Bitcoin Trading Alert originally sent to subscribers on October 19, 2015, 11:38 AM.

In short: short speculative positions, target at $153, stop-loss at $283.

Gemini, the Bitcoin exchange the financial media are currently most interested in is not doing as well as you might have suspected (at least for now), we read on CoinDesk:

Gemini, the long-awaited New York-based bitcoin exchange founded by Cameron and Tyler Winklevoss and billed as the "Nasdaq of bitcoin", finally debuted on 8th October.

Featured in articles by The Financial Times, TechCrunch and Wired, and promoted via a TV appearance on Fox News, Gemini it succeeded in grabbing the attention of the mainstream media like few industry products before it.

While a success in terms of promotion, however, Gemini is showing signs it is struggling to appeal to bitcoin's active trading community. Though representatives of the exchange stated they're seeking to attract a more institutional clientele than their competitors, avid bitcoin traders tell CoinDesk that they believe this strategy will be difficult to execute.

They argue that Gemini's pricing model, charging both buyers and sellers on each trade, while potentially attractive to infrequent institutional traders, could prove an issue that will drive away retail traders, a demographic they argue is essential for building liquidity.

Our take here is that to judge that the exchange is going to fail would be premature. Gemini might not be doing well so far but the main idea behind the exchange is that it would attract the kind of investor we don’t see on other exchanges – financial institutions. The volume has been low on Gemini, but it’s been not even two weeks that the exchange operates. So we would give it some more time before proclaiming it a failure. It is quite possible that the exchange might bring in operators from the financial world in the next couple of months. We’ll definitely be looking for info on that.

For now, let’s focus on the charts.

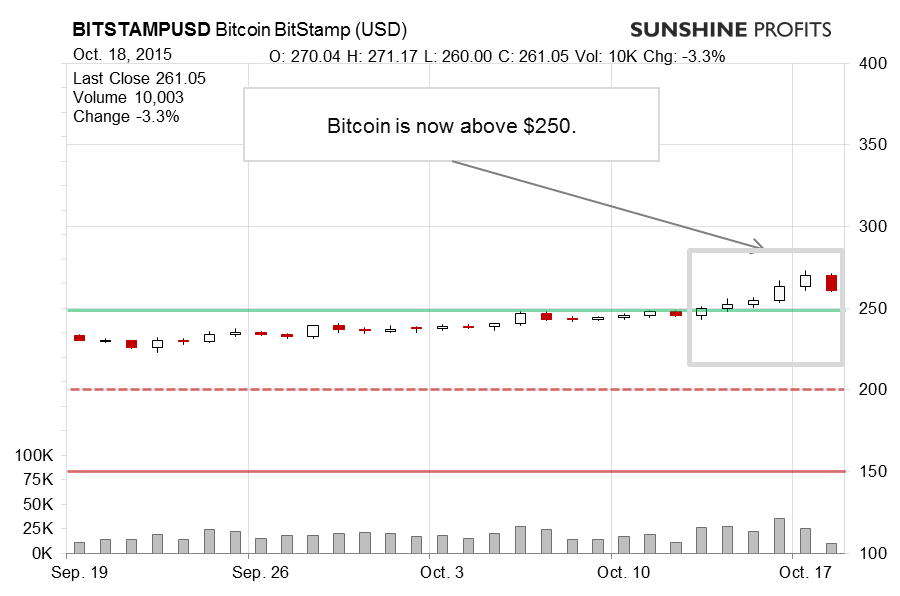

On BitStamp, there was action and Bitcoin moved away from $250 (green line in the chart). The currency briefly touched $273 on Saturday. This looks like a very bullish development. But is it?

For all the action we saw on the surface, we don’t view too much evidence in favor of the bullish case at the moment. Yes, Bitcoin went up but there’s not much else to support the bullish outlook. How’s that? Well, Bitcoin is above $250 but it didn’t really move above a declining trend line based on weekly prices and the 2013 and July 205 tops (not visible on the chart). So, Bitcoin is up but it has yet another possibly significant declining trend line ahead. But there’s more.

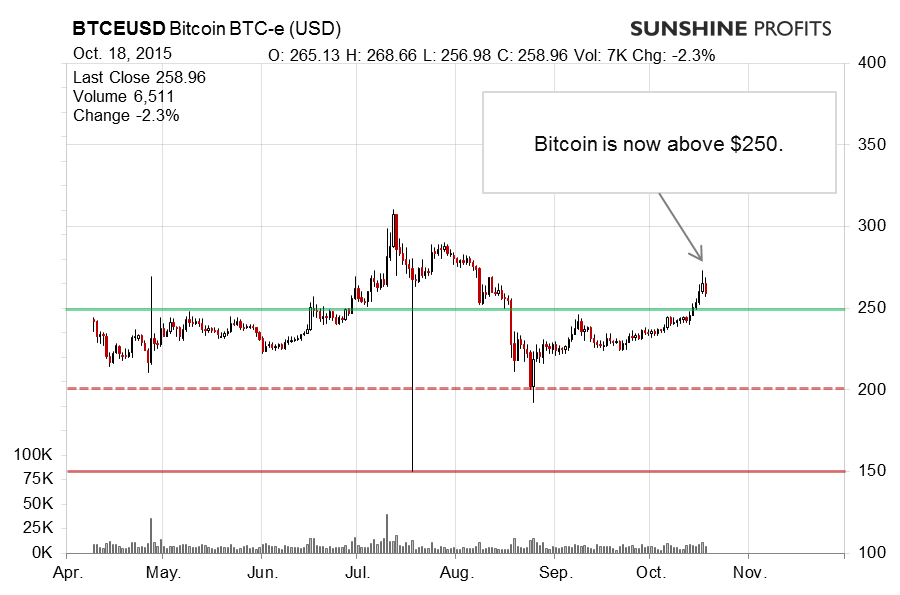

On the long-term BTC-e chart, the situation is pretty similar to what we saw on the short-term chart. Bitcoin is above $250 (green line) but the situation might actually be less rosy that. So, this might actually create a trading opportunity.

First of all, the move above $250 hasn’t really broken a possible declining long-term trend line (not visible in the chart). Bitcoin went above this line but dropped below it pretty quickly. Secondly, the volume was larger than in the couple of days before but not really huge, so the move wasn’t very strong in terms of volume. Thirdly, we might have just seen an overbought position. The RSI Index went above 70 and is now back below this level. This might mean that we’re now getting out of the overbought territory. This might be an indication of a decline to come, all the stronger for the reason that an important resistance level is in play just now.

For those reasons, and the fact that our stop-loss level was barely touched (the high was literally at our stop of $273) over the weekend, we are of the opinion that re-entering the short position might be a good idea.

Summing up, in our opinion speculative short positions might be the way to go now.

Trading position (short-term, our opinion): short speculative positions, target at $153, stop-loss at $283.

Thank you.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts