Bitcoin Trading Alert originally sent to subscribers on November 16, 2015, 11:06 AM.

In short: short speculative positions, target at $153, stop-loss at $515.

Carolyn Wilkins, Senior Deputy Governor at the Bank of Canada, has expressed the view that digital currencies might change the way inflation and interest rates work, we read on the Vancouver Sun website:

"One important challenge that central banks now face, many of them, is that conventional monetary policy is stretched to its limits in many countries, where policy interest rates are at, or below, zero."

The Bank of Canada, Wilkins added, has already begun taking a closer look at innovative monetary-policy tools that have been used by central bankers around the world, including asset-purchase programs, or quantitative easing, and negative nominal interest rates.

The bank's plan also aims to examine ways to respond to global changes already underway.

Wilkins underlined several examples such as the rise of alternative payment methods such as PayPal and the sharing economy's growing popularity through services like Uber.

"We have to envisage a world in which people mostly use e-money, perhaps even one that's not denominated in the national currency, like Bitcoin," Wilkins said, referring to the virtual currency.

"This would create a new dynamic in the global monetary order and one in which central banks, quite frankly, would struggle to implement monetary policy."

This doesn’t mean that central banks will adopt Bitcoin any time soon. We don’t even think that Bitcoin will be adopted by central banks in the next 10 years. The comments by Wilkins rather show that central banks are slowly coming to the realization that current developments in technology might have an important impact on inflation targeting in the future. Actually, this happened before. The introduction of credit cards changed the way money was created and weakened the effectiveness of monetary policy before inflation targeting was introduced.

In the same way, the development of blockchain-based payment systems, for instance micropayments, might seriously impact the ability of the central banks to pursue their inflation mandates. This is not a current problem, but rather a potential future one. As such, the Bank of Canada is looking into possible future changes in the conduct of monetary policy.

For now, let’s focus on the charts.

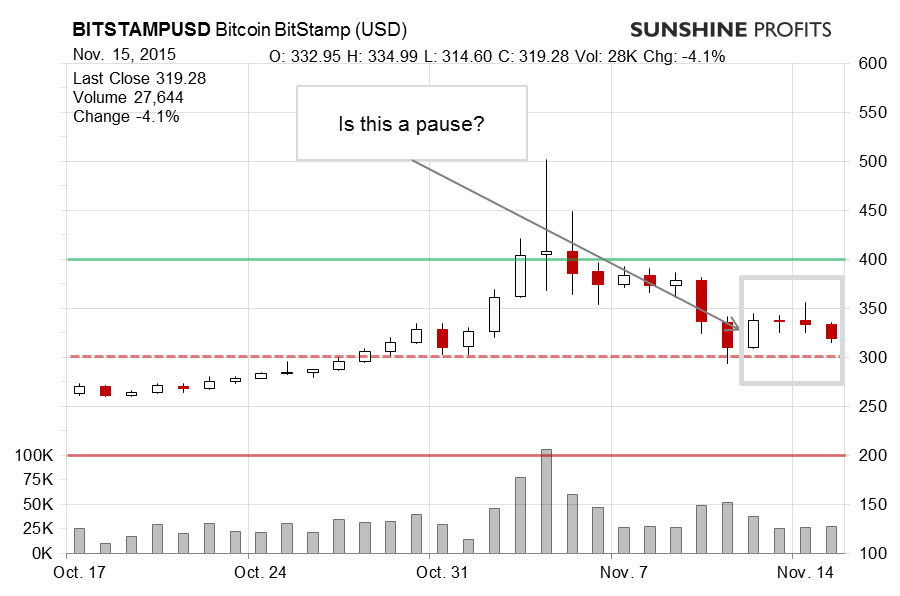

On BitStamp, we have seen the volume drop and Bitcoin above but not far from $300 (dashed red line). Does this mean that a rebound is now possible? Let’s recall our recent comments:

(…) Bitcoin is now around $320, the lower bound of our initial range for a breather. The most important question here seems to be whether today’s appreciation (…) is a sign of future appreciation. Our take is that this is possibly not the case. In our assessment, the $320-350 range is still a place where Bitcoin can rebound and we wouldn’t even be surprised if Bitcoin went above $350 in the next couple of days. At the same time, the outlook is still clearly bearish, which is supported by the recent trend but also by the fact that the volume of today’s move up has been relatively weak, at least compared with yesterday’s decline. But there’s more to support the bearish case.

These comments remain up to date. Today, we’ve seen a very little appreciation and the volume has been weaker than yesterday. This reads as a bearish sign. On the other hand, it is still very possible that we’ll see some kind of a corrective upswing. Would it change the outlook? Not likely, in our opinion. Bitcoin is still very far from oversold, the trend remains down. Also, the 7-day moving average is about to break below the 30-day moving average – a development that preceded moves lower in the past, particularly if a local top had already been seen. This was not 100% accurate (no indicator is) but it is a sign that the second leg of the decline is possible.

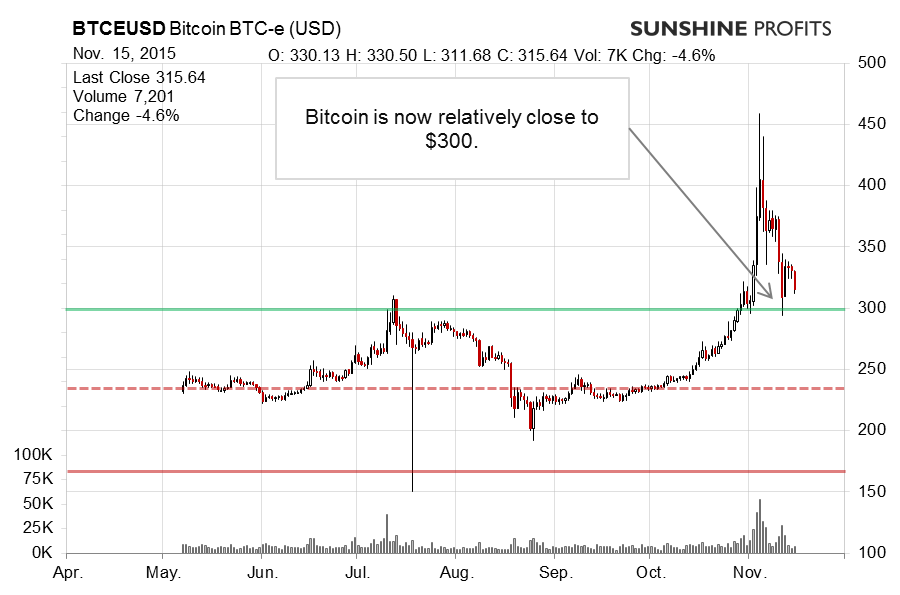

On the long-term BTC-e chart, the situation still looks bearish. Let’s recall our recent comments:

The outlook is still very much bearish, the action today doesn’t seem supportive of higher prices, it rather signals lower prices in the future.

Another factor to consider is the reading of the RSI. We currently see the RSI at around 50. This tells us that Bitcoin has possibly declined less than it might before the market sentiment turns around again. In the recent past, local tops in Bitcoin usually coincided with an overbought reading on the RSI. We saw that in late October / early November. More importantly to the current situation, after local tops, the RSI tended to go all the way to oversold before a bottom was formed. We still haven’t seen an oversold reading, and we’re not even that close to it. Based on that, and on the indications we mentioned earlier, our take is that Bitcoin might still have room to decline. This doesn’t have to unfold in the next couple of days. Actually, the way down might play out over the next couple of weeks. Stay tuned for updates on the current outlook.

This is still valid – there have been no major changes since our last alert was posted. On BTC-e we’ve also seen very little appreciation on small volume so far today (this is written around 10:45 a.m. ET) – not a bullish development.

The main question now seems to be whether the decline will continue immediately. It doesn’t necessarily have to. Our take is that the plunge might materialize in a matter of days but it also might take weeks before it is completed. Actually, major trends in Bitcoin tend to last weeks and months rather than days. As such, we still are of the opinion that Bitcoin has room to move lower, perhaps a lot of room. We monitor our already profitable hypothetical positions. We opened those positions with Bitcoin around $389 and now the currency is trading at about $320. This means that on this one trade only, and in a matter of 11 days you could have gained 17.7% (before transaction fees). At the moment, it is our assessment that these profits might still grow. We also are of the opinion that any corrective upswing or period of sideway trading that might follow is not worth exiting the positions – it might be hard to re-enter shorts once the decline has started. Stay tuned as we’ll keep you posted should our view on the market change.

Summing up, in our opinion speculative short positions might be the way to go now.

Trading position (short-term, our opinion): short speculative positions, target at $153, stop-loss at $515.

Thank you.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts