Bitcoin Trading Alert originally sent to subscribers on April 17, 2015, 12:05 PM.

In short: speculative short positions, stop-loss at $239, take-profit at $153.

First results of the #BitcoinSurvey have come in, we read on Bitcoins in Ireland, and some of the indications are pretty surprising:

Over 51% of respondents are actively using bitcoin with 27% of respondents saying they’ve used bitcoin in the week prior to them doing the survey, and 22% saying that they had made a transaction that day. Respondents are also actively recruiting people into bitcoin, with 80% responding saying that they have gotten friends, family or a company to use bitcoin. 28% also reported that they had gotten several friends to use bitcoin.

On wallets, 99% of respondents said they had one, with 30% saying they are using a desktop wallet, and 26% using a mobile wallet. Paper wallets came in third at 15%, followed by the Bitcoin Core at 13%. 72% responded saying that they have tried several bitcoin wallets, and found one they’re happy with, with just 11% saying they hadn’t found one they’re happy with yet. 16% have lost access to a wallet, although most people responded that this was either in the early days, when bitcoin was worth nothing, or if more recently, it was a nominal amount.

On exchanges, 80% of respondents said they were registered with an exchange, and 25% of respondents use it to buy bitcoin for themselves to spend. 26% of respondents said that they had lost some bitcoins due to an exchange being “hacked”, closing down, or their exchange account being compromised.

The most shocking result is the extent of security problems. It turns out that 1 in 4 participants of the survey had problems related to the security of the exchanges and these problems resulted in loss of bitcoins. One has to take this with a pinch of salt, since the survey is not actually large (there’s hope of having 1,000 respondents by the end of May) and this might distort the results relative to the overall population of Bitcoin users but even halving this number leaves us with levels that are unacceptable to people not infatuated with Bitcoin but simply willing to transfer their money.

Security might be one of the most burning issues now. A more secure Bitcoin infrastructure and exchanges are needed in order to bring down the number mentioned above. A more secure network would help Bitcoin avoid being associated with fraud or illegal activities. The fact that regulated exchanges are gearing up to enter the Bitcoin space more aggressively might an indication that things are going to turn around in a matter of years. The most pressing question now is at what cost the increased security will come. In order to stay competitive, Bitcoin has to offer cost advantage over money transmitters and credit cards. We’ll have the first indications of how this turns out when the first large regulated exchanges are launched.

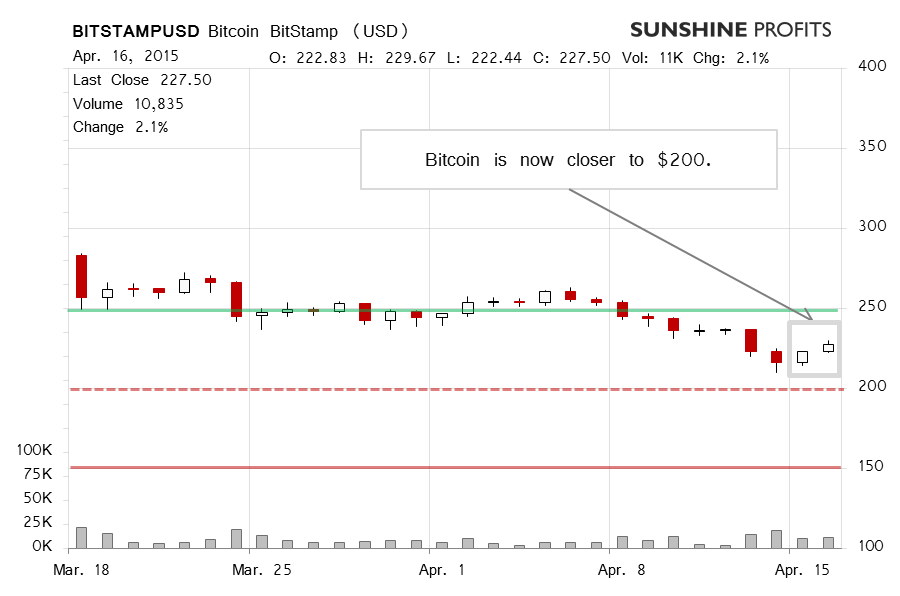

For now, let’s focus on the charts.

On BitStamp, Bitcoin went up both yesterday and on the day before. This could have looked like the end of the decline but we were rather cautious about that yesterday:

(…) we’ve seen some action to the upside (…) but neither the move itself nor the volume has been strong. Actually Bitcoin has move up only slightly today and the move is still far from the $250 level (green line in the chart). We might still see some movement to the upside but the current combination of lack of strong volume and relatively weak price moves makes the short-term outlook less bullish than could look at the first sight. Bitcoin might still depreciate over the next couple of days, weeks.

It turns out that the action today lends credence to this point of view. Not only has Bitcoin not gone up but it has actually depreciated, more than erasing all of yesterday’s gains (this is written after 11:00 a.m. ET). The volume today has been similar to what we saw yesterday, possibly slightly higher (the day is not over yet, mind). It seems to us that the odds of a further move lower, which would magnify the gains we already have on the hypothetical position, have just become even more favorable.

On the long-term On the long-term BTC-e chart, the pause in the decline is now visible, but it definitely is very far from what we could call strong. Yesterday, we commented in the following way:

Does the move up invalidate the bearish outlook? Not necessarily. The action hasn’t been very strong so far and Bitcoin is still below $230. The move of yesterday and today looks very much like a breather after a steady decline. We’re still not quite at $200 and it seems to us that the pause we’re seeing now might only be that – an interlude before more declines come.

Today’s action, which is in line with what has happened on BitStamp, has been supportive of this view. Right now, we think that two scenarios are particularly relevant for Bitcoin. The first one would have Bitcoin wavering around the current level for a couple of days or even longer before going down. The second would see Bitcoin dropping more substantially in a matter of the next few days. Either one of those suggests that Bitcoin might go down, multiplying the gains already achieved on our hypothetical position. Consequently, we think that keeping short positions intact might be a good idea since we would be willing to wait out a period up and down moves as the following decline might be quite substantial.

Summing up, in our opinion speculative short positions might be the way to go now.

Trading position (short-term, our opinion): short, stop-loss at $239, take-profit at $153.

Thank you.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts