The Consumer Price Index (CPI) jumped 0.4 percent in April. What does it mean for the gold market?

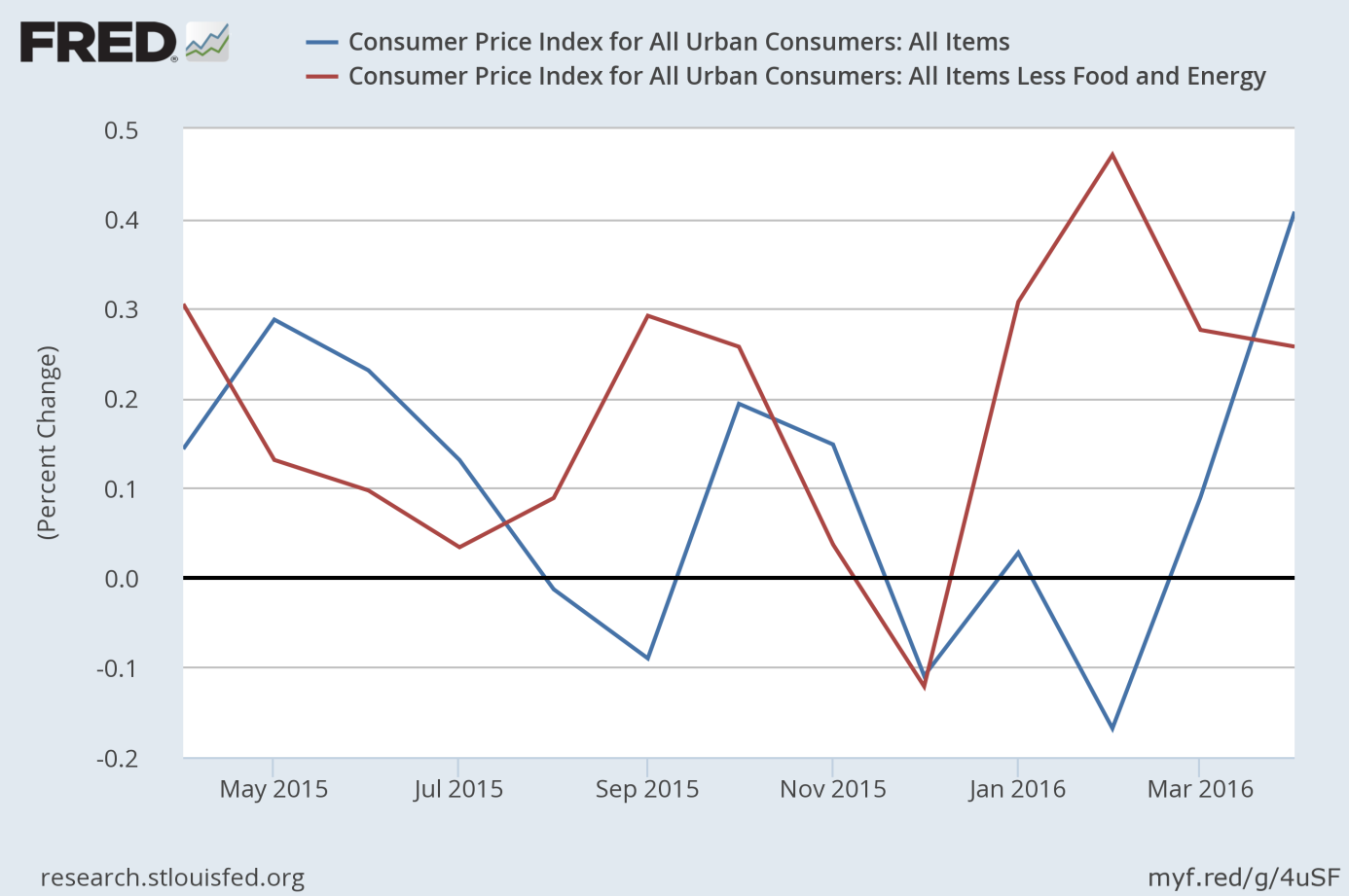

Tuesday was full of economic data, including reports about the CPI, housing starts, building permits, industrial production and capacity utilization. Let’s focus on the inflation report today. Consumer prices increased 0.41 percent last month, following a 0.1 percent rise in March, according to the Bureau of Labor Statistics. The jump was mainly driven by a 3.4 percent surge in energy prices (with the gasoline index rising 8.1 percent), however, core CPI still increased by 0.26 percent. As one can see in the chart below, the inflation rate really accelerated. Actually, the jump was the biggest gain since February 2013. It goes without saying that the data favor the U.S. monetary policy hawks who would like to hike interest rates further.

Chart 1: CPI (blue line) and core CPI (red line) month-over-month from April 2015 to April 2016.

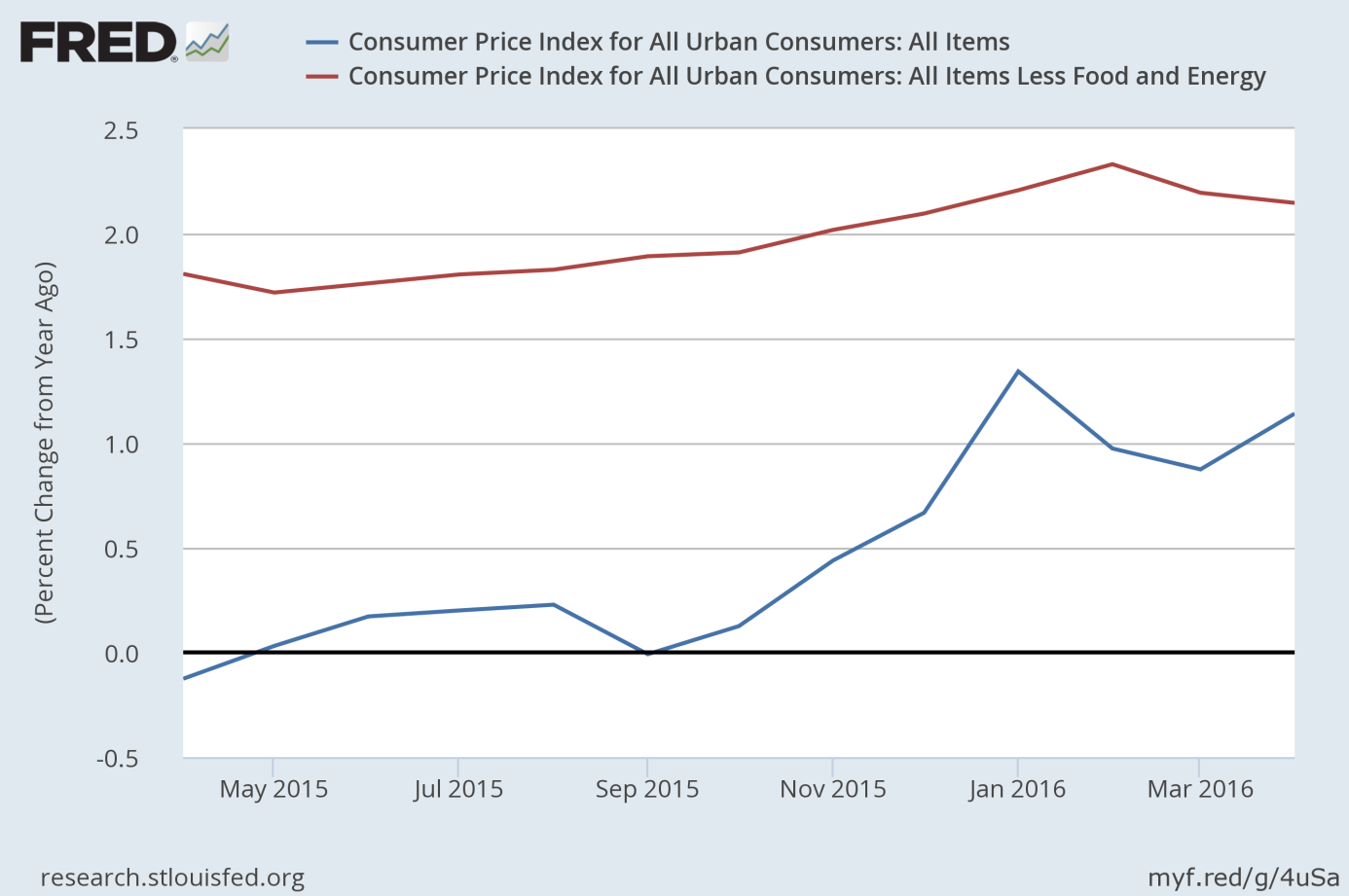

On an annual basis, consumer prices rose 1.1 percent, while the CPI excluding energy and food prices increased 2.1 percent.

Chart 2: CPI (blue line) and core CPI (red line) year-over-year from April 2015 to April 2016.

The chart above shows that the annual dynamics was less impressive (the core rate was down a tick from March) last month, however, it should please the FOMC members. Indeed, the market odds of the Fed hike in June increased from 3.8 to 18.8 percent. It still means that investors does not expect any move during the nearest FOMC meeting, however, they moved their forecast of the Fed hike from December to September. It’s a huge move, which should push gold prices down.

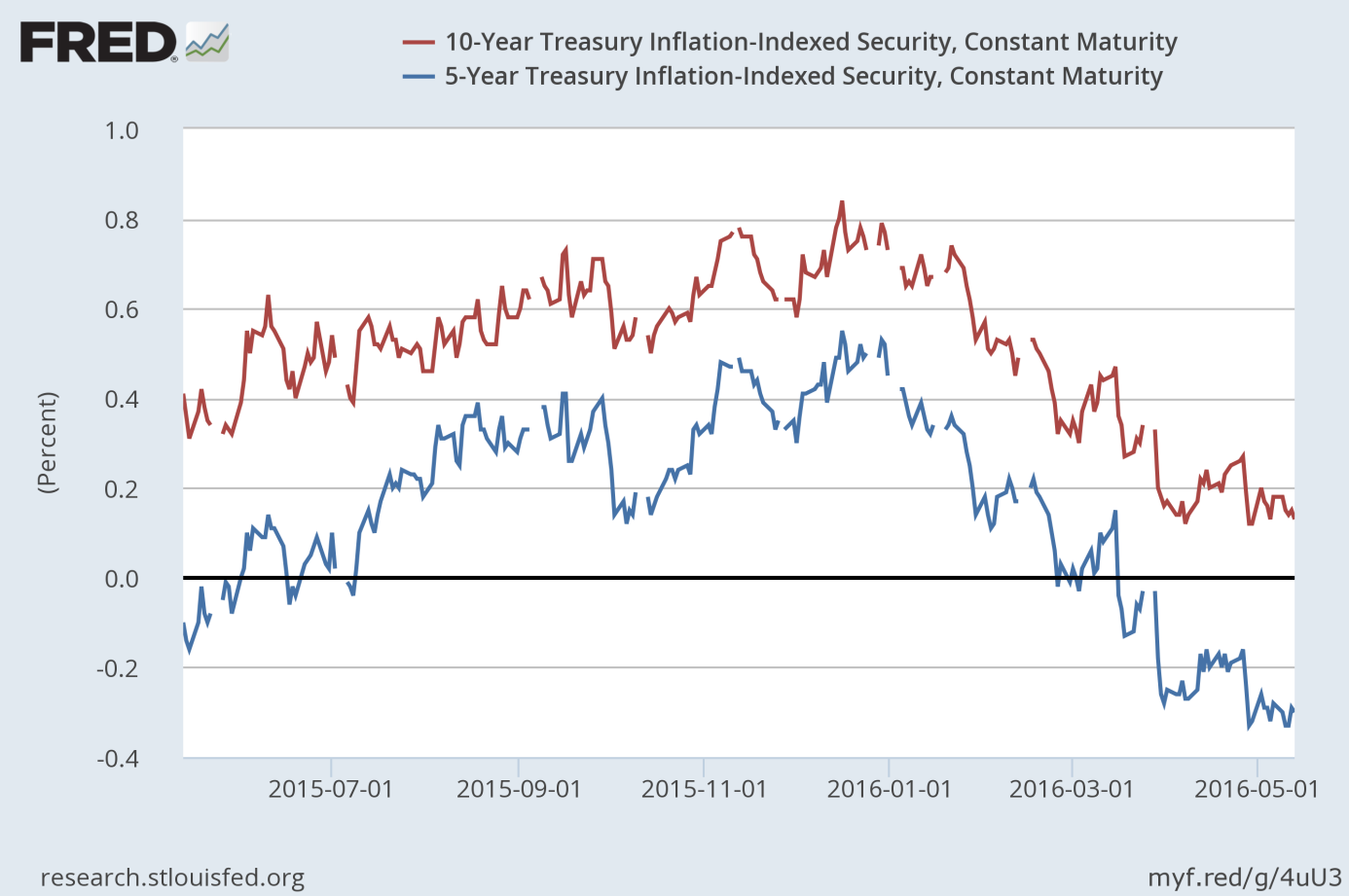

However, the yellow metal has been undaunted and settled the day higher in New York. The reason may be that although higher prices may translate into a more hawkish monetary policy, the rise in inflation also means lower real interest rates. Indeed, real interest rates, proxied by the inflation indexed Treasury rates, have been declining this year, as one can see in the chart below. Actually, 5-year real interest rates became negative in March, which is good news for gold.

Chart 3: The 10-year Inflation-Indexed Treasury rate (red line) and the 5-year Inflation-Indexed Treasury rate (blue line) from May 2015 to May 2016.

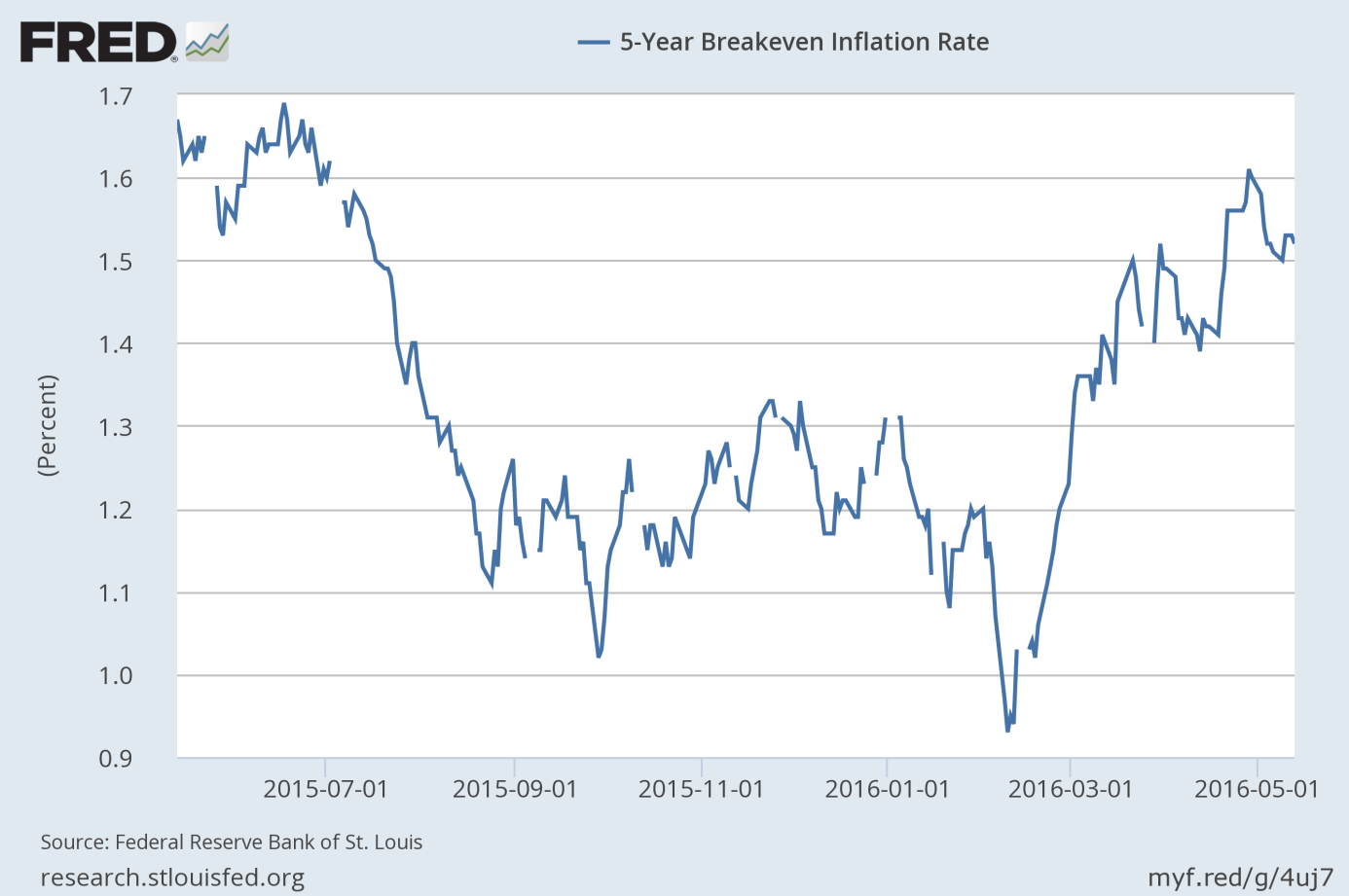

The key takeaway is that the CPI rose 0.41 percent in April. The jump was driven by the largest increase in the energy index since February 2013. However, the rise in consumer prices was broad-based. It means that if only commodity prices remain stable, the overall inflation rate may accelerate. Indeed, the chart below presents that inflation expectations have increased since February.

Chart 4: The expected inflation rate in the next 5 years from May 2015 to May 2016.

Therefore, the rise in inflation, both realized and expected, increased the probability of Fed hikes in June and September. And investors should remember that inflation numbers were lower when the Fed raised interest rates in December. However, given the lack of negative reaction in the gold market yesterday, it seems that either precious metals investors still doubt that the Fed would adopt a more aggressive approach this year, or that they welcomed the rise in inflation as it lowers real interest rates – gold usually shines in the environment of low (and especially negative) real interest rates.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview