Forex Trading Alert originally sent to subscribers on February 10, 2015, 10:51 AM.

Earlier today, the USD Index moved higher once again as concerns over the current situation in Greece continued to weigh on the euro. As a result, EUR/USD approached yesterday’s low, but then rebounded. Where the pair head next?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: long (stop loss order at 1.1056)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: short (stop loss order at 1.2676)

- USD/CHF: none

- AUD/USD: none

EUR/USD

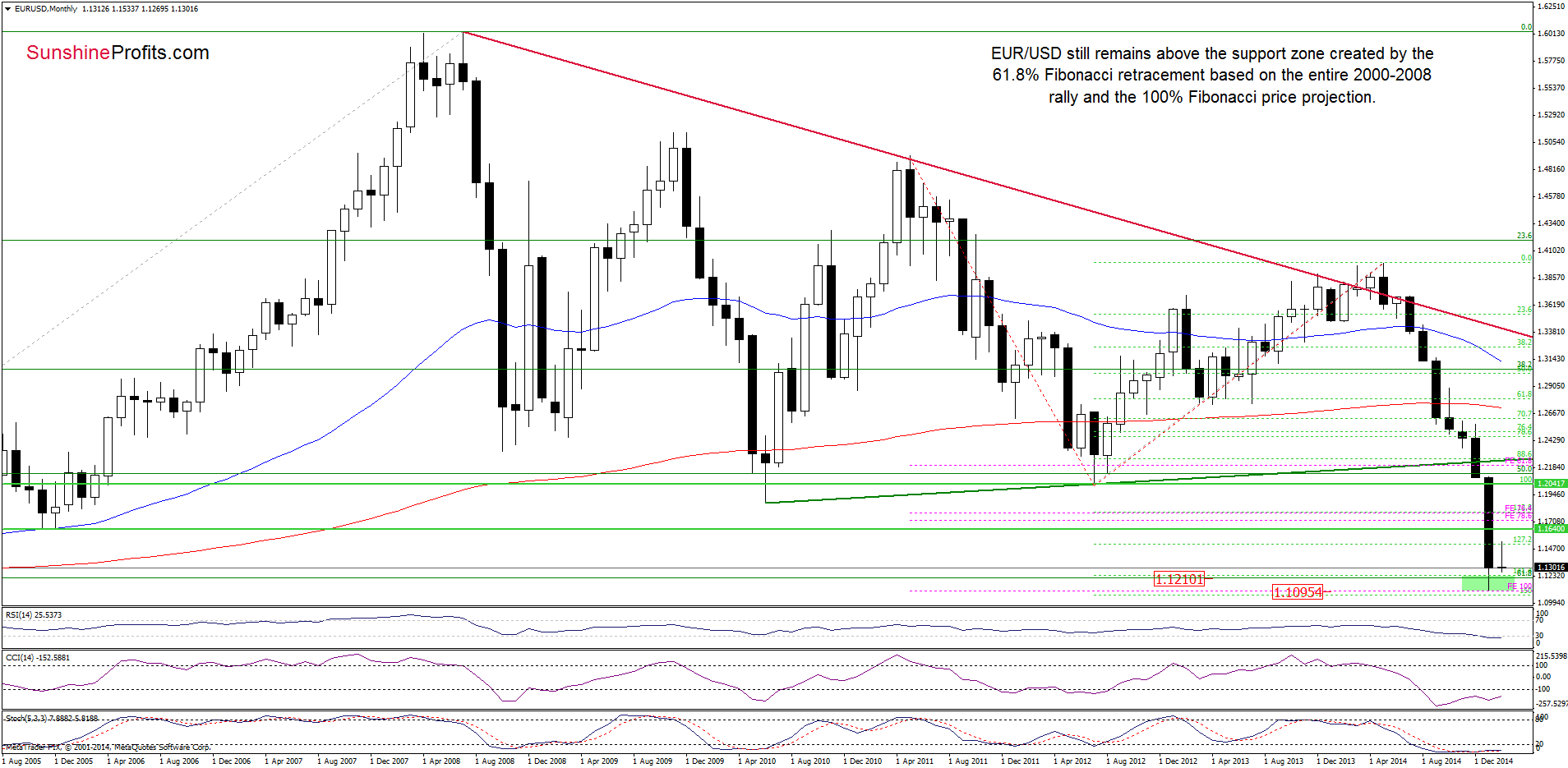

The medium-term picture hasn’t changed much as and invalidation of the breakdown below the 61.8% Fibonacci retracement and its potential positive impact on the exchange rate are still in effect. Having said that, let’s focus on the daily chart.

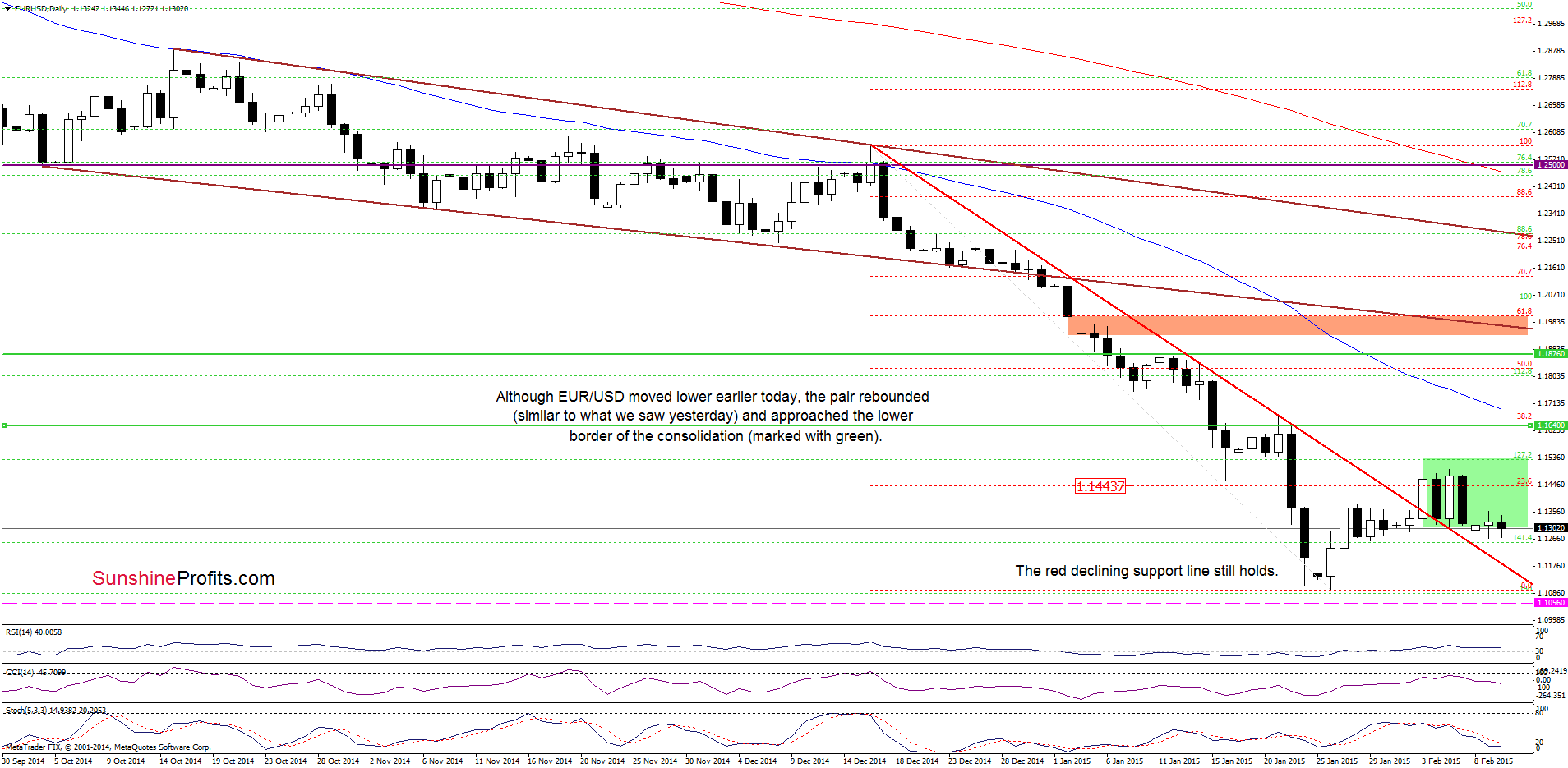

Looking at the above chart, we see that although EUR/USD declined slightly earlier today, the pair rebounded, approaching the lower border of the consolidation. We saw similar price action yesterday, which suggests that as long as the red declining support line is in play another attempt to invalidate the breakdown below the lower line of the formation is more likely than not. Taking this fact into account, we think that higher values of the exchange rate are still ahead us.

Very short-term outlook: bullish

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): Long positions with a stop loss order at 1.1056 are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/JPY

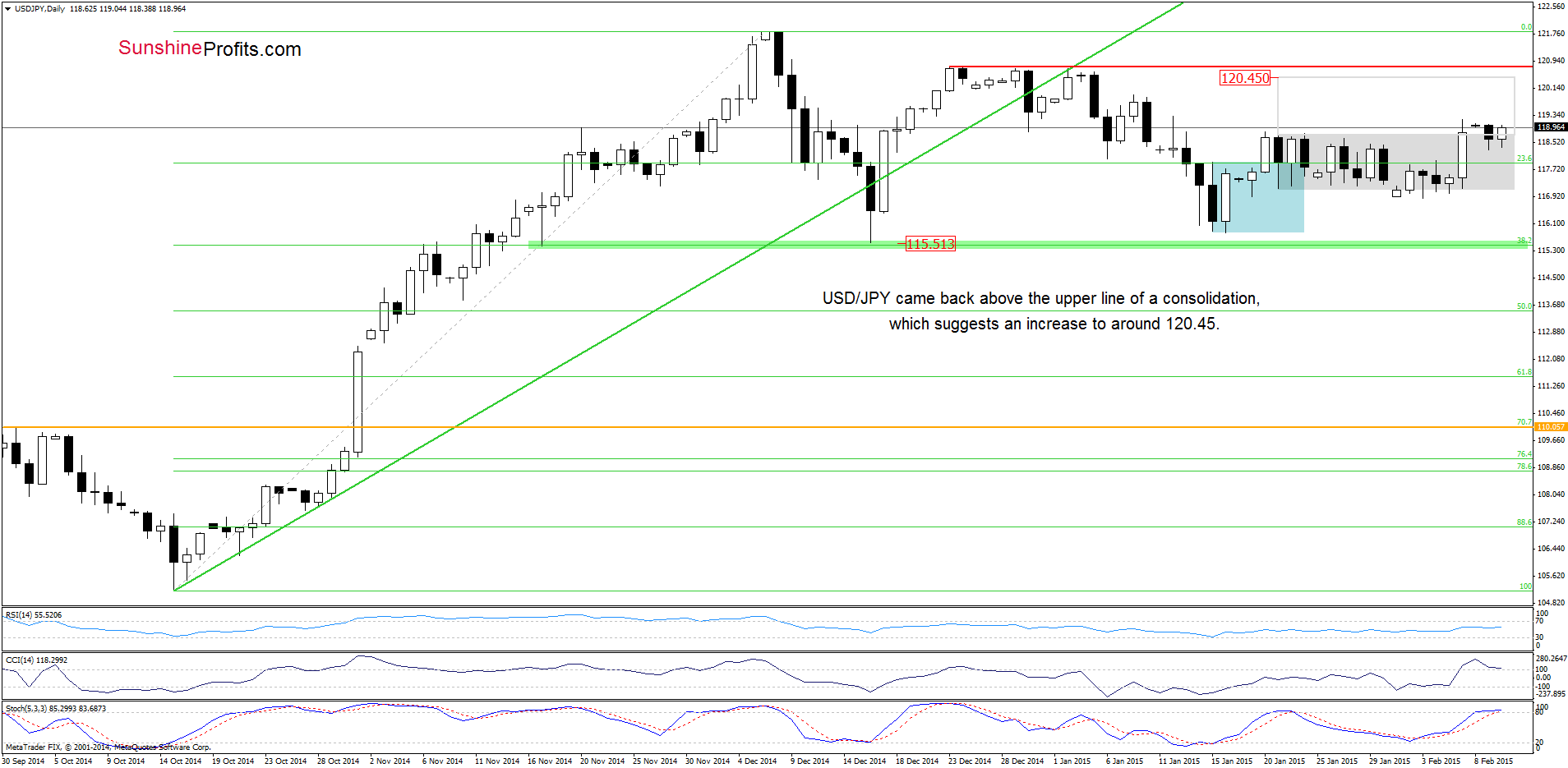

The situation in the medium-term hasn’t changed much as USD/JPY is still trading between the Dec high and low, under the 61.8% Fibonacci retracement. Today, we take a closer look at the short-term changes.

From this perspective, we see that although USD/JPY moved little lower yesterday, the pair reversed and climbed above the upper line of the consolidation (marked with grey) once again. Therefore, what we wrote on Friday is up-to-date:

(…) This is a positive sign, which suggests further improvement and an increase to around 120.45, where the size of the upswing will corresponds to the height of the formation.

Very short-term outlook: bullish

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

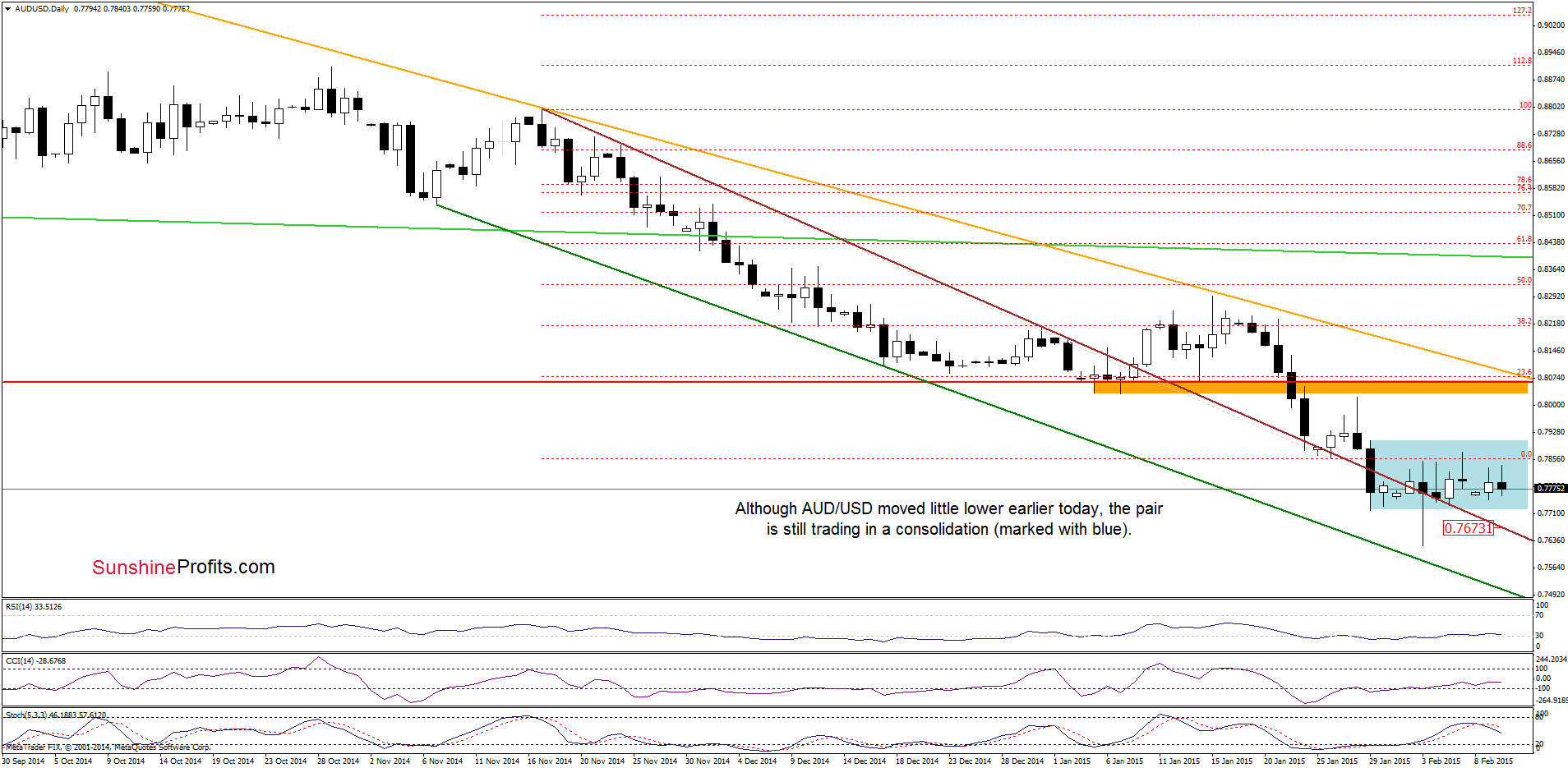

As you see on the weekly chart, an invalidation of the breakdown below the Jul 2009 lows and its potential positive impact on future moves is still in effect.

Having said that, let’s take a closer look at the daily chart.

As you see on the above chart, the situation in the very short-term hasn’t changed much as AUD/USD is still trading in the consolidation. Therefore, we should consider two scenarios. On one hand, if currency bulls manage to push the pair higher and break above the Jan 29 high of 0.7905 we’ll likely see further rally and an increase to the orange resistance zone. On the other hand, if the exchange rate moves lower from here, AUD/USD will test the strength of the brown support line (currently around 0.7673) once again. Which scenario is more likely? Taking into account sell signal generated by the Stochastic Oscillator, it seems to us that we’ll see lower values of the exchange rate in the near future.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts