Forex Trading Alert originally sent to subscribers on October 13, 2015, 5:16 AM.

In recent days, the USD Index has been trading around the level of 95, which resulted in the consolidation in GBP/USD. Will the proximity to important resistance levels encourage currency bears to act in the coming days?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1887; the downside target around 1.0938)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

EUR/USD

Looking at the daily chart, we see that the situation hasn’t changed much as EUR/USD is consolidating around the barrier of 1.400 and the 50% Fibonacci retracement. Although the pair could test the Sept high, the current position of the indicators (a negative divergence between the CCI and the exchange rate, the Stochastic Oscillator above the level of 80) suggests that reversal is just around the corner.

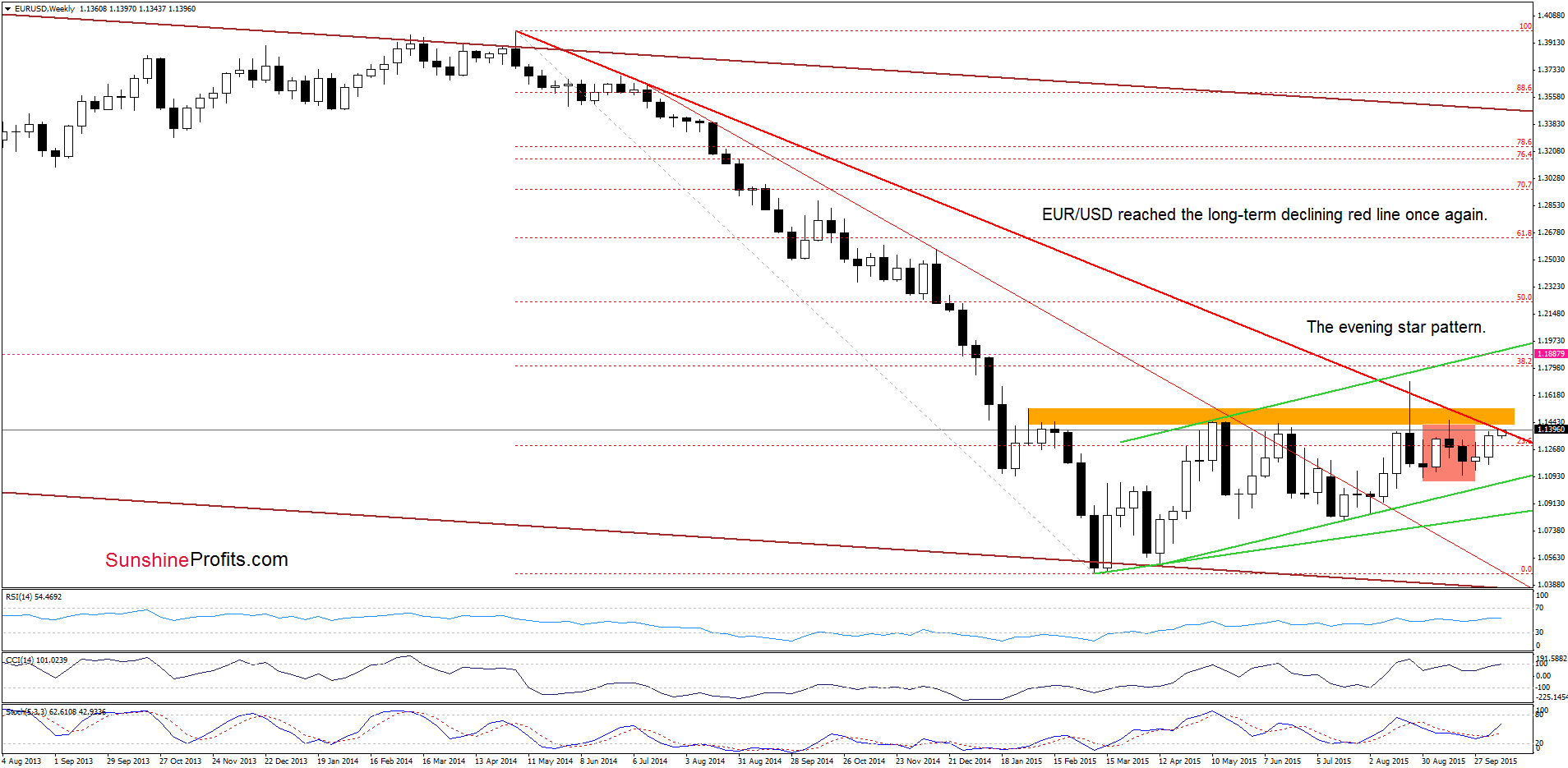

Are there any other factors that could encourage currency bears to act? Let’s examine the weekly chart and find out.

From this perspective we see that the exchange rate reached the long-term red declining resistance line and re-approached the orange resistance zone (reinforced by the bearish evening pattern). In previous weeks this area was strong enough to stop currency bulls and trigger a pullback, which suggests that we’ll likely see similar price action in the coming days.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1887 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

GBP/USD

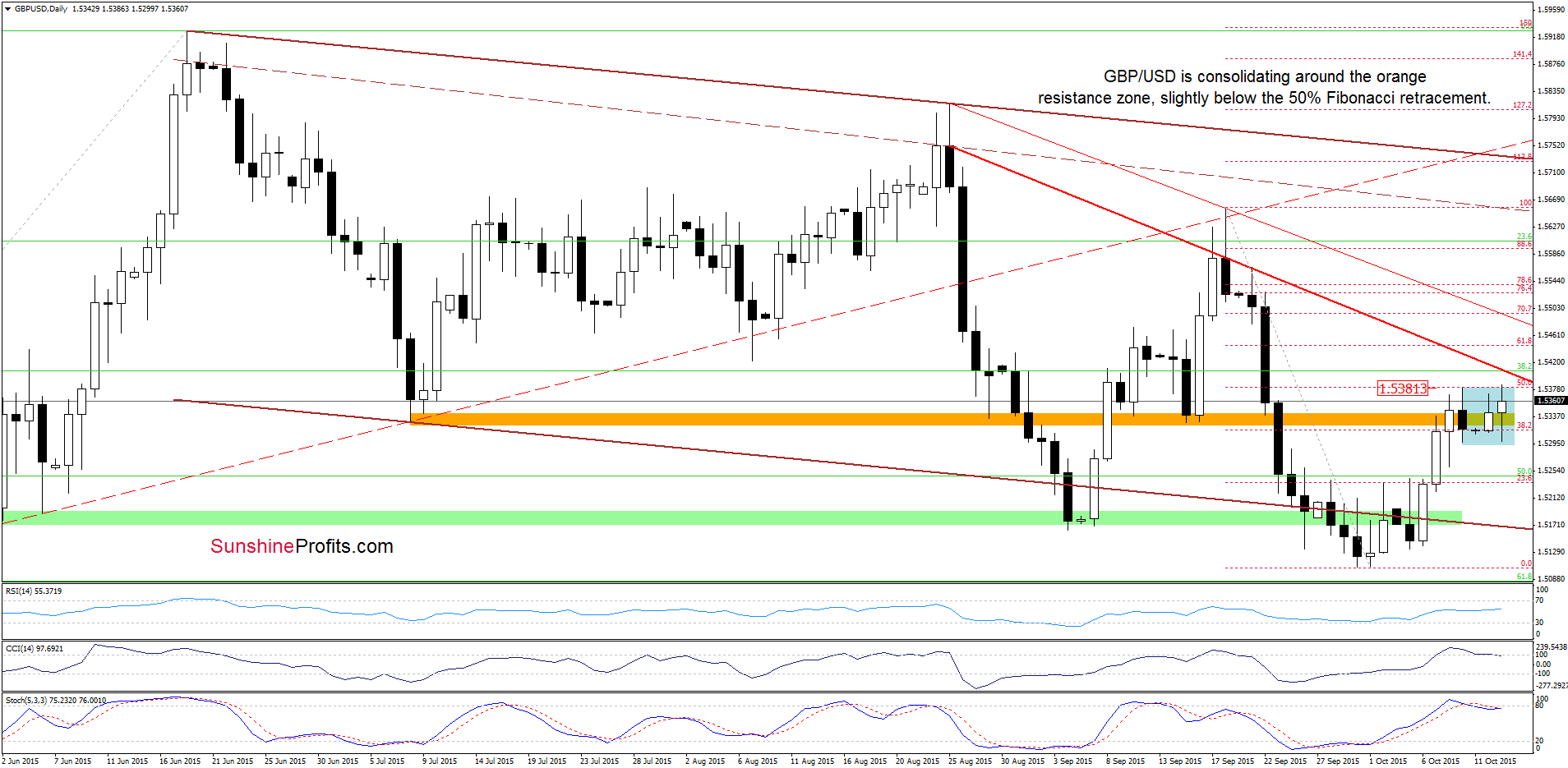

The situation in the medium term hasn’t changed much as GBP/USD remains in the red declining trend channel. Today, we’ll focus on the very short-term changes.

As you see on the daily chart, GBP/USD is consolidating in a narrow range around the orange support/resistance zone - slightly below the 50% Fibonacci retracement. Although the pair could go higher from here, we think that the short-term resistance red line (based on the Aug 25 and Sept 18 opening prices) in combination with the current position of the indicators (the CCI and Stochastic Oscillator generated sell signals), will be strong enough to stop currency bulls and trigger a downswing in the coming days. If we see such price action, the initial downside target would be around 1.5192, where the support line based on the previous lows currently is.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CAD

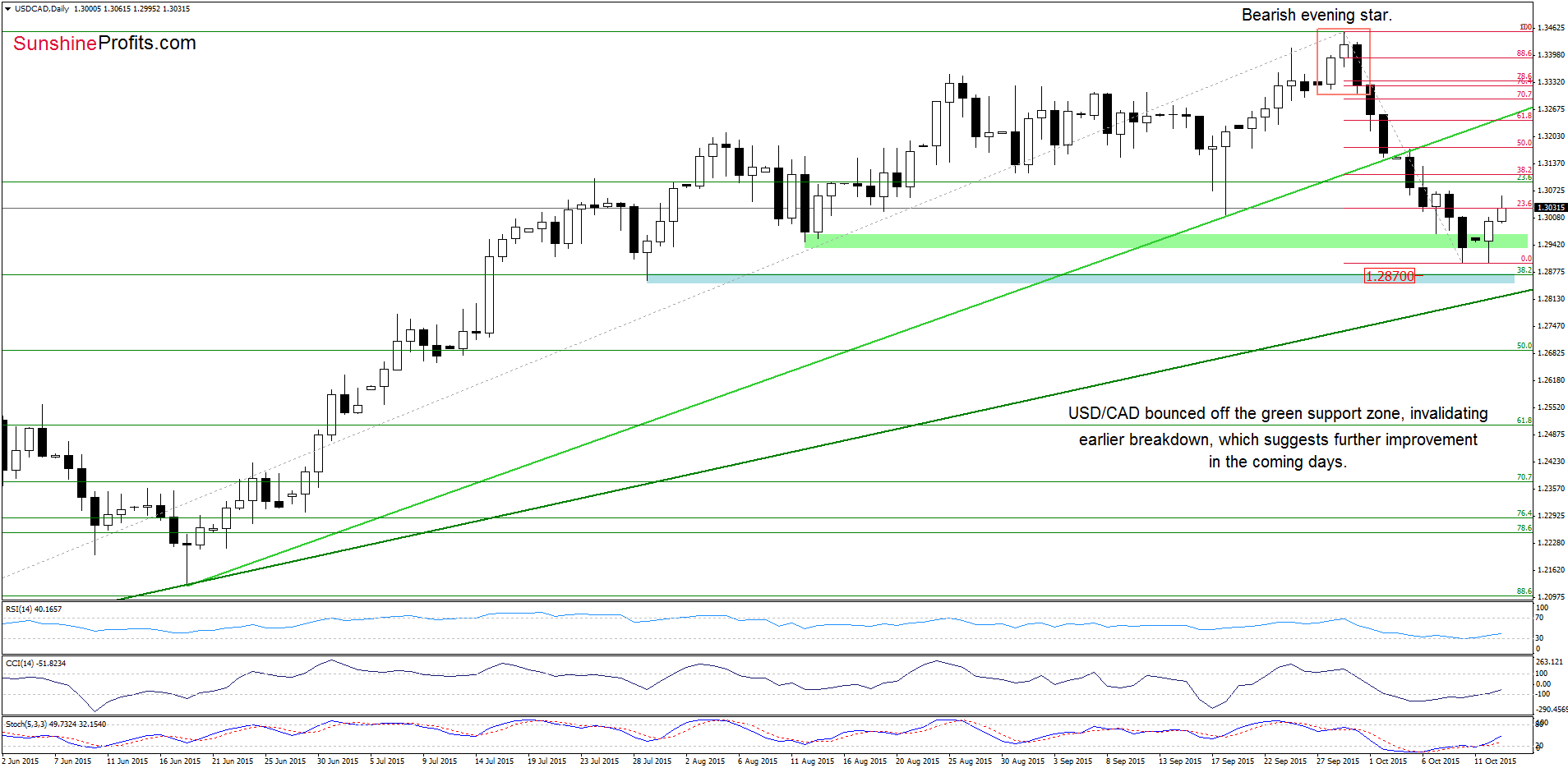

Looking at the daily chart, we see that the proximity to the 38.2% Fibonacci retracement encouraged currency bulls to act. As a result, USD/CAD bounced off the green support zone, invalidating earlier breakdown. Taking this positive fact into account, and combining it with buy signals generated by all 3 indicators, we think that further improvement is just around the corner.

But are there any factors that could hinder the realization of the pro-growth scenario? Let’s examine the weekly chart and find out.

From this perspective, we see that although USD/CAD increased, the pair remains under the previously-broken resistance level based on the 2009 high. Therefore, we think that further improvement will be more likely and reliable if we see an invalidation of the breakdown in the coming days. Until this time, another downswing can’t be ruled out (especially when we factor in sell signals generated by the weekly indicators).

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts