The beginning of the 2015 abounded in extremely important central banks’ actions: the Swiss National Bank’s (SNB) decision to abolish the exchange-rate floor and introduction of quantitative easing by the European Central Bank’s (ECB). What these events imply for the global economy and the gold market?

Let’s begin with the SNB’s action. Last week it removed the peg of 1.2 Swiss francs to the euro, introduced in 2011 in order to prevent capital inflows and appreciation of the currency. It was a complete surprise for the investors and the Swiss franc rocketed beyond the previous parity. Why did the SNB drop the peg so suddenly?

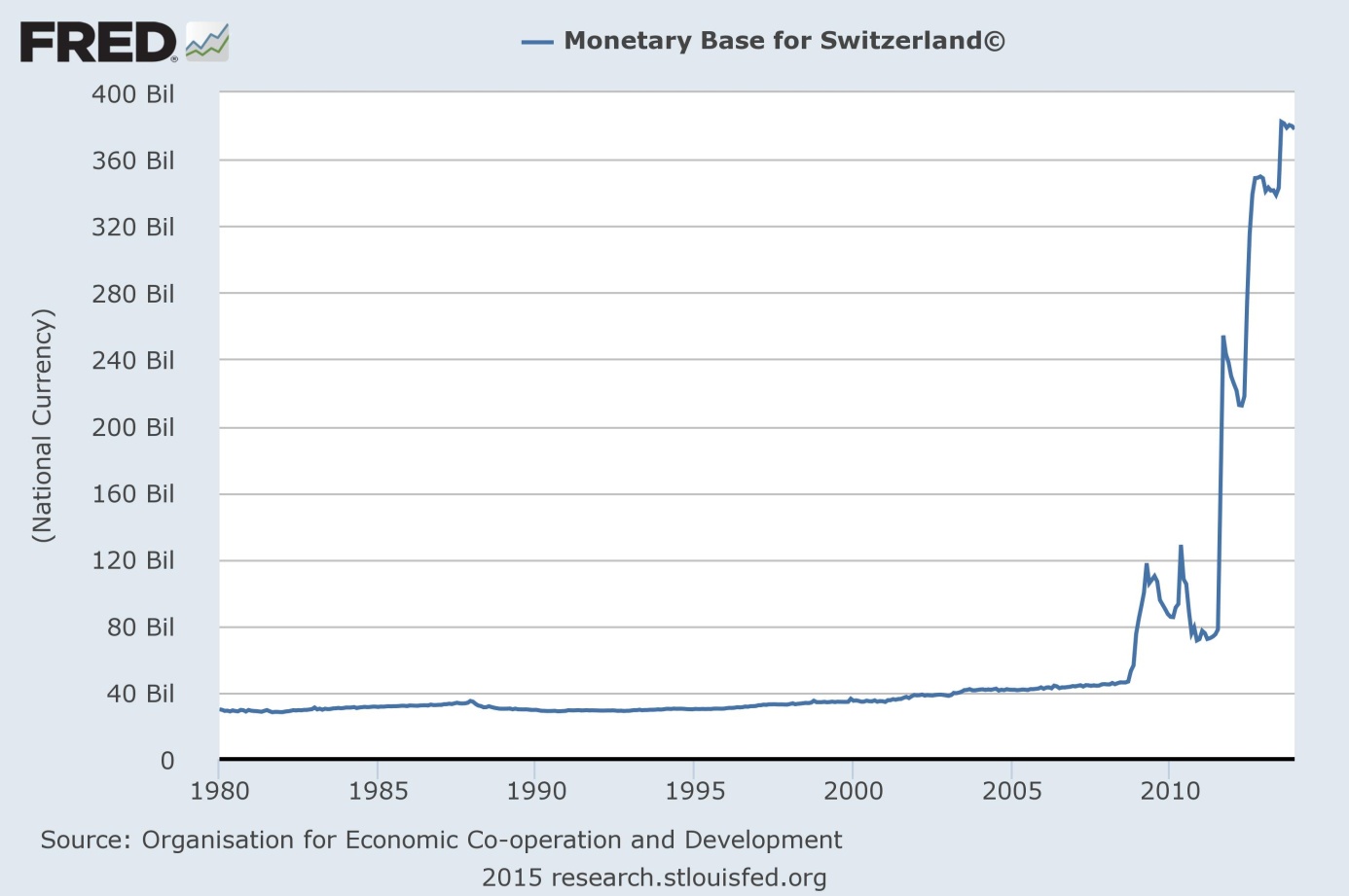

Since the SNB can print as many francs to prevent its currency’s appreciation as it wants (unlike other central banks which defend their currencies against excessive depreciation and, thus, are limited by the size of their respective foreign-exchange reserves), the only reason that the Swiss central bank stopped printing francs is that it was willing to do it. It is true, that price inflation is low in the Switzerland; however the SNB significantly increased the monetary base during the last few years, as you can see in the chart 1.

Chart no 1. Swiss monetary base from 1980 to 2013

Source: research.stlouisfed.org

Please note that SNB’s balance sheet rose from 100 billion CHF in 2009 to 524 billion CHF in 2014, becoming the central bank with the biggest balance sheet to GDP ratio (nearly 80 per cent) among developed countries (compare with Fed’s 22 per cent). In other words, the Swiss bank did not want to buy more euros, because it would make Switzerland too sensitive to swings on the forex market. Please note that Switzerland’s FX reserves in euro-denominated assets amount to around 40 percent of its balance sheets, while the Swiss export to the Eurozone is less than a few years ago.

But why should the central bank worry about balance sheet’s losses, as a private company would? Perhaps, the reason was that the 45 percent of SNB’s shares is held by… private shareholders, who receive dividends from the central bank. The rest is owned by the cantons, which also care about cash transfers from the SNB. Perhaps, the SNB also felt some pressure due to the Swiss Gold Initiative, despite its rejection in the recent referendum.

Undoubtedly, the anticipated implementation of QE by the ECB influenced the SNB’s decision. Without removing the peg, the Swiss central bank would have to expand its balance sheet at an even faster rate. The SNB’s and financial markets’ predictions were correct: the ECB announced today the €1.1 trillion Quantitative Easing program (€60 billion per month from March, 2015 until September, 2016, or longer, until inflation is back on track unless). What are the implications of European QE? It seems likely to us that it will not spur economic growth, because it will not substitute the structural problems of the euro zone. Moreover, contrary to the situation in the U.S. when the Federal Reserve first started buying bonds, the longer-term interest rates are already low in Europe. Instead QE can help governments and financial markets, and exporters as it weakens the euro.

This should be good news for gold investors. The yellow metal was gaining in recent weeks, reaching its highest price (around $1300) in five months, due to anticipated European QE and turmoil in currency markets triggered by the SNB. Gold once again confirmed its role as safe haven, gaining in both currencies: euro and U.S. dollar. It should not be a surprise, given the fact that the removal of the franc’s peg to euro was one of the biggest currency shocks since the collapse of the Bretton Woods system in 1971 (which occurred, by the way, three months after the abandon of Deutschmark’s peg against the dollar in May, 1971).

It’s very difficult to exactly predict the immediate future impact of the QE in euro zone on the gold market. On one hand, the U.S. dollar should be gaining, creating pressure on the yellow metal (gold does not have to rally in US dollar terms). On the other hand, many investors (especially from Europe) recalled the gold’s functions as safe haven (gold is now more likely to rally in euro terms) and a hedge against increased volatility in the market Indeed, there has been a rapid move into gold-backed ETFs on the back of the SNB’s surprise. A total of 23 tons of gold were added to these funds on 15-16 January, 2015 (the highest inflows on two consecutive days since November 2011) reversing the two months of ETF outflows. It means that ‘smart’ money (gold-backed ETFs are mostly held by hedge funds and large speculators) – perhaps from Europe – changed its attitude towards gold.

We can’t say much about the next moves of gold based on ECB’s and SNB’s announcements, as the markets are mostly emotional in the short run and can decline even given positive fundamental situation. However, the QE program is a bullish factor for gold from the long-term perspective, (especially in terms of the euro) and it suggests that if the final bottom in gold was not formed already, we might not have to wait for it for much longer.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Gold Trading Alerts

Gold Market Overview