Based on the October 7th, 2013 Oil Investment Update

One of the main events of recent days was the first U.S. government shutdown in 17 years. Light crude dropped to a new monthly low at $101.05 on concerns that this event would reduce demand for black gold in the world's largest oil consumer market. In the previous week, the yellow metal also declined and dropped below $1,300 an ounce. Despite this declines, on Wednesday, both commodities rebounded sharply supported by a weaker U.S. dollar as commodities priced in the greenback became less expensive for holders of other currencies. Additionally, in the second half of the previous week we saw similar price action in both cases.

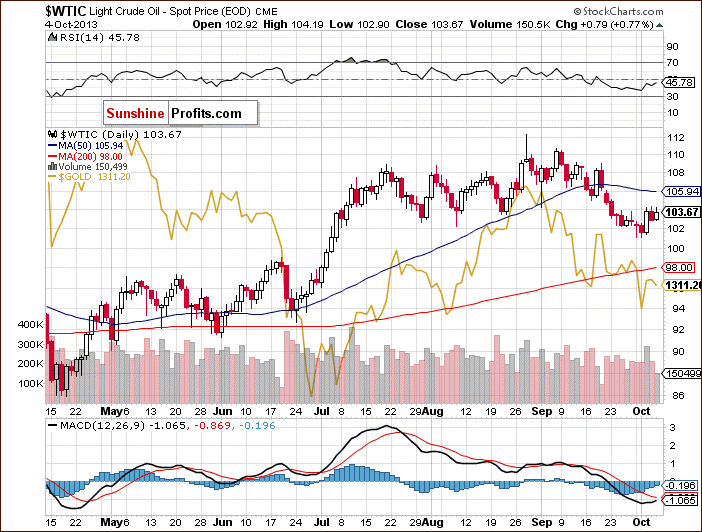

Taking the above into account, investors are probably wondering: what could happen if the recent positive divergences between both commodities remain in place? Can we find any guidance in the charts? Let's take a look at the charts below and try to find answer to this question. We'll start with the daily chart of crude oil (charts courtesy by http://stockcharts.com).

On the above chart, we see that the situation improved slightly in the previous week. Last Monday, crude oil dropped to a new monthly low of $101.05 per barrel. With this move the price of crude oil declined not only below the August low, but also below the 38.2% Fibonacci retracement level. Despite this drop, we saw a pullback, which erased most of the losses late in the day.

In the following days, we saw further improvements as oil bulls managed to hold this level. This positive event triggered another pullback, which pushed light crude to the previously-broken rising medium-term support line on Wednesday. Additionally, the price of light crude came back above the 38.2% Fibonacci retracement level and the breakdown below this level was invalidated. Although crude oil closed Wednesday almost at the rising medium-term support/resistance line, the buyers didn't have enough strength to break above this resistance until the end of the previous week.

Looking at the above chart, we see that crude oil remains in the declining trend channel. Therefore, if we see a breakout above the medium-term support/resistance line, we could see a move up to the declining short-term resistance line based on the Aug. 28 and Sept. 19 highs - currently close to the $106.4 level (marked with blue).

Please note that the nearest support is the September low and the 38.2% Fibonacci retracement level. If it is broken, the next one support zone will be slightly below $100 per barrel where the 50% Fibonacci retracement level intersects with the June high.

Once we know the current short-term outlook for crude oil, let's take a closer look at the chart below and check the link between crude oil and gold. Has it changed since our previous essay on oil and gold was published? Let's examine the daily chart.

Looking at the above chart, we see similar price action in both commodities at the beginning of the previous week. They declined on Monday, however, in the case of crude oil, the buyers managed to hold the September low in the following days, which resulted in a sharp pullback on Wednesday. Meanwhile, gold declined and reached its new lowest level since the August top. Despite this drop, the rest of the week looked similar for both commodities.

Summing up, looking at the relationship between crude oil and gold, we notice similar price action in both commodities in the previous week. Therefore, if this relationship remains in place, we could see some strength on a short-term basis in case of the yellow metal and crude oil. However, we should still keep in mind that the recent decline in crude oil is just slightly bigger than the previous ones and light crude remains above the 38.2% Fibonacci retracement level, which forms strong support. From this point of view, the uptrend is not threatened at the moment. At the same time, the downtrend in gold remains in place and the yellow metal remains below the declining resistance line which has already successfully stopped buyers several times.

Thank you.

Nadia Simmons

Sunshine Profits' Crude Oil Expert

Oil Investment Updates

Oil Trading Alerts