Bitcoin Trading Alert originally sent to subscribers on September 28, 2015, 12:26 PM.

In short: short speculative positions, target at $153, stop-loss at $273.

A peer-reviewed journal focusing on Bitcoin is set to publish papers on the cryptocurrency, we read on the Bitcoin Magazine website:

Ledger, a new peer-reviewed scholarly journal, will publish full-length original research articles on cryptocurrency and blockchain technology, as well as any relevant intersections with mathematics, computer science, engineering, law and economics.Ledger will be published online on a quarterly basis by the University Library System, University of Pittsburgh, as an open-access journal.

“The journal Ledger invites authors to submit their original research for the inaugural issue of the very first peer-reviewed academic publication devoted solely to the field of cryptocurrencies and its related subtopics,” says the first Ledger Call for Papers. “Ledger is the first peer-reviewed journal devoted to the inherently interdisciplinary subject of cryptocurrencies, and is proud to be supported by its distinguished editorial board.”

The Ledgereditorial board includes representatives from MIT, Stanford University, Duke University, Cornell University, Oxford University, and New York Law School, as well as Jerry Brito, executive director of advocacy group Coin Center, and Vitalik Buterin, founder and lead developer of the “Bitcoin 2.0” platform Ethereum.

This marks yet another step in the evolution of cryptocurrencies – the development of the academic side of the subject. Yes, we have seen papers on Bitcoin before, but this might be the first journal where articles on Bitcoin would be reviewed by fellow researchers, which could result in quality work being published. Of course, this is not automatic.

“Ledger” has the opportunity to become a platform for ideas on digital currencies. Just as economic journals have been the outlet for ideas regarding other asset classes. Even if it is still very early and impossible to say what kind of work might be published in the journal precisely, we still tend to think that the development of such a publication is a sign of a slowly maturing Bitcoin market.

For now, let’s focus on the charts.

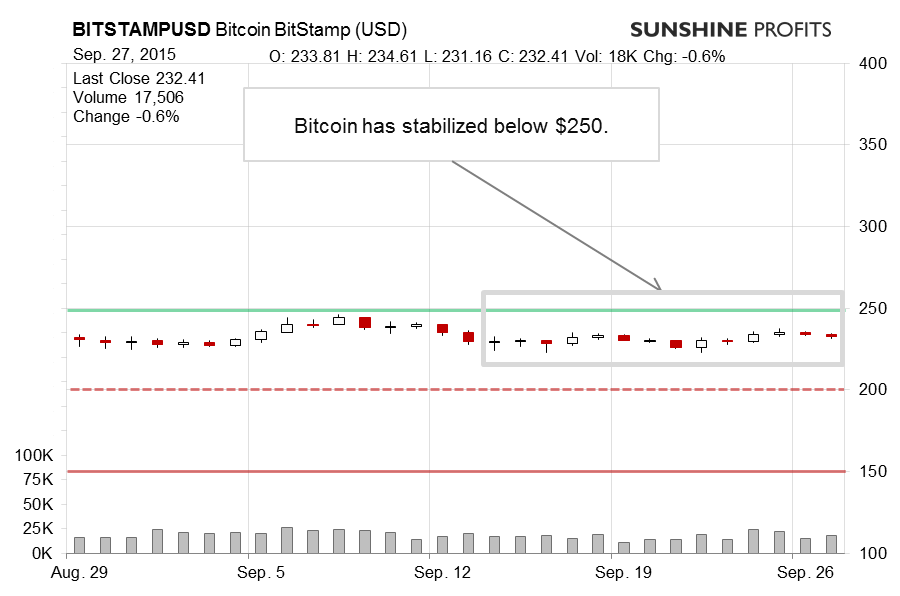

On BitStamp, we saw a couple of days of little action as evidenced on the chart. Today has been slightly different as Bitcoin has been up (this is written around 12:00 p.m. ET). The main question remains: “Is this a meaningful signal?”

Our take is that it’s not, at least not at the moment. Yes, Bitcoin is above a possible trend line (not visible in the chart), but it’s still below $250 (green line in the chart) and the move today has been far from extremely volatile. The situation, as it is, is not really bullish at the moment. We would have to see more appreciation/volatility for the outlook to shift.

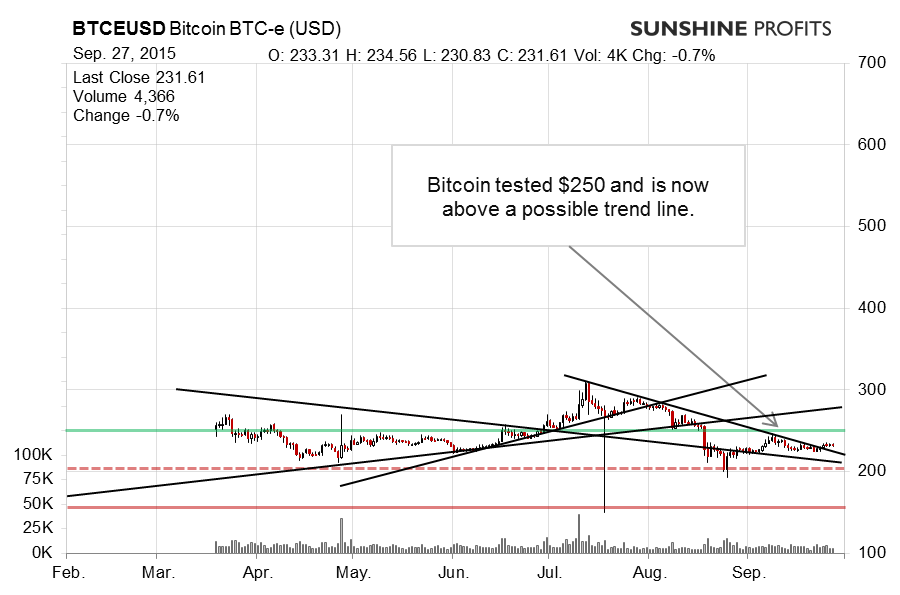

On the long-term BTC-e chart, the main development is a move above possible declining trend line. The move isn’t confirmed by volume, however, which makes the implications a lot less forceful. We wouldn’t be surprised to see “surprises” to the downside, just as we commented in our recent alerts:

Bitcoin is definitely not oversold at this moment, judging by the reading off the RSI Index (not visible in the chart). It seems that the currency still has a lot of room to move more significantly to the downside. In the perspective of the next couple of weeks, we wouldn’t be surprised to see it at $200 or below this level.

For the outlook to change now Bitcoin would have to appreciate on more volatility, possibly to above $250. We haven’t really seen this so far and the outlook remains unchanged.

Summing up, in our opinion speculative short positions might be the way to go now.

Trading position (short-term, our opinion): short speculative positions, target at $147, stop-loss at $273.

Thank you.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts