Forex Trading Alert originally sent to subscribers on July 29, 2014, 1:40 PM.

Earlier today, the Conference Board showed that its index of consumer confidence increased to 90.9 in the previous month and it was the highest reading since October 2007. As a result, EUR/USD extended losses and dropped to its lowest level since November. Will currency bears push the pair below 1.3400?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (stop-loss order: 1.3550)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

EUR/USD

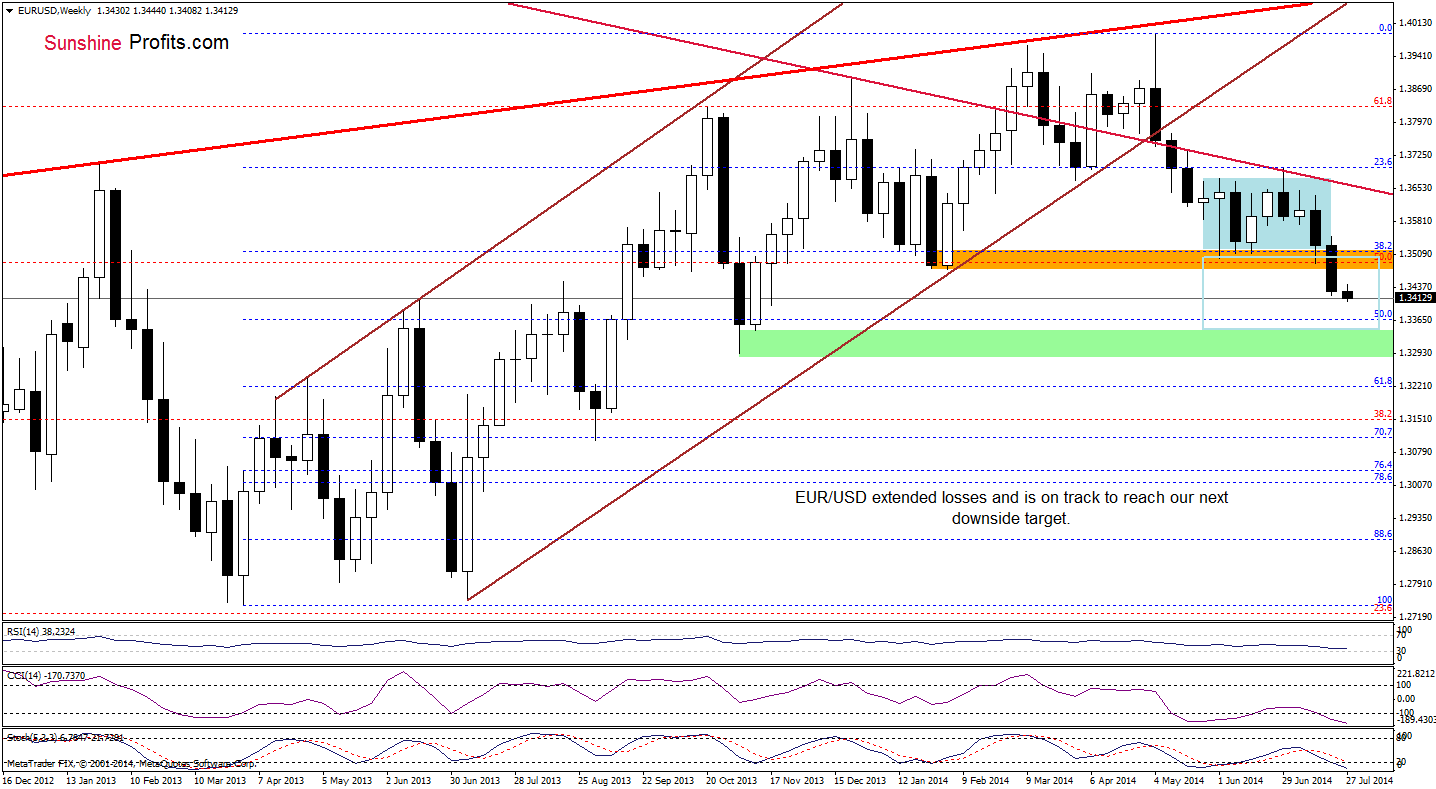

The situation in the medium-term has deteriorated as EUR/USD extended losses and hit a fresh 2014 low, which means that what we wrote last Wednesday is still up-to-date:

(…) we may see a drop even to around 1.3320, where the size of the downswing will correspond to the height of the consolidation.

Please keep in mind that before currency bears will be able to realize the above-mentioned scenario, they will have to break below the 50% Fibonacci retracement level (around 1.3367), which serves as the nearest medium-term support at the moment.

Having say that, let’s check where the short-term support levels are.

Quoting our Forex Trading Alert posted on Friday:

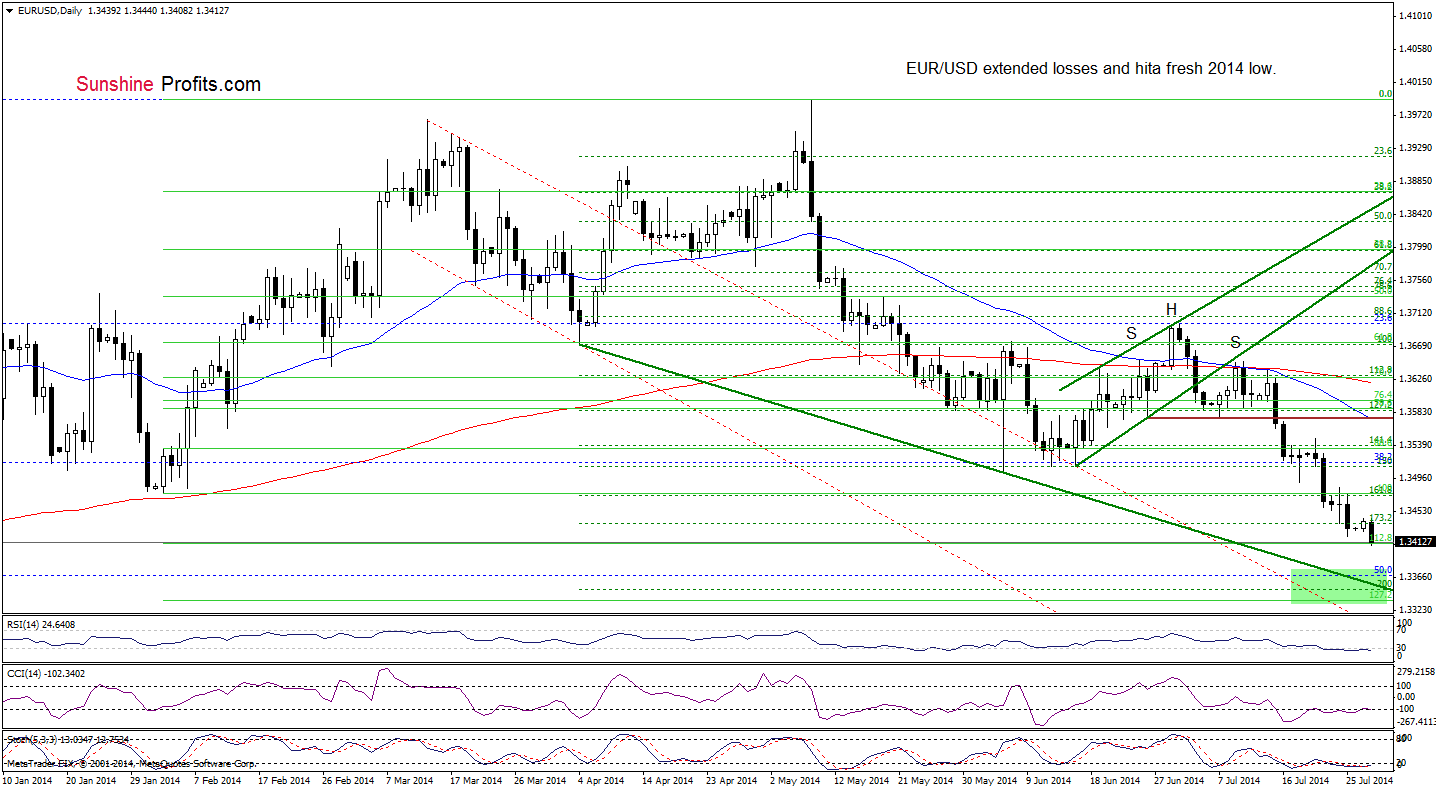

(…) as long as there are no buy signals and EUR/USD remains below the recent lows, another move lower is more likely than not. If this is the case, (..) the pair will likely drop to 1.3411, where the 112.8% Fibonacci extension (based on the entire Feb-May rally) is.

Looking at the above chart, we see that the exchange rate moved lower and reached our downside target earlier today. Taking this fact into account, we believe that what we wrote on Friday is up-to-date:

(…) If it holds, we’ll see a rebound to the February lows, but if it’s broken, the pair will drop to around 1.3335-1.3368, where the very strong support zone (created by the 50% Fibonacci retracement, the 200% Fibonacci extension based on the Apr-May increase, the 127.2% Fibonacci extension based on the entire Feb-Ma rally and the medium-term green support line) is.

(...) we should keep an eye on the current EUR/USD moves as the position of the indicators suggests that a pause or corrective upswing is just around the corner (on the short-term basis).

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: bearish

Trading position (short-term): Small short positions (using half of the capital that one would normally use). Taking into account the recent moves we decided to change our stop-loss order from 1.3670 to 1.3550. We still believe that the probability for the continuation of the decline is not extremely high, which is why we are not doubling the short position at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CAD

Today, we’ll focus on the daily chart.

On Friday, we wrote the following:

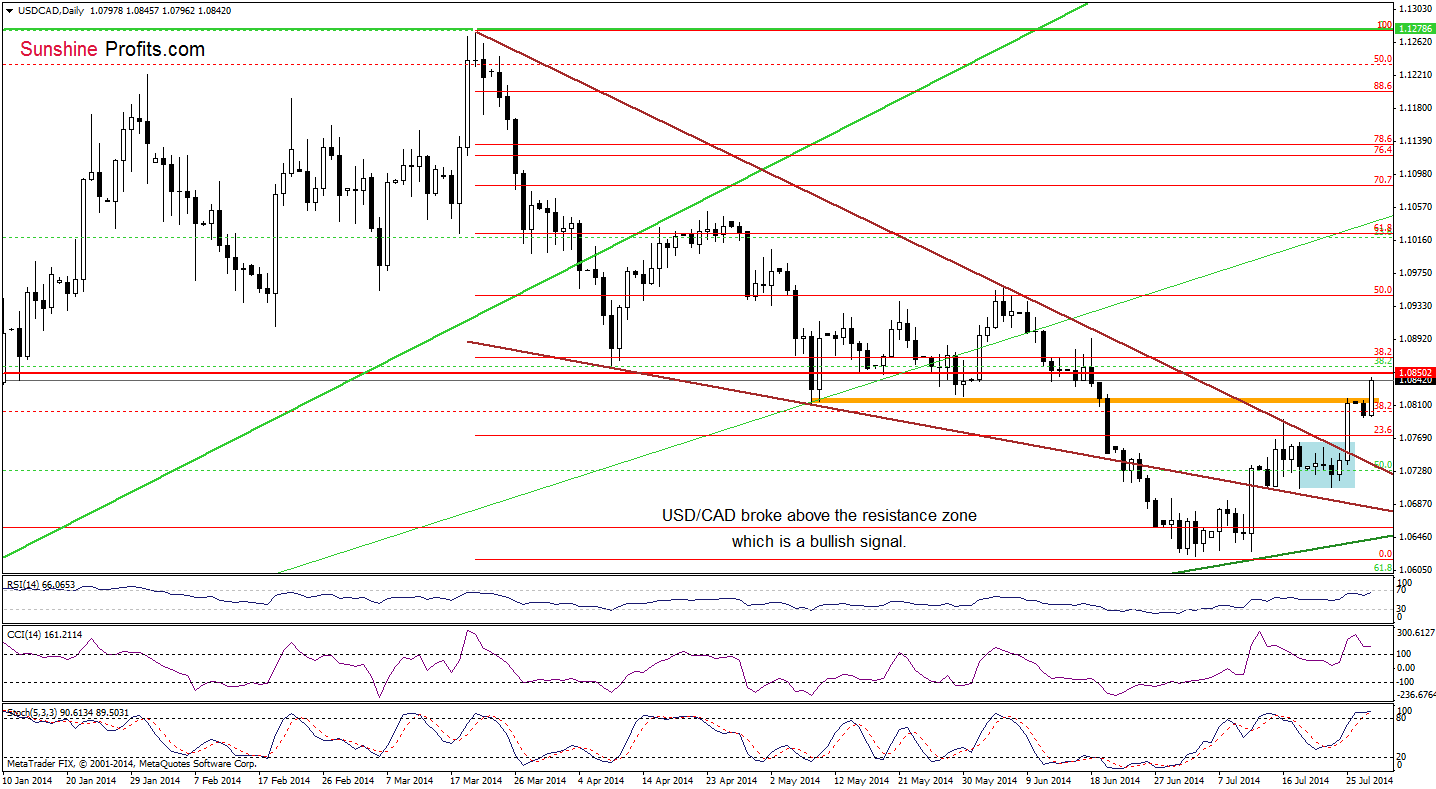

(…) if currency bulls do not give up and take their chance to push the pair higher, we’ll see an increase to the resistance zone created by the previous lows (around 1.0813-1.0821) or even to the 38.2% Fibonacci retracement based on the entire March-July decline at 1.0869.

As you see on the above chart, the situation has improved once again as USD/CAD broke above the resistance zone, which triggered further improvement in the following hours. Therefore, we think that we’ll see a realization of the above-mentioned scenario in the near future. Please note that the CCI and Stochastic Oscillator are overbought, which may encourage forex traders to push the sell button. Nevertheless, as long as there are no sell signals, another attempt to move higher can’t be ruled out.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bearish

Trading position (short-term): In our opinion no positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

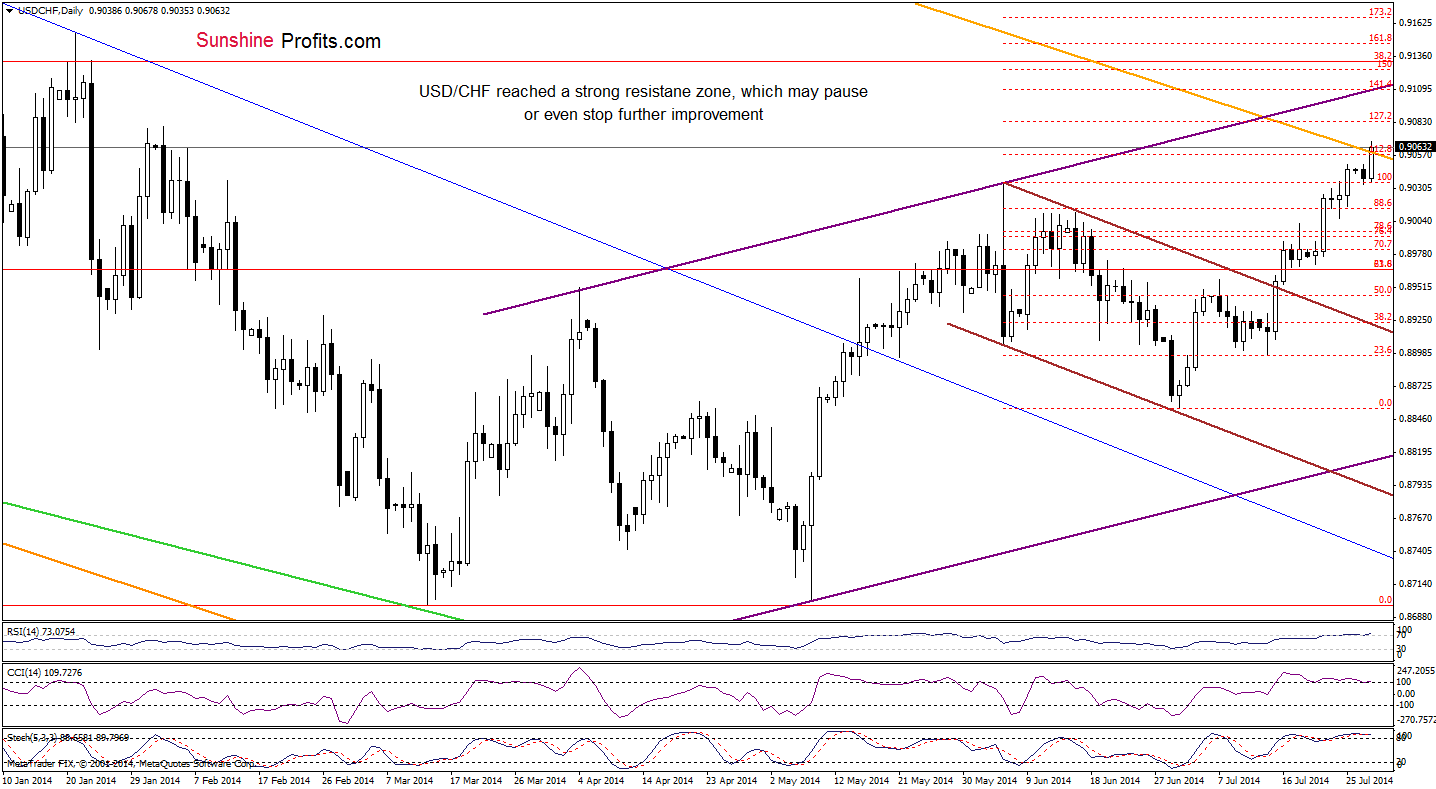

USD/CHF

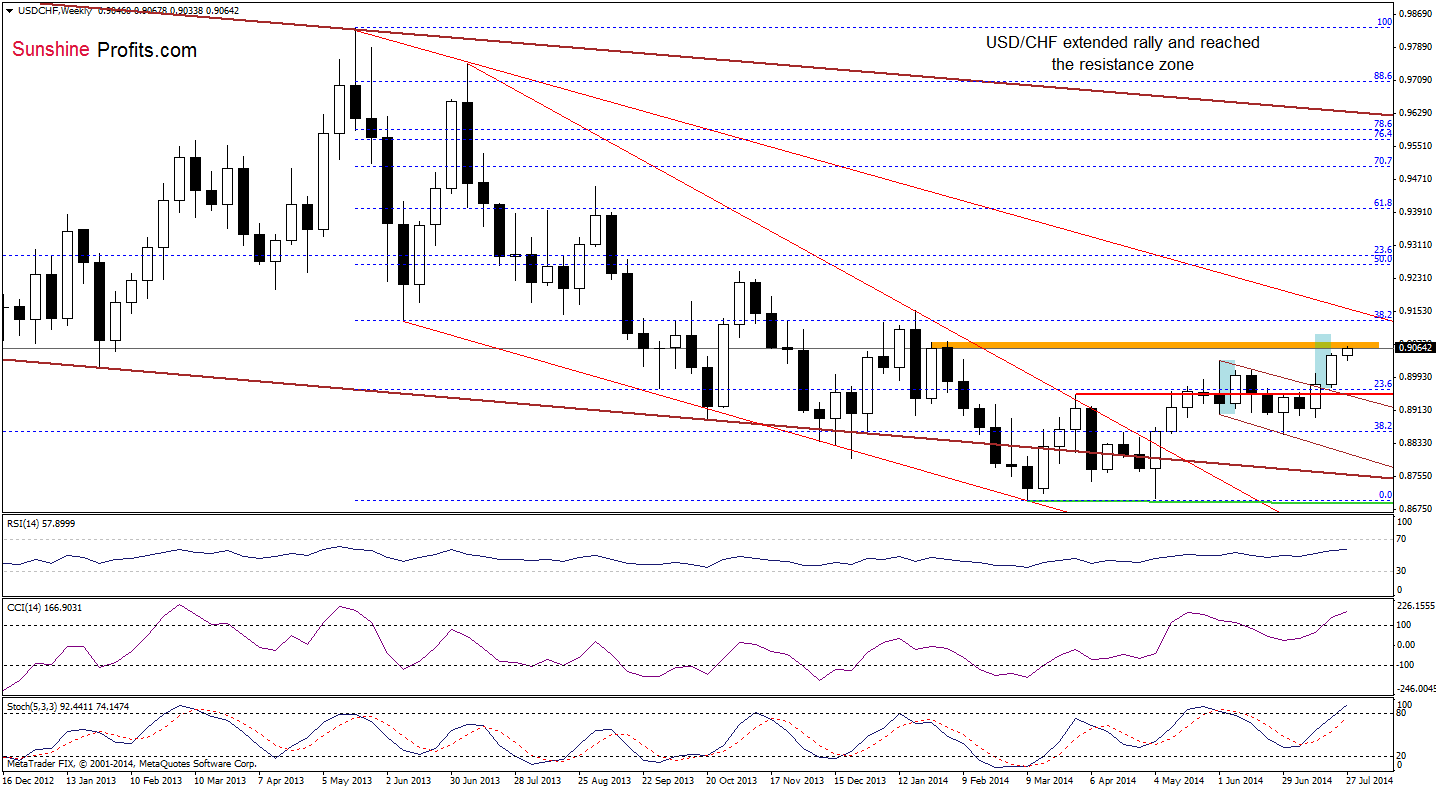

As you see on the above chart, the situation in the medium term has improved slightly as USD/CHF extended rally and reached the resistance zone (marked with orange) around 0.9080. What’s next? We believe that the best answer to this question is our last commentary on this currency pair:

(…) If this area encourages forex traders to push the sell button, we’ll see a pullback and a test of the strength of the previously-broken upper line of the declining trend channel. However, taking into account the current position of the indicators (which still have space for further growths), it seems that the exchange rate will move higher and reach its next upside target (around 0.9091), which corresponds to the height of the trend channel.

Are there any short-term factors that could stop further improvement? Let’s check.

On Friday, we wrote:

(…) the pair successfully broke above the June high (…) and it seems that there is nothing that could stop currency bulls before a test of the strength of the resistance zone created by the 112.8% Fibonacci extension and the declining resistance line (marked with orange and based on the May and July 2013 highs).

As you see on the daily chart, the situation developed in line with the above-mentioned scenario and USD/CHF reached our upside target. If this strong resistance holds, we’ll see a pullback from here and a drop to around 0.9017, where the Friday low is. However, if currency bulls manage to push the pair higher, the next upside target will be at 0.9083 (the 127.2% Fibonacci extension) or even around 0.9109, where the upper line of the rising trend channel (marked with purple) intersects the 141.4% Fibonacci extension. Please note that the current position of the indicators (the RSI climbed above the level of 70 and there are negative divergences between the CCI, Stochastic Oscillator and the exchange rate) suggests that a pause or correction is just around the corner.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed with bullish bias

LT outlook: bearish

Trading position (short-term): In our opinion no positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Please note that this is the final Forex Trading Alert for this week. The next one will be posted on Monday, August 4. The following alerts will be posted normally. We apologize for this week‘s inconvenience and thank you for understanding.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts