Bitcoin Trading Alert originally sent to subscribers on December 29, 2015, 9:17 AM.

In short: short speculative positions, target at $153, stop-loss at $515.

As 2015 is coming to a close, we take a look at what might come for Bitcoin in 2016. A few excerpts from an article on CoinDesk:

(…) Bitcoin will shine as a safe haven asset

I expect renewed volatility in global markets, and as a result I see liquidity problems popping up unexpectedly.

As a result, funds and investors will seek to hold assets with low counterparty risk. I think bitcoin will be one of these, more so than in previous years.

(…) Sidechains will be appreciated as major technical breakthrough

Similar to how bitcoin had to overcome accusations of being a Ponzi scheme in the early days, sidechains technology is now met with skepticism and mistrust.

As more operational sidechains come online and their utility and open-source nature become visible to the world, I expect perception to change for the better.

Actually, we are quite skeptical that Bitcoin will become a safe haven asset of choice in 2016. The main reasons for that are that the legal status of the currency is still somewhat “shaky” and there are no appropriate compliance procedures in place. Both of these might become less of the problem in the years to come (not necessarily in 2016 alone) but Bitcoin will still face an important obstacle in the way to become an important safe haven asset – liquidity. With the Bitcoin market still relatively small and not expected to grow exponentially, we see commodity investors having a hard time to appreciate Bitcoin quite the way they value gold. This doesn’t mean that there won’t be progress. Quite the contrary, we expect Bitcoin to win over considerable capital in the next couple of years – possibly with the launch of new Bitcoin ETFs. We just don’t expect Bitcoin to take the place of gold in 2016.

The second point from the article is extremely interesting from the technological point of view. We’ve covered sidechains before and now we would like to emphasize their potential importance. The main point of the idea is to create small separate blockchains parallel to the main Bitcoin blockchain. This sounds complicated but the gist is that small parts of the Bitcoin ecosystem could be changed rapidly without impacting the whole system. This would allow developers to test and implement new solutions in operational conditions. In this way, it might be a lot easier to check how specific technological solutions actually work. There’s a great idea for lightning-quick payments but the security needs to be checked first? Implement it for a sidechain and if it works. The bottom line is that sidechains might make Bitcoin a lot more flexible and interesting to customers.

For now, let’s focus on the charts.

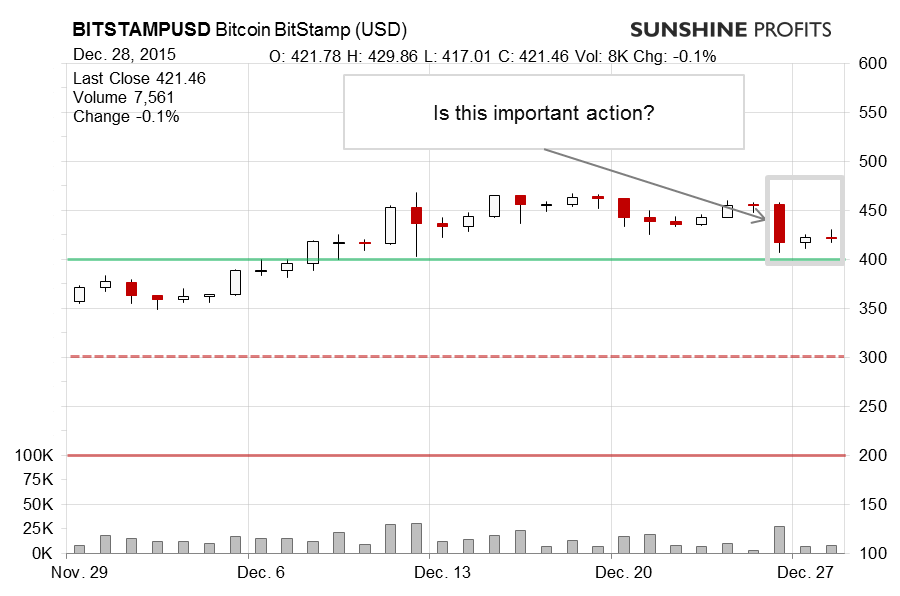

The first thing to notice on the BitStamp chart is that surprisingly little has changed in the last couple of days. This might seem odd at first since Bitcoin plunged on Dec. 26, but becomes clearer once we look at the whole pattern following the early-November top. First and foremost, the situation was already bearish before Dec. 26, so even though Bitcoin moved down and the move itself is bearish, not much actually changed since the outlook had already been bearish before. Recall what we wrote previously:

(…) The action we saw (…) might be an indication that Bitcoin is about to move away from the discussed $480. There are no sure bets in any market but this seems to have fairly bearish implications. For the situation to become very bearish, we would have to see three days (including today) below the recent trend, which hasn’t happened yet.

Bitcoin moved down away from $480 and we are just one day short of having a short-term breakdown which could have bearish implications for the next couple of days. Even more importantly, Bitcoin is still well below a possible long-term declining resistance line based on the 2013 and early-November 2015 tops. This means that the medium-term outlook hasn’t changed and remains bearish. With the medium-term outlook still bearish and a hint that lower prices might be just around the corner, it seems that yet another decline might materialize relatively soon.

On the long-term BTC-e chart, a move to $400 is even more visible than on the previous chart. Bitcoin is still shy of $400 but a move below this level could transpire in the next couple of weeks. Recall what we wrote previously:

(…) we just saw a drop below $450 which also suggests that a move above the previous high failed (we see the double top pattern in the chart). Bitcoin is now below a possible rising short-term trend line which is weakly bearish. Also, the currency is back at a possible declining long-term trend line. If Bitcoin closes below this line for some time or we see a pronounced move below this line, the situation could become very bearish.

Bitcoin is once again back from overbought territory. This is a relatively strong suggestion that the recent short-term move up might be turning around for good. Again, there are no sure bets in any market but the current situation suggests that the outlook for the next couple of weeks is bearish.

This is still the case. Actually, the recent developments have made the situation more bearish than it was before. The next big move to the downside might be triggered by a slip below $400 (green line in the chart). It seems that paying attention to market moves in the next couple of weeks might turn out to be particularly profitable.

Summing up, in our opinion speculative short positions might be the way to go now.

Trading position (short-term, our opinion): short speculative positions, target at $153, stop-loss at $515.

Thank you.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts