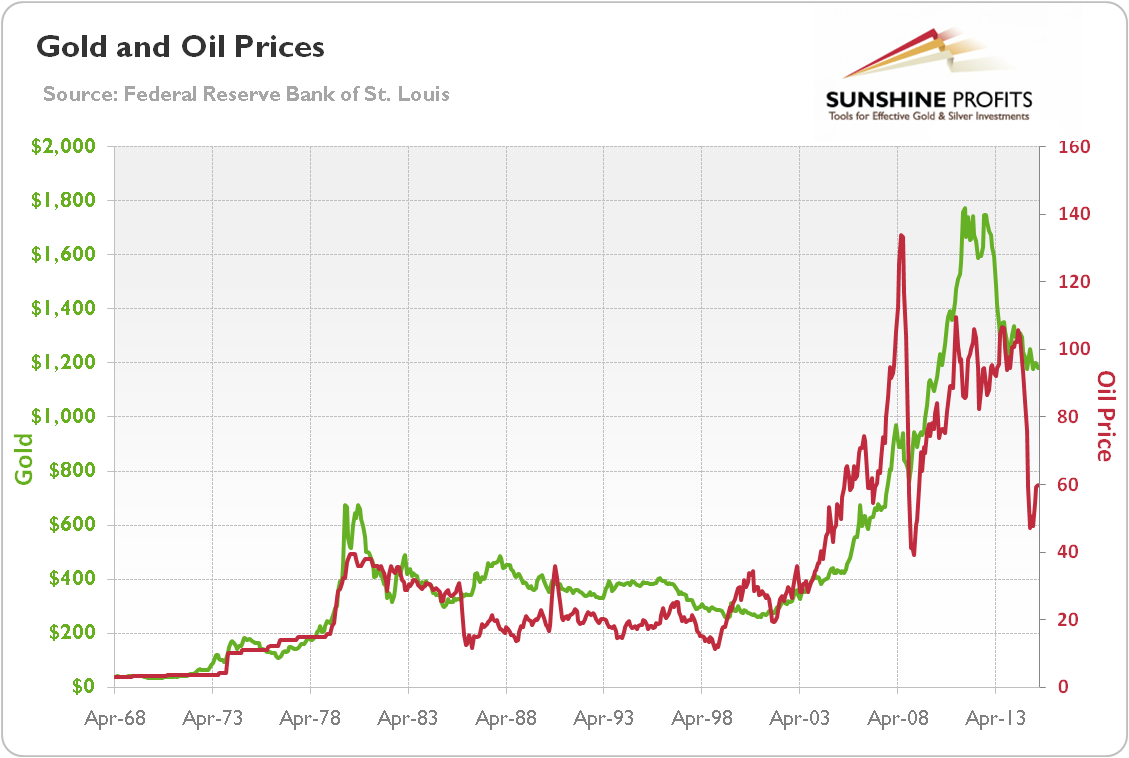

The performance of oil is also commonly seen as one that moves the price of gold. To verify this claim, let’s take a look at chart 1. Although the relationship is far from being perfect, both commodities tend to move in tandem in the long-term. The prices of both gold and oil were rising in the 1970s and 2000s, while declining in the 1980s and 1990s, although the price of oil performed in a much more volatile way.

Chart 1: Gold price (green line, left scale, PM fixing) and oil price (red line, right scale) from 1968 to 2015

Is this only a co-movement or there is some casual relationship between oil and gold prices? Well, the most popular theory sees a link between these two commodities working through the inflation channel. According to this view, rising oil prices usually influence the aggregate price level, which boosts demand for gold to hedge against inflation. There are some problems with this approach. First, as we have shown in the previous edition of the Market Overview, the shiny metal does not necessarily hedge against the price inflation all the time. Second, when oil prices rise, other prices should relatively fall, since more funds spent on oil means lower monetary demand for other goods and services (unless the money supply increases).

Thus, it seems that the oil price does not move the gold price, but rather that both commodities are correlated with the movement of some external driving factors. For many analysts, geopolitical events, especially in the Middle East, impact the prices of oil and gold simultaneously (both gold and oil investment is often becoming more profitable in these cases). Although there may be some grain of truth in this view, the geopolitical concerns affect gold only in the short-term (if at all). This means that geopolitical risks cannot explain the long-term relationship between gold and oil prices.

In our opinion, both commodities are simply influenced by common macroeconomic factors: interest rates or exchange rates. For example, when the greenback rises in value, the oil and gold prices tend to decline (as gold and crude oil traders sell). Changes in the interest rates can additionally affect the U.S. dollar and thereby oil and gold. If the real interest rates fall, then the opportunity cost of holding commodities falls, making them more attractive in comparison to other assets. Gold and oil represent the most actively traded commodities in the world. Their high financialization means that portfolio managers may quickly respond to a decline in interest rates by shifting out other assets into oil and gold markets. The oil prices may also rise due to higher incentives for extraction tomorrow rather than today (resulting in slowing the pace at which oil is pumped) and carrying inventories.

Investors should not forget about the impact of monetary policy. Commodity prices are more flexible than the prices of consumer goods; hence they are affected more and faster by the monetary trends. Thus, the properly defined inflation channel should imply that both oil and gold price rise in response to money supply growth, especially if they are regarded as an inflation-hedge due to limited supply. Indeed, the oil and gold boom of the 1970s (and of the 2000s) were partially caused by the highly expansionary monetary policy of Arthur Burns (and Alan Greenspan and Ben Bernanke respectively), which weakened the confidence in the U.S. economy and its currency (which caused forex traders to sell the US currency). Similarly, the bear market in oil and gold during the 1980s and 1990s can be explained in part by the monetary tightening implemented by Paul Volcker and the renewed trust in the biggest economy in the world and the greenback.

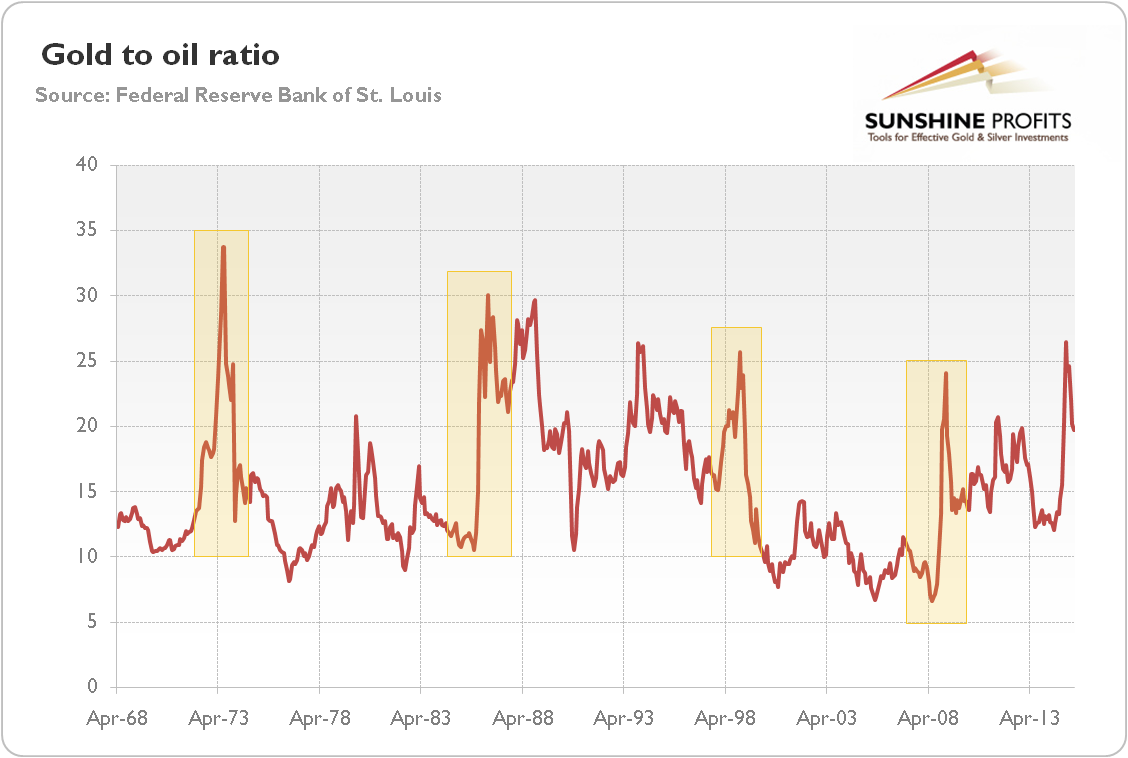

However, the strength of the U.S. dollar does not explain the changes in the relative prices of gold and oil. The chart below shows the gold to oil ratio, i.e. the price of gold divided by the price of oil. This is worth looking at, since the relative ratio enables us to analyze the relationship between gold and oil without disruptive effects of the monetary policy. As you can see, the ratio is quite volatile, which indicates that gold and oil reacts differently on the same external developments.

Chart 2: Gold to oil ratio (gold price divided by oil price) from 1968 to 2015

Although there is no clear pattern, the gold to oil ratio often surges during financial crises, like the 1973 oil crisis, the Latin American debt crisis in the 1980s, Asian and Russian crises in 1997-1998, or the outbreak of the Great Recession in 2008. This proves that gold is not merely a commodity, but also a monetary asset, which reacts to different factors than oil, at least in the short and medium run.

The key takeaway is that oil performance does not drive the price of gold. The observed co-movement results from the fact that both commodities are correlated to the movement of the same macroeconomic factors, such as the monetary policy, the U.S. dollar and the real interest rates. This fact reflects that “correlation does not imply causation”. Indeed, after taking into account the impact of fiat money, there is no obvious relationship between oil and gold, and the latter (as a monetary asset) reacts more strongly to financial crises, while oil (as an industrial commodity) to the fundamental forces of supply and demand. If you’re interested in learning more about gold and crude oil, we invite you to read our detailed report on gold, crude oil and silver.

If you enjoyed the above analysis and would you like to know more about the most important factors influencing the price of gold, we invite you to read the September Market Overview report. If you’re interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts. If you’re not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview