Bitcoin Trading Alert originally sent to subscribers on July 14, 2015, 12:39 PM.

In short: no speculative positions.

Bitcoin transactions still need a lot of improvement as far as their security is concerned. Today, we saw a piece on Bitcoin security on the Ars Technica website:

Turns out, going after someone’s Bitcoin transactions is much easier than you might think. After all, as the saying goes, once you’re pwned, you’re pwned.

After Hacking Team, the Italian spyware vendor, was hacked earlier this month, and 400GB of its internal data was released, Ars reviewed many internal e-mails from the company. These documents clearly illustrate how simply Hacking Team's "Money Module" worked, and they provide a small glimpse into which customers were particularly interested in it.

In general, the Italian spyware company sold (and hopes to continue to sell) software that allowed targets to be surreptitiously surveilled as they used computers or smartphones, and its clientele included law enforcement agencies worldwide. Back in January 2014, Hacking Team internally announced a new feature as part of its version 9.2 upgrade to its Remote Control System suite, and the new iteration would include a way to "track cryptocurrencies, such as BitCoin [sic], and all the related information."

So, despite being labeled as a way to make payments hard to trace, Bitcoin might actually be relatively easy to track. This theme has been coming up a lot in the articles we tend to see on various news sites and technical web pages. In a way, Bitcoin needs transparency to function as a means of transferring money but it definitely has to be improved as far as the simple security of transactions is concerned. This is something we’ve been writing about for some time now.

For now, the technical details of Bitcoin seem to make it vulnerable to the activity of groups like Hacking Team. We would expect new solutions to come in the next couple of years which would improve the security of digital currency transactions and make them more comparable with the security of credit cards and various money transfer services which are popular at the moment.

For now, let’s focus on the charts.

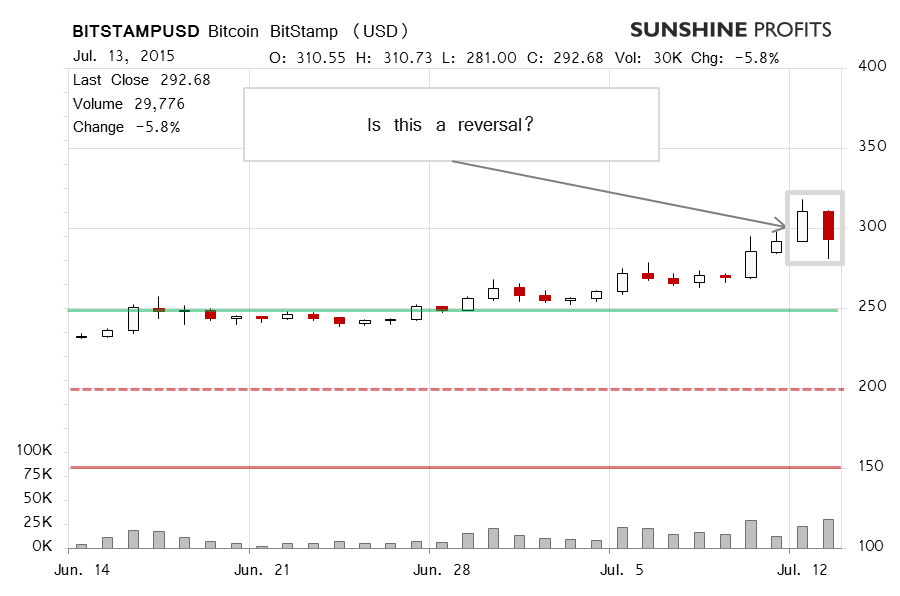

On BitStamp, we saw a relatively strong move down yesterday, both in terms of price and volume. Bitcoin almost erased the previous day’s gains and it closed visibly below the $300 level. This was a definitely bearish development. Was it bearish enough? Recall what we wrote yesterday:

A deal was struck [between Greece and its creditors] and Bitcoin has fallen. Is it enough to short the currency? We think that the odds are getting more and more favorable toward a move down but Bitcoin is still above $250 (green line in the chart), which seems like the point at which short positions could be reentered. Right now, Bitcoin is still well above this level. We think that a move to $250 seems likely now but not likely enough to bet on the move just yet.

Today’s action doesn’t provide us with a clear indication. Yes, Bitcoin has stayed below $300 and there has been no visible appreciation (this is written after 12:00 p.m. ET) but the currency has also remained in a visible short-term uptrend and possibly above the long-term trend down.

On the long-term BTC-e chart, we see this more clearly. Bitcoin is below $300 but still above a possible downward sloping trend line. It would take for Bitcoin to move to $250 (green line in the chart) to possibly turn the situation around back to bearish. Yesterday, we wrote:

(…) Does this mean that the move up is over? It might. Bitcoin hit overbought territory and is now declining. This looks like a situation where the currency could depreciate further. But the volume hasn’t been explosive. It has been relatively significant but not necessarily suggesting panic. And Bitcoin is still above both $250 (green line in the chart) and the possible rising trend line. Even though it seems that the situation has become more bearish for Bitcoin, it hasn’t become bearish enough to open short positions just yet, in our opinion.

This is still the case. The situation is more bearish today than it was yesterday but it’s still short of decisively bearish.

On an administrative note, due to my travel plans, there will be no Bitcoin Trading Alert on Thursday, Jul. 16, 2015. Instead, we have prepared the alert you are reading at the moment (Tuesday, Jul. 14, 2015). In this way, you still get two alerts this week. The next Bitcoin Trading Alert is scheduled for Monday, Jul. 20, 2015.

Summing up, we don’t support any speculative positions at the moment.

Trading position (short-term, our opinion): no positions.

Thank you.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts