Based on our latest gold Market Overview report.

In terms of asset purchases monetary policy was, is and will be accommodative. More importantly so is the case with interest rates, which are still flirting with zero percent range - despite the fact that that lowering was believed by some to be temporary. I remember that even in 2009 there were people seriously arguing that we should expect interest rate hikes in few months. The history has proven them to be astonishingly wrong.

The continuous message from the Fed is that even with asset adjustments the rates are supposed to stay low until official inflation becomes a danger, or unemployment is finally significantly lower. That is all fine, we understand the signal, but we are also curious as to when the Fed officials consider this to have happened? When do they expect either much lower unemployment, or endangering inflation rate - the point at which the interest rates are raised again? Interestingly we received some additional information on this at the end of year 2013.

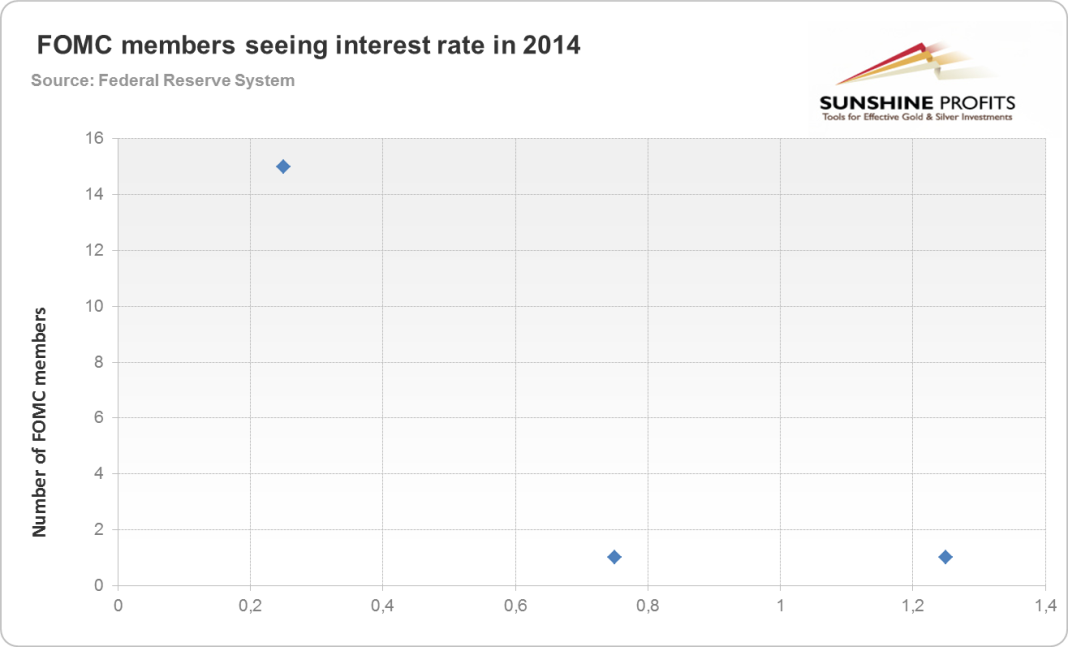

In general Fed officials are seeing interest rate hikes on the horizon, but not in the near horizon. Here is the graph depicting interest rate levels in 2014 according to FOMC members:

Only two members of the Committee believe that the interest rates will be raised slightly to 0.75, or 1.25. The rest of FOMC, 15 members, believe that interest rates are staying at their current level at least for another year until 2015. Therefore you know what to expect in 2014 for the next few months: more cheap money policy.

Things may change in 2015, since that is the time at which most members see the hiking happening.

In any case, as you see, the possible backing away from very low interest rates is the topic to be discussed at the end of our New Year. For now it is out of the question. Interest rates are to remain low for the following months to come. Therefore do not expect to see big changes in monetary policy. The asset buying program remains in place, although slightly shaken (mostly by hot words coming out of few experts' mouths); the record low interest rates are not going away soon.

What does it signal for the gold market? You all know it. Cheap monetary policy is a good fundamental variable boosting the demand for dollar alternatives - gold and silver.

Thank you.

Matt Machaj, PhD

Sunshine Profits‘ Market Overview Editor