Bitcoin Trading Alert originally sent to subscribers on September 12, 2016, 10:30 AM.

In short: no speculative positions.

The current banking system is global, at least in theory, but it definitely seems that the term “global” does not actually apply to all parts of the payments space the way we would like it to. International wire transfers still tend to be slow and costly. It is perhaps irritating that sending an email takes seconds but sending $5 abroad is slow, expensive or altogether impossible. This is why companies like Western Union still charge hefty fees for overseas transfers. As it turns out, Bitcoin and other digital currencies might offer a way forward for making the remittance industry more accessible. On Quartz, we read:

Worldwide, 230 million people send $500 billion in remittances each year, primarily using firms like Western Union, Moneygram, and RIA, which together control 1.1 million retail locations and account for more than 25% of the world’s annual remittance volume. (…)

(…) Transferring $20 from the US to the Philippines via Viber and Western Union incurs a flat $4 fee, along with a 4% foreign exchange fee. After being converted to the Philippine peso, the money arrives at its destination as $15.15, a loss of nearly $5.

That may not seem worse than an average ATM fee, but the vast majority of Asian migrants are domestic helpers, crewmen, and construction workers. Most send home the equivalent of $200 each month—often more than a quarter of their personal income. The roughly $12 in fees they must pay to transfer that amount is equivalent to half a day’s wages.

For more than a year, startups have been working on this problem by building Bitcoin alternatives to traditional money-transfer methods. (…)

The nascent industry has spawned at least three new players in the past year—Payphil, Sentbe, and SCI—and more established Bitcoin exchanges like Korbit and Coinplug are also entering the market. They seem to be having an impact—that $12 charge on a $200 transfer is more like $6 with Bitcoin. Insiders estimate that Bitcoin-powered transactions now account for 20% of the remittances flowing between South Korea and the Philippines each year.

There are still a lot of problems with adoption, though. The article points out that a lot of the people sending money back home are not really interested in what Bitcoin is. Their main interest is to transfer the funds without a hitch and at a reasonable price. Bitcoin, as a new technology, might raise brows. The ultimate test will be whether the funds can remain secure and the fees can remain low. Our general sense is that digital currencies will not put Western Union out of business as the penetration is still very weak and if Bitcoin turns out to facilitate the exchange, money transmitters would generally be willing to include it as a technological solution. At the same time, a lot of development has to happen both on the technological side and as far as the law is concerned. Bitcoin is still very much in the grey zone in many countries and its status would have to be clarified for money transmitters to embrace the currency.

For now, let’s focus on the charts.

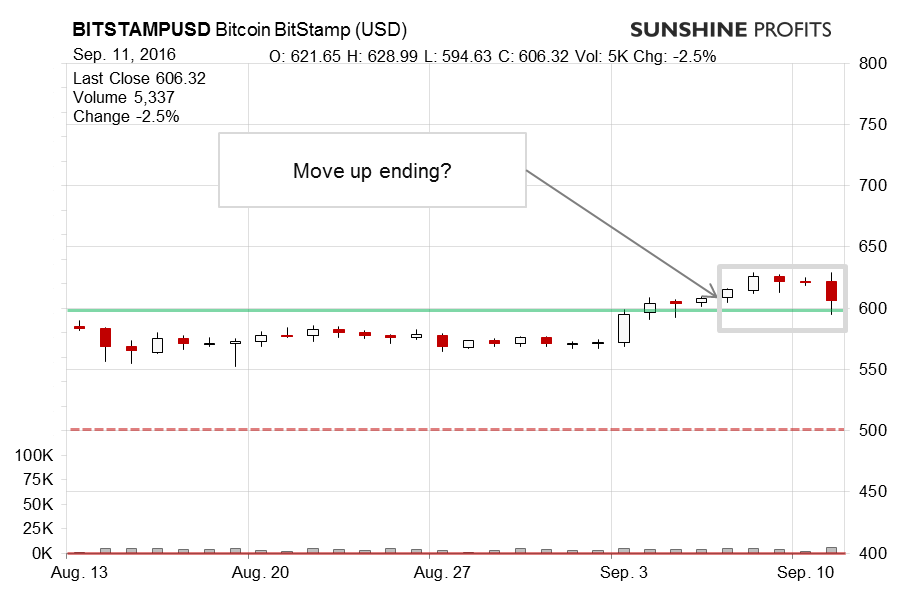

On BitStamp, we saw Bitcoin lose some steam and temporarily dive below $600. Does this mean that the situation is back to bearish? Let’s recall our previous comments:

The most important part now seems that Bitcoin is only partially above the Fibonacci retracement levels. If we look at the retracement levels based on the May-June rally, Bitcoin is currently at the 50% level and actually a little below this level. In this case, we don’t see much support for a break to the upside. If we look at the levels based on the decline from the July top to the early-August low, Bitcoin is above the 38.2% retracement level but we haven’t yet seen three daily closes above this level. At the same time, the recent move to the upside didn’t take place on huge volume. It seems that the move up on relatively low volume might be a fake breakout.

Bitcoin didn’t move much until today. Today, we’ve so far seen a move similar to the one we saw last Saturday (…). The change is that what we’re seeing now looks less like a fake breakout. There is at least one consideration which weakens the bullish implications of the move.

The situation changed again yesterday. Bitcoin went down, quite visibly compared with the previous days, and the same can be said about the volume. The action was not explosive but Bitcoin went below $600 for a time before coming back above this level. Does this mean that the situation is now bearish? We think that it is more bearish but not necessarily extremely bearish at the moment.

On the long-term BTC-e chart we again see a dip toward $600. Recall our previous comments:

The currency might be on the verge of a breakout above the recent downward trend based on the June top and the precipice of the late-June/early-August decline. At the same time, the move above the trend is not confirmed (at least not yet) and the move hasn’t taken place on significant volume. This makes us doubtful about the possible breakout.

Another thing we seem to see now is a series of lower highs. This is a bearish indication, which counterbalances some of the possibly bullish indications. The situation still looks bearish, in our opinion.

From the long-term perspective the perspective is not that different from what we had previously. The short-term perspective discussed earlier makes us cautious at the moment. The one factor that weakens the bullish implications we mentioned before is the relatively weak volume. The magnitude of the volume is nothing like what we used to see during strong upswings in the past. An additional factor which might limit the move up is the proximity of the overbought level in the RSI indicator. This factors might suggest that the move up is about to be over. At this time, however, a further move up is still likely, and as such, we would prefer to wait before reentering our hypothetical short positions.

What we wrote previously is still up to date. The recent move to the downside tilts the situation back toward bearish territory. The move is not pronounced enough, in our opinion, to change the outlook. Bitcoin is back below the 50% Fibonacci retracement level based on the June-August move down but not below the 38.2%. The situation is currently close to bearish but not really there. It wouldn’t take much for Bitcoin to get back to bearish. Stay tuned.

Summing up, in our opinion not having speculative positions might be favorable at the moment.

Trading position (short-term, our opinion): no positions.

Thank you.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts