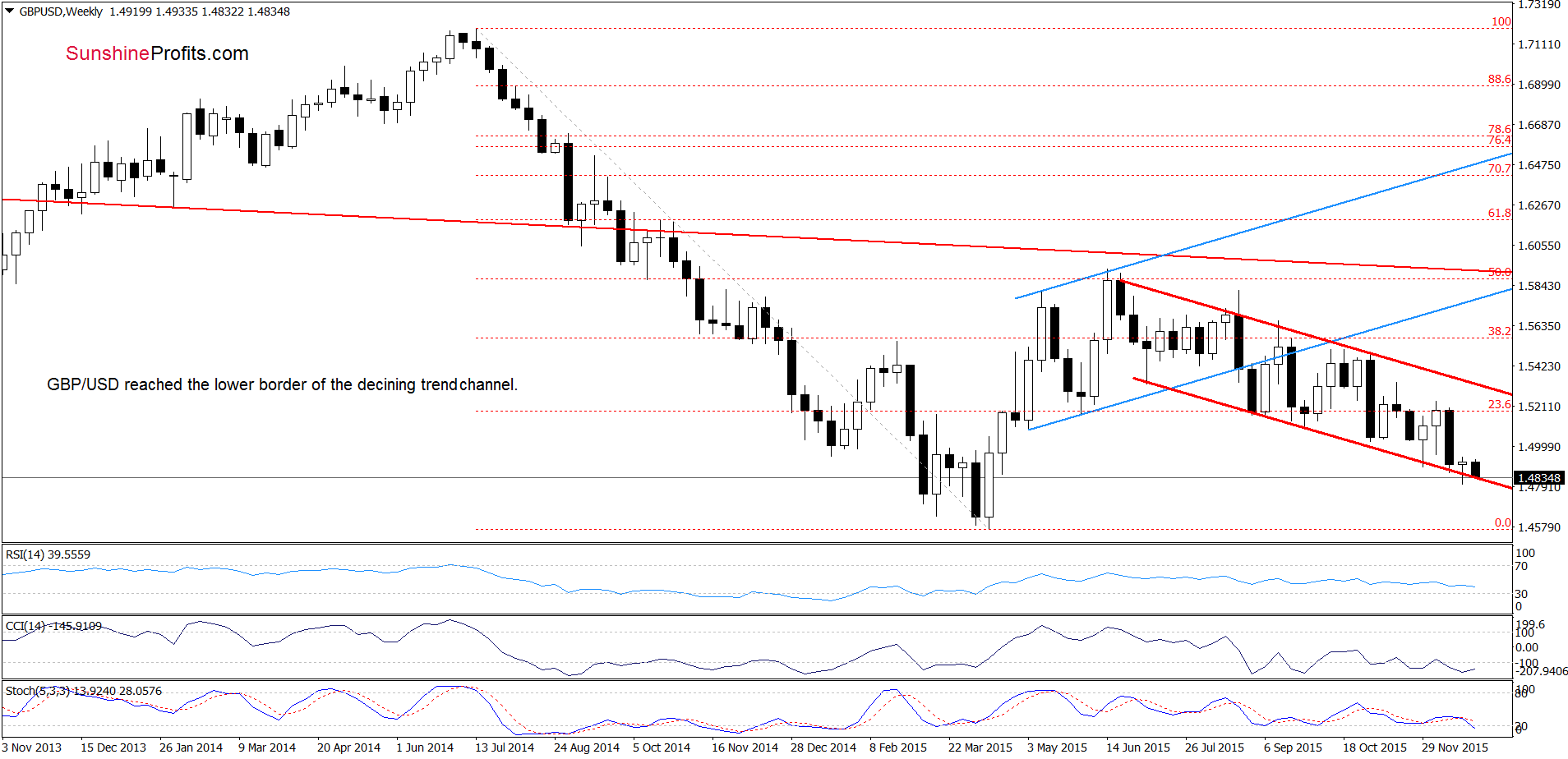

GBP/USD

On the above charts, we see that although GBP/USD broke below the medium-term brown support line, currency bulls pushed the pair higher, which resulted in an invalidation of the breakdown. Despite this positive signal, the pair reversed and dropped under this important support line once again, which suggests a test of the blue support line based on the previous lows – especially when we factor in a sell signal generated by the daily Stochastic Oscillator. At this point, it is also worth noting that such price action will trigger a drop under the lower border of the red declining trend channel (marked on the weekly chart), which would be a bearish signal that could result in a decline even to the Apr low in the coming weeks.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

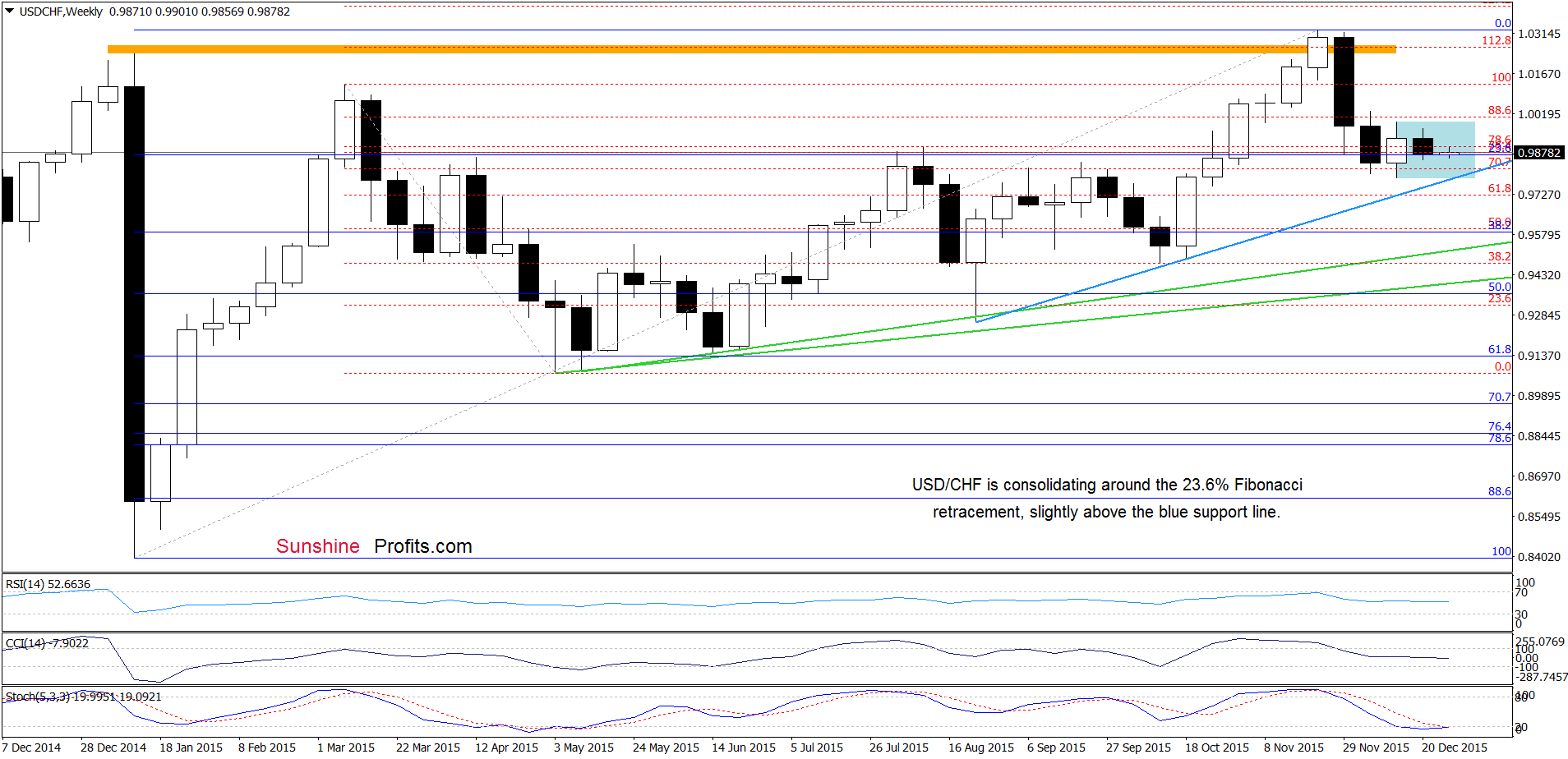

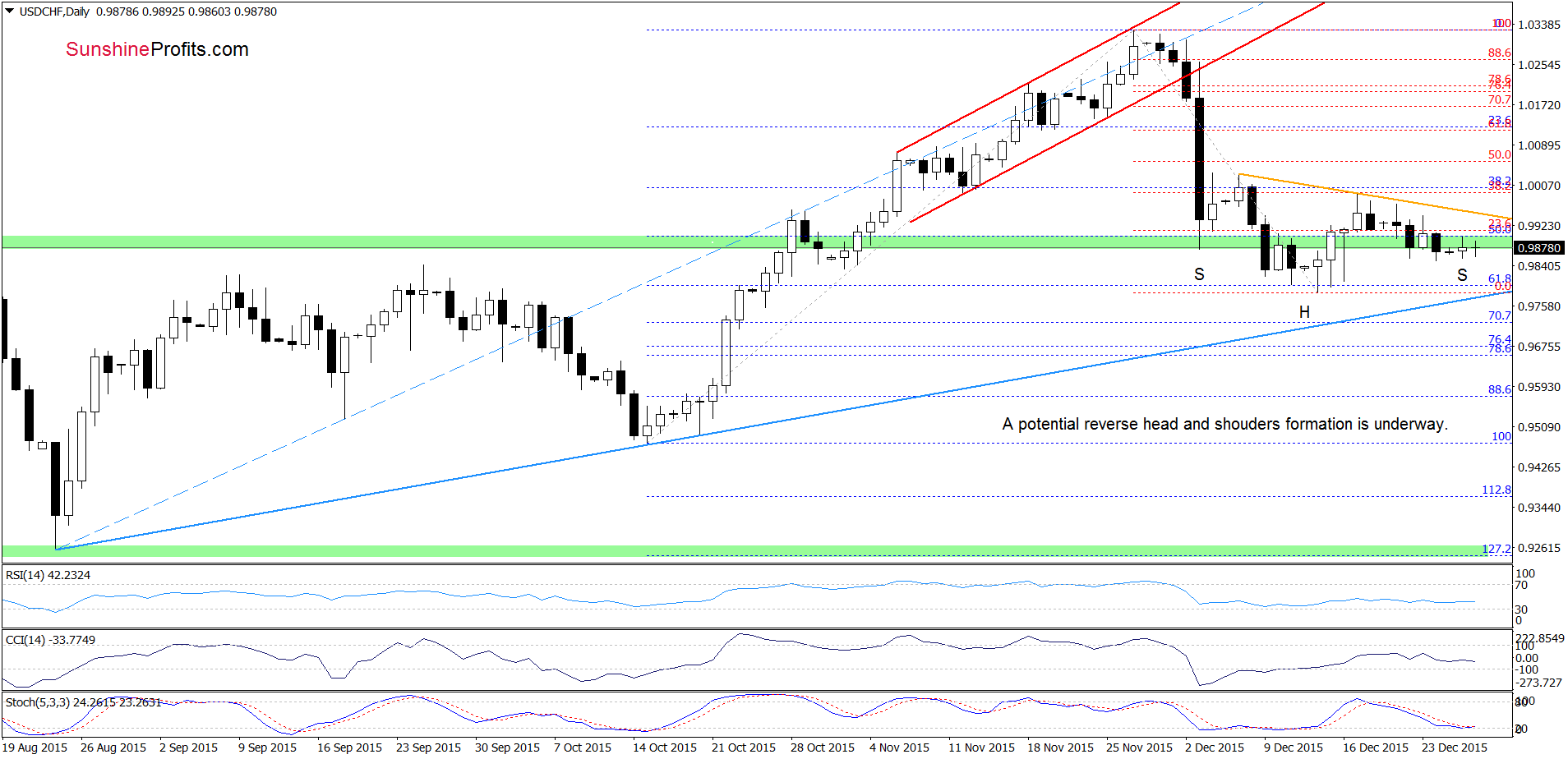

USD/CHF

On the above chart, we see that the situation in the medium term is a bit unclear as USD/CHF remains in a blue consolidation around the 23.6% Fibonacci retracement based on the entire May-Nov rally. Nevertheless, the current position of the Stochastic Oscillator (it is very close to generating a buy signal) suggests that higher values of the exchange rate are just around the corner.

Are there any other technical factors that could encourage currency bulls to act? Let’s examine the daily chart and find out.

The first thing that catches the eye on the daily chart is a potential reverse head and shoulders formation. Nevertheless, it would be more reliable if USD/CHF breaks above the orange resistance line (the neck line of the formation) based on the previous highs. Finishing today’s commentary on this currency pair, please note that the Stochastic Oscillator is very close to generating a buy signal, which could encourage currency bulls to act in the coming days.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective, however, if USD/CHF breaks above the neck line of the potential reverse head and shoulders formation, we’ll consider opening long positions. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts