Forex Trading Alert originally sent to subscribers on November 17, 2015, 5:39 AM.

Earlier today, the USD Index extended gains and hit a fresh Nov high of 99.78 as demand for the greenback continued to be supported by expectations that the Fed will hike interest rates in Dec. As a result, USD/CHF climbed to the March highs. Will we see a breakout and further rally in the coming days?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (stop-loss order at 1.1476; initial downside target around 1.0462)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

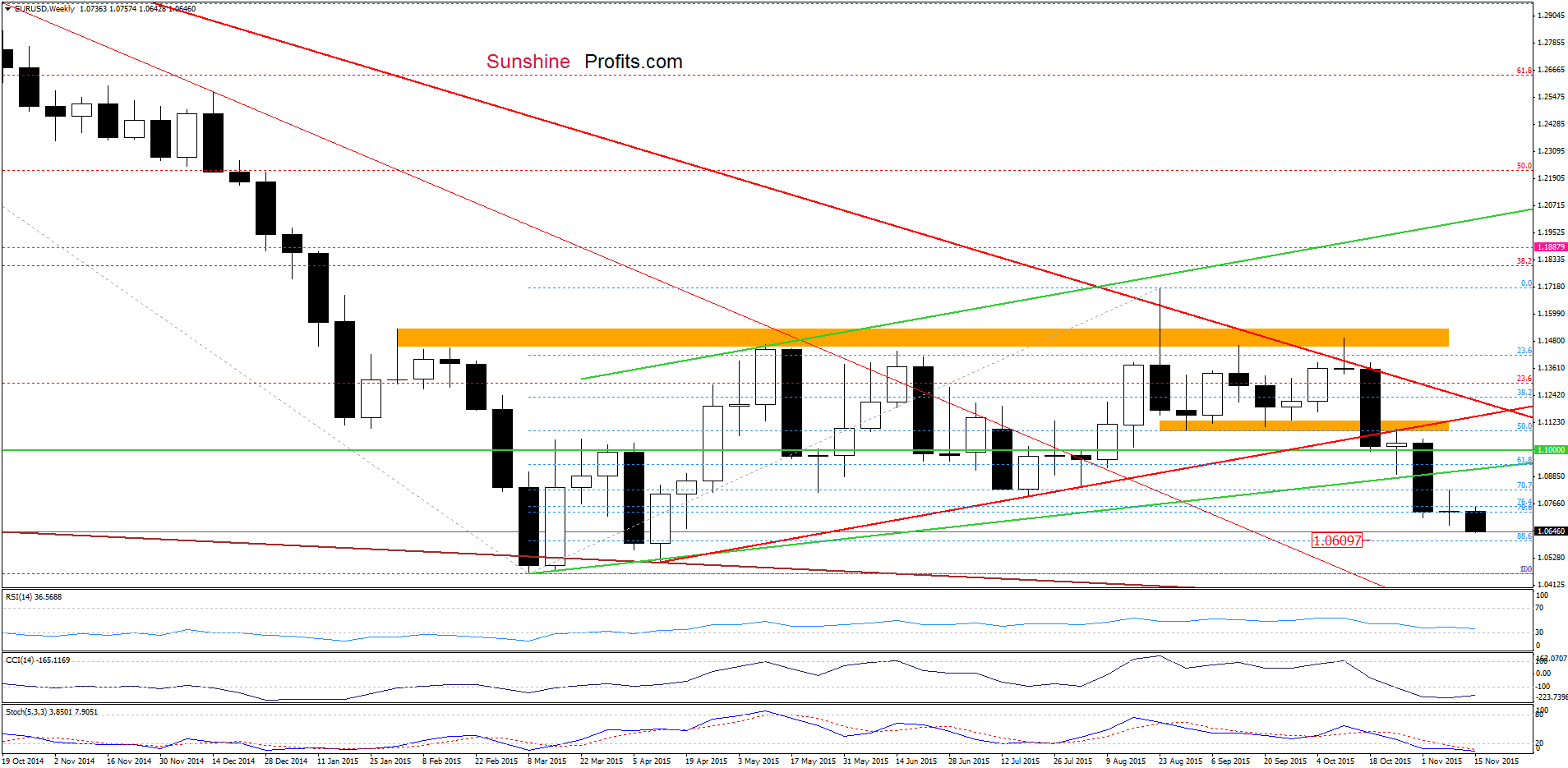

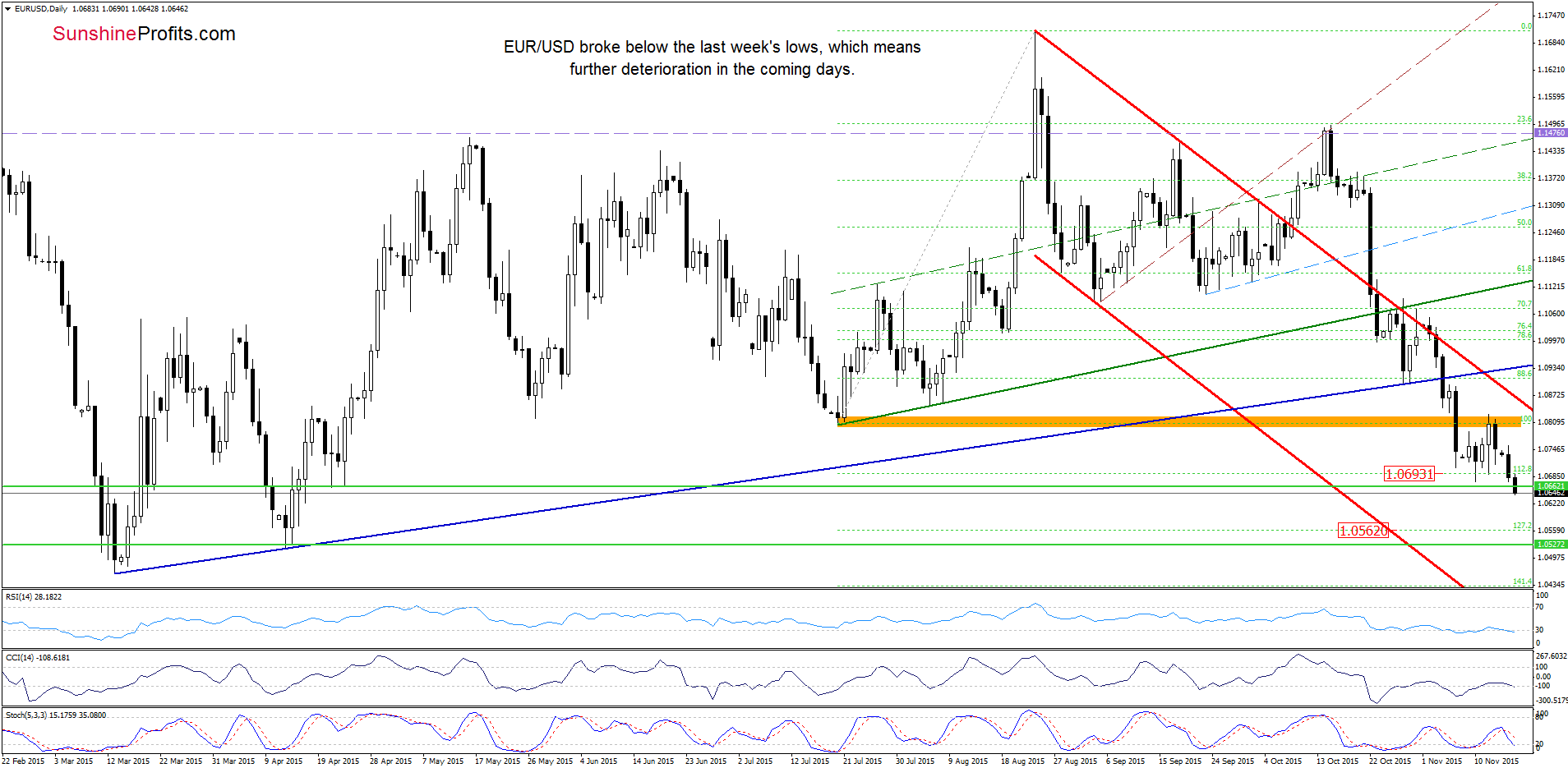

EUR/USD

Looking at the above charts, we see that EUR/USD broke below the last week’s lows, which suggests that currency bears will try to realize the scenario from our Friday’s alert:

(…) If (…) the pair extends losses, (…) we may see a decline to 1.0609, where the 88.6% Fibonacci retracement (marked on the weekly chart) is.

Please note that if this support is broken, the next downside target would be around 1.0562, where the 127.2% Fibonacci extension (based on the Jul-Aug rally) is.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (which are profitable) with a stop-loss order at 1.1476 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

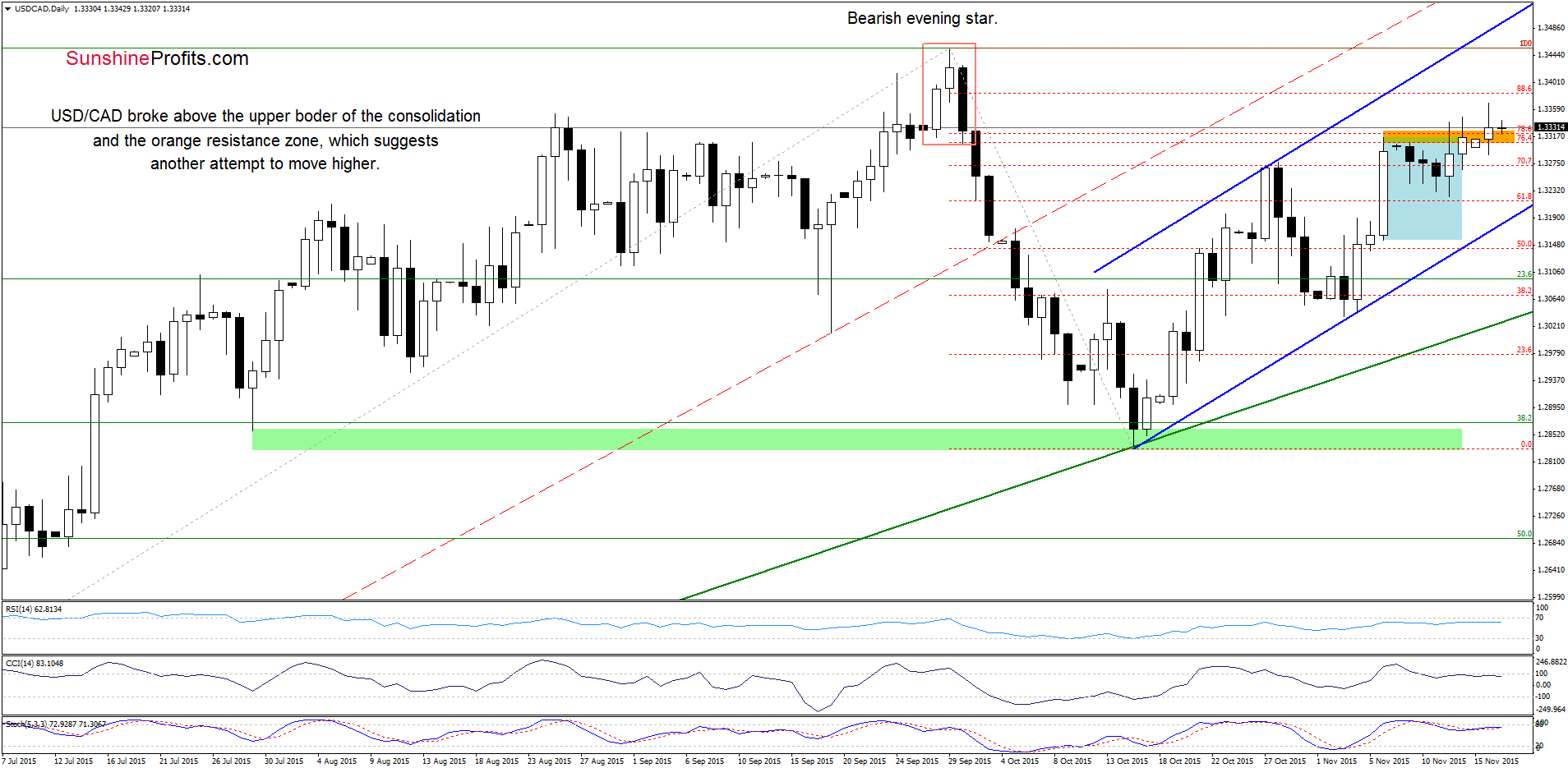

USD/CAD

Looking at the charts, we see that USD/CAD extended gains and broke above the upper border of the blue consolidation and the orange resistance zone (created by the 74.6% and 78.6% Fibonacci retracement levels). This is a positive signal, which suggests that we may see another attempt to move higher. In this case, the initial upside target would be the 88.6% retracement or even the Sept high. Nevertheless, the current position of the indicators suggests that reversal is just around the corner.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

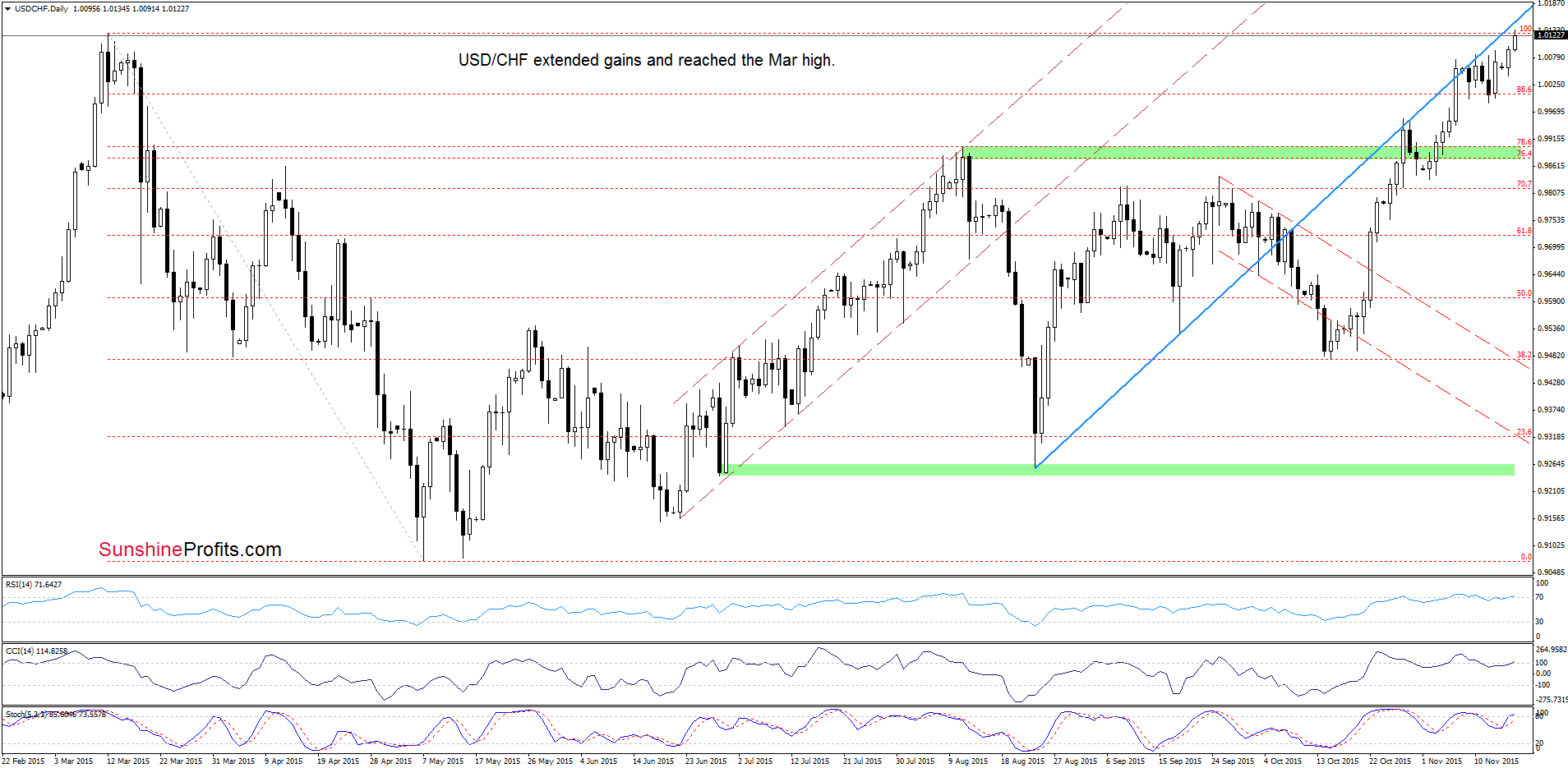

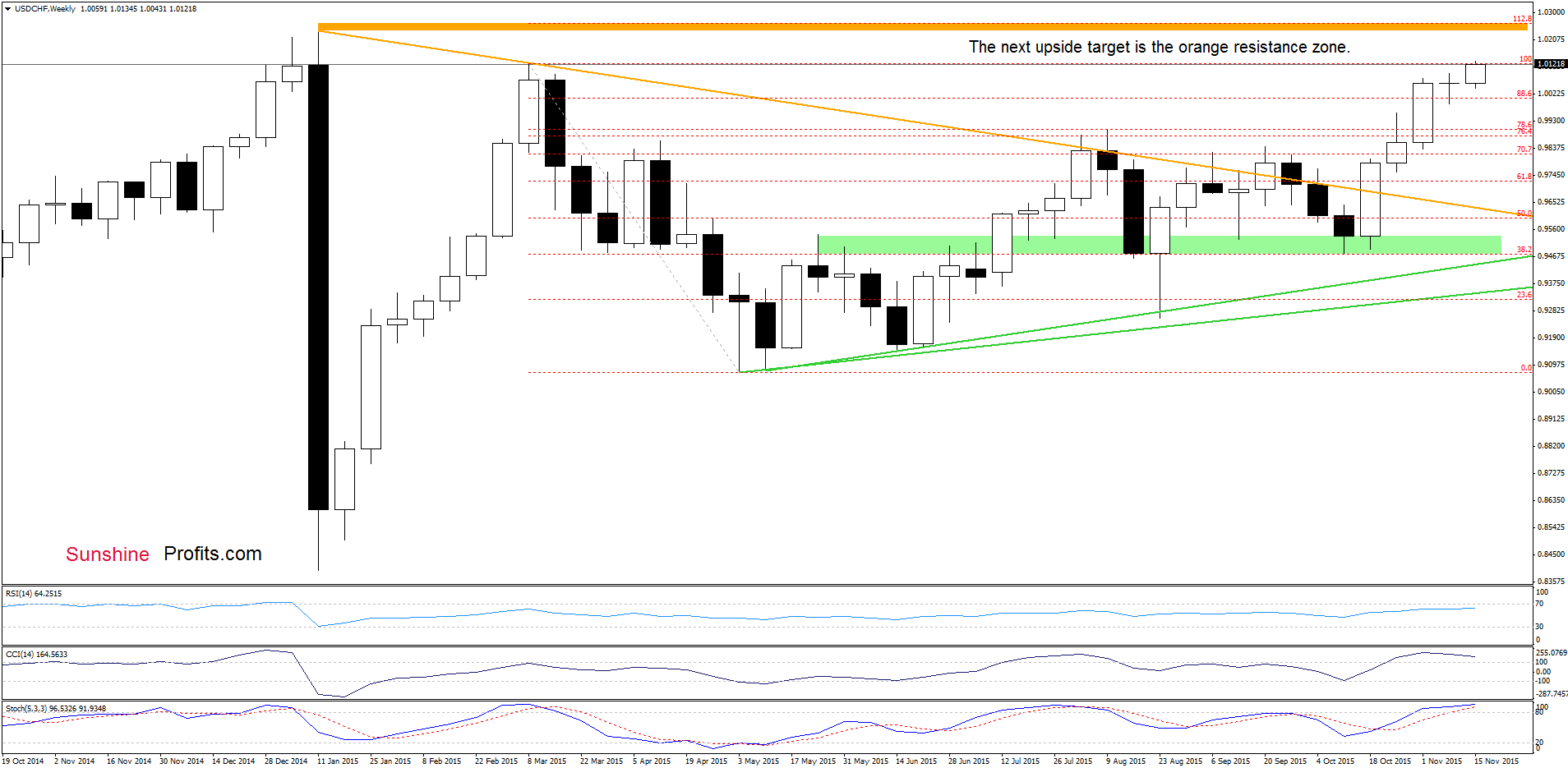

USD/CHF

As you see on the daily chart, USD/CHF extended gains and climbed to the Mar high. Additionally, in this area is also the blue resistance line, which continues to keep gains in check. Taking this fact into account, and combining it with the current levels of the indicators, it seems that reversal is just around the corner. Nevertheless, as long as there are no sell signals another attempt to move higher can’t be ruled out. However, in our opinion, further rally will be likely and reliable only if we see a successful breakout above the above-mentioned key resistance zone.

What could happen if currency bulls manage to break above it? Let’s take a closer look at the weekly hart and find out.

From this perspective, we see that the breakout above the Mar high will likely trigger a test of the orange resistance zone reated by the Jan high and the 112.8% Fibonacci extension.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts