Bitcoin Trading Alert originally sent to subscribers on January 14, 2016, 10:29 AM.

In short: short speculative positions, target at $153, stop-loss at $515.

PayPal, the payment giant, has added a Bitcoin entrepreneur to their board of directors, we read on CNN Money:

Wences Casares is a financial tech entrepreneur and the CEO of Xapo, a Swiss company that offers digital wallets and debit cards for the electronic currency Bitcoin.

Casares joined the board on Tuesday, PayPal (PYPL, Tech30) announced Wednesday.

PayPal is the leading company in Internet-based payments. For some time, it has indicated an interest in something called Blockchain, the technology that drives the online currency Bitcoin.

(...)

In a statement, PayPal CEO Dan Schulman said Casares' experience with Bitcoin would help PayPal adapt to a future of mobile payment and digital cash.

"Wences's unique line of sight into the future of commerce is ideally aligned with PayPal's vision of transforming the management and movement of money for people around the globe," Schulman stated.

What does this mean for Bitcoin? Not much for the currency itself in the short term but it certainly is a sign that PayPal is treating Bitcoin seriously. Bitcoin, or at least the Blockchain, doesn’t seem like a fad anymore. Actually, even though PayPal’s move might be the most visible in media in recent weeks, banks and financial institutions have been looking into digital currencies for some time now.

What role Casares will play exactly remains unclear but we don’t think that Bitcoin will supersede existing PayPal systems in any way. Does this mean that PayPal will somehow link to Bitcoin in the future? It’s too soon to answer. We certainly expect PayPal to further monitor the development of digital currencies. It wouldn’t be surprising to see the company tinkering with its own Bitcoin-inspired network, just like banks or exchanges are.

For now, let’s focus on the charts.

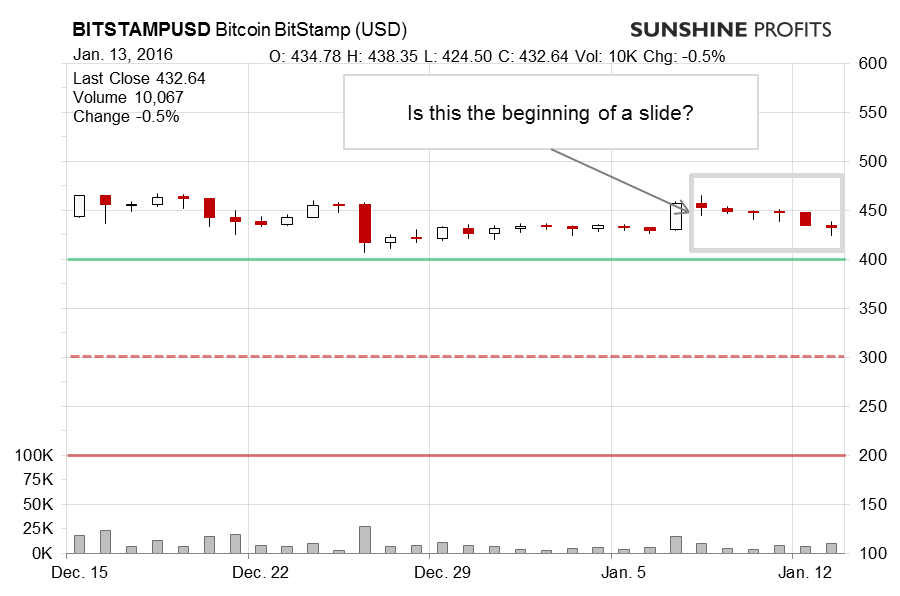

On BitStamp, we saw a day of depreciation on Tuesday. Bitcoin moved visibly below $450. This was not a very significant move in and of itself – the volume was not huge for once – but the important point here is that a move below $450 seems to be confirmed. This is a bearish indication. Also, a quick look at the chart reveals that the recent local top is at Jan. 8 and it actually coincides with a possible long-term resistance line. Bitcoin seems to have bounced back off the resistance line and with a move below $450 possibly confirmed the situation is now even more bearish than it was only a couple of days ago. Recall our previous comments:

(…) we saw the most curious thing. At least if you consider the claim that Bitcoin is an “alternative asset like gold.” The stock market has corrected quite significantly in the last two weeks. Gold moved up while stocks plunged but Bitcoin’s reaction was really muted. The currency moved strongly only on one day – on Jan. 7 it appreciated visibly. However, one day of appreciation is nothing like the reaction we saw in gold. This might mean, among other, two things: Bitcoin is a different “alternative asset” than gold or the Bitcoin market is weak enough for the plunge in stocks not to have an important impact on the Bitcoin exchange rate. Both of these possibilities, particularly the latter, open a window for more declines in the Bitcoin market. Actually if the second proposition is true (Bitcoin too weak to react to the stock selloff), we might be in for significant depreciation in the weeks to come.

On the long-term BTC-e charts, we see that Bitcoin might be making a move. The currency is down from the recent high, below $450 and below a possible long-term declining resistance line. The situation today is actually even more bearish than it was when we posted our previous alert (and it was already pretty bearish back then). Our previous comments remain very much up to date:

Right now, it seems that $400 will be the next trigger for the decline and that the $350-380 range might be reached quite fast once the move below $400 materializes (if it does). There’s more – the $350-380 range is based on three premises: the end point of the late-November rally (relatively weak), the psychological $350 level (a bit stronger but not much), and the possible rising support line at $380 based on the July 2015 low and the October 2015 prices (also stronger than the first one). If the $380 level is broken, it might be the case that the next decline could bring Bitcoin as low as to the $300-320 level. We wouldn’t be surprised by such a move in the next couple of weeks.

It is possible that we’ll see more action in the next couple of days or weeks. Bitcoin could still wrangle a bit around $450. The recent move, however, has made the decline back down to $400 and beyond even more of an opportunity, in our opinion.

Summing up, in our opinion speculative short positions might be the way to go now.

Trading position (short-term, our opinion): short speculative positions, target at $153, stop-loss at $515.

Thank you.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts