Bitcoin Trading Alert originally sent to subscribers on August 1, 2014, 1:26 PM.

In short: we still support long speculative positions, stop-loss at $550.

We read a piece on Businessweek on the Bitcoin Foundation’s recent foray into politics:

The Bitcoin Foundation’s executive director, Jon Matonis, travels the world to promote the virtual currency as a replacement for traditional money. Some of his members want him to focus on a less lofty goal: helping them make lots of old-fashioned cash.

Matonis, a longtime advocate of what he calls “non-political money,” has built the group into a kind of a bitcoin governing body. Early this month he hired a Washington lobby firm, and yesterday he unveiled a website aimed at raising the virtual currency’s public profile.

Some foundation members are dismayed by Matonis’ leadership and grander plans. Investors from Silicon Valley in particular would like the group to focus on more technical matters, particularly fortifying the underlying bitcoin software so it can grow into a viable, large-scale payment network.

Both approaches have their merits. Developing stable Bitcoin code is definitely instrumental in laying the groundwork for secure payments. The development of various additional security features and other functionalities is currently underway with various startups working on such solutions.

On the other hand, it is also important to reach out to regulators to make them aware of what Bitcoin is and what it is not. Our general comment here would be that the tech side should be developed further and that changes in the way work is organized seem inevitable but discontinuing any lobbying or communication efforts is probably not a good idea since it would open Bitcoin up to the risk of being misunderstood or inappropriately regulated by the authorities.

For now, let’s turn to the charts.

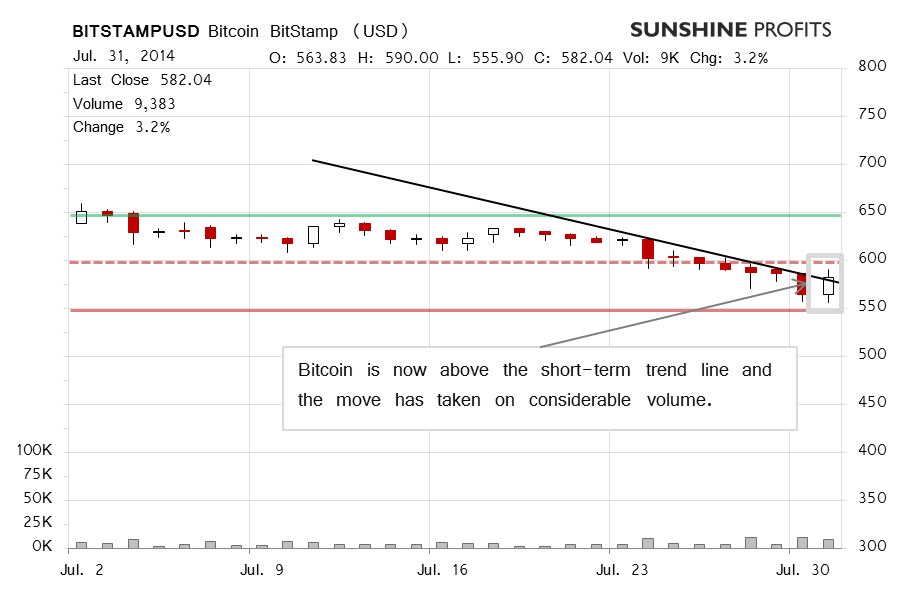

On BitStamp we saw a strong move up yesterday on significant volume. This move took Bitcoin slightly above the recent declining trend line (black line on the chart). Commenting on this appreciation, yesterday we wrote:

We realize it’s hard to keep positions when the market is moving in the other direction, even if the move down isn’t deep compared with previous slumps, as is the case with the recent decline. This is perfectly natural, but it also might influence previously adopted strategies. And moving your stops or closing position based on two days of deeper depreciation (the decline we’ve been seeing has been mostly realized in two trading days) might be the moment where emotions get in. But as long as the previously adopted stop hasn’t been reached and the outlook hasn’t changed meaningfully, it’s most probably best to keep your strategy in mind. Those of you who have done so might be relieved by the action today.

Up to this moment (this is written before 11:45 a.m. ET) Bitcoin has gone up 4.1% today, reversing almost all yesterday’s losses. The volume is still not quite as high as yesterday but it’s definitely elevated compared with what we had seen on Tuesday. The day is still not over, mind.

Is this reason enough to get optimistic? Definitely not. This is the first day of strong appreciation since July 11 and the most pronounced move up since June 30 but one day of appreciation doesn’t really change the whole picture. Having said that, the picture is still, in our opinion, favorable for long speculative positions. It’s just that we wouldn’t jump in with more capital merely based on today’s action. Because of that, we leave the positions unchanged.

Today, however, we’ve seen more positive action and the trading volume is in the range of what we saw yesterday (this is written after 12:30 p.m. ET). This move might be a game changer as far as the recent trend is concerned. On day of appreciation after a decline is nothing unusual but two days of strong action might show that there is buying power in the market.

Bitcoin has already gone above $600 (dashed red line on the chart). If it keeps this level, we might be in a favorable situation as far as a further move up is concerned. The move up might slow down in the days to come but our bet now is on a continuation of the reversal.

On the long-term BTC-e chart, we’re seeing a move up back to one of the medium-term trend lines (upward sloped, marked in black). If you recall what we wrote two days ago:

So far we haven’t seen Bitcoin plummet. The volume now is relatively low and we are still inclined to bet on the currency going up. Seeing the recent depreciation, we also keep an eye on any stronger moves to the downside which could trigger the $550 stop-loss.

As it turns out, the last two days have brought bullish developments. The moves we’ve seen are also visible from the long-term perspective which makes them all the more significant. The key question here is if the move up will be continued. Our take now is that Bitcoin might still go higher in the next couple of days, although we wouldn’t be surprised by a short pause.

Summing up, in our opinion long speculative positions might be the way to go now.

Trading position (short-term, our opinion): long, stop-loss at $550.

Thank you.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts