Earlier today, the USD Index extended losses and dropped below the level of 101 after disappointing preliminary GDP reading. What impact did this drop have on the euro, the yen and the Australian dollar?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.0735; the initial downside target at 1.0388)

- GBP/USD: none

- USD/JPY: long (a stop-loss order at 111; the initial upside target at 115.43)

- USD/CAD: long (a stop-loss order at 1.2949; the initial upside target at 1.3302)

- USD/CHF: long (a stop-loss order at 0.9891; the initial upside target at 1.0180)

- AUD/USD: none

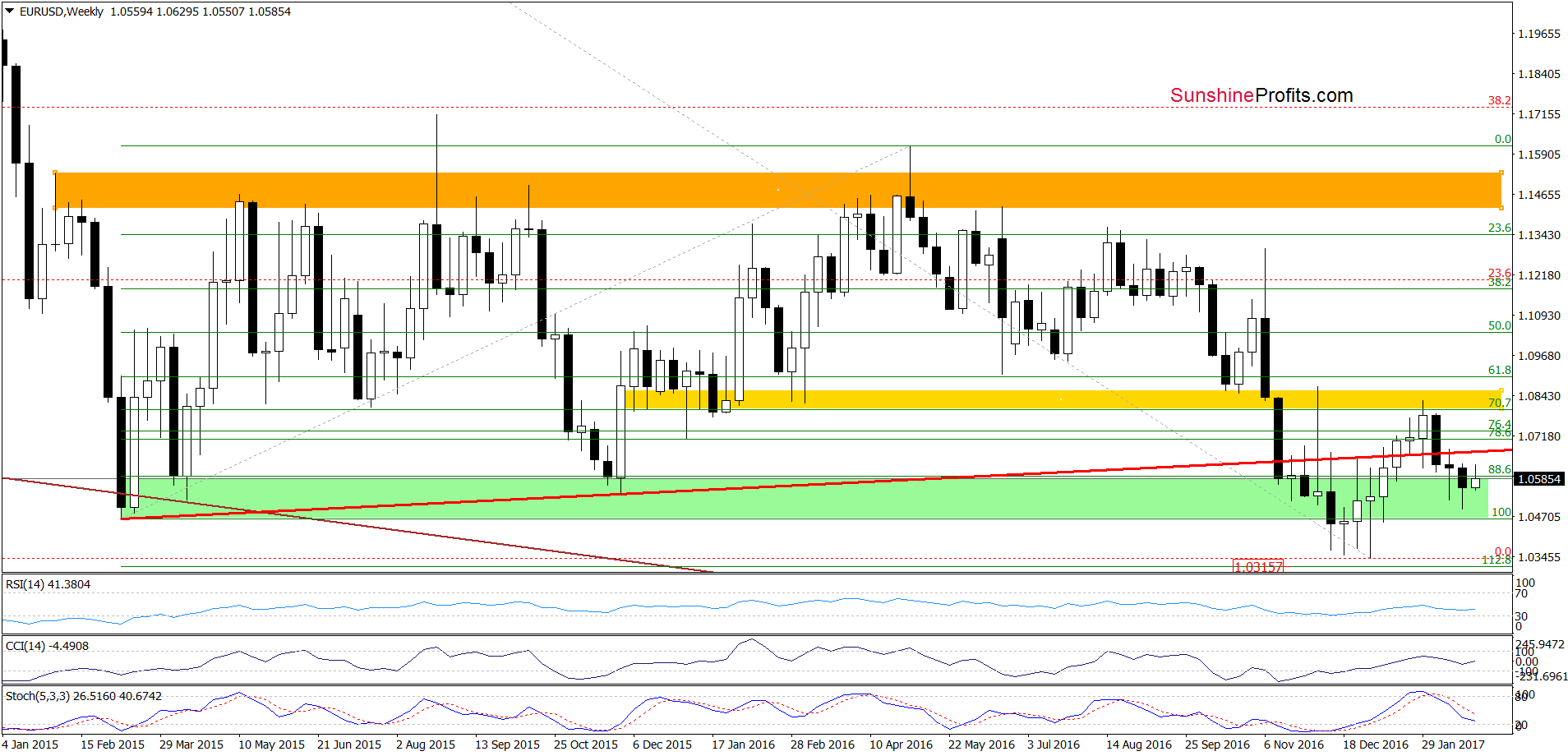

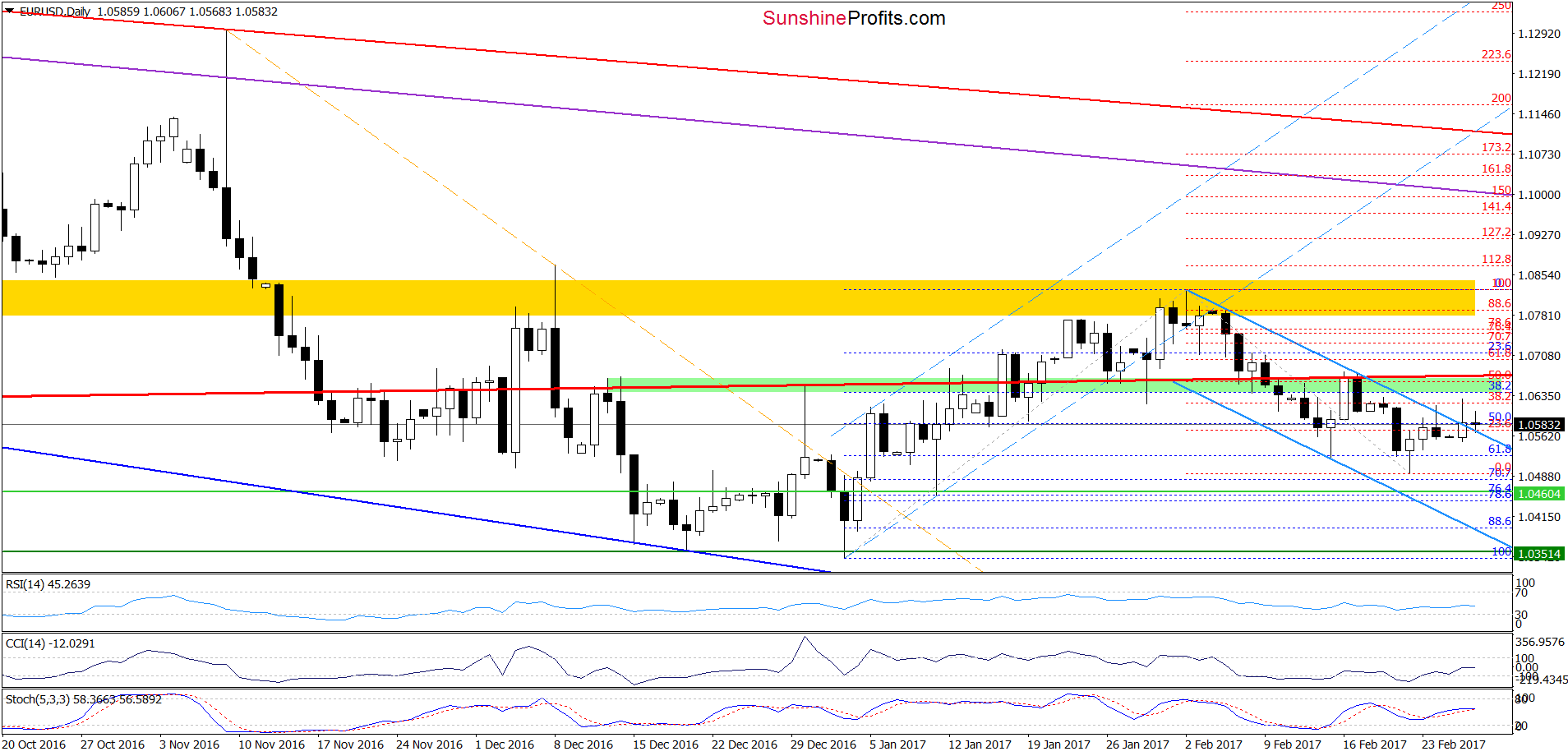

EUR/USD

Looking at the charts, we see that EUR/USD increased above the upper border of the blue declining trend channel, which suggests that we may see another verification of the breakdown under the long-term red resistance line and the green zone. Nevertheless, the sell signals generated by the weekly indicators remain in place, suggesting that reversal is just around the corner. If this is the case, we’ll likely see a drop to around 1.0460 (the 76.4% and 78.6% Fibonacci retracements) or even to the lower border of the blue tend channel in the coming days.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.0735 and the initial downside target at 1.0388 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

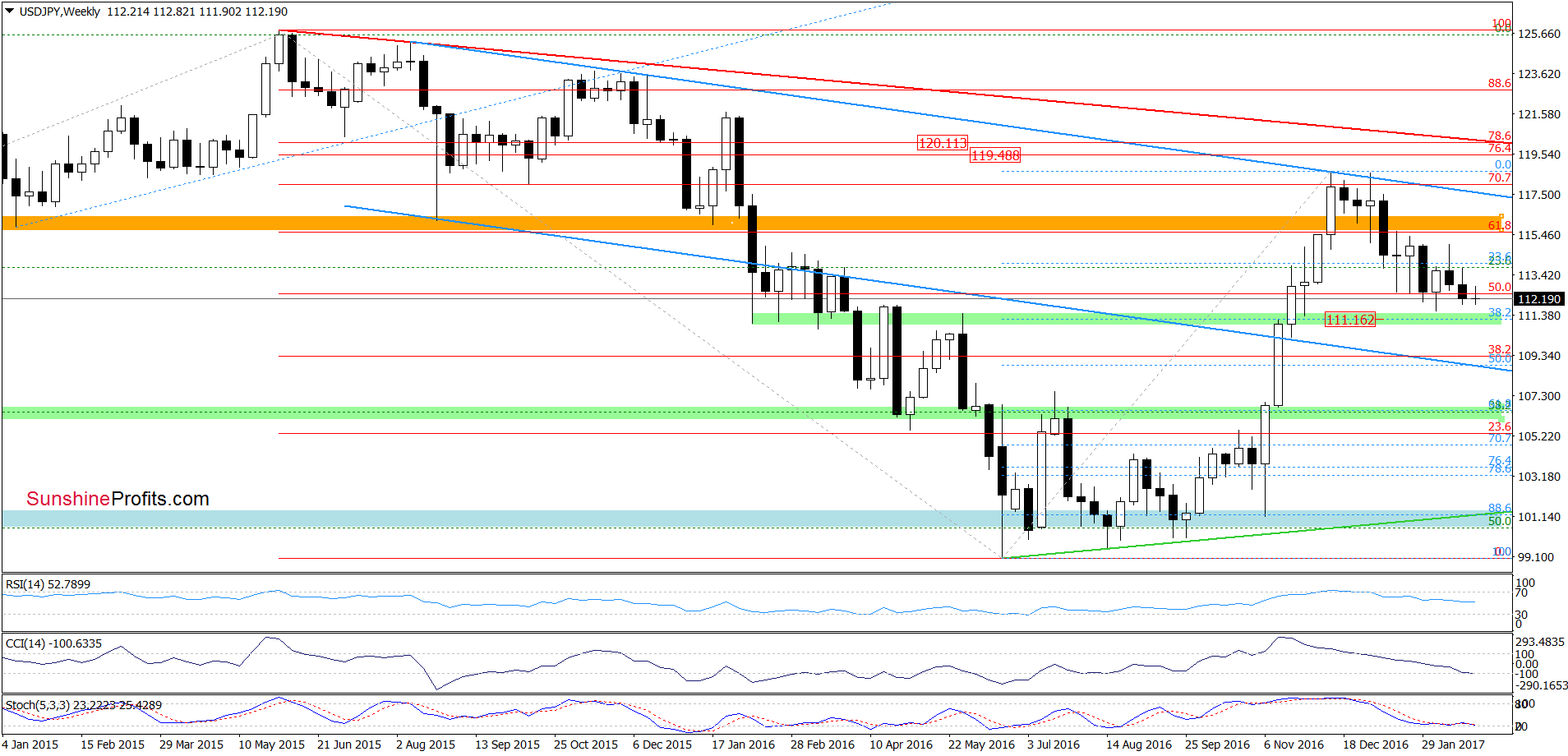

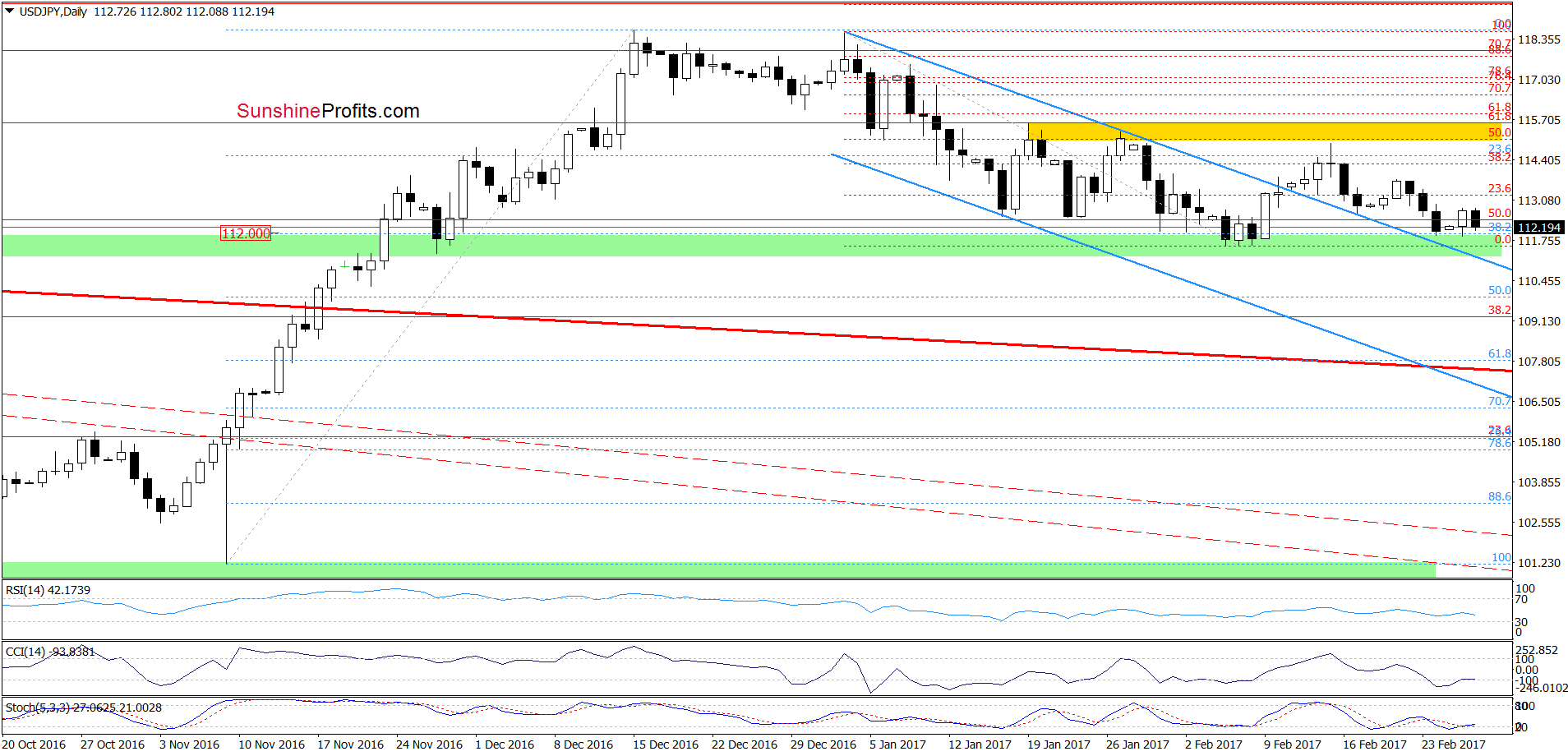

USD/JPY

On the above charts, we see that USD/JPY moved lower, which looks like another re-test of the strength of the green support zone. Additionally, slightly below current levels is also the previously-broken upper border of the blue declining trend channel, which together with the position of the indicators suggest that the space for declines is limited and reversal is just around the corner. If this is the case and the pair rebounds in the following days, the initial upside target will be the yellow resistance zone.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Long positions (with a stop-loss order at 111 and the initial upside target at 115.43) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

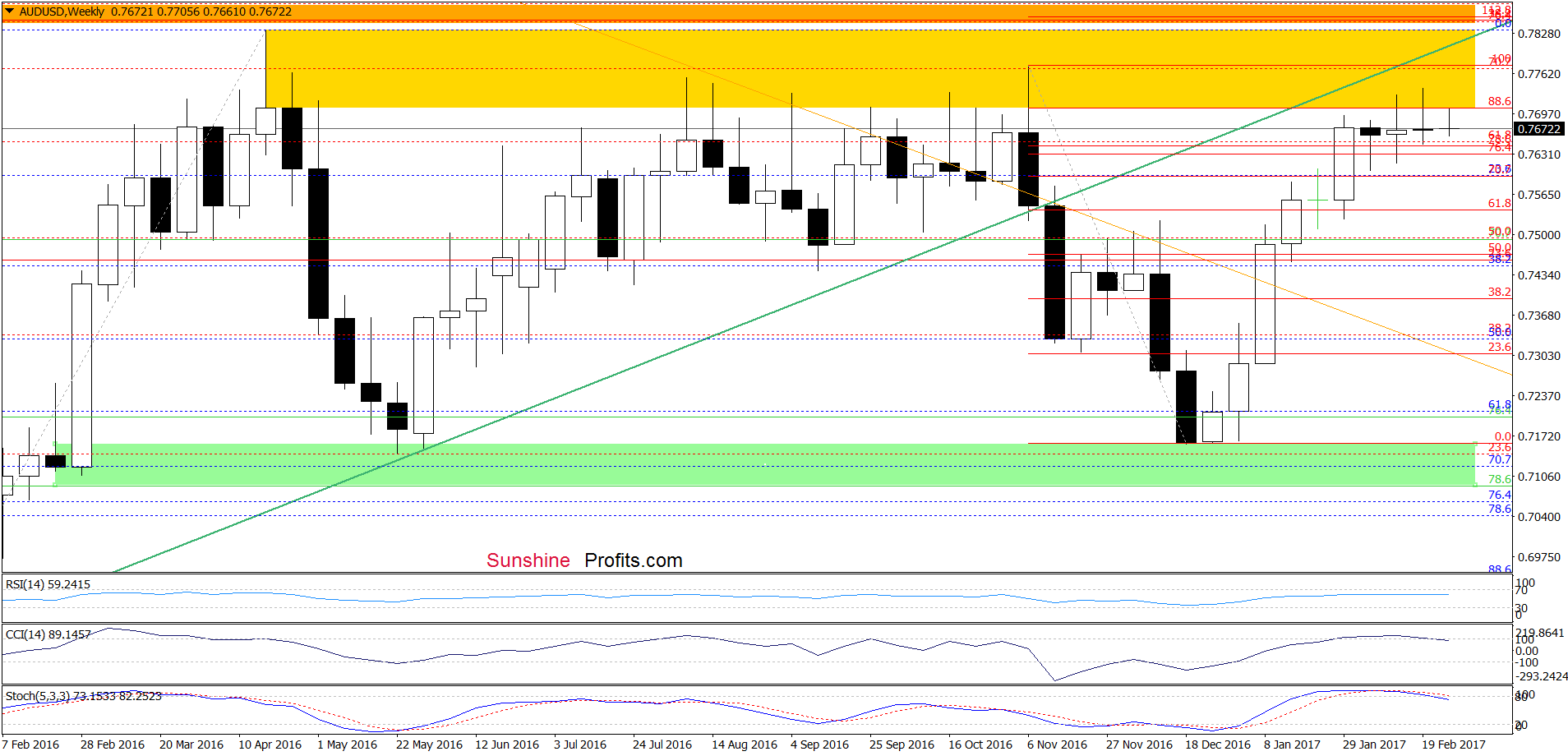

On the weekly chart, we see that AUD/USD is still trading below the yellow resistance zone. As you see, this area was strong enough to stop currency bulls several times in the past, which suggests that another attempt to move lower may be just around the corner. This scenario is also reinforced by the current position of the indicators – the CCI and the Stochastic Oscillator generated the sell signals, supporting lower prices of the exchange rate.

Will the very short-term picture confirm this pro bearish scenario? Let’s check.

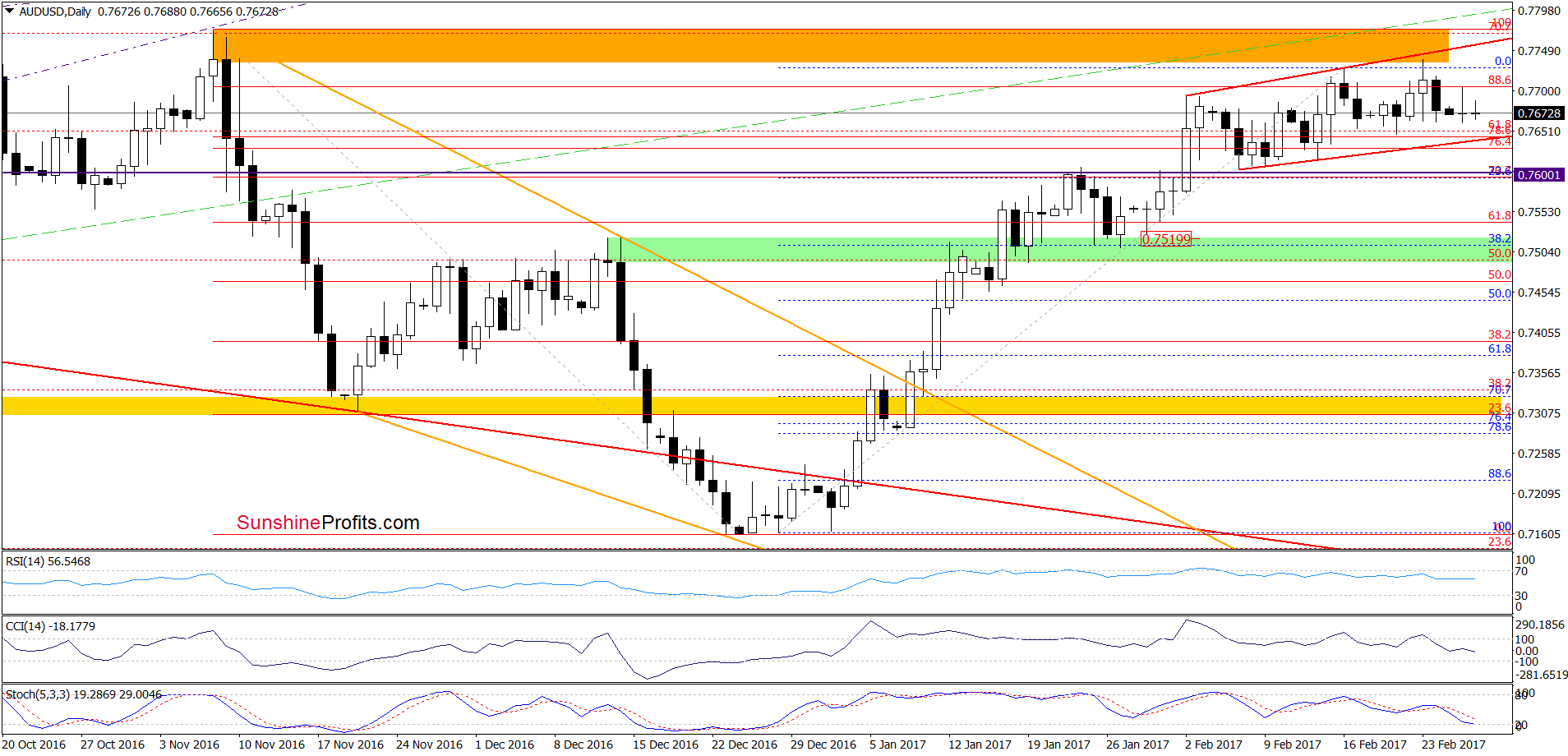

Looking at the daily chart, we see that the overall situation hasn’t changed much as the exchange rate is still trading in the red rising trend channel. Nevertheless, taking into account the sell signals generated by the indicators and the medium-term picture, we think that the pair will test the lower border of the formation in very near future. If AUD/USD declines under this support line, we’ll consider opening short positions.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. However, if AUD/USD declines under the lower border of the red rising trend channel, we’ll consider opening short positions. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts