Why did China devalue the yuan and what are its possible consequences for the global economy and the gold market? There are two main narratives: according to the first, China entered the currency wars and devalued the yuan to make country’s exports more competitive, while the second story says that the recent move loosed up control over peg and made the value of the yuan more market driven (Beijing uses now a “managed float”, which allows the yuan's exchange rate to fluctuate within a band of 2 percent above or below a point set by the People's Bank of China based on the previous day's trading). Which one is true? Well, the above motives are not mutually exclusive and China could kill two birds with one stone.

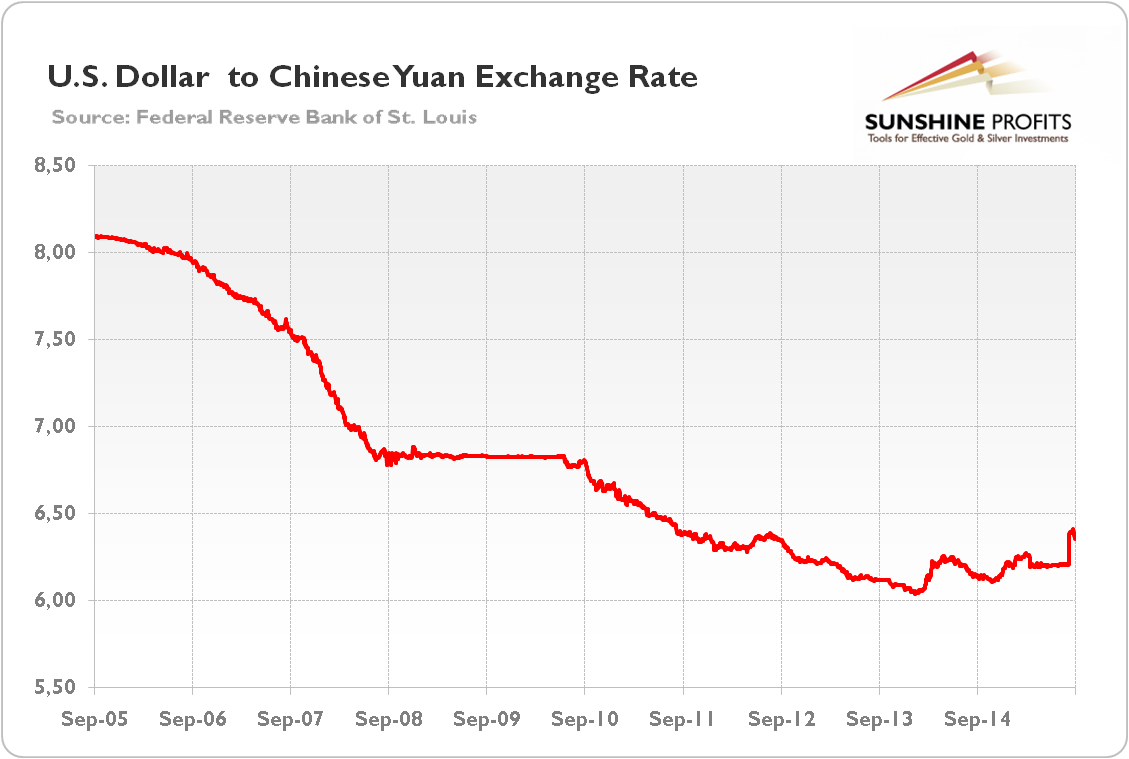

Let’s take a look at the chart below, presenting the U.S. dollar to Chinese yuan exchange rate. As it can be seen, the yuan has been continuously strengthening over the past ten years (the chart is denominated in yuan to greenback, so the fewer yuan per dollar, the stronger the yuan, and vice versa). This is because – partly in response to U.S. pressure – China has tied the value of its currency to the U.S. dollar.

Chart 1: The U.S. Dollar to Chinese Yuan Exchange Rate from 2005 to 2015

Consequently, the yuan rose to levels unjustified by market fundamentals and appreciated against almost all currencies (including the greenback itself) putting China in a difficult position (the appreciation hurt exports and counteracted the expansionary measures undertaken by the PBOC to prevent the economic slowdown). Therefore, what China really did was only a small adjustment against a constant devaluation of the U.S. dollar. Now it should be obvious that the Red Dragon is not the nasty currency warrior – the truth is that it is the U.S. who might deserve this title. Why? Well, Uncle Sam was obviously taking full advantage of the greenback’s position as the world’s reserve currency by increasing the money supply and exporting the printed U.S. dollars to China in exchange for cheap consumer goods. It was an excellent strategy for the U.S. as China stayed with U.S. dollars, from which it was purchasing U.S. Treasury bonds, helping to cover the U.S. debt.

Hence, China simply moved to a more market-based valuation for its currency, but at a time more convenient to China than to the U.S. With this move, the Red Dragon simultaneously slightly supported its declining exports (the yearly rate of growth fell to minus 8.3 percent in July from 2.8 percent in June) and the overall economy (as the exports account to 26.40 percent of the China’s GDP), and pleased the IMF (to make the yuan one of the world’s reserve currencies) and the U.S. itself which has been pushing China for years to make yuan freely tradable without government intervention (however, Uncle Sam wanted the yuan to appreciate, not depreciate, after such move – as you can see, even the biggest forex players have to be wrong at times).

What are the possible consequences of the devaluation of the yuan for the global economy? The 3.5 percent drop is perhaps too small to cause significant direct effects (either in China, or globally), but the yuan is still overvalued against the U.S. dollar by several percent, so further depreciation is likely (especially when full flexibility will be introduced). The devaluation was in a sense the game changer, prompting more outflows from China, especially since foreign investors expected that more currency depreciation will follow (as the scale of devaluation was too little to make much of a difference). Although foreign investors have been burned by malinvestment in real estate, excess production capacity, and declines in equities, they could always count on that their yuan-denominated investment would go up in foreign exchange terms, thanks to the peg to the dollar. This brake is now gone. Moreover, the capital outflows in China’s current currency regime require intervention in the currency market to prevent weakening of the yuan. This is why the Red Dragon has been selling the U.S. Treasuries recently, exerting upward pressure on their yields.

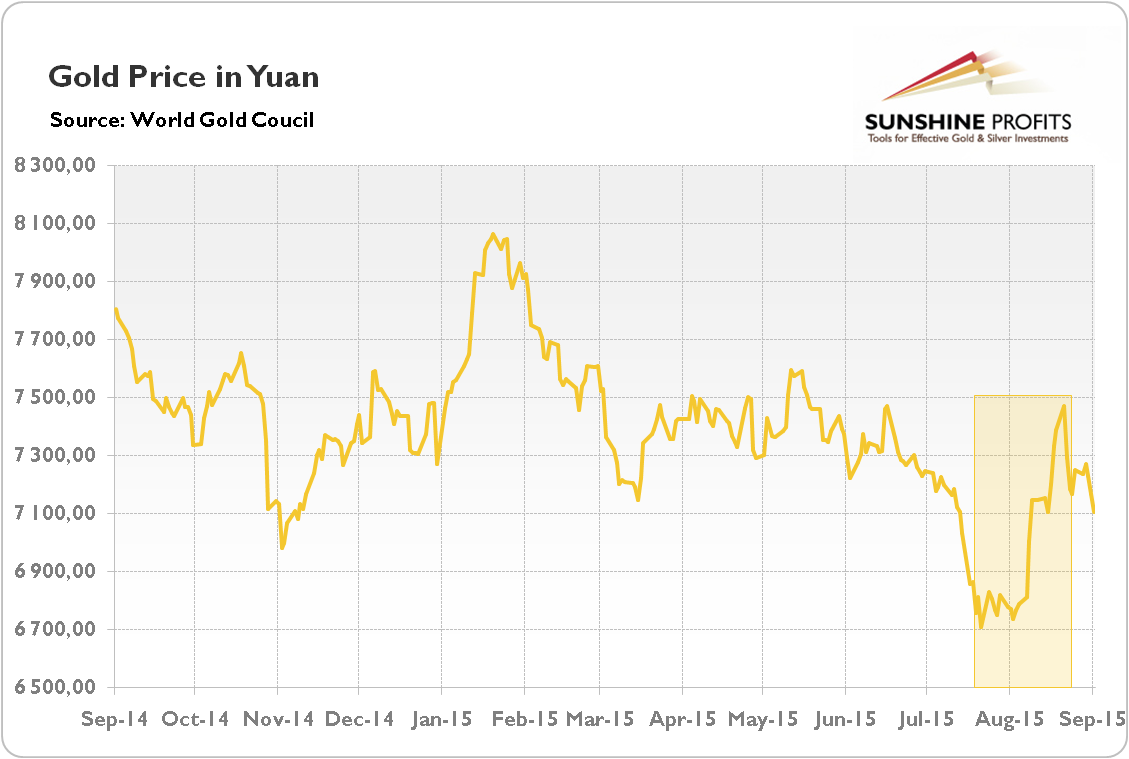

And how could the devaluation of yuan affect the gold market? Well, further depreciation would spur Chinese demand looking to hedge against the currency devaluation and drive the price of gold expressed in yuan higher, as the last devaluation did (see the chart below). The assessment of effects for the price of gold in terms of the U.S. dollar is more complicated, however if the recent devaluation indicates anything, the shiny metal should gain after possible further depreciation. The big moves in the currency market cause a lot of uncertainties, which would spur safe-haven demand for gold. Moreover, the upward pressure on the Treasury yield resulting from China’s sales could undermine the health of the U.S. financial system – positive news for the gold market (especially if the liquidation of Treasuries by China and other emerging markets prompts Fed to adopt even more dovish stance). In other words, gold will likely have one more reason to rally in the medium term, but the above does not say when exactly such rally would start and other techniques need to be used as well in order to estimate it).

Chart 2: The price of gold expressed in Chinese Yuan over the last year

Summing up, the recent devaluation of the yuan was caused both by implementing the market-oriented reforms and trying to support China’s economy. The price of gold rose after this move because of safe-haven demand, but the impact of the devaluation was naturally limited as its scale was small. However, it could have been a game changer, which would definitely end China's carry trade, accelerate the capital outflows from China and the deterioration of the balance sheets of indebted Chinese companies. Thus, the Red Dragon could be forced to fully liberalize its currency, which would mean further depreciation. Since the currency markets are usually the major channel of contagion, the safe-haven demand for gold could then increase. However the unwinding of China's carry trade will additionally strengthen the U.S. dollar, exerting the downward pressure on the yellow metal. We’ll be monitoring the markets and describe which effect is likely to prevail as soon as more information becomes available.

If you enjoyed the above analysis and would you like to know more about the recent developments in China and their impact on the price of gold, we invite you to read the October Market Overview report. If you’re interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts. If you’re not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview