Bitcoin Trading Alert originally sent to subscribers on November 30, 2015, 11:08 AM.

In short: short speculative positions, target at $153, stop-loss at $515.

Drivechain, a Bitcoin-related project is focusing on the possibility of separate blockchains which would enable additional features to be tested and implemented without risking the integrity of the main blockchain. On the Brave New Coin website, we read:

Imagine there is a Bitcoin-like system out there that you’d like to use, but would rather not go through the risk and effort of buying the native tokens for. Sidechains offer a solution where the value of bitcoins can be transferred onto other blockchains, so that bitcoin users can take advantage of the properties of these separate systems.

Smart contracts, voting, super-fast confirmation times, and even a way for competing bitcoin versions to live side by side. Whatever the function you require from a blockchain solution, sidechains promise to make access seamless, trustless and decentralised.

(...)

“With sidechains, altcoins are obsolete, Bitcoin smart contracts are possible, Bitcoin Core and BitcoinXT can coexist, and all hard forks can become soft forks. Cool upgrades to Bitcoin are on the way!” - Paul Sztorc, Drivechain Author

Sadly, sidechains are nowhere near finished yet, despite some non-trivial VC investments. Nonetheless, the overall concept promises access to limitless problem solving solutions, and a small collection of different teams are working on ways to implement the architecture that makes that happen.

Sidechains seem like an attractive concept for Bitcoin developers. If the touted advantages of sidechains turn out to be true, this could be an important step in the development of additional features for the Bitcoin network. We still are years away from this. It doesn’t even seem that the financial sector has caught on to the idea that sidechains might be a viable option for Bitcoin development.

It might be possible that sidechains will become interesting for large financial companies just as the concept of the blockchain has recently come into the focus of banks, credit card companies and exchanges. Make no mistake, Bitcoin is definitely not the main technology grasping the attention of the financial sector right now but its prominence, or the prominence of the blockchain, might increase in the years to come.

For now, let’s focus on the charts.

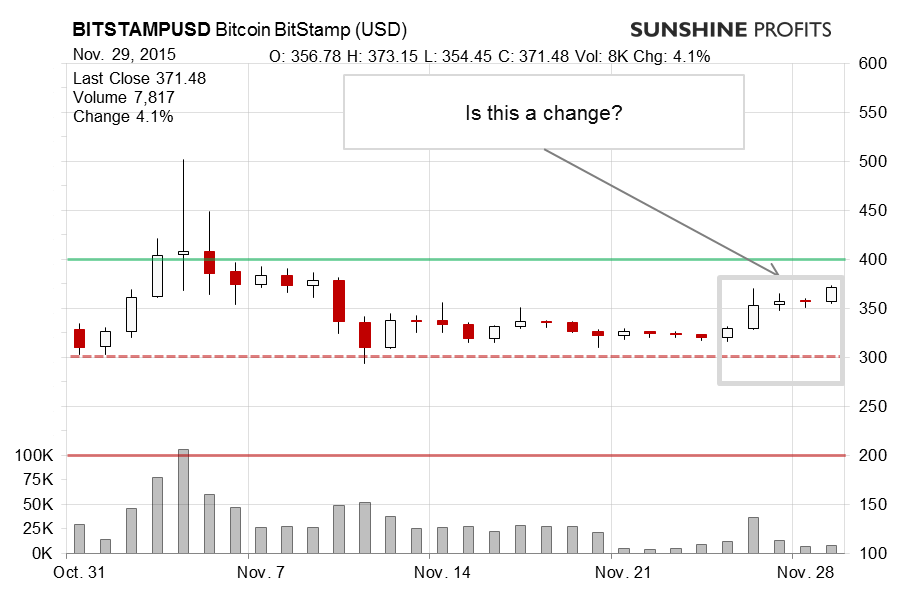

On BitStamp, we saw an uptick yesterday but the magnitude of the move was not necessarily significant. The volume was also smaller than the move we saw on Thursday. Does this change the current outlook in any way?

Generally, we don’t think so. Please, recall our previous comments:

(…) First of all, the most bullish indication yesterday was the volume. It was higher than during the previous couple of days but even on the above charts we see that the volume in the couple of days prior to yesterday had been seriously muted. If we take a look at the November top and the following decline, yesterday’s move doesn’t really look like much. Also, yesterday’s move didn’t end up even close to any possible meaningful resistance areas, not to mention breaking them. As such, the move seems not much more than a temporary uptick – the outlook remains bearish, in our opinion.

Now, the volume has been relatively muted, at least compared with Thursday. The RSI has moved closer to 70 but it still doesn’t read overbought. The combination of smaller volume and less powerful moves definitely looks bearish, in spite of the recent appreciation.

On the long-term chart we clearly see the recent appreciation but the volume looks nothing like the moves we saw in October. Recall our recent comments:

Just as on the BitStamp chart, we see that the move yesterday didn’t really break any important resistance lines. When we look at the RSI, we see that it has risen from 50 but it’s still below 70. This is nothing unusual in downtrends if we look at past situations when Bitcoin was after a local top. Even if the RSI were to reach 70, this wouldn’t necessarily mean a change in outlook – it would have to be accompanied by other signals which we’re not seeing at the moment.

Another thing to consider it the action today. Bitcoin has been relatively stable, around $350 (this is written after 10:15 a.m. ET). There has been no real continuation of the move up. Perhaps more importantly, trading has been weak, more similar to what we saw Saturday to Wednesday than what took place yesterday. Of course, there are no sure bets in any market and we accept the possibility that Bitcoin might go up some from here but, in our opinion, the bearish outlook for Bitcoin remains unchanged.

The only change we really see in Bitcoin now is that the RSI (not visible on the chart) is now relatively close to 70. In a way, the situation we’re seeing now is unique – we rarely see Bitcoin form a local top and then the RSI come close to 70. The last time we saw similar action was in late July – it was followed by significant declines and the move up in the RSI was the mark of the end of the corrective upswing. Another instance from the past – June/July 2014 – was followed by a prolonged period of declines. In January 2014, there was another such occurrence – it marked the end of the upswing after the major 2013 top.

If you take the above into consideration, it turns out that the current situation is actually bearish news for Bitcoin as all the situations we mentioned were followed by depreciation. At the moment, we are of the opinion that the recent upswing is a temporary upswing and declines might follow, if not immediately than over the next couple of weeks.

Summing up, in our opinion speculative short positions might be the way to go now.

Trading position (short-term, our opinion): short speculative positions, target at $153, stop-loss at $515.

Thank you.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts