European banks bled after the Brexit vote. What does imply for the gold market?

Yesterday, we reported on the repercussions of the British referendum for bond yields. Today, we take a closer look at its consequences for the European banks. They were in poor condition even before the vote, but the surprising result made them suffer. European banking stocks lost 22 percent of their value in the two days of trading following the UK’s EU vote (and they did not recover in the last week). The most harmed entities were the Italian banks, and Deutsche Bank.

It should not be surprising as the Italian banks are the Achilles’ heel of the Eurozone financial system. They have €200 billion in gross non-performing loans (around 18 percent of their total balance sheets). Some analysts argue that Italy faces the risk of a full-blown banking crisis, as Italian bank shares experienced a bloodbath on Monday and they are down more than 50 percent this year. It goes without saying that it should be a positive scenario for the gold market.

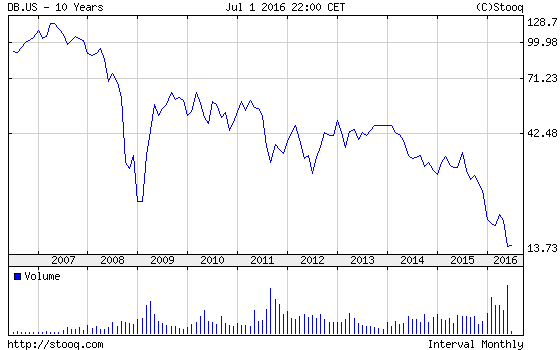

With regard to the German giant, the shares of Deutsche Bank have fallen to a level lower than during Lehman’s debacle, as one can see in the chart below.

Chart 1: The quote of Deutsche Bank’s shares from 2006 to 2016.

Certainly, something bad is going on. It is an important development for the gold economy and the gold market as Deutsche Bank is the largest contributor to systemic risks among the largest lenders globally, according to the IMF. Moreover, Deutsche Bank is heavily exposed to the Brexit risk, as about 20 percent of its revenue reportedly comes from the UK.

Summing up, the European banks are in a relatively weak condition, especially the Italian ones with huge amounts of non-performing loans. The aftermath of the Brexit vote may add some fuel to fire – actually, the shares of European banks have already plunged about 20 percent since the referendum. Now, the question is whether the worst is behind us. For now, it seems so, but investors should remember that the problems of European banks have not really been solved yet. Therefore, there is further potential for declines, which should support the gold market, as the shiny metal is usually negatively correlated with the risky assets (although it is more a bet against the U.S. economy than the EU economy).

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview